Why does it say that Stablecoins are better than Bitcoins?

On January 3, 2009, Bitcoin was born. A new concept of money gradually entered common people’s life from cryptogram enthusiasts and geeks in the following decade and created lots of epic history.

Today, cryptocurrencies seem to have gone through their great prosperity period. Presented by bitcoin, the cryptocurrency purely based on an algorithm to build trust is gradually becoming quiet. However, the stablecoin, which has an asset-backed guarantee, has sprung up.

1 The basis of currency price

The essence of money is a special commodity that can serve as a general equivalent and is a generally accepted transaction medium, payment instrument, value storage, and pricing unit. The “universal acceptance” is the price basis of money. Only when it is trusted and accepted by most of people can an item become a currency.

A 1000 HKD which has a very low printing and production value can be valued at a price of 1000 HKD is because people trust the government.

2 Fragile trust consensus

The birth of Bitcoin is precisely the hope of completely deviating from the centralization mechanism, and building a brand new global currency with pure trust consensus. This has attracted countless people in the early development of Bitcoin.

However, a large quantity of “bitcoin” was released one after another. Ethereum ICO even became the main reason for the bear market.

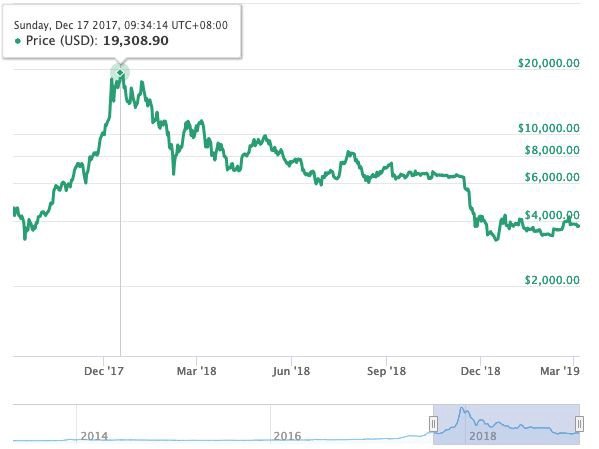

In December 2017, Bitcoin suffered a plunge after rushing to nearly 20,000 US dollars. In 2018, the price of Bitcoin and other cryptocurrency were falling down like a waterfall.

The huge price volatility of cryptocurrencies is revealing that the trust consensus is too fragile.

3 The stablecoin applied in a specific scenario has more advantages.

People began to look for a better way to make the cryptocurrency “stable”, and a stablecoin with asset-backed nature came into being.

The user purchases the stablecoin EUSD with US dollars through the Epay platform. For every dollar to be deposited, it will automatically issue equivalent amount EUSD to the user. When the users initiate a redemption within the platform, Epay will recycle and destroy the EUSD and return the equivalent dollar to the user. With a fixed 1:1 exchange rate with US Dollar, the price of EUSD is more stable than Bitcoin.

Most stablecoin anchor to certain assets (generally a certain currency) to maintain price stability, which makes the stablecoin have the advantages of cryptocurrency and the reputation and stability of the legal currency.

For this reason, stablecoins are being adopted by more and more institutions.

Epay’s global remittance network is taking the advantages of EUSD to achieve a faster, more economical and safer services, breaking the market that has long been monopolized by traditional remittance giants such as Western Union, SWIFT, etc.

In addition to Epay, JP Morgan Chase, the largest financial institution, the largest Facebook social platform, are aggressively advancing their stablecoin program. These platforms all have the need for money payment and circulation, and the use of stablecoins is undoubtedly a sensible choice.

The attempts took by the keen players in the market seem to indicate that, ten years after the birth of blockchain technology, the real protagonists are not “bitcoins,” but these stablecoins.

Congratulations @paymentthing! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness and get one more award and increased upvotes!