Practical Approach to Investing in Cryptocurrencies. 2019 Update

Cryptocurrencies are a novel asset class. We recommend you to dig in the Cryptoassets book by Burniske and Tatar, although we’ll provide more guides and educational material on crypto as we roll. In this article we aimed to pinpoint a crucial economic phenomenon which is a market cycle. When buyers become enthusiastic with a certain financial instrument, the price increases inducing others to buy more of it. Often it exceeds any rationale leading to a “bubble.”

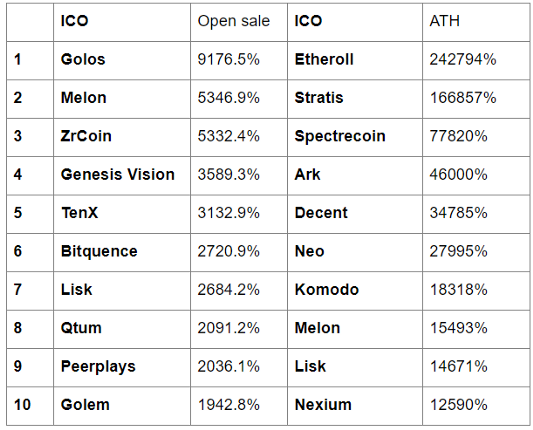

Between 2017 and 2019, the initial coin offering market (ICO) was valued at stunning $28.3 billion. The average multiplier for the top 10 public token sales was at x38 times at the opening date versus the ICO price. An all-time high (ATH) or the peak price for one token on the market was on average x657 times per top 10 offerings(!).

Biggest returns for ICOs on the first day of open sale and for all time (in 2017). Stats from the research by Esoteric Capital

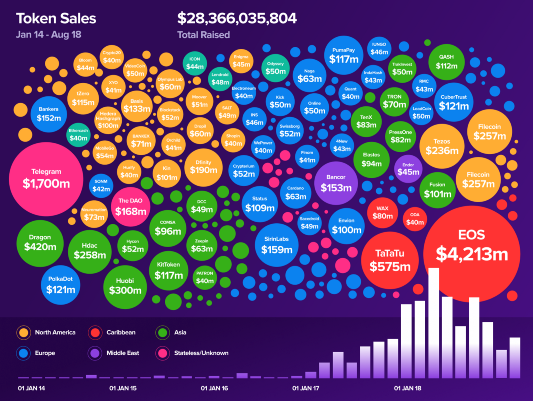

The state of ICOs as of mid-2018 by Elementus: total amounts raised

Everything surged in 2018 following the Bitcoin’s ATH of $20,000. However, the downfall, or so-called crypto winter, entered the scene. As Elementus team explained, the market has matured since then and eventually transformed into the security token offering (STO). Some call it a digital security/token offering; but despite the naming, the conclusion is clear: we are witnessing a tremendous shift in the world of capital. (By the way, we will elaborate in future articles on a true definition of the “capital.”)

Cryptocurrency proved to be an alternative payment system and financial instrument. We are going to discuss the key five reasons why there must be a massive crypto comeback and how you can still join the party. Remember: the cycles have a tendency to repeat; this is why there is a high likelihood of prices going up. (As we are editing this, BTC made +20%).

Reason #1. Digital gold

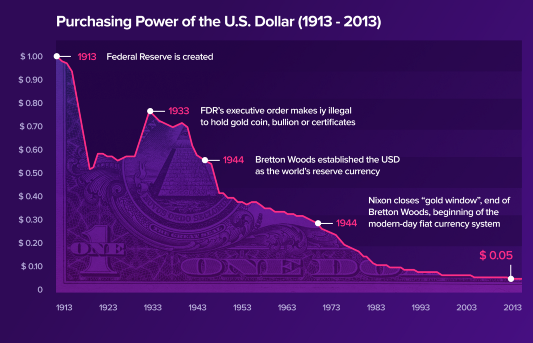

While there is a service that literally put gold on the blockchain, you may have heard that Bitcoin is the new “gold standard.” Before we speculate further, let us explain what people often refer to when mentioning it. In economics, it is the system under which currency has a direct link to gold. The scarcity of the metal leads to limited emission and, as a result, less influence on the money. Historically, there were a few attempts to abandon the gold standard which tightened all the currencies to each other. Currently, there is no such limitation. Instead, central banks (or federal reserve systems) are allowed to print more money in excess. Basically, it’s just digits in Excel on a centralized ledger.

