Trading Cryptocurrency Markets

Hey everyone! My name is Vlada Gurvich, I am a support manager at Platinum, where we make ICO advertising and help companies prosper. By the way, you can get the demo of our STO platform now!

We are also a part of the University of Blockchain and Investing, the first platform for blockchain education in the world. If you want to know how to market an ICO, just follow the link and read our course:

Behavior of Cryptocurrency Investors by Demographic

2.1 Introduction to Cryptocurrency Sales Patterns

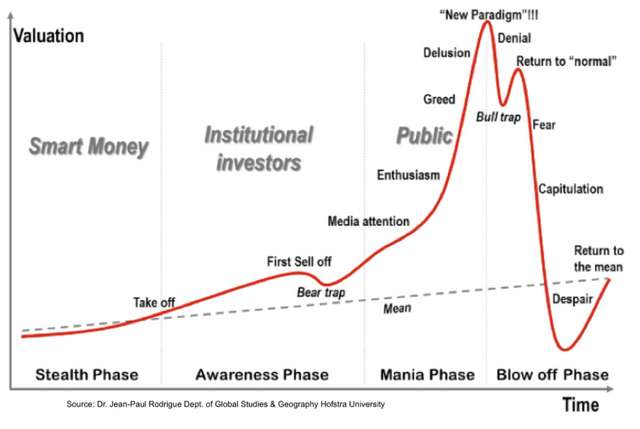

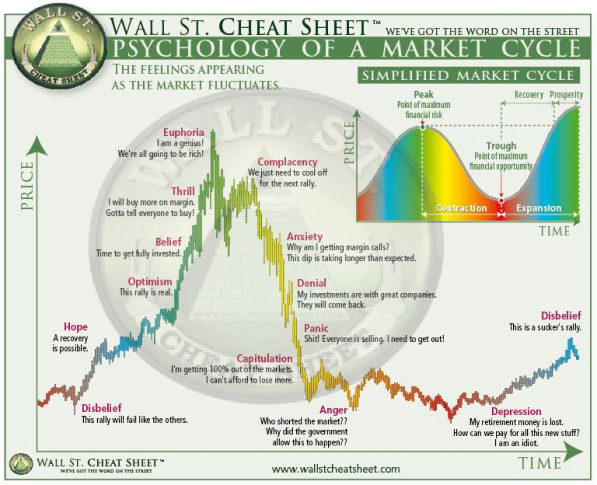

Due to the fact that cryptocurrency has its roots firmly planted in the cryptography community, the vast majority of early adopters are representative of that group. In this section we cover the basic structure of the cryptocurrency market cycle and the makeup of the community at large, as well as the reasons behind different trading decisions.

Refer to definitions as necessary for Bull Run, Bear Market, ATH, FOMO and HODL:

2.1 Introduction to Cryptocurrency Sales Patterns

Bitcoin leads the bull rally.

FOMO (Fear of missing out) occurs, the price surge is a constant topic of mainstream news, business programs cover the story, and social media is abuzz with cryptocurrency chatter.

Bitcoin reaches new All Time high (ATH) Market euphoria is fueled with even more hype and the cycle is in full force. There is a constant stream of news articles and commentary on the meteoric, seemingly unstoppable rise of Bitcoin.

Bitcoin’s price “stabilizes”, In the 2017 bull run this was at or around $14,000.

A number of solid, large market cap altcoins rise along with Bitcoin; ETH & LTC leading the altcoins at this time.

FOMO comes into play, as the new ATH in market cap is reached by pumping of a huge number of alt coins.

Top altcoins “somewhat” stabilize, after reaching new all-time highs.

The frenzy continues with crypto success stories, notable figures and famous people in the news.

A majority of lesser known cryptocurrencies follow along on the upward momentum.

Newcomers are drawn deeper into crypto and sign up for exchanges other than the main entry points like Coinbase and Kraken. In 2017 this saw Binance inundated with new registrations. Some of the cheapest coins are subject to massive pumping, such as Tron TRX which saw a rise in market cap from $150 million at the start of December 2017 to a peak of $16 billion! At this stage, even dead coins or known scams will get pumped.

ubai.co

platinum.fund

The price of the majority of cryptocurrencies stabilize, and some begin to retract. When the hype is subsiding after a huge crypto bull run, it is a massive sell signal. Traditional investors will begin to give interviews about how people need to be careful putting money into such a highly volatile asset class.

Massive violent correction begins and the market starts to collapse.

