September in Review

Dear community,

The month of September brings the summer to a close and leads us into autumn. Leaves fall to the ground, eventually becoming fertilizer that spurs new growth. The natural process is a great analogy for where we are at Covesting. The progress we have unveiled this month at Covesting is the result of many challenges faced behind the scenes. We take delays and development issues, and turn them into a determination and passion to create an industry-leading platform.

Release Candidate

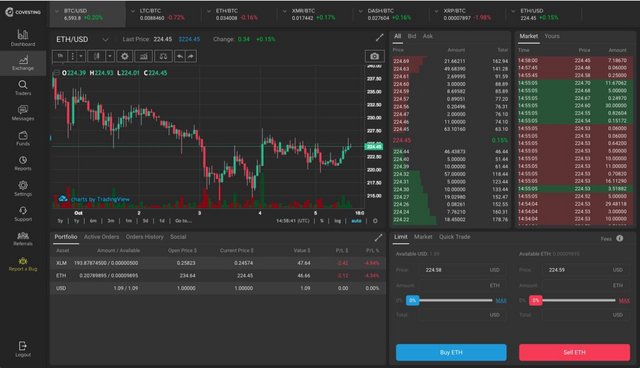

September was a big month for Covesting. We proudly unveiled that the Covesting Release Candidate was live. The Release Candidate update brought with it a number of security and performance improvements on the backend. On the front end, we added a new Quick Trade feature, expanded the list of base cryptocurrencies that can be deposited and withdrawn, and enabled whitelisting of cryptocurrency addresses for additional layer of asset security. You can always follow latest Release notes on our website: https://support.covesting.io/hc/en-us/articles/360009645513-Release-on-the-18th-of-September-2018

Trading Competition

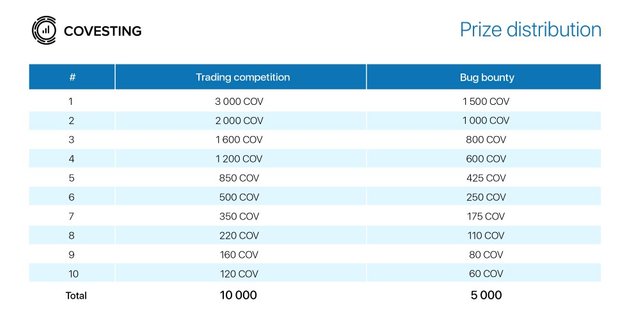

On September 25th we have launched our Trading Competition! The four-week-long Trading Competition includes roughly 200 traders competing for a grand prize of 10,000 COV. Covesting provided all participants with $100 to trade with, and a total of ten top traders will be selected to receive a portion of the COV prizing based on the return on investment achieved during the participant’s trading activities.

To ensure no competitors become inactive, the Covesting team will be actively managing the pool of competitors throughout the Trading Competition. Any trading accounts discovered to be inactive for a week or more, will unfortunately be disqualified from the competition. At that point, Covesting will award the vacant spot to another applicant at random.

When it’s all said and done, the top trader will receive 3,000 COV tokens, with the remaining 7,000 COV distributed among the other nine winners.

Dark Mode

In September, we also enabled “Dark Mode” for Covesting. While the new feature mostly comes down to user preference, our Dark Mode offers an elegant and appealing visual style that evokes a sense of strength, significance, and mystery, and invites users to explore and interact with each aspect of our cutting edge platform.

Bug Bounty Program

For Covesting users that weren’t accepted into the Trading Competition, we are providing yet another way for users to win COV tokens. Also in September, Covesting introduced its Bug Bounty Program. To encourage users to provide much needed feedback on any bugs discovered while trading, Covesting is awarding a grand total of 5,000 COV tokens to the top ten bug reporters, based on the quality, quantity, and severity of reported bugs.

There is no limit to the number of participants or reports participants can make, and everyone is welcome to participate simply by reporting any bugs discovered during the four-week-long Trading Competition. Winners of the Bug Bounty Program prizes will be selected at the close of the Trading Competition. We invite you to report any discovered bugs via the Bug Report form in our platform, e-mail [email protected], or through the report-a-bug form in the Help Center.

We have already begun receiving a large number of reports, and already most of these minor bugs have been fixed. We thank you for your continued support and extremely valuable feedback.

