Countinghouse Fund has Announced the Creation of the Crypto Fund

The cryptocurrency market is projected to achieve continuing growth and attract an increasing number of cryptocurrency holders around the globe. While offering a great number of investment opportunities, the crypto market still has a rather high degree of unpredictability. At the same time, there is an inverse relation between reduction and growth of volatility in the fiat and cryptocurrency markets. In line with it, Countinghouse Fund is shifting its focus from the fiat trading to cryptocurrency market to help professional traders increase their investment returns.

https://www.countinghousefund.com/

Countinghouse Fund is a cryptocurrency-focused hedge fund. The main objective of the project is to provide traders with the suite of services that will minimize their risks and increase profits. With its extensive expertise in financial market, Countinghouse Fund intends to link this knowledge to the new blockchain environment.

Countinghouse Fund's investment strategy

Countinghouse Fund relies on the direct-access method provided to brokers, which is the pass with the maximum profit value. The Fund will boost its competitive advantage by implementing risk management and proven trading strategies. As the trading algorithms used for foreign fiat exchange have been successfully tested for financial operations with cryptocurrency, the existing business structure can be properly transferred to the cryptomarket up to 90%.

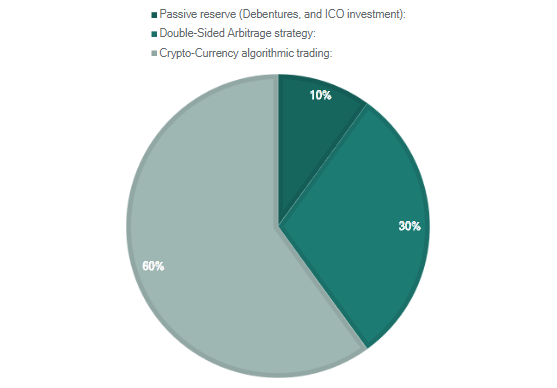

The Fund will allocate 60% of its assets to cryptocurrency algorithmic trading. The remained fourth is needed for double-sided arbitrage method as well as for loans and ICO investments with 30 and 10% of the fund respectively. The Fund is committed to make any financial reports available to the public.

Features and structure of the Fund

There is a plenty of risks associated with exchange trades. Therefore, Countinghouse Fund will implement a set of several methods to facilitate risks:

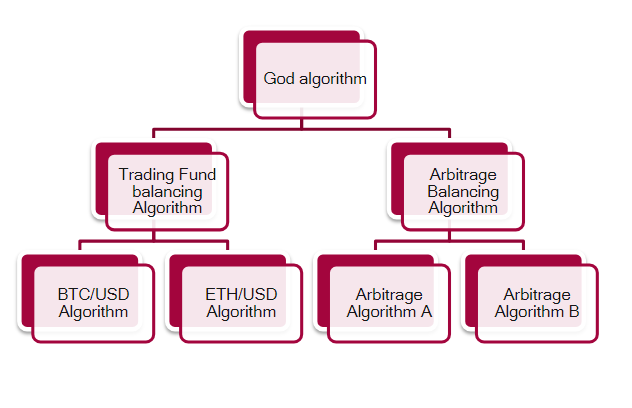

1. Portfolio weighting is an automated algorithm to analyze portfolio's weight. Each currency pair will be traded one by one. This will allow to counteract a decrease or increase in one pair.

2. The system implements Z-Score values for trade entries as well as R-Values for risk assessment.

3. With its innovation, the cross-portfolio “God-Stop”, the system will detect statistically dubious losses, and close active trades in this case.

4. The system relies on market movements rather than market forecasts to deliver a high return in investment.

Investors will be charged 7% of their monthly profit as a commission.

Profit calculation

Before integrating the algorithms for trading on fiat into the cryptocurrency market, the team conducted an annual research on the market capitalization of a $50.000 fund. The use of the double-sided arbitrage method has proven its efficiency in wealth generation.

https://www.countinghousefund.com/

The first year of cryptocurrency trading should result in approximately 600% of the annual return. Hence, the value of the token would grow up to 1000% from the starting point. The profitability of the Fund for the second year should come to 800%.

Benefits of investing in Countinghouse Fund

The implementation of blockchain resolved the issue of initial investment outlay. This means, that investors will be able to obtain access to the Fund and invest as much as they wish. The Fund will provide its participants an access to low-risk opportunities as the system operates on trading algorithms and risk mitigation strategies. Unlike traditional shareholdings, an ICO Fund allows for acquiring the holdings at any juncture. The Fund emphasizes its security policy as a foremost priority. Fiat currency will be kept in non-lending banks. In order to secure assets, the Fund relies on a multi-level system of the wallets.

Token Sale Plan

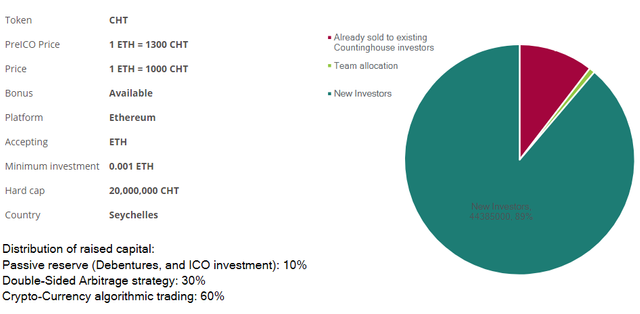

CHT Token is the base currency of the Fund and will be used to pay all fees for the service. The ICO started on April 3, 2018 and will end on June 12, 2018. There is no Soft Cap for the reason that enough of the ICO was purchased by investors from the fiat currency fund, which is another project of the team.

Countinghouse Fund is a managed fund. Its primary goal is to make profits by trading active investments as well as make use of the movement and volatility on the market. Hence, the Fund will operate on successful trading algorithms with the use of mathematical risk management. As part of the Fund's management, investment portfolios will be calculated based on the automated algorithms. In order to avoid human errors, the system will fully rely on mathematical algorithmic trading entries. In addition, there is a holding in fiat currency.

Links

Website: https://www.countinghousefund.com/

WhitePaper: https://www.countinghousefund.com/whitepaper

Telegram: https://t.me/joinchat/G_h8RQ8DgHdVbyzCeoMAxg

Facebook: https://www.facebook.com/countinghousefund

Twitter: https://twitter.com/CountinghouseFd

Medium: https://medium.com/@contact_28273

ANN: https://bitcointalk.org/index.php?topic=3116930

Author: https://bitcointalk.org/index.php?action=profile;u=2049300

ETH: 0xda2574CFeB7De808c08E542000E62C4949ee3233

author: telegram: bonanza_kreep

Disclaimer

This review by Bonanza Kreep is all opinion and analysis, not investment advice.