Why should one care, you might ask? Well, over the years this approach has been destroying your purchasing power. Even if you kept a conservative savings account, it is likely to lose value in a long-term. We wish you to work less and earn more, not vice versa. Here is a graph of 1 USD inflation and 1 BTC deflation over 10 year period. Feel the difference.

Bitcoin is the opposite. Its creator, Satoshi Nakamoto, envisioned the cryptocurrency as an alternative to the unfair fiat system. Instead of letting someone to create money out of thin air, the virtual currency with several cryptic algorithms has a predictable emission and clear rules for all. You can choose to opt in. Then, you ultimately become the bank, with no third parties involved. Most importantly, bitcoin has only appreciated over time.

Reason #2. STO and tokenization as a new trend

As you may have heard, there are alternative coins besides bitcoin — altcoins. Instead of waiting for years before they can grow in value and relying entirely on the open source community, teams behind these projects raised money in a novel form of crowdfunding, the ICO.

But when governments signaled their intolerance towards the shady business of many ICOs, this method of raising capital tarnished its reputation.

However, the exchanges turned this peril into an opportunity. As a result, many established regulated platforms for launching own token or a Security Token Offering (STO). Binance Launchpad, Bittrex, OKex, NEXT.exchange, Waves, and more did it recently and even produced a new term, the Initial Exchange Offering (IEO) as a crowd-pleaser. Blockchain projects restored trust in venture capitalists and brokers. Now, everyone speaks of tokenized securities and how various assets could be digitized and registered on a distributed ledger with the further right to be traded freely and without borders.

There are entire skyscrapers being tokenized and companies paying dividends to the holders of their tokens. Companies like Expand revolutionize the world of microtasks and microlending, thanks to the innovative nature of cryptocurrencies, and we only scratched the surface of blockchain companies working on real solutions.

Reason #3. Corporate tokens and blockchain businesses

It may seem ethereal, but companies are betting on own payment systems to reward users and strengthen the ecosystem. For instance, in 2018, Facebook resisted the spur of hype around cryptocurrencies and banned all related ads. Later, it hired a blockchain department, and now we are well aware of a possible “micropayment solution” to be tested in its portfolio company WhatsApp.

Earlier that year, journalists went crazy by gathering the crumbs of news about Telegram’s development of blockchain ecosystem TON or The Open Network. It is going to be an all-in-one solution for fast and secure communication, private proxy, reliable storage, and peer-to-peer payments. The immense white paper describes the technology in detail, while for some it had seemed to be a gathering of all the blockchain developments at that moment. Notably, the founder of this behemoth, Pavel Durov, has had experience with internal currency — “votes” — back in the days when still working on VK.com. The private sale of $1.7 billion (and then an additional $1.7 billion) aimed at scaling that experience into the real virtual republic with its own (Federal) TON Reserve.

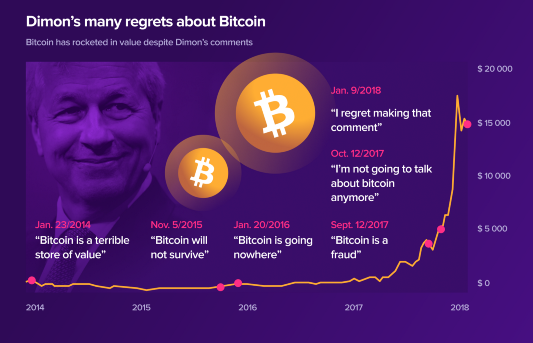

JPMorgan Chase, one of the largest banks and asset holders, launched their token for instant and frictionless international payments. For those who’ve been in the market for at least a few years, that’s a curious fact for two reasons. First of all, the CEO of JPMorgan Jamie Dimon has been against the biggest cryptocurrency (let aside altcoins), but eventually regretted own comments and accepted the innovative nature of the technology. Secondly, the concept of new JPM Coin resembles another digital currency called Ripple that already serves over 200 corporate clients: from banks to private funds.

Reason #4. Infrastructure 3.0

If that is not enough, we invite you to watch the rich and insightful speech of Jeremy Rifkin. This famous American economist and social theorist has been advising the likes of Angela Merkel and other top rank government officials on improving the efficiency of their states. His main point is that even the most developed countries such as Japan, the UK, Germany, or the US cannot crack the efficiency ceiling of 20% without new infrastructure.

