Vitalik Buterin doesn’t want non-blockchain and fiat projects to conduct ICOs, and here are economic reasons behind that

For the last several years, there has been going a very basic discussion in the blockchain community, and the topic is: should non-blockchain projects use ICO/TGE as a funding mechanism? The answer that old-school blockchainers like Ethereum founder Vitalik Buterin give to that is simple: No. Vitalik has expressed his opinion in multiple speeches, presentations and interviews (here is one several example), and he is certainly not alone in the no-ICO-for-fiat-projects camp.

Let’s try discussing this in more detail and finding the reasons behind this point of view.

First of all, blockchain and distributed ledger technologies are not some miracle land that is seated somewhere on a distant cloud, this is a normal industry that has all attributes and characteristics of one: it employs people who get paid for their work, it rents some office space (however tiny it is), it consumes resources such as electricity, storage and computing capacity, it uses remittance, banking and other financial services.

The size of blockchain sector is rather difficult to calculate since most of the projects do not provide any statistics at all. On top of that there are no statistical standards for the sector. Leave alone the fact that there are no big research institutions that collect such statistics, put it together and process into aggregated data. The only number we can work with is market capitalization of tokens and coins openly circulating on crypto exchanges.

This market capitalization term shall be explained better. Historically, it arrived from the stock market where capitalization derives from the term capital, and in effect it reflects market value of a company, or companies, thus reflecting current size (or value) of capital that those firms can use for their needs. Stocks/equities can be used in mergers and acquisitions, as option payments to employees, as pledges in loans and marginal trades and so on.

It is somewhat different with coins and tokens. By nature, utility tokens (which currently represent a significant part of the crypto market) are not entitled to any property, assets or shares in business. They represent a payment mechanism for some specific service that every particular project offers or provides. This statement is, obviously, a serious simplification since there are plenty of other attributes for every particular token or coin: rights and obligations as regards to the network of the project, roles in its architecture and everything that relates to the network consensus mechanism. However, for a regular buyer the token is a guarantee, or an option, to consume some specified service. So, for sake of correctness, crypto market capitalization shall be called combined purchasing power.

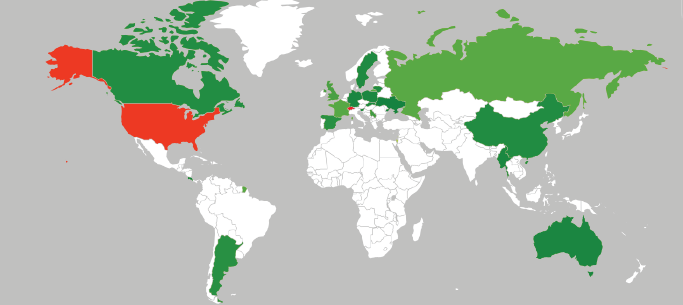

Illustration: World ICO Heat Map by Wulf A. Kaal, Professor, University of Saint Thomas School of Law

ICOs have been the swan and the ugly duckling of the crypto universe since they became massive about three years ago. The bad part is easy to explain, as it has been the talk of our crypto town on a daily basis: scam, fraud, over-fundraising, little control of spending by the community, and so on, and so forth. The good part was the inflow of resources.

Any typical ICO goes as follows: the project accepts Bitcoin, Ethereum, Litecoin, Bitcoin Cash, or any other top-20 crypto currency (and gives the buyer its tokens in exchange). In order to buy into an ICO, any outsider has to buy this top crypto currency in the first place. Some of these ICOs developed tricky combined schemes allowing investors to buy in with fiat contributions but this is nothing compared to crypto: according to the statistics disclosed by several projects, ETH stands for around 70% of the total funds raised, and BTC covers another 20%+. During 2015-1H17, the majority of ICO buyers were blockchain professionals who invested their basic crypto currencies into something that looked more promising and had good expectations to grow faster than the basic asset (i.e. BTC/ETH). Over time, as the world got to acknowledge blockchain and its prospects, the ICO spree attracted more and more outsiders, forcing them to buy crypto currencies with their fiat money, thus inflating prices for BCT/ETH and causing the purchasing power of the crypto universe to increase.

Currently, it stands somewhere slightly below $500bn, according to Coinmarketcap, and was as high as $830bn at its Jan’2018 peak. This doesn’t mean that if every crypto currency holder sells his or her holdings entirely, it could be transformed into $500bn of USD cash (given there will be no buyers, the price won’t sustain). Theoretically, this means that in every given second, there is $500bn worth of blockchain services that can be consumed by paying with crypto.

