BTC chart review March 12 @ 20:00 PST

The monthly BTC chart from Bitstamp shows the massive parabolic move in 2017 with 9 heikin ashi bars over the upper bollinger band. (Look for that type of move in the conventional markets)

After pulling back within the band and producing 3 red heikin ashi bars, BTC now has a neutral doji

Stochastics are leveling off from the decline from the overbought level

The weekly chart from Bitstamp shows support at the 50 week moving average in March.

The low produced on Feb 6th has not been pierced to the downside which suggests that it may have been the low for 2018...?

The 20 week ma is rolling over and price will be 'squeezed' by the supporting 50 dma.

Stochastics are on an upswing which is a positive sign

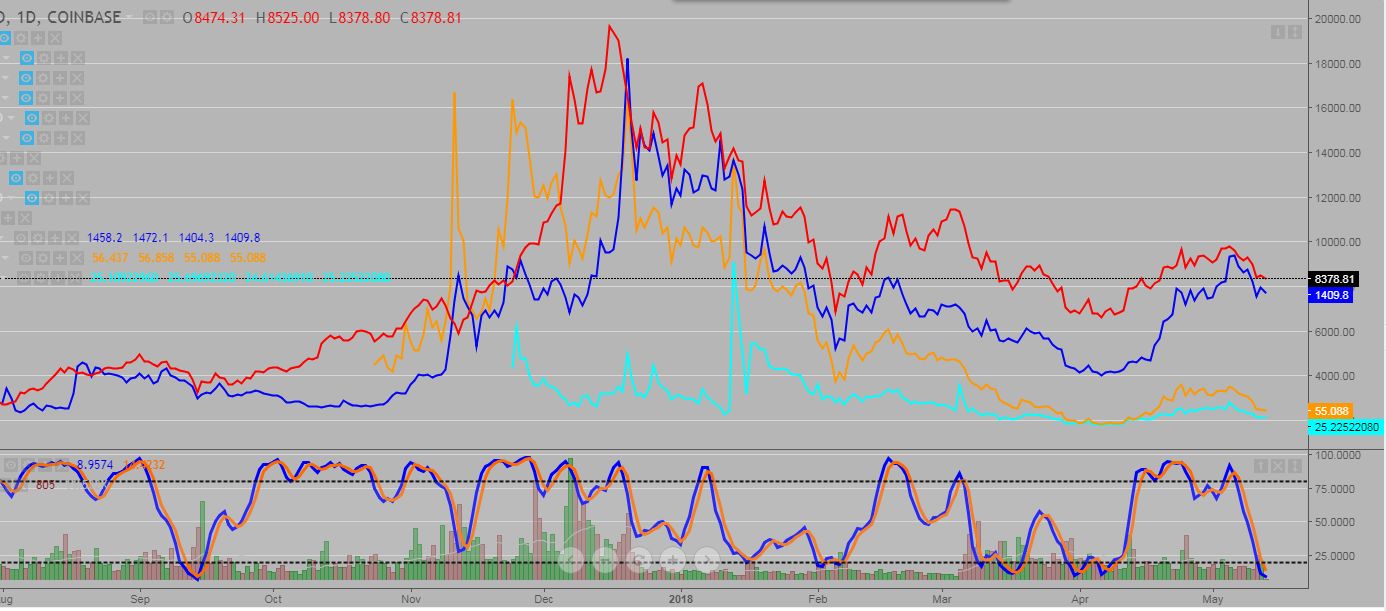

The daily chart from the GDAX exchange shows the current decline and support at the 50 dma

The heikin ashi bars are still in the red, but the last one is short which suggests that the downtrend is slowing down a bit.

Stochastics are oversold, is BTC ready for a cyclical turn around back to the upside?

Stochastics

This is a daily line chart comparison of BTC in Red, Bitcoin Cash in Blue, Bitcoin Gold in Orange and Bitcoin Diamond in light blue.

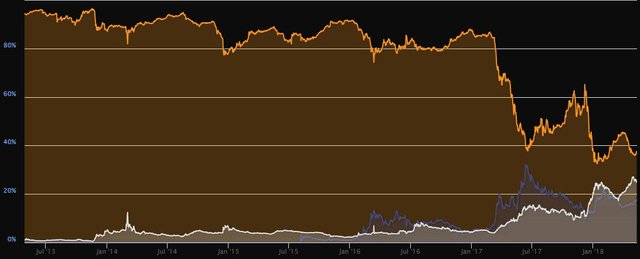

From coinmarketcap, you can see the BTC marketcap decline since 2013 when it had 95% dominance. The blue line is ETH and the white line is the 'alts' which are on the rise.