BTC begins to fall consistently on a daily basis, wiping out the insane gains of many medium to small cap cryptos with it. Panic selling sweeps through the market.

Depression sets in, both in the markets, and in the minds of individual investors who failed to take profits, or heed the signs of imminent collapse. The price stagnation can last for months, or even years.

Eventually, we are back to the beginning of the cycle again.

This is human nature.

This is all based on the fear and greed that has been moving markets and motivating investors since anyone can remember.

2.2 The Influence of Age upon Trading

Did you know? Cryptocurrencies have been called “stocks for millennials”

You can also have a clear understanding of the role exchanges play in the new decentralized environment and become a real crypto professional right now. Buy our course and make the first step for your bright future!

Get this course!

According to a survey conducted by the Global Blockchain Business Council, only 5% of the American public own any bitcoin, but of those that do, an overwhelming majority of 71% are men, 58% of them are between the ages of 18 and 35, and over half of them are minorities. The same survey gauged public attitude toward the high risk/high return nature of cryptocurrency, in comparison to more secure guaranteed small percentage gains offered by government bonds or stocks, and found that 30% would rather invest $1,000 in crypto. Over 42% of millennials were aware of cryptocurrencies as opposed to only 15% of those ages 65 and over.

In George M. Korniotis and Alok Kumar’s study into the effects of aging on portfolio management and the quality of decisions made by older investors, they found “that older and experienced investors are more likely to follow “rules of thumb” that reflect greater investment knowledge. However, older investors are less effective in applying their investment knowledge and exhibit worse investment skill, especially if they are less educated and earn lower income.”

ubai.co

platinum.fund

2.3 Geographic Influence upon Trading

One of the main drivers of the apparent seasonal ebb and flow of cryptocurrency prices is the tax situation in the various territories that have the highest concentrations of cryptocurrency holders. Every year we see an overall market pull back beginning in mid to late January, with a recovery beginning usually after April. This is because “Tax Season” is roughly the same across Europe and the United States, with the deadline for Income tax returns being April 15th in the United States, and the tax year officially ending the UK on the 6th of April. All capital gains must be declared before the window closes or an American trader will face the powerful and long arm of the IRS with the consequent legal proceedings and possible jail time.

Capital gains taxes around the world vary from jurisdiction to jurisdiction but there are often incentives for cryptocurrency holders to refrain from trading for over a year to qualify their profits as long term gain when they finally sell. In the US and Australia, for example, capital gains are reduced if you bought cryptocurrency for investment purposes and held it for over a year. In Germany if crypto assets are held for over a year then the gains derived from their sale are not taxed. Advantages like this apply to individual tax returns, on a case by case basis, and it is up to the investor to keep up to date with the tax codes of the territory in which they reside.

Further fueling the perennial January market retracement is Chinese New Year, which usually takes place in Spring. Chinese traders may feel the need for extra funds to purchase gifts or spend on big festive meals for their family etc. So, we see a lot of profits being locked in and withdrawn from the crypto ecosystem around this time of year.

ubai.co

platinum.fund

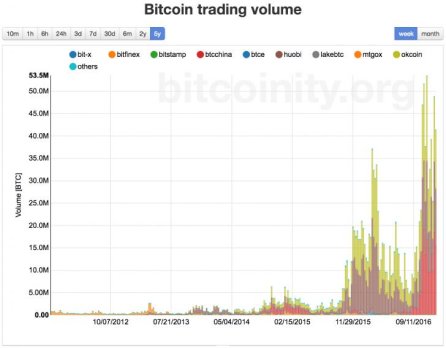

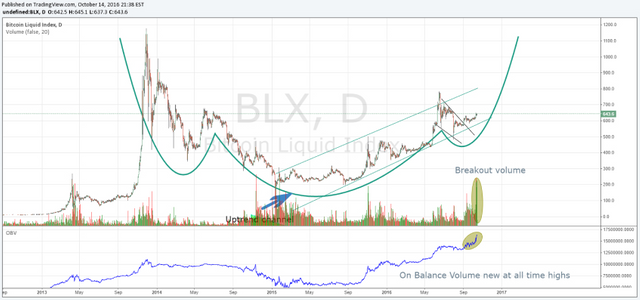

2.4 2013 Bull run vs 2017 Bull run price Analysis

In late 2016 cryptocurrency traders were faced with the task of distinguishing between the beginnings of a genuine bull run and what might colorfully be called a “dead cat bounce” (in traditional market terminology). Stagnation had gripped the market since the pull-back of early 2014. The meteoric rise of Bitcoin’s price in 2013 peaked with a price of $1,100 in November 2013, after a year of fantastic news on the adoption front with both Microsoft and PayPal offering BTC payment options. It is easy to look at a line going up on a chart and speak after the fact, but at the time, it is exceeding difficult to say whether the cat is actually climbing up the wall, or just bouncing off the ground.