But is it true? Hardly doubt that. One can name between a dozen and a hundred of projects that are offering some fully cooked product (or MVP, at least) available for immediate buying, and none of them come close to $1bn in annualized revenues, let alone $5bn. In essence, current market value of tokens and coins still represents a mere expectation of the public; an expectation that there would be sufficient level of activity in the blockchain sector that would justify those valuations.

While each and every commentary suggests that there will be a massive burst of the bubble with 90% of ICOs being wiped out of the market, there are good chances that overall imbalance can be eliminated painlessly. In order for it to happen, one thing must become true: the industry must start providing external services while continue attracting external capital.

And that’s where we come back to our initial question: should the industry support fiat-oriented businesses as ICO campaigns and projects? As we mentioned earlier, blockchain Founding Fathers claimed over and over: no. They always gave good technical and infrastructural reasons to support this position but rarely commented on the economic one. However, there is nothing to be ashamed of when stating the obvious: when fiat-centered businesses raised crypto currency, they milk the money out of blockchain. And vice versa – when blockchain enterprise collects fiat money, it fuels the industry by inflowing the capital.

The same is true when you analyze the projects’ business models. Today, blockchain projects consume a lot of resources from the outside (meaning fiat) world: internet providers, legal support, banking, transportation, you name it. The opposite is far from true yet; use of blockchain hasn’t become massive and banks and insurance companies, remittance services and media are only making their first steps in incorporating blockchain in their day-to-day operations.

The key item on our agenda remains the same as it was a year ago. Blockchain has to build up its position as a supplier of services and consumer of capital; and try limiting external consumption of resources and outflow of capital. This means more clients from the fiat world (paying either in fiat, or in crypto), more subcontractors receiving payments in crypto (salaries and tech stuff, presumably) and more fiat money invested in new ventures offering outside services and selling to the outside world, not the opposite.

I made it clear earlier that I’m a believer in crypto. Please note that my trust relies on facts and figures, trends and expectations, not only general inspiration. As usual, feel free to share your thoughts and views, I’m always open for discussion.

You can contact me in

No one should be doing an ICO. While it is currently a big money making thing for everyone, there is very little due diligence done on any project (whitepaper is not enough) and there is no investor protection whatsoever in most ICOs. Moreover, retail investors pumping these projects have very little expertise in analyzing blockchain projects. A lot of projects currently have no need to be on a blockchain, yet companies are raising millions of dollars and what happens when they are unsuccessful as 90% of them will be.

My view is far from that radical. One shall compare ICO to angel investing rather than to IPO (which is a major mistake and a common opinion). Think of this as a way to to 3F stage on investment, but on the global scale. Being an angel investor, you throw you $100 to a neighbourhood kid experimenting in his/her garage, and in crypto world the whole planet is your playground: you can put your fingers in honey pots from Tallinn to Jakarta. In terms of risk, very true: the segment is not regulated and law enforcement mechanisms don't exist at all. So what? Consider these investments 93% risky (as all VC firms do), and the result won't surprise you.

hi, thanks for replying.

Traditional crowdfunding can achieve the goals you mentioned and give investors some sort of protection, and ownership. And protecting investors from investing in higher risk countries is probably important. I doubt if adding country risk to equity risk is a good thing. Developed markets have mature financial markets and developing countries have protectionist regulatory policies and less open financial markets. The problem is with current VC set-up probably. A crowd funded VC may be a better idea.

Additionally we don't yet know if ICO projects are 100% risky or 93% or lower. token price increase is not indicative of a product that can overtake a centralized company or of any form of success. Token price appreciation is probably just speculation and hype.

Very true in all aspects. Just to be clear: VCs are marching on full steam towards crypto markets and there are plenty of projects that are working to establish a framework (a legit one) to tie fiat investments with crypto. A lot is still to be done but there are good signs of progress in the area. There have been over 120 crypto related fund established, according to Next Autonomous, and I bet that some of them have lawyers onboard bity enough to protect their clients' funds. And as regards to the price of tokens, we are yet to see if there will be any products that those tokens enable buying. My guess that some projects will deliver upon their promises and success rate in blockchain as a whole will be higher than zero. But let's wait and see, right?

absolutely, that is why we are invested in them. :)

You got a 16.11% upvote from @upmewhale courtesy of @sofiapaskal!

Earn 100% earning payout by delegating SP to @upmewhale. Visit http://www.upmewhale.com for details!

This is another reasonable work from you again boss @sofiapaskal..

Merci, mon ami))

Upvote this reply and follow https://steemit.com/@a-0-0