Liquidity Network - Secure, scalable and efficient cryptocurrency payment platform

Introduction

The blockchain boom that started in 2009 when bitcoin was launched has continued to gather pace and momentum against popular expectations. When you look at the number of cryptocurrency projects and blockchain instruments in roughly a decade now, it would seem that this technology has been in existence since fifty years ago. For example, there are more than 1600 cryptocurrencies with a combined market capitalization of over 500 billion dollars. New ICOs launch everyday and these numbers keep rising. Initially, blockchain technology emerged as a superior financial payment and recording-keeping solution. But today, it has extended its relevance and now finds applications in other sectors such as health, education, insurance, business, government, to a name a few. As blockchain technology and cryptocureencies continue to push for mass adoption, the progress made so far does not look like stopping anytime soon. The possibilities are simply endless.

While we can point to several achievements of blockchain technology in a relatively short time, there are glaring technical and functional challenges that lingered. From scalability and security to mass adoption, the common problems of blockchain are very well documented. Though several new projects propose different solutions, it remains to be seen how core challenges of blockchain technology are completely overcome. This article will explain how a blockchain project aims to solve the bottlenecks of blockchain payment that others have struggled with. But before that, take a deeper look at some the current challenges of blockchain technology.

The problem

Below are some of the challenges of blockchain technology that must be addressed to consolidate the progress already made and and make room for further adancement.

1. Scalability: This is one of the oldest challenges of blockchain technology. In case you are not aware, scalability deals with the number of transactions any blockchain can process in unit time. For blockchain technology as a whole, the amount of transactions that can go through the system is terribly low. For example, Visa handles more than 24,000 transactions per second. But Bitcoin and Ethereum that hopes to replace Visa and others, can only manage at most 7 and 15 transactions per second respectively. The result is that blockchain transactions are inherently slow and usually queued up. In some cases, it takes between several minutes to hours or even days to complete a single transaction. It becomes nearly impossible to replace current financial systems with blockchain technology since it cannot cope with the high volume of transactions that happens every second. In a modern and digital economy characterized by speed, blockchain will remain a second option to traditional systems if scalability is not solved.

2. Inefficient offchain solutions: As mentioned in the introduction, many solutions have been proposed to blockchain problems. One of them is processing some transactions off the blockchain. While many projects have implemented this idea, they usually require some deposits or collateral on the part of the user before their transactions are processed. To put this in proper perspective, it is like Visa asking you to commit some money before your transactions can be processed. This is unheard of, but that is what current offchain processing solutions look like. This makes it difficult for most users who do not have the extra funds to commit as collateral to transact on the blockchain. As a result, it prevents the mass adoption of cryptocurrencies.

3. Inability to rebalance offchain: While taking transactions offchain is a noble idea, almost all the blockchain projects that implement this system find it difficult to refill or rebalance offchain. This simply means that the one reason for taking the transaction off the blockchain - to overcome scalability - is defeated. When all transactions are brought back onchain to rebalance them, the system is overloaded with transactions waiting to be processed, making it slow again. Additionally, onchain rebalancing is costly and does not facilitate the privacy of transacting parties.

4. High cost: This is a general challenge of all blockchain platforms. The processing fees deter people from adopting blockchain technology. Each transaction has a network fee that the user must pay. In many platforms, the fee is costly and eats into the main transaction fund. This is especially a big issue with transactions that involve very low fund. When high fees are charged on such small fund transactions, almost everything is taken. Also, some blockchain platforms charge registration fees, requiring the new member to pay some membership fee to be allowed access to use the system. Additionally, for onchain rebalancing systems, there is high cost associated with that which users must pay. All these make blockchain systems costly and drives users away from adopting the technology.

The above are some of the challenges of blockchain technology, although it is not an exhaustive list. However, these and several other challenges not mentioned here will be solved by a unique blockchain solution called Liquidity Network. What is it? How does it work, and is this project worthy of a thorough examination? Take your time, take a look at the project from the next paragraph.

