Ethereum's life saver, let's met the platform that will handle the overload on the Etherem Network. Let's meet the Liquidity Network

Source

A new year is upon us, many things have happened since the birth of Bitcoin more than a decade ago... it is time for Blockchain Technology and Cryptocurrencies to overcome the challenges that are hindering their final breakthrough as the leading payment method, account system, and store of value.

But what are those challenges that are preventing Blockchain Technology to gain mass adoption and to be a ubiquitous tech? They are related to scalability issues such as Blockchain congestion, costly fees, and complicated working mechanisms. These problems harm the usability of the Blockchain Technology and hinder the usage of Cryptocurrencies as a payment method.

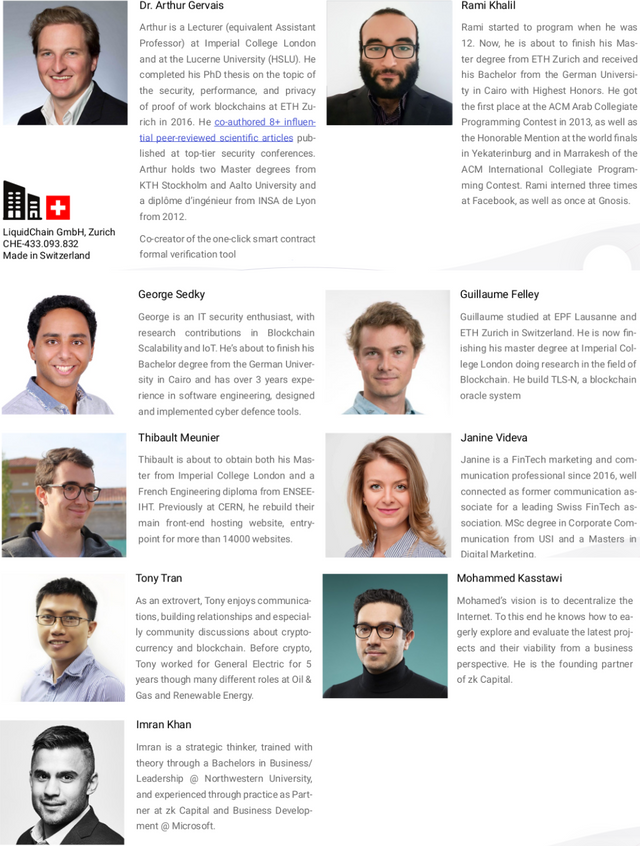

But there are already many skilled developers, businessman, and researchers committed to finding the solution for these issues. One of such wise men from the Imperial College London and his team have come with an audacious solution, the Liquidity Network!

Professor Gervais' proposal, A Transfer and Swap Platform for any Token

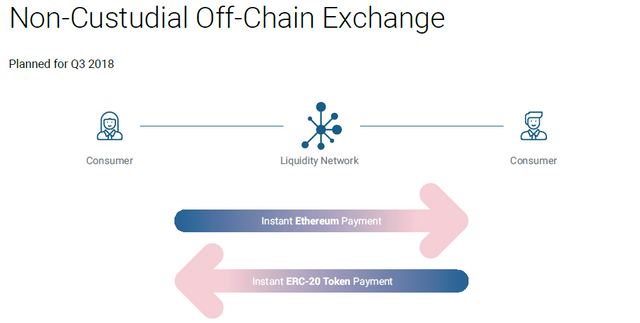

The first implementation of the Liquidity Network is the Liquidity Exchange. It allows non-custodial and congestion resistant off-chain swaps which have cheaper transactions fees than any other exchange in the market. The fact that the Liquidity Exchange has off-chain payment channels grants the throughput of centralized exchanges, and the fact that it is non-custodial grants all the security advantages of decentralized exchanges (DEX).

The above features allow the management of heavy network requirements, thus millions of users would be able to trade and transact on the Liquidity Network while enjoying the speed of centralized services, while at the same time enjoying the security and privacy of decentralized networks.