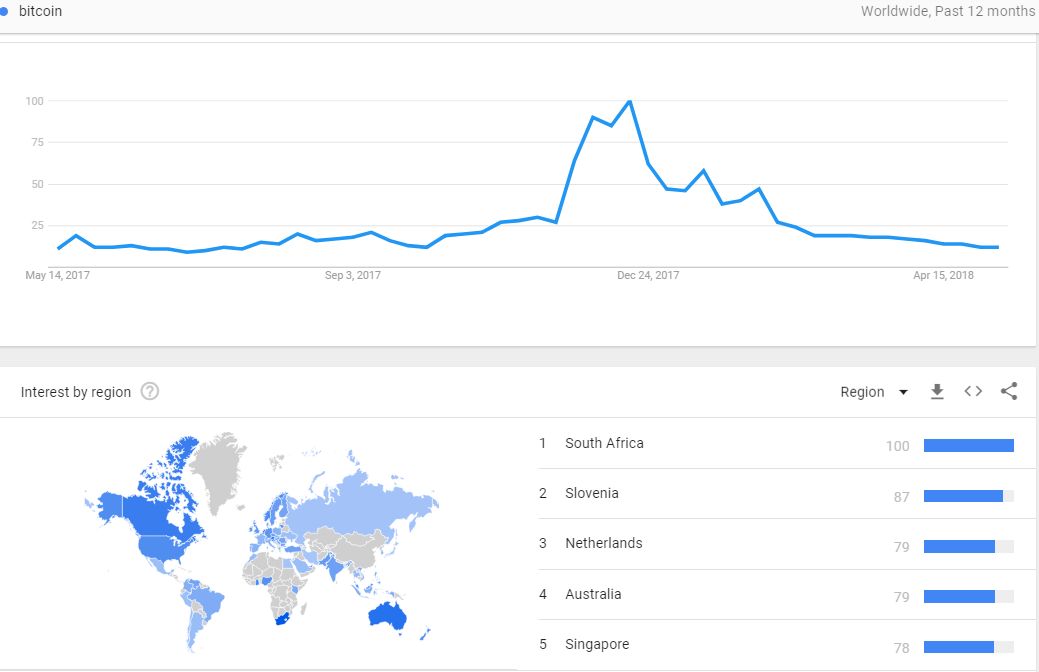

Google trends shows the continued decline in the search for BTC with South Africa in the #1 search position.

There are 2 BTC addresses that have a total of 327k Bitcoins for a total of 2.7 billion US dollars.

The BTC address that holds the most Bitcoin has 205,118 coins in it for a total of 1.7 billion and 1.21% of the total coins

The latest BTC random news from Google:

I've mentioned that the Feb 6th low was the low for 2018 in previous posts. While BTC appears to be rising and falling on a whim, it is technically in a bullish pattern of higher highs and higher lows.

BTC Monthly Chart - Strong Trendline + Strong Support = Long?

I think the low for 2018 was in February, my bias is slowly up until the retail buyers come in. Then 20k

Fantastic review!

Great information post sharing bro...

Hello! Good article! I'm interested in the them of ICO and crypto-currency, I'll subscribe to your channel. I hope you will also like my content and reviews of the most profitable bounties and ICO, subscribe to me @toni.crypto

There will be a lot of interesting!

Glad you enjoyed the post. I find it hard to keep up with all of the ICO's, it takes a lot of time!

Let's hope for best..

You got a 1.94% upvote from @postpromoter courtesy of @glennolua!

Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support the development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

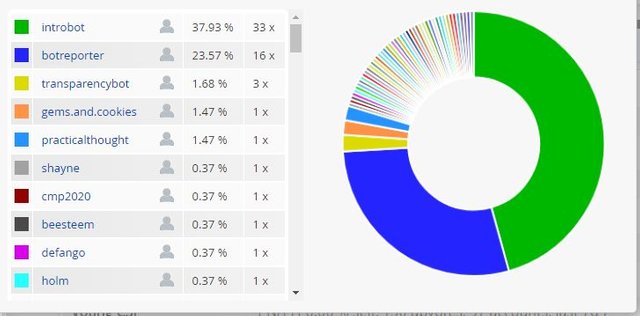

This post has received votes totaling more than $50.00 from the following pay for vote services:

upme upvote in the amount of $11.88 STU, $20.80 USD.

smartsteem upvote in the amount of $11.49 STU, $20.11 USD.

postpromoter upvote in the amount of $11.12 STU, $19.47 USD.

appreciator upvote in the amount of $11.00 STU, $19.25 USD.

buildawhale upvote in the amount of $10.95 STU, $19.16 USD.

For a total calculated value of $56 STU, $99 USD before curation, with approx. $14 USD curation being earned by the paid voters.

This information is being presented in the interest of transparency on our platform and is by no means a judgement as to the quality of this post.

The developer of @transparencybot, @bycoleman has purchased delegated SP and up-voted his other accounts over the last 7 days @introbot 37%, @botreporter 23%, @transparencybot 1.6%

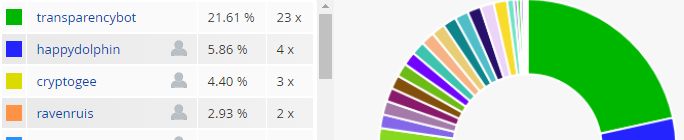

@transparency bot upvotes itself 21% of the time.

Producing multiple accounts and up-voting that account can be seen as taking advantage of the rewards pool. One person with multiple accounts may be looked into and addressed if/when illicit activity is noticed.

This information is being presented in the interest of transparency on our platform @bycoleman and is by no means a judgement of your work.

In addition @bycoleman has used the following bidbots in a previous post:

buildawhale for 69.63, $278.52 USD

upmyvote for 25.36, $101.44 USD

minnowbooster for 22.23, $88.92 USD

boomerang for 18.07, $72.28 USD

smartsteem for 12.21, $48.84

Dollar amounts have been taken from the current Steem price.

@transparencybot posts are not directly related to the content of the originators post and are unsolicited, which by definition is spam.

The payouts listed by @transaparencybot do NOT deduct the original amount that was submitted to the bidbot or the amount for curation.

Everybody knows I, @bycoleman have used bidbots in the past, I have stated this clearly on several occasions, In-fact, I have instructed others on how to use them.

The profits from these boosted posts were donated or given back to the platform via contests.

I lease SP from an individual not MB, build team is simply the intermediary, and they do a very fine job with this.

Yes, I have several accounts that I believe are assets to the platform, which I support directly and indirectly to ensure they are able to perform as they are intended. @Tranparencybot is non-profit, these votes will not return back to me.

I do hope to profit from my other services, it takes a great deal of time and resources to create and maintain these and each of them I believe are assets to the community. Each person is free to judge accordingly.

Is your intent transparency or to discredit the messenger?

I believe most people can see our motives pretty clearly.