The Solution - Liquidity Network

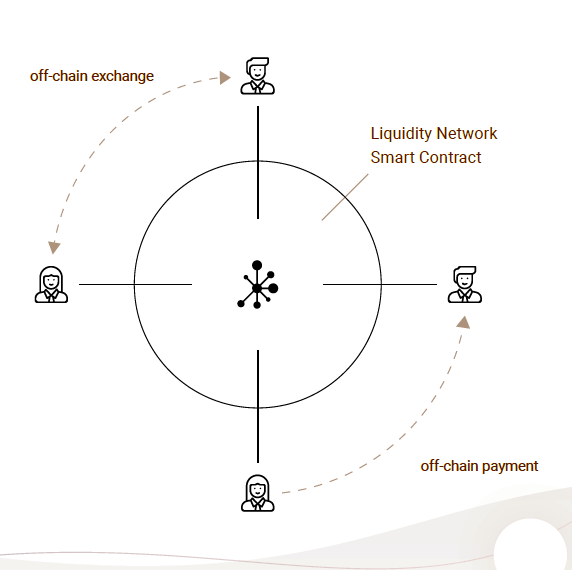

Liquidity Network is a simple, secure and decentralized payment gateway that wants to power mass adoption of blockchain technology with unique solutions to cost and scalability. Built on the Ethereum framework, Liquidity Network, offers a scalable, non-custodial, offchain payment solution that allows several multiple users who are members of a payment hub, to send and receive big and small value transfers in a cost-efficient manner.

Liquidity Network is not a re-invention of the wheel, but an improvement or upgrade of it. It hopes to make existing blockchain payments more efficient and scalable. Liquidity Network will merge the best of two worlds - centralized and decentralized technologies - to enormously improve the speed and security of blockchain transactions. Liquidity Network wants to power the mass adoption by eliminating the high costs associated blockchain transactions, allowing users bi-directional transfer of Ethereum on the platform.

Being a proven non-custodial payment solution, Liquidity Network will not require users to lock up funds while transacting. Instead, users will be capable of sending and receiving instant payments securely without the attendants costs in today's blockchain payments. Consider how Liquidity Network hopes to achieve these feats with unique technologies and efficient components.

How Liquidity Network solves major blockchain challenges

Liquidity Network aims to bring about a simple, efficient and cost effective blockchain payment system that will drive mass adoption. To realize this, the platform is built on two fundamental components each of which contributes uniquely to the project overall goal. Consider the following:

Liquidity Network Nocust Hub

To start, it should be explained that Nocust stands for "Non-Custodial". The Nocust offchain Hub by Liquidity Network is a peer to peer payment system where members of the hub are their own custodian. A custodian is person or an institution that you trust your funds with and hopes that they will keep it safe and do business with it on your behalf. For example, if you save money in a bank, the bank becomes your custodian and you pay them for services rendered. In addition, your savings are relatively safe, but not always, and you cannot take all your money anytime you wish.

Liquidity Network Nocust offchain payment hubs are designed to let members of the hub keep their private keys and not handing it over to a custodian. The payment hubs are interconnected and users can send payments across the hubs in a trustless manner. User funds on the hub are always accessible and can be sent to other users on the hub. The blockchain has one of the highest security features of any financial system, so user funds are secure and can never be compromised by anyone.

There are several benefits of the payment hubs non custodial system for blockchain transactions of Liquidity Network.They include the following:

1. It solves the scalability Issue: The Nocust payment hubs are off the blockchain. Hence, users who are members of the hub can send or receive payments and these are processed inside the hub. Since blockchains are generally congested, redirecting these transactions offchain will help the blockchain to be less congested and faster. Liquidity Network Nocust hub is capable of supporting millions of users that can transact simultaneously. The ability to support several million users without transaction delays and queues will mean that any blockchain that implements Liquidity Network will be able to scale and this will promote the mass adoption of blockchain technology.

2. Non-Custodial hub makes payments instantaneous: The Nocust hub system makes each user their own custodian. As such, funds are not locked unnecessarily away. So once a user makes payment to another user, it is received instantly since there will be no waiting period for any third-party custodian to confirm the transaction and release the funds. Today's off blockchain systems are very slow because custodians must validate payments before they are released and recorded on the public ledger. The Nocust payment hub will make blockchain payments super fast and position blockchain technology to become capable of large volume of transactions if there is mass adoption.

Also, the Nocust hub payment system lets the user keep their private keys, ensuring that each user does not trust their funds to anyone. In later sections of this discussion, we will see why letting users keep their funds is very crucial in today's financial system filled with risks.

3. Cheap transaction costs: Transactions on the blockchain are very costly because the people that validate payments charge network fees for each transaction. Imagine what happens when small value transactions are processed. After the network fee, there will be nothing left. The Nocust hub payment system effective removes network fees. To begin, the transactions are processed offchain, so there will be no network processing fees. This feature is very critical to mass adoption because fees charged on small value transactions leaves a bad impression on new users who are normally not charged for performing transactions elsewhere. Hence the cheap or no transaction fees will encourage small value transfers and make people to embrace blockchain technology.