Hold on a minute! Is the Liquidity Network somehow centralized?

The answer to this important question is NOT AT ALL!. Let's examine three key parameters that the Liquidity Network has and are the requirements for a system to be called decentralized.

Source

- Funds Ownership: Liquidity Network users are always in control of their funds.

- How redundant the network is? (i.e. the reliability of the network due to the replication of critical components on it): The Liquidity Network is designed to create the interconnection of many hubs in a hub network similar to a network of Lighting peers. Therefore providing high redundancy.

- Is the Liquidity Network censorship resistant? Hubs have absolute freedom to choose not to forward payments, users can simply remove allocated funds from the smart contracts and no hub operator can prevent this from happening. Also, users are free to join whatever hub they want.

It seems too good to be true, doesn't it? Off-chain but still decentralized payment channels, negligible transaction costs, a non-custodial and scalable platform, how does the Liquidity Network mange to have all this features? Let's have a closer look at the Liquidity Network design.

Liquidity Network's Architecture

The Liquidity Ecosystem's foundation lies upon the perfect synchronized operating mechanism of its two core elements, the Liquidity Hub NO-CUST and Revive.

A network of non-custodial hubs

We are already familiar with custodial institutions such as banks, in custodial institutions you have to trust third parties with your funds. The risk of suffering loses from poorly managed investments or funds theft. With the advent of the Blockchain Technology, everyone can be their own bank, every user is responsible for their private keys (funds)... but the Blockchain Technology current stage of development provides a user experience similar to what the earlier internet users had back in the 90s when trying to send an e-mail.

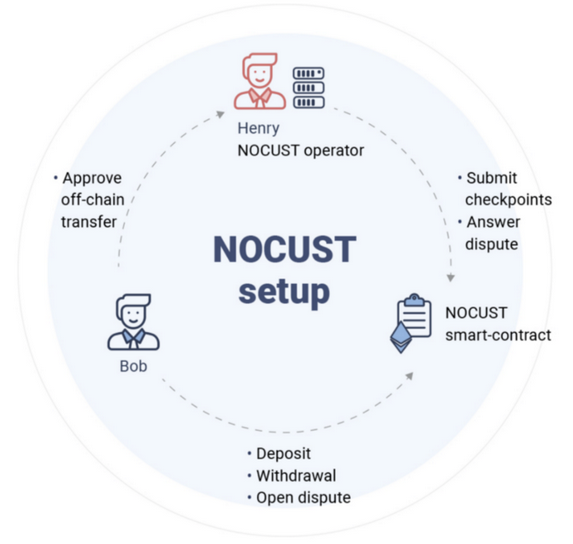

NO-CUST is a layer-2 scaling solution that solves current usability issues. A NO-CUST based payment hub allows its users to readily make off-chain instant transactions without the need of any custodian and without paying blockchain transaction fees.

Source

The designers of the Liquidity Network envisioned a universal hub of users joining to transact his funds with other members of the hub instantly, off-chain and therefore with lower cost than traditional on-chain transactions. One of the most novel features is that the funds in a hub are no longer locked between the two transacting users but are available for each user on the hub. Also, at the same time, funds are secured by smart contracts on the Blockchain which almost nullifies the possibility of thievery between users in the hub.

This design outpaces Lightning technology since an excessively large amount of payment channels are not required within a hub that can host thousands of users. Also, it has a much simpler and user-friendly design in which instant and free payments channels for non-custodial off-chain swaps are created. Furthermore, different hubs can be interconnected with a mechanism similar to traditional payment channels providing the possibility for users of different hubs to make off-chain payments.

Hubs can perform off-chain rebalancing of payment channels

We all know the importance of being able to rebalance our payment channels, privacy is tightly related to security, thereafter it is a must-have in any network whose objective is to bring onboard millions of users. Thanks to REVIVE rebalancing can be done off-chain, thus scalability is no longer a concern in the Liquidity Network. The only time when rebalancing has to be done on-chain is when a dispute arises, then it can be handled as in traditional payment channels.