Know Your Customer

Compliance is among the chief priorities of the Covesting team, and proper know-your-customer (KYC) polices are a must to become a world leader in the industry. To get a better understanding of the challenges surrounding KYC, such as how many employees we may need to onboard to best serve our customers, or in what ways we can improve the process, Covesting launched its KYC process along with our Trading Competition so we can further test and polish the process. Now, every registered user can verify his/her account and get ready for the full release.

Continued Confidence: Rome Wasn’t Built In a Day

Over the last few months, Covesting has made significant progress towards achieving our ultimate goal. Our teams are working around the clock in order to deliver the polished, unique product we set out to create. We have grown from a small team of just two to nearly 40 global employees across two offices. We have assembled an executive team with 100 years of combined expertise in the investment industry. We offer enterprise level infrastructure and 24/7 support for all our customers. Already now, everyone can witness that Covesting is about to offer the most features compared to other exchanges, such as our Social trading features, a fiat gateway with proper banking solutions, live portfolio monitoring tools, advanced reporting, and much more. Check out the comparison table below.

When you are developing a project as ambitious as Covesting, there are bound to be strange and unexpected challenges along the way. Development is a difficult and demanding process for startups like Covesting, and we’re constantly working on testing or tweaking code to comply with requirements put in place by regulators. We expect and welcome not only bugs, but many of them. The more bugs we encounter, the better product we can deliver in the end.

We always aim to adhere to our Road Map, however, there is always the possibility of delays. Like any growth-orientated business using custom-built technologies, we need to remain nimble in our timelines and be willing to scrap, adjust, or completely re-develop important aspects of the Covesting platform. Oftentimes, delays are necessary and lead to a better product in the end.

Despite the challenges we continually face, we remain as confident as ever in reaching our ultimate vision for Covesting. We will also continue down our path of full transparency, and provide detailed updates to our community along the way.

Q&A Session With CEO

Due to the fact we continue to receive recurring questions from the community, we have created this helpful Q&A session offering answers to frequently asked questions. Here we go:

What is the process for getting successful traders on-board? There were no professional traders in the 200 beta testers, if I am not wrong — please let us know your plan to get successful traders and community leaders that will bring followers.

In order to get successful traders on board, we need to have a working product first. There is no point of asking them to take part in the competition in the current stage as these professional traders are of another level. They are not interested in bug bounties or competition prizes. These people manage millions of dollars and represent either a fund or act as private advisors. So at the moment we simply keep in close contact with them and update them on our latest developments.

In regards to “popular traders”, who are mainly famous due to their Twitter or YouTube presence — these people will be contacted at a later stage as well, with a private invitation and favorable trading conditions. Many other successful traders will organically join the platform as there is simply no proper competitor out there which provides portfolio tracking tools and success fees. So as our marketing kicks off, most of the industry participants will join the platform anyway. At the end of the day, every “truly successful” trader needs to show off his trading results to his followers. Not trading view statistics, but actual profits which can’t be fabricated.

What is Covesting doing for US residents? Honestly the road to regulations in US is very far and it’s going to be a while before exchange buy, sell and/or copy trading is available to US residents.

How about listing COV on other popular exchanges (Binance, Bitfinex, Kraken etc)? Even liquidity aggregation or order book connectivity with Kucoin will be good.

— https://medium.com/covesting/covestings-statement-regarding-servicing-u-s-clients-and-cov-token-ownership-cb491c6a81fe this article has been made specifically to explain our current position in relation to US citizens. How liquidity aggregation from Kucoin would solve the issue with US citizen onboarding is not really clear. Listing COV on an external exchange is not our goal at the current stage, as it’s strategically disadvantageous.

It is rumored that the team will be buying a lot of COV for internal liquidity. What will this process look like? I don’t ask this question because I’m hoping for a huge increase in the price, I am just worried about liquidity in general, seeing how abysmal the market on Kucoin is right now.

This process will be continuous, part of the COV tokens for internal liquidity have already been purchased.

Are there any partnerships ahead of us you can comment about? Is the partnership with that bank still on the table once DLT gets granted?

