Sponsored Writing Contest: CASPIAN

In the formation of our learning, it is necessary to be a carrier of knowledge that in the future is pro of the platform and one of them is to have knowledge about Caspian

What you should know about..!*

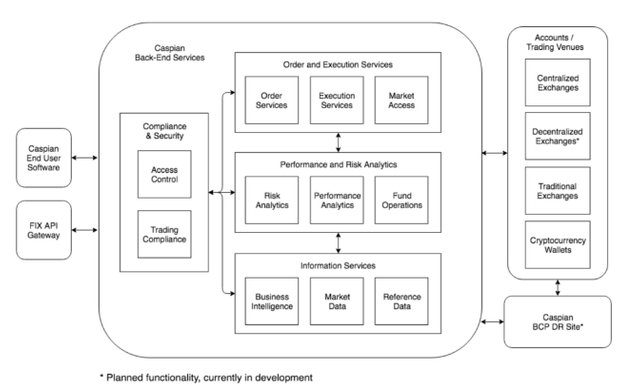

- As we know that the Caspian is a complete asset management solution that covers the entire life cycle of the business. Includes a fully developed OEM, PMS and RMS. It provides a unique interface in all major encryption exchanges, a complete set of sophisticated trading algorithms, historical P & L and exposure tracking and professional customer service. This creates a barrier to entry for individuals and institutions that might otherwise participate in this growing economy.

Caspian is an ecosystem designed to solve the problems facing crypto investors using asingle, user-friendly interface. It achieves this by providing sophisticated connectivity and interoperability across various digital asset exchanges. Caspian is expected to drive further growth in digital asset participation on the part of institutional and experienced investors.

Caspian

Caspian

As an open platform. Our software is designed to run smoothly with your existing technology infrastructure, and has three functions as it is:

- Execution.

- Position & Risk Management.

- Compliance & Reporting.

Caspian Provides everything you need to manage your crypto portfolio as well as products Oems, Algo, Risk, Pms and finally Compliance, Run your Caspian portfolio manage the technology..!

- All operators of digital assets are aware of the security risks that currently exist in the purchase of digital assets. Exchanges are vulnerable to hackers, a risk that has been born in a series of thefts resulting from the loss of more than 4 billion equivalent dollars since 2011. Existing exchanges lack many 9 customer protections offered by the commerce platforms in traditional markets. These include effective customer support and risk management capabilities.

This creates significant flexibility, allowing the platform to accommodate solutions ranging from private clouds hosted in a client’s traditional datacenter to environments supporting large numbers of clients hosted on cloud computing platforms provided by established players in the space.

The system is designed to handle large volumes of data while ensuring low latency for messages on their way to and from the exchanges. While Caspian was not initially designed for high frequency trading, the capacity and latency numbers it can achieve nonetheless approximate the performance such a client would need.

Is a key strategic priority for the Tora system upon which Caspian was built, leading to 99.99% uptime in the past ten years of operation.This is achieved via a number of complementary functions:

● :all critical Caspian services have built-in redundancy and replication, ensuring a resilient architecture with no single point of failure.

:all critical Caspian services have built-in redundancy and replication, ensuring a resilient architecture with no single point of failure.

● : The services are exposed via a load balancer, which runs a routing algorithm to redirect any request to the least contended gateway instance, which is most capable of handling the request at the time it is made.

: The services are exposed via a load balancer, which runs a routing algorithm to redirect any request to the least contended gateway instance, which is most capable of handling the request at the time it is made.

● :For the low-probability but high-severity risk of a major failure that could render the primary site unreachable or unusable, Caspian will offer a backup cloud.

:For the low-probability but high-severity risk of a major failure that could render the primary site unreachable or unusable, Caspian will offer a backup cloud.

Caspian is currently operational and connected to over ten exchanges. We expect to add up to forty exchanges to the ecosystem by the end of Q3 2018.

They plan to grow the business and launch additional functions and functionality the following 12 months, as detailed below:

● Partnerships with existing exchanges to speed client acquisition and facilitate introduction to high volume traders.

● Customer outreach through service providers such as fund administrators. Caspian plans to connect with various service providers that work with new and existing asset managers evaluating the crypto space.

● Build on the existing relationships of both Kenetic and Tora to identify and reach out to traditional asset managers looking to move into crypto asset classes, as well as existing crypto funds. Caspian is well placed to reach these groups at an early stage and drive their adoption of the platform.

● Expansion into crypto communities, including organizing trading competitions, setting up bounty programs and other community programs.

● Outreach aimed at developer communities, including organizing hackathons.