Source: Liquidity Network Whitepaper page 12

Possible applications for the Liquidity Network

The best airdrop solution for starting projects

Airdrops have been one of the most used methods to raise awareness for newly launched projects. Current airdrops solutions have many characteristics that are not aligned with the spirit of decentralization and open blockchains. One of such characteristic is the need for custodians or wallet providers who know the users' private keys, this resembles the mechanisms of banking institutions. In order to avoid the need for such custodians, some airdrop solutions make thousands of on-chain transactions to send the tokens to the users. This method heavily loads the blockchain, limits the scalability of the airdrop, increases the cost of the airdrop due to the transaction fees, and ends up spamming the blockchain.The Liquidity Network allows anyone to host Airdrops within the Liquidity Network ecosystem. Airdrop issuers will be able to target millions of users and conduct their airdrops with no transaction costs. Also, no custodians will be required, thus private key leakage will be prevented. Furthermore, new engagement methods can be leveraged such as sending multiple drops, varying the size of each drop, and many other possibilities with no additional cost.

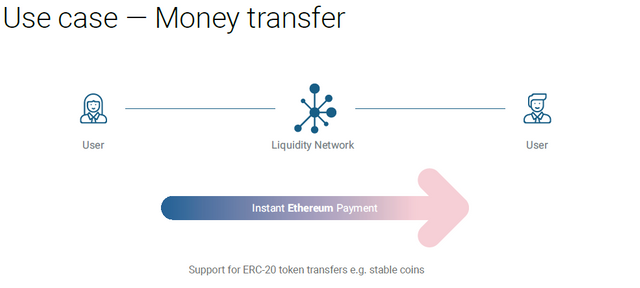

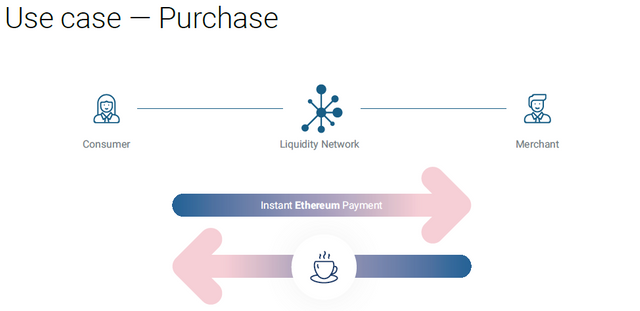

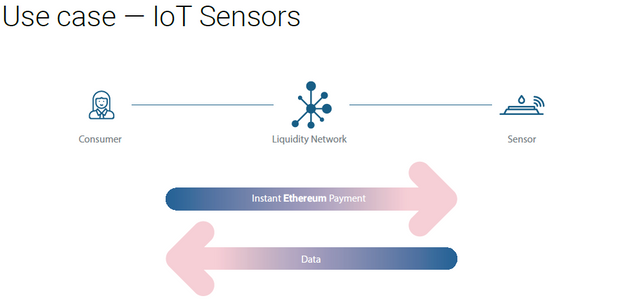

Unparalled platform for sending and receiving digital assets

Source: Liquidity Network Whitepaper page 17

Source: Liquidity Network Whitepaper page 18

Source: Liquidity Network Whitepaper page 19

Source: Liquidity Network Whitepaper page 20

Liquidity Network Addressable market

Due to his versatiliy, the Liquidity Network can be a game changer in many growing business models. Some of the most promisings are:

Comparing the Liquidity Echange with current solutions

Source: Liquidity Network Whitepaper page 25

Marketplaces have experienced many evolutions from its starting point as a physical location where vendors and buyers met to trade goods and services for money. We got a more formal and standardized approach with the creation of the New York Stock Exchange (NYSE), and recently centralized exchanges such as Kraken provided the platform for trading large volumes of cryptocurrency.

