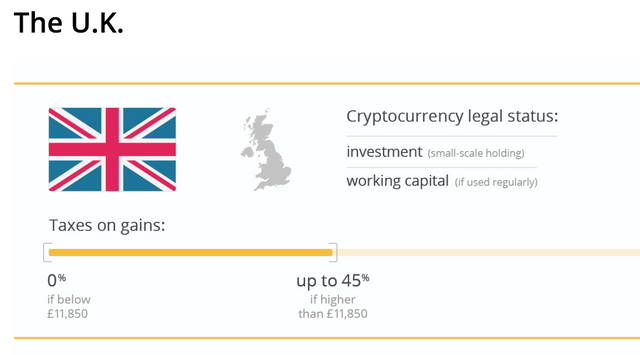

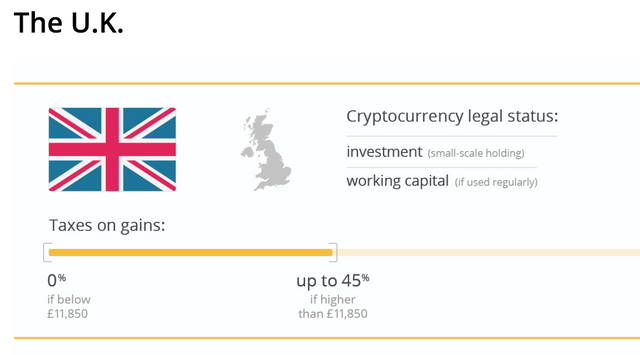

Taxes on gains: Free, if below £11,850, then up to 45 percent

Her Majesty’s Revenue and Customs (HMRC), an agency responsible for collecting taxes in the U.K., introduced its guide on the taxation of Bitcoin and other coins in 2014. Thus, income received — and charges related to activities involving crypto — are subject to corporation tax, income tax or capital gains tax, depending on the specifics. As a HMRC representative explained to British media outlet Alphr, “whether any profit or gain is chargeable or any loss is allowable will be looked at on a case-by-case basis.”

Nevertheless, cryptocurrencies normally fall into the capital gains tax category for casual users in the U.K., being considered investments. However, some traders might be liable to income tax, depending on how regularly they trade and the volume of those operations. According to HMRC:

“Where an asset (including Bitcoin) is held as an investment — as opposed to being working capital in a trading activity — the presumption is that any profit or gain on its disposal will be charged to Capital Gains Tax.”

Similarly, crypto-to-crypto transactions are taxable events as well. However, as the HMRC points out, every situation might vary, depending on the circumstances.

Importantly, there’s a tax-free allowance for every U.K. citizen of working age. For the 2018/2019 tax year, for instance, it constitutes £11,850 per person. If the taxpayer exceeds that amount, he or she is liable to pay 20 percent tax on anything earned between £11,851 and £46,350, 40 percent on earnings of £46,351-£150,000 and 45 percent on gains above £150,000.

Source:cointelegraph

^^^Grow The STEEM Community...ReSTEEM-UpVote-Follow^^^

45% is a crazy amount to be taxed!

Great post sir @steemitpresident. i like your post.