● Outreach to relevant industry bodies, including Financial Information eXchange (FIX) and the Alternative Investment Management Association (AIMA).

● Promotion of Caspian through events, trade shows, conferences and meet-ups.

● Online marketing strategy focused on institutional and experienced traders.

The Caspian token is an ERC-20 compliant token to be issued on the Ethereum blockchain. The CSP token model has been designed to serve several principal objectives. In the broadest sense, the goal is to link Caspian’s best-in-class functionality with a token that incentivizes platform use and the development of unique third-party tools and features. Specifically, the token is intended to create a rich, participatory ecosystem where platform users also become community members with an active interest in the platform.

User-to-Platform Utility: The Commission Discount Programs and the Discount Payment Function will provide fundamental value to the token by allowing token holders to earn and potentially combine different discounts that can offset platform fees. . !

User-to-User Utility: The CSP rewards developers who offer their apps for free.

Token provides utility but is not necessary: The token is designed to enhance the user experience and enrich the Caspiancommunity.) It is not designed to be necessary to enjoy the base feature set of the

platform. Even without the token, clients can use all core features discussed in the preceding sections.

Here is this video where it gives you all the functions you need to manage your encrypted fund..!

- Chairman Founder and CIO of Evolution Capital Management and founder of Tora. Prior to founding Evolution and Tora, Mike worked in a number of senior management and trading positions at bulge bracket investment backs. Mike holds a B.A. in Politics from Princeton University.

- CEO & Co-founder Tora CEO for the past 14 years. Prior to that, Robert spent 11 years in the enterprise software and high-tech industry in Europe, North America, and Asia at such companies as WebPartner and Audiosoft. Robert holds a B.A. in Economics from Princeton University.

- COO & Co-founder Kenetic COO since inception. Prior to that, David spent 10 years as Managing Director and Head of Asia Trading at Och-Ziff Capital and was the former chairperson of HKeX Hedge Fund market council. David holds a B.A. in Psychology and B.Comm. in Finance & Economics from the University of Sydney.

- CTO & Co-founder Managing Director at Tora for the past 12 years. Prior to that, Gerrit managed the development of high volume trading applications and analytical tools for various hedge funds and bulge bracket investment banks. Gerrit holds a B.S. in Computer Science from Stanford University.

- CFO Tora CFO for the past 10 years. Prior to that, Paul held senior financial positions at WAGIC, Intertop, and Isonics. Paul spent the first 9 years of his career in public accounting, last serving as Senior Manager at Deloitte. Paul holds a B.S. in Business – Accounting from California State University, Fresno and is a certified public accountant.

- Chief Strategy Officer Co-founder and Managing Partner at Kenetic. A former front-end developer with

over 10 years’ experience in web and enterprise application development. Jehan founded the Ethereum HK community 2014, and co-founded the Bitcoin Association of Hong Kong 2014. Jehan holds a B.A. from Johns Hopkins University.

- Oved is a co-founder of AirSwap, a decentralized, peer-to-peer token trading platform for erc20 tokenson the Ethereum blockchain.

- Ivan is professor and head of the research group in cryptography at Aarhus University. Ivan is co-founder of Cryptomathic, Partisia and Sepior.

- Former star-trader at Goldman Sachs, promoted to Vice President by the age of 26 and made the “top 30 under 30” list in Trader Magazine in 2008 and Forbes Magazine in 2011 after profitably trading the 2008 and 2011 crashes. Moved to Geneva-based macro fund Jabre Capital in 2011, before deciding in 2014 that the future of finance lay in blockchain technology.

"Cryptocurrencies provide a unique and attractive combination of returns and volatility"

Here this video demonstration of compliance!

- Caspian Website

- Caspian WhiterPaper

- Caspian Steemit

- Caspian YouTube

- Caspian Telegram

- Caspian Videos

- Caspian Blog

- Caspian Eventos

- Caspian News

- Caspian Linkedin

- Caspian Management

- Caspian Twitter

By knowing a little more about Caspian The complete solution to know about Caspian has been for important users that provides a access to all crypto exchanges through a singles interface. of your product, These compliance levels allow users to create and adhere to rules that are appropriate for their assessment of risk-reward and ability to withstand variance. All breaches are fully audit trailed and recorded.

Click Here if you want to know more about the contest and how important it is..!

This script was made by @mariabarreto, for the contest @Originalworks, Sponsored by CASPIAN..!

Link to tweet Caspian twitter

Caspian 2018

Good script congratulations luck!

thanks! @airam05

Thanks to use @jzeek service

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!