But centralized exchanges have proven to be untrustworthy platforms. Since centralized exchanges hold users' private keys they become the attack vector of many malicious parties. Further developments lead to the decentralized exchanges, here high-volume of transactions with great security where available for the first time, but on-chain exchanges have slow transaction speeds and have the risk of blockchain congestion. The Liquidity Exchange is the next stage of the evolution providing a platform where the funds are secured by the blockchain but the transactions are as fast as in centralized blockchain. Also, off-chain channels allow avoiding the high transaction fees of the on-chain solutions.

Source: Liquidity Network Whitepaper page 24

The Liquidity Network also outpaces current off-chain solutions. No rigid fund lockage, free off-chain registration, Eth support, instant ERC20 token exchanges, and a user-friendly interface are some of the advantages that the Liquidity Exchange has over its main competitors.

The Liquidity Network Token

The Liquidity Network is built to create a cross-chain, off-chain payment processing platform where hubs will compete with each other to attract end users and merchants.

The LQD will not be a general purpose cryptocurrency, it is intended to be a special purpose token which will be accepted as a payment method for added-value services. Regular users will not be required to buy LQD to tokens to use the standard features of the Liquidity Network, they only will be necessary for accessing extended services.

Conclusions

The Liquidity Network will provide an off-chain payment platform with all the advantages of Blockchain-based networks with none of their weaknesses.

Payment is the main application of the Blockchain Technology, to achieve mass adoption we need platforms that provide services with the same reliability, the same privacy, and similar cost than banking-like services. Thanks to the NO-CUST and Revive, the Liquidity Network grants end users a payment method that is as fast and cheap as traditional banking transactions. Another key feature to succeeding in the tasks of bringing millions of users is to have a user-friendly system that most of the population can enroll in.

The Liquidity Network provides all of the required features to solve current blockchain challenges. It will be first deployed onto the Ethereum Blockchain, but it can be made compatible with many other such as Bitcoin, Neo, and many others. The Liquidity Network is a groundbreaking technology tool that will boost the development of the Blockchain Technology.

Additional Information about the Liquidity Network

Check out this interesting videos about the Liquidity Network

Roadmap

Team

Want to be updated with LIQUIDITY news?

Stay engaged with their social media accounts

- Liquidity Network Wallet

- Liquidity Network WhitePaper

- Liquidity Network NOCUST Paper

- Liquidity Network REVIVE Paper

- Liquidity Network Twitter

- Liquidity Network Apple App Store (IOS)

- Liquidity Network Google Play Store (Android)

- Liquidity Network Telegram Group

- Liquidity Network Telegram Announcement

- Liquidity Network Github

- Liquidity Network Blog

- Liquidity Network Youtube

Here is my tweet about the Liquidity Network

This is my entry for the @originalworks contest

lqd2019

Here is a video I made about Liquidity. It took ages to be uploaded so I am publishing it in a comment.

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!

Hi, @joelsegovia!

You just got a 0.55% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

You got a 14.29% upvote from @votejar courtesy of @joelsegovia!

You have been defended with a 10.00% upvote!

I was summoned by @joelsegovia.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by joelsegovia from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

This post has received a 16.21% upvote from @lovejuice thanks to @joelsegovia. They love you, so does Aggroed. Please be sure to vote for Witnesses at https://steemit.com/~witnesses.

You got a 25.00% upvote from @whalecreator courtesy of @joelsegovia! Delegate your Steem Power to earn 100% payouts.

Thank you so much for using our service! You were protected from massive loss up to 20%

You just received 18.18% upvote from @onlyprofitbot courtesy of @joelsegovia!

More portion of profit will be given to delegators, as the SP pool grows!

Comment below or any post with "@opb !delegate [DelegationAmount]" to find out about current APR, estimated daily earnings in SBD/STEEM

You can now also make bids by commenting "@opb !vote post [BidAmount] [SBD|STEEM]" on any post without the hassle of pasting url to memo!

* Please note you do not have to key in [] for the command to work, APR can be affected by STEEM prices