Categories of offchain Transactions

Liquidity Network has designed the offchain transactions into two categories. This gives users plenty of options to choose what will work best for them. Consider the features of each category and their limitations:

(1) Two party payment channels: Here, the transaction can happen only between two users. There are further possibilities under this category. for example, Funds are only allowed in a single direction and one of the two users must deposit some crypotcurrency which will serve to secure the maximum amount of funds allowed through the offchain channel. This arrangement is know as Uni-directional two party payment channel. Under the Bi-directional channel, funds can be sent by any of the two parties and one of them must deposit some collateral.

Still under the two party payment channel, there is another arrangement called Linked payment channels. Here, the transacting parties are usually separated from each other. Both of them must deposit some collateral. Route finding and other factors are taken into consideration here to establish other elements of this type of transaction. Finally under this first category, more than two parties could be involved in of the above sub-category arrangement. When that happens, it is called 2-party payment Hubs.(2) N-Party Payment Hubs: This second category is much simply than the first one category since it does not require complex routing and collateral refilling. Here too, more users than just two can participate in the transactions. The network fees here costs very little and there is swift transfer of funds across the hub.

The above are the two major classifications of Nocust payment hubs on the Liquidity Network. One good thing about the whole arrangement is that user funds are never stored on the server. Each user holds their private keys. Consider why this is unique and important.

Benefits of allowing users to hold their private keys while the server processes transactions.

Users retaining their private keys: Security has been a major talking point in the blockchain industry lately. The frequent cases of systems intrusion have not helped the situation. Blockchain users are wary of their electronic wallets where hard-earned funds are stored. Platforms that manage user wallets can be compromised by hackers and investor funds can be lost or stolen over night. Trust is now an expensive commodity because some cases of dishonest business practices on the part of blockchain platforms. This have resulted in loss of user funds. Because of the above reasons, users on the payment hubs are allowed to hold their keys so that they can sleep with both eyes closed. It will give them confidence that their funds are secure and safe since its difficult to trust other people.

Additionally, letting users hold their private keys will give them instant access to their funds. At any time they want to transact, there will be no need to wait for anyone to unlock their funds since they have the keys. Finally, users can take full advantage of blockchain security features to make their funds as secure as they know how.

Centralized servers processing transactions: Speed has been a downside of blockchain technology. It is obvious that centralized platforms make use of centralized servers to process transactions swiftly. little wonder that Visa could handle more than 24,000 transactions per second. Liquidity Network merges the best of two worlds to achieve security and speed. Just as discussed above, blockchain gurantees the security of funds. But, to beat speed and improve scalability, centralized servers in the hub are used to process offchain transactions at a very fast rate. Merging these two techniques will result in a fast and seure transactions offchain. It is a novel idea to use centralized servers because blockchain technology was not originally designed to handle large volumes of transactions. As such, there is no point try to re-invent the wheel. So using centralized servers will ensure there is speed on the system, while allowing users to hold their private keys will ensure security and availability of their funds.

Now, consider how the second fundamental component of Liquidity Network ensures that offchain transactions are rebalanced offchain.

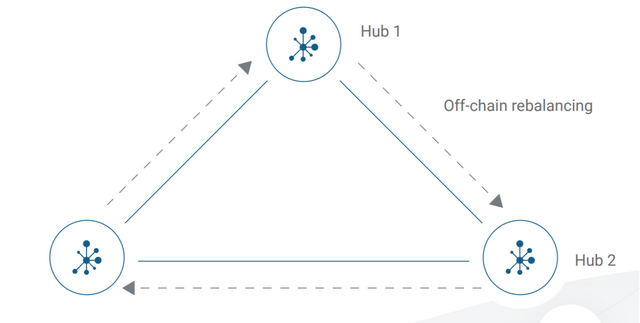

Revive - Effectively rebalancing transactions offchain

The second pillar of Liquidity Network network is REVIVE. It performs the crucial work of rebalancing offchain transactions to remove to come back onchain for rebalancing. Almost all offchain payment channels limit the rebalancing of funds on the blockchain. This process is very costly and contributes in no small measure to the degradation of the blockchain, leading back to scalability and speed issues. To solve this challenge, REVIVE was introduced into the system. This will ensure that offchain payments rebalancing happen offchain.