Here, we will discuss the factors that gave savvy investors clues as to why the 2017 bull run was going to outstrip the 2013 rally. Hopefully this will help give insight into how to differentiate between the signs of a small price increase and the start of a full scale bull run.

2.4 2013 Bull run vs 2017 Bull run price Analysis

1.Most importantly, Volume was far higher in 2017. As we can see in the graphic below, the 2017 volume far exceeds the volume of BTC trading during the 2013 price increase. The stranglehold MtGox held on trading made a huge bull run very difficult and unlikely.

2.4 2013 Bull run vs 2017 Bull run price Analysis

- The crypto ecosystem was much more mature in 2017.

Since 2013 more than $1billion had been invested in Blockchain companies. Much of this investment was going into the infrastructure of payment networks that make Blockchains more useful on a mass scale.

- Positive press was far more likely in 2017/18 than in 2013. The reputation of Bitcoin was still mired in the ongoing Silk Road darknet marketplace scandal in 2013.

2.4 2013 Bull run vs 2017 Bull run price Analysis

Fraud & Immoral Activity in the Private Market

3.1 Introduction & Brief History of Cryptocurrency Fraud

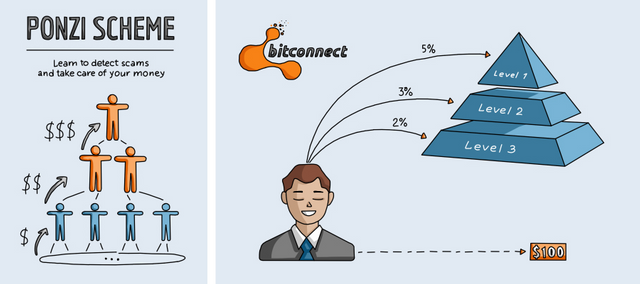

Ponzi Schemes

Cryptocurrency Ponzi schemes will be covered in greater detail in Lesson 7, but we need to get a quick overview of the main features of Ponzi schemes and how to spot them at this point in our discussion.

3.1 Introduction & Brief History of Cryptocurrency Fraud

Here are some key indicators of a Ponzi scheme, both in cryptocurrencies and traditional investments:

3.1 Introduction & Brief History of Cryptocurrency Fraud

A guaranteed promise of high returns with little risk.

Consistent flow of returns regardless of market conditions.

Investments that have not been registered with the Securities and Exchange Commission (SEC).

Investment strategies that are a secret, or described as too complex.

Clients not allowed to view official paperwork for their investment.

Clients have difficulties trying to get their money back.

3.1 Introduction & Brief History of Cryptocurrency Fraud

The initial members of the scheme, most likely unbeknownst to the later investors, are paid their “dividends” or “profits” with new investor cash.

The most famous modern-day example of a Ponzi scheme in the traditional world, is Bernie Madoff’s $100 billion fraudulent enterprise, officially titled Bernard L. Madoff Investment Securities LLC. And in the crypto world, BitConnect is the most infamous case of an entirely fraudulent project which boasted a market cap of $2 billion at its peak.

Exchange Hacks

The history of cryptocurrency is littered with examples of hacked exchanges, some of them so severe that the operation had to be wound up forever. As we have already discussed, incredibly tech savvy and intelligent computer hackers led by Alexander Vinnik stole 850000 BTC from the MtGox exchange over a period from 2012-2014 resulting in the collapse of the exchange and a near-crippling hammer blow to the emerging asset class that is still being felt to this day.

3.1 Introduction & Brief History of Cryptocurrency Fraud

The BitGrail exchange suffered a similar style of attack in late 2017 and early 2018, in which Nano (XRB) was stolen that was at one point was worth almost $195 million. Even Bitfinex, one of the most famous and prestigious exchanges, has suffered a hack in 2016 where $72 million worth of BTC was stolen directly from customer accounts.

That’s it for today! You can also have a clear understanding of the role exchanges play in the new decentralized environment and become a real crypto professional right now. Buy our course and make the first step for your bright future!

Learn more about Platinum ICO promotion services, contact me via Instagram right now:

✅ Enjoy the vote! For more amazing content, please follow @themadcurator for a chance to receive more free votes!