Ideal Money: The Curtain Raiser (LVI)

Blockchain and cryptocurrency are inseparably linked. As much as a decentralized form of money simply cannot exist without the security provided to it by blockchain, a blockchain cannot be created without giving people incentives to create it. Decentralized currency is that incentive. Robustness and sustainability of any decentralized system depends on the strength of the consensus algorithm deployed. We introduce AI and SDGs into the crowdfunding equation and voila there we have the “Ideal Money!”

In recent years there seems to be a growing consensus amongst thought leaders that eventually all money will be virtual money. As a result there’s a race to design a cryptocurrency that meets the rigors of “Ideal Money,” creating mega hype around stable crypto-currencies. But is stability enough and sustainable?

In a previous blog we concluded:

Whether collateralized, pegged or algorithmically stabilized, each and every stablecoin out there needs a speculation-independent self-sustaining ecosystem for long-term stability, which they all lack.

Such schemes of selling speculative crypto assets to acquire money only work as long as the humans are playing along.

So if the so-called stable coins do not solve the problem, how do we create asymptotically stable money? or Ideal Money?

To answer those questions we need to first understand the prior art definitions of “Money” and “Ideal Money”.

What Is “Money”?

Economists define money as a medium of exchange, a unit of accounting, and a store of value.

The four most relevant types of money are commodity money, fiat money, fiduciary money, and commercial bank money.

What Is “Ideal Money”?

Ideal Money is a theoretical notion promulgated by John Nash (Nobel Laureate in Economics) to stabilize international currencies. It was a hypothetical solution to the Triffin dilemma — the conflict of economic interests between the short-term domestic and long-term international objectives when a currency used in a country is also serving as world reserve currency. Although it could never be translated into practice, this is how Nash defined Ideal Money in his own words:

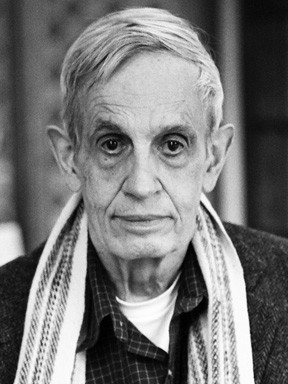

John Nash Jr

Nash further believed that “the money systems that could qualify as “ideal” are dependent on the political circumstances of the world.” The sociopolitical circumstances of today are far removed from the time when John Keynes, Robert Triffin and even Nash, conceived their monetary theories. There’s no denial that their concern for ideal money actually arose from the respective fiscal circumstances of their times. Those circumstances hardly bear any relevance to the dynamics of present day currency markets.

Any definition of ideal money that’s not in sync with the dynamics of today’s currency markets will fall flat. For instance, if it is volatility that fuels the Trillions in daily trading, infinite stability will kill it. So volatility may not be that bad after all, and stability may actually be stagnating.

The Radical Thinking

For balancing today’s global economic needs with the sociopolitical will of nations of the world to pursue and fund future sustainability of our planet, we need some radical thinking on some of our existing conformist practices.

Should money just be a medium of exchange, a unit of accounting, and a store of value and nothing beyond that?

Actually none of those attributes create any innate value in money beyond the credibility of the currency issuer, at least not since gold’s exit as a currency hedge.

Does Money become Ideal Money (or stable) by pegging it, collateralizing it or algorithmically stabilizing it or even with Nash’s ICPI?

Our own investigation establishes that perpetual growth (technically impossible) is bare essential for any pegged, collateralized or algorithmically stabilized cryptocurrency scheme to work. Neither did Nash’s ICPI ever see the light of the day.

Straying away from the conventional definitions of Money and Ideal Money, we gave ourselves ten commandments to guide our quest further. First five of them are listed here:

- Ideal money should be sustainable and bear infinite portability, homogeneity, durability, consistency, convertibility, parity and liquidity.

- Ideal money should be universally cognizable and a trustless guarantee of value that it represents.

- Neither created out of debt, nor via selling speculative assets, nor collateralized, pegged or algorithmically stabilized, ideal money should carry sustainable intrinsic equity that supports its long-term self-sustenance independent of its issuer/creator.

- Ideal money should neither bear zero volatility nor infinite stability. Supply and demand based optimal measures of volatility and stability makes it asymptotically stable.

- Ideal money should be decentralized with self-regulating artificial intelligence that autonomously regulates the balance between its creation, its supply, its utility and its circulation, and renders it more than merely a medium of exchange, a unit of accounting, or a store of value.

In future posts we’ll walk through these guidelines for creating the Ideal Money.

Credits: This article was first published on Medium

Prosperist Pledge-LVI:

If you wish to pledge support to the Prosperism movement, the terms remain the same as previous posts, with the following pledge:

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

Thank you for your continued support.

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.