Countinghouse Fund: Hedging the cryptocurrency market with trading algorithms

The first crypto hedge fund launched in 2011. After a relative lull during which it was joined by a few others, 2017 saw a veritable bumper crop of 167 new hedge funds investing in cryptocurrencies. By the beginning of 2018, though, profits and new capital have drastically slowed down, and several of those funds were forced to close. This did not prevent others from rising up to take their place. Though the risks of investing in crypto hedge funds are considerable, ranging from the unpredictability of this nascent market and the looming prospect of new government regulations to the simple possibility of scams, so are the potential rewards for those investors who remain undeterred.

https://www.countinghousefund.com/

For those who are willing to accept the risks, the Countinghouse Crypto-Fund ICO may seem like an attractive opportunity. Countinghouse Global, the owners of this new fund, promise to bring to the cryptocurrency exchanges their 10 years of experience on the fiat foreign exchange market and their updated trading algorithms. Although it is just one such project among many, and some of the team's claims are difficult to verify (perhaps unsurprisingly, given the private nature of the industry), perhaps it is one that will stand the test of time.

How will this crypto hedge fund operate?

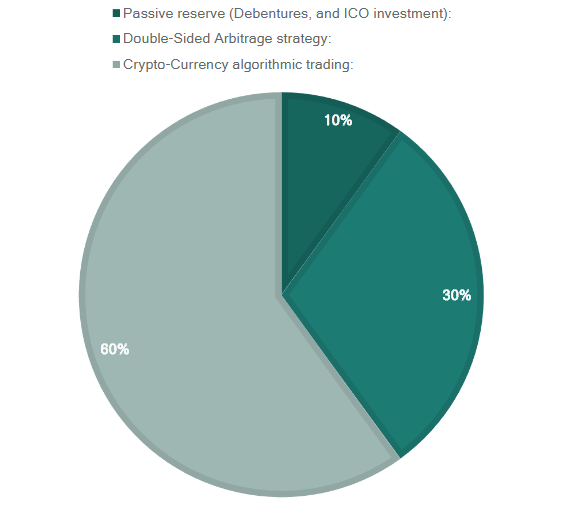

Countinghouse plans to apply algorithmic trading models and mathematical risk management methods to extract profit from the cryptocurrency exchanges. While algorithmic trading plays the main role in Countinghouse's strategy, it also includes debentures, ICO investments and double-sided arbitrage (between fiat and crypto- currencies). The fund has a long-term, evolving plan that assumes explosive growth for the first couple of years, followed by a gradual stabilisation as cryptocurrencies themselves become more stable and more widely accepted. The current fund allocation may well change in response to the market's evolution.

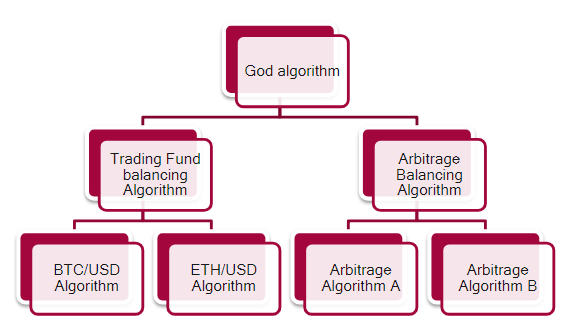

The automated algorithms used by Countinghouse function in a complex hierarchy, regulating each other to minimise risks and losses, adjusting to unexpected developments and ensuring the long-term sustainability of its strategy. Trading is fully mathematical to cut down on the influence of human error.

https://www.countinghousefund.com/

To invest in the Crypto-Fund, one would simply need to acquire the Countinghouse Fund token (CHT), granting a corresponding share in the fund and its profits. Countinghouse pledged to use some of the expected revenue to buy back tokens to decrease supply and drive up the cryptocurrency's value.

What does Countinghouse have to offer to its investors?

Countinghouse touts its team's experience and the consistent high performance of its algorithms, both on Forex and on the cryptocurrency exchanges during an earlier test run. Its direct hedging strategy is versatile and ideal for volatile markets, of which the current cryptocurrency market is a prime example. The IT side of the project (including cybersecurity) is handled by Wisper Connect, a long-standing partner. As an established business that is simply expanding into a new sphere, the fund should be free to use most of the new investments for their direct intended purpose, i.e. trading. Being based in the Seychelles, the cryptocurrency arm of the fund is able to act without delays and restrictions due to favourable regulations.

Countinghouse predicts an annual return of 600% in the first year and 800% in the second year, with an accompanying growth in the speculative value of the CHT (a greater than 1000% increase on the original ICO price is cited).

When compared to a traditional hedge fund, Countinghouse offers a number of unique advantages. For one thing, it is considerably more accessible: there are no upper or lower limits to the investment. Also, the tokens could be bought and sold at any time and without any involvement on the Countinghouse's part, giving the investors a higher degree of flexibility.

ICO details

The ICO for the Countinghouse Fund token (CHT) will take place from 3rd April 2018 00:00 GMT to 12th June 2018 00:00 GMT.

Risks and promises

As was already pointed out, the crypto hedge fund industry is itself highly volatile, its dynamic growth offset by risks. It has been described as a bubble, and at that, one that has already started to lose air. At the same time, there can be no doubt that some of the hedge funds are both genuine and sustainable, and those are likely to deliver great revenues to those who invest in them. It is a risky game, but the rewards offered are considerable. The best that an investor can do is to study the available options and seek out the advice of those in the know.

The Countinghouse Crypto-Fund seems very appealing on paper, but even if all of its hard-to-check claims regarding its past record are true, there can always be unexpected problems. As the disclaimer on its site states, “past performance is no guarantee of future performance”; likewise, Countinghouse's whitepaper warns of specific risks such as “unforeseen regulatory or legal restrictions” and “risk of devaluation of crypto-currencies and/or fiat currencies”. Still, it must be conceded that self-adjusting algorithmic trading appears to be a good fit for the complexity and unpredictability of the cryptocurrency market, and that any company that masters this approach at this time will find itself in a unique position of strength.

Links

Website: https://www.countinghousefund.com/

WhitePaper: https://www.countinghousefund.com/whitepaper

Telegram: https://t.me/joinchat/G_h8RQ8DgHdVbyzCeoMAxg

Facebook: https://www.facebook.com/countinghousefund

Twitter: https://twitter.com/CountinghouseFd

Medium: https://medium.com/@contact_28273

ANN: https://bitcointalk.org/index.php?topic=3116930.new#new

Author: https://bitcointalk.org/index.php?action=profile;u=2049300

ETH: 0xda2574CFeB7De808c08E542000E62C4949ee3233

Disclaimer

This review by Bonanza Kreep is all opinion and analysis, not investment advice.