There are some 170 million wood utility poles in the United States alone that have been serving as a backbone for the communication: first as the telegraph and later carrying electricity. Amsterdam, one of the financial centers of the world, is home to lots of old-style houses that have to be adapted to the modern drainage system preventing leaking and other inefficiencies.

Thus, elements of smart homes, smart utilities and, eventually, smart cities must revolve around the concept of the Internet of Things (IoT) to become more efficient.

Guess what, it would require some kind of digital currency to interact with distributed ledgers and make automatic micropayments. Basically, devices will communicate with each other on their own and pay bills, purchase food, and order supplies efficiently. IOTA is only one example in this domain; Taiwan partnered with the project to make a futuristic world today. The Third Industrial Revolution will require a LOT of investments from the government as well as enterprises. Thus, investing in it even part of your crypto portfolio seems more secure than a T-bond or a 401K pension fund.

Reason #5. Famous investors bet on a new boom

After all, any economic cycle expects periods of inflation (up to the point of a bubble) and recession (thank god, not a depression any more). Hyman Minsky who predicted the global financial crisis of 2008 decades prior to it, had warned us of securitization risks — the problem that cryptocurrencies solve by inherited trustless nature. Therefore, either there is going to be a new crypto bubble or the great financial crisis, prices for the crypto assets are primed to skyrocket.

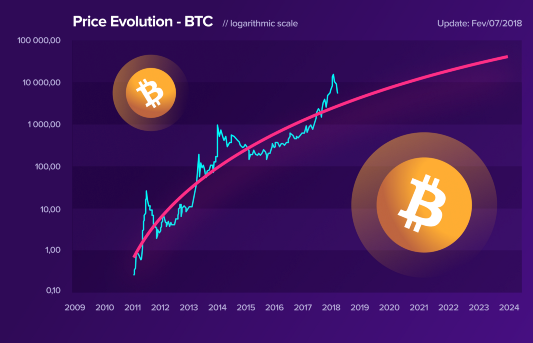

A logarithmic growth chart for bitcoin

It’s incredible, but Bitcoin’s price resembles the non-linear graph quite well. Let’s see what influential people have to say about the price of the main cryptocurrency by 2020. (Keep in mind that altcoins may follow the pattern of bitcoin as well).

- $1,000,000 according to John McAfee;

- $100,000-$200,000 according to Jim Blasko;

- $91,000 according to Thomas Lee;

- $75,000 according to Mark Yusko;

- $55,931.60 according to Hayes model;

- Murad Mahmudov is convinced that bitcoin will achieve a new all-time high in 2020, and Tone Vays agrees: there is a 40% chance that this happens.

Should I invest in cryptocurrencies in 2019?

We have reviewed five key reasons to invest in crypto assets in 2019. Moreover, the fundamentals prove it is a favourable time to do so. In fact, we call you upon considering reasonable risks along with the benefits of investing in crypto. While enough observers expect a new bull run, it might be postponed. Furthermore, when you purchase a cryptocurrency you must be confident it is stored securely. Noozzle can help you with everything: from buying to storing and trading.

Unexpected bonus reasons.

Of course, there are many more reasons to consider buying cryptocurrencies with your risk capital. A financial crisis could destroy liquidity and, thus, the volume of available cash. One can’t imagine this happening, but the mass transition to electronic cash could be huge trouble: banks become in full control of your money. With crypto, you are the bank.

If the Internet were to shut down, transactions could be broadcasted over the radio, mesh networks, and satellite. The technology is here. Again, you’ll be among the minority that supports and creates liquidity in such an apocalyptic scenario. For other practical ways of cryptocurrency, read our other articles.

The time has come. Invest in cryptocurrencies with Noozzle before the next bull run. We build crypto products that give people financial freedom, control over own wealth, and stellar user experience. We believe that crypto world should be free and open for everyone.

Please give us a thumb up!

- Website: https://noozzle.space

- Twitter: https://twitter.com/NoozzleSpace

- Facebook: https://www.facebook.com/Noozzle.space

- Linkedin: https://www.linkedin.com/company/35614362

- Medium: https://medium.com/@noozzle.space

- Steemit: https://steemit.com/@noozzle/

- Youtube: https://www.youtube.com/channel/UCL07fY3bJCbjQzU_DkQiq7g

- Reddit: https://www.reddit.com/user/noozzlespace

- Official Telegram Group: https://t.me/noozzle_space

- Noozzle Announcements: https://t.me/noozzle_announcement

- Noozzle Telegram Chat: https://t.me/noozzle_live

Congratulations @noozzle! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!