All Eyes This Weekend On.....Soybean Prices - Part 2

I last spoke about Soybeans one month ago,

All Eyes This Weekend On.....Soybean Prices

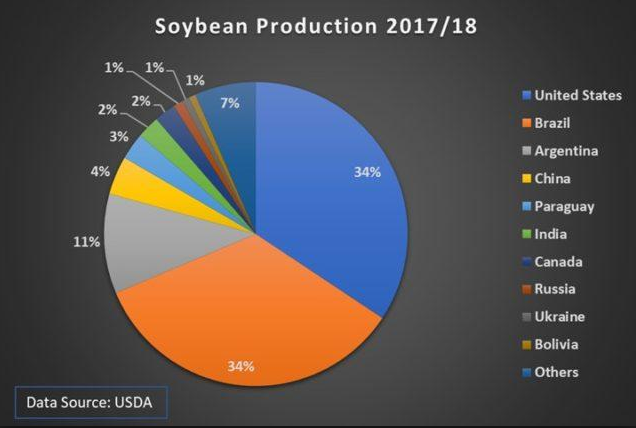

However, China has canceled all shipment of beans from the U.S. causing the prices in the soybean futures market to drop to the lowest price in a decade. China brought in 6.92 million tonnes of soybeans in October, with 94% of that volume coming from Brazil. The US soybean farmers will have their eyes and ears glued to the TV hoping some type of agreement is reached.

However, if a deal is made and if price breaches the 9210 level, there is nothing stopping price from getting back to the weekly supply level with a first target at the 950, just before the daily supply levels.

NOTE: an error was made, the pink dashed line should state $920 and not $9200.

As a way to amend the US-China trade war, China resumed soybean purchases from the US last week. The US Department of Agriculture announced that China bought 1.13 million metric tons of soybeans this week.

China is the world's largest consumer of soybeans,

and bought more than half of American exports last year.

But China counter at the beginning of the trade war last year was to reduce dependence on American soybeans.

However, China doesn’t have the means to increase their domestic production of Soybeans and had to result to South America. South American filled in the balance momentarily, but they couldn’t keep up with China’s appetite. Regardless of whether the resumed purchase of soybeans was part of the negotiation or China’s relentless appetite for soybeans, it’s a win for American farmers.

So where is the price of Soybeans heading next, lets go to the charts?

Well, price is hugging that trend line like a couple in love and finally breached the upper range at $920. The chart is suggesting price will pull back before moving higher to the daily supply at $957.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

Commodities are pretty tough these days as the trade war has really fundamentally changed the structure of those industries. I imagine that the future will look very different from the past no matter the results of the agreements.

Posted using Partiko iOS

The key is the us dollar, watch out for my next post on soybeans and I will explain in depth.