The benefits of this technique is as follows:

Improves scalability: REVVE lets users of a payment channel to rebalance the channels without coming onchain. When rebalancing is done off the chain, the blockchain is given less load and this will make it more scalable. Combining this with the payment hubs will ensure that everything is done entirely in the channels. The blockchain handles less transaction processing , and is hence capable of sharing the load of work from users betwork offchain and onchain.

Onchain rebalancing is costly: Because of this, REVIVE make such that all rebalacing happens offchain. Eliminating the need to do it onchain, hence, eleminating the associated costs with onchain rebalancing. Users are saved the financial strain of paying for onchain rebalancing.

REVIVE makes Liquidity Network very unique. There are other offchain payment alternatives, but they always struggle with scalability and high cost since they implement onchain rebalancing. But with REVIVE, scalability is improved and the need to perform costly onchain rebalancing is all but eliminated.

Simplified Routing Design

Existing offchain solutions in the blockchain industry such as Lightning Network and Raiden require complicated and costly routing infrastructure to achieve optimal performance.

On its own, Liquidity Network employs very simple routing designs. Since the project relies heavily on the hubs that are interconnected, simple routing designs ensures that two users of different hubs can send and receive payments since the hubs are interlinked with each other. This too contributes to lowered operating costs and faster transaction times

The token

LQD token is a utility token that fuels economic activity on the platform. The token gives holders access to privileged features of the platform.

The personal end users of the system will be the main source of demand for usage of the network. Therefore, to facilitate the creation of this demand, end users will not be encumbered with having to interact using LQD tokens in regular usage scenarios. The LQD Token’s primary purpose is to be used to access premium features in the Liquidity Network (e.g. ServiceLevel Agreements). That is for example to guarantee a particularly high number of transactions per second, the user would need to provide a certain amount of LQD tokens to the hub provider.

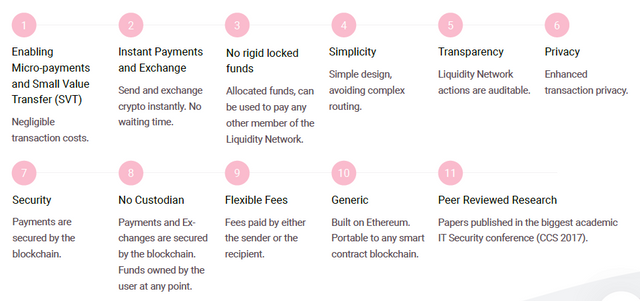

Liquidity Network Benefits at a glance

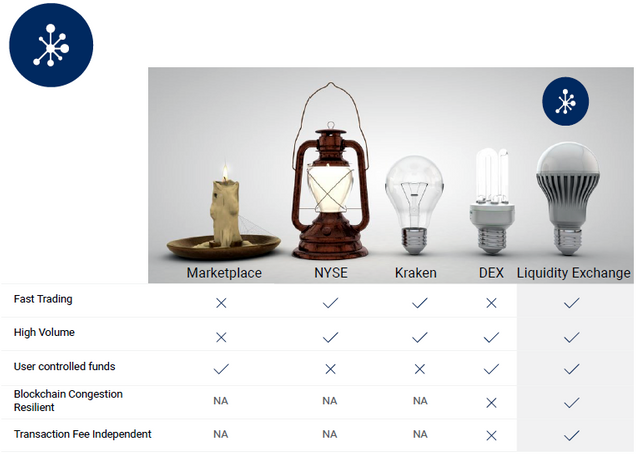

How does Liquidity Network fare with exchange alternatives?

When it comes to crytocurrency exchange platforms, there too many of them out there boasting features that others do not have. But, overall, have they solved scalability - the main design flaw of blockchain technology? You probably know the answer. How about exorbitant transaction fees and locking up user funds? These are glaring problems in the cryptocurrency exchange market today. Take a look at the chart below and see how Liquidity Network is a truly significant upgrade to existing solutions.

Liquidity Network fare with Offchain alternatives

It is safe to say that all offchain payment solutions have one significant problem in common - they lock up users fund. That is not all. Just take a look at the table below and see other drawbacks of Liquidity Network competitors in the offchain payment solution.