Partnerships are definitely on the table. It’s wrong to have a presentation with institutional partners during the development process. We need to showcase the platform in its absolute beauty in order to make a decent impression and score meaningful partnerships. Partially finished products will result in unnecessary travel, as well as resource and time costs. We prefer to start negotiations once we have all pieces from our BRD document 100% finished.

Also, once the platform is up and running and there is a white label solutions for partners to use, will they also need to use COV as the main currency? (Requirement) or is it possible that you will license the platform and enable the partner to use their own currency (not much advantage for COV investors).

We will still evaluate if white-labeling could be our path in 2019. The board hasn’t made a decision on it yet, but the question is on the table. The COV token will be integrated into the platform with all of the features and will remain as important part of the infrastructure.

When can we expect index funds (COV-25 and so on) to be live?

After the copy-trading module is fully developed and integrated. It is very difficult to estimate at the current stage, as every new product would also require GFSC approval prior to release.

Lastly, we have seen some YouTubers posting about Covesting during the ICO Phase. It would be great to see some new videos covering our exchange. Are influencers actively (being) approached to make them aware of the generous ref program. If the answer is: “not yet”, when will this start to take off?

Yes why not. But we will start working with YouTubers once the product is finished and fully released. Promoting a partially developed platform is not a really good idea.

Can we expect some features that will set Covesting apart this year?

We believe that trader rankings, portfolio performance stats, the internal messaging system, proper reporting modules are already existing features that do not exist in the industry. But yes, copy-trading will be a paramount feature to set us apart from other exchanges, along with liquid order books etc.

Do you feel the platform development is held back ATM by bureaucracy (of which we understand the importance)?

Are you in contact with any companies, institutions, professional traders waiting on DLT approval to move in?

Yes, we are in contact with potential partners and networks of traders that are really excited to see our platform go live. We prefer not to disclose particular names at the current stage. We will announce once the partnerships take place.

Are the developers even human?

They are human with the rare ability to work as many hours as robots do.

Can we expect any big platform releases (with all reported bugs fixed, new features) before the soft launch and traders’ competition over? The last one was on the 18th of September and with bug bounty has been happening it’s common to release such updates more often because not all the bugs can be fixed on a live platform.

Actually there are many intermediary releases which have fixed some minor bugs. We do not think that keeping bugs until the next big release is a good idea if we can fix them ad-hoc. But yes, there will be a larger release with infrastructural updates prior to the soft launch.

Are users actively joining Covesting platform still?

Yes, they are organically joining the platform even with 0 zero marketing at the current stage.

How much money will be allocated to marketing?

As per our whitepaper, we aim to allocate 25% to marketing.

How is the app coming along?

The App is ready. Waiting to appear in Appstore where we have received preliminary approval.

If the copy-trade feature is the backbone of the Covesting platform and the traders are the backbone of copy-trade feature, how do you justify the enormous lack of the professional traders in the competition?

Are they not familiar with the competition or with Covesting in general? Is there any marketing to target the traders? And how do you expect the users to register on Covesting if there are no serous traders to follow on it?

Explanation about our approach towards “professional” traders is above. We do not aim to involve professionals at final development stages. We rather do that once the platform is fully developed and copy-trading is functioning which can be very appealing to any trader.

Can you please list the top 3 things you wish you could have done better? What are the 3 biggest lessons you’ve learned so far at Covesting?

*Lessons:

- Development is not a straightforward process. Most of the tasks appear during the development and it’s almost impossible to foresee them upfront, therefore it’s quite hard to estimate exact delivery time of the product.

- Manage expectations of the community because of lesson 1!*

How is the Covesting team going about coding for copy trading? Is the code being written from scratch? Any additional insight into copy trading and its development is much appreciated.

3) Copy trading is written from scratch. Apart from the copy-trading functionality, the performance tracking system is a very important feature. We had to rebuild the whole performance calculation formula and logic, since traditional formulas that are being used with some other companies are not effective and do not represent true performance figures. Mainly due to the fact that it doesn’t take into account capital movements (transfers from / to portfolio). Neither “Dietz” or “Modified Dietz” formulas work properly, so we had to come up with our own solution. We are still in the process of testing it and therefore you may find some bugs with portfolio performance calculation figures. Please report them if you see any!

As always, if you ever have any questions or concerns, please feel free to contact our 24/7 support team.

Sincerely yours,

Covesting team