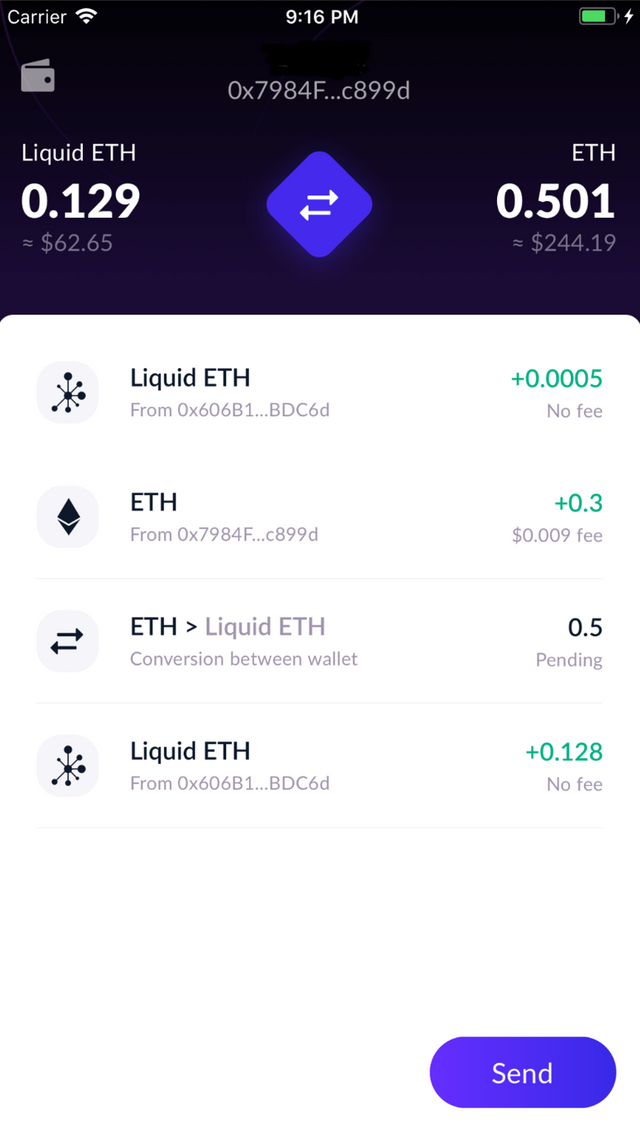

Liquidity Network Deaktop and mobile applications

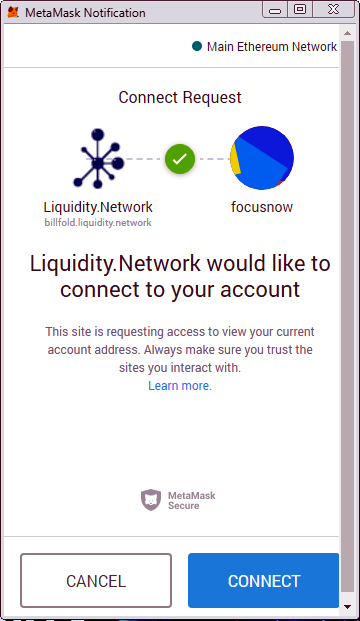

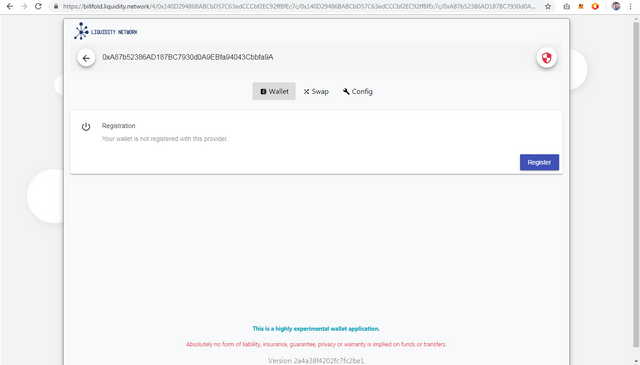

Liquidity Network will provide user interface for all devices - Desktop and mobile. Below, you can see the desktop version. I logged in using my Metamask Ethereum client. I will register my wallet later.

Usecase

Liquidity Network has a very wide application sector since all blockchain projects would benefit from an efficiently scaling platform. Below are some sectors and uses cases for each of them.

Droppcoin is the name of blockchain project that wants to launch some airdrop. This project is managed by a group of 5 computer programmers that have been into cryptocurrency trading for 8 years now. The Droppcoin team are fully aware of the current challenges facing the blockchain industry especially with regards to airdrops. They are particularly not comfortable with sending private keys of the airdrop wallets to participants although this is a common practise. Wishing to be the custodian of the airdrop participants, they began to independently research the possiblity of conducting their airdrop without retaining possession of users private keys. One week later, John who is part of the team came across Liquidity Network and was convinced that among other benefits of implementing Liquidity Network on their platform, it will be possible to run the airdrop without holding users keys. After the team researched Liquidity Network, they agreed to implement it. Happily, the airdrop campaign was successful and users help their private keys and not Droppcoin.

PetMoni is gadget that monitors dogs left by their owners at home which alerts the owner immediately the dog barks. But, users have complained of delayed alerts that comes several minutes after the barking. EverytnPets, the firm that manufactures the PetMoni, decided to investigate. They discovered that the delay problem is from the cloud service from where the captured barking signal is relayed to the owner's device. EverytnPets began to investigate possible alternatives since they experienced the same issue with their former cloud provider. After searching online, EverytnPets discovered that blockchain could be used to relay the signals faster. They stumbled upon Liquidity Network and was satisfied with the offchain processing feature that makes transactions super fast. EverytnPets implemented Liquidity Network and are now happy that PetMoni is working perfectly well for users.

Robert is a cryptocurrency day-time trader. He understands that speed is the key to this type of crypto trading. He continues to search for an exchange platform that delivers the fastest value transfer. A friend told him about Liquidity Exchange and he decided to try it out. Robert was amazed and could not believe the speed of the platform after his first exchange on it. Robert investigated and learnt about the offchain payment feature of Liquidity network. He is happy that he finally found an exchange platform that delivers in real time.

Conclusion

Liquidity Network is a unique solution to the major problem facing blockchain technology - scalability. While there are numerous offchain payment alternatives, non of them have come close to increasing the number of transactions a blockchain can process. Liquidity Network tackles the scalability issue by employing an offchain payment hubs that can be rebalanced using VIVE technology. This reduces the workload onchain and increases transaction speech so much that it powers mass adoption.

Liquidity Network uses a non-custodial technique to let users be in control of their funds and does not lock up user funds. This makes blockcahin payments fast, secure and private. Most important, Liquidity Network makes blockchain payments cheap as users are not charged exorbitant network fees for making payments. In addition, it powers small value transactions that many current blockchain users avoid due to charges. Liquidity Network has everything to gain. If the team's vision is executed completely, this project will effectively drive the mass adoption of blockchain technology in the whole world.

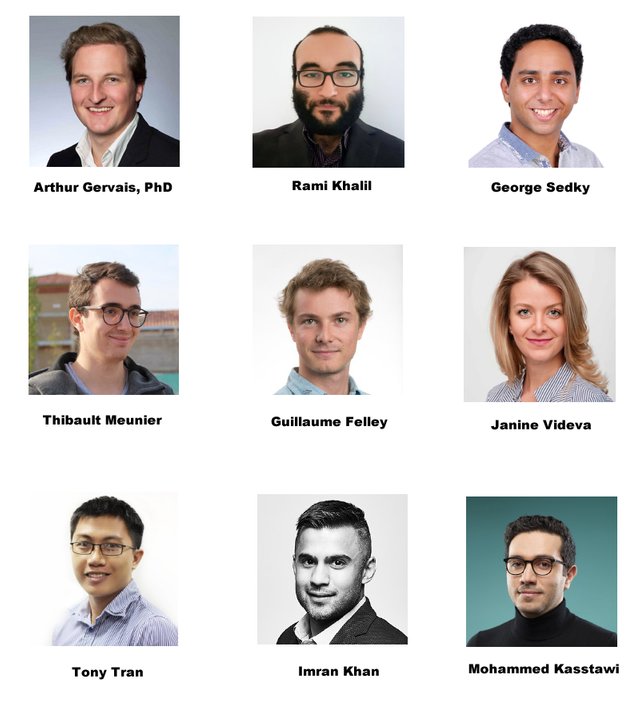

The team

Roadmap

Find More Information about Liquidity Network

Liquidity Network Wallet

Liquidity Network WhitePaper

Liquidity Network NOCUST Paper

Liquidity Network REVIVE Paper

Liquidity Network Apple App Store (IOS)

Liquidity Network Google Play Store (Android)

Liquidity Network Telegram Group

Liquidity Network Telegram Announcement

Liquidity Network Twitter

Liquidity Network Github

Liquidity Network Blog

A quick Intro Video

Who Organized this Contest?

This contest was organized by @originalworks. You can participate in the contest by clicking here.

Image credits

Unless otherwise indicated, all images in this article were taken from Liquidity Network Website and whitepaper

Twitter link

lqdtwitter2019

Nice content.

All the best:)