Doubting your Prejudices? - Knowledge and Understanding could help on the way to - The Internet of Money

Dear Steemit friends,

today i watched a great talk with Mike Novogratz, who is well known as supporter of blockchain technology and cryptocurrencies since his buddy drew his attention to the topic.

Novogratz Talks Cryptocurrencies and Regulation - video by Bloomberg TV Markets and Finance

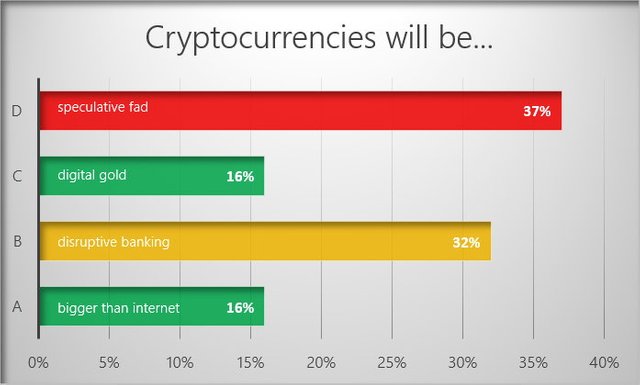

In the beginning the moderator intitiated a quick survey in the audience which reveals a quite positive sentiment in my eyes.. only 37% or a third of people questioned are negative on cryptocurrencies. The other 63% are more or less on a more optimistic side deciding for special use cases or 1/6 even see a coming revolution.

If you ask me, i cannot decide because there is truth in all 4 answers. Some cryptocurrencies will disappear because they have simply no use case, benefit or were created to cheat people. But there are also many which will stay and a handful will prevail as worldwide standards. Bitcoin is already something like digital gold, period. Disruptive yes, but not just for traditional banking.. like we see and use money, a long lasting learning process for us all. Yes it will be bigger than the internet, because it works just with the internet and will transform the internet to a internet of value.

question: Cryptocurrencies will be...

| answer | percentage agree |

|---|---|

| A. Bigger than the internet.🌐 | 16% |

| B. Disruptive, but mainly to traditional banking. 🏦 | 32% |

| C. Something like digital gold. 🏆 | 16% |

| D. A speculative fad with no intrinsic value whatsoever. 🧙 | 37% |

as chart

based on data provided by Bloomberg

I can understand people who still thinking of a fraud or strange thing. Deflationary money with high volatility is nothing we are familiar with. All the geeky stuff with miners, blocks, money that is not touchable and just digital code is for many simply too much at the moment.

"This is the revenge of the nerds."

It's a funny saying Mike Novogratz is using but indeed true in terms of wealth creation under early adopters of cryptocurrencies or early developers of a new technology called blockchain together with the rising application of cryptocurrencies.. above all Bitcoin, these coins, tokens which are the fueling the whole ecosystem at the same time.

The nerds he is talking about are people like Roger Ver (CEO BCH), Richard Heart (BTC), Vitalik Buterin (co-founder ETH), Dan Larimer (CTO EOS), David Sønstebø (founder IOTA), Charlie Lee (founder LTC), Steve Wozniak (Supporter BTC), Charles Hoskinson (CEO Cardano), Andreas Antonopoulos (evangelist BTC/ETH) which were passioned since the early days of Bitcoin (2009) or came in just a few years later to push the development forward.

All these people sharing the conviction that blockchain technology and cryptocurrencies are the future. They have dedicated their lives either to create communities or companies around a platform technology and/or do missionary work like Andreas Antonopoulos to teach the masses on the way to mass adoption.

Finally there are many quite regular people who just bought some bitcoin, made first transactions in the darknet with text messages back in the days and did hold more or less til today and are now millionaires, bitcoin maximalists, evangelists, libertarians, often people who are technology savvy, used to computers, programming and the internet. People like that are not seldom a bit pale, thin with not best social engagement but have realized that is something very interesting. They were and are the pioneers who have ensured the development and growth, a community driven approach and now transforming to serious businesses around blockchain technology.

The simple fact of the matter is - It's already unstoppable!

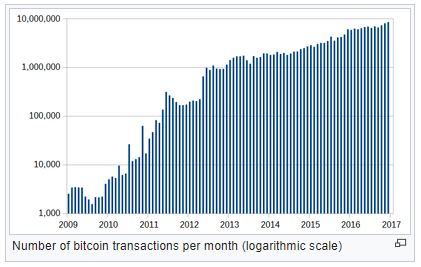

The Bitcoin network is already so huge and decentralized around the world that it's simply not possible or economic to try a 51% attack to get control and make some double spending. Bitcoin passed long ago this critical security threshold and is growing more and more to make the network even more secure for all participants. The chart above shows clearly the growth of confirmed transactions by the network.

If we look back to the survey above you may think there are some doubts that maybe next year or in 5 years all that stuff is over, no cryptocurrency, no bitcoin anymore.. no one will talk about blockchain and this weird Satoshi Nakamoto and his gang and everything will change to "normal" again.. we have our regular internet pages, software tools and our regular life.. even our inflationary US dollars and Euro.. real money! NOT these odd codes written by hackers to steal our money..

Hello?! Heeellloo?!.. i apologize but i must waking you up now if these were your thoughts.. The internet of just information is OVER, period! While i'm writing this tens of thousands of developers worldwide working with godlike speeds and enthusiasm to bring this new technology to life or enhance it. And day by day more people join to contribute to the movement and seeing the opportunity to transforming their lifes.

Mike Novogratz talks about that moment as he was hit by a mental sledge hammer visiting a building where a whole team of highly intelligent and skilled programmers worked on a now well known platform for smart contracts called Ethereum.. this was already a few years ago! Nowadays the idea is grown to a huge platform for decentralized games and applications, ICO's widely adopted. The first half of the year alone $7 billion of venture capital were collected via smart contracts on the Ethereum blockchain. Yes, billions! not millions and also that is just the beginning.

Rumors and News - Institutional investors are lining up slowly

Currently we see still may open questions for regulators. What is an security and what not? What are the guidelines for an ICO? Which ICO's are fraudulent? Investors ask: "Which tokens could be stopped by the SEC completely because they work like securities?" .. This is still a toxic environment for conservative investors with deep pockets waiting on the the sidelines and doing business as usual in the stock, bond and future market. But they are already watching to recognize the right point in time to jump in. Following a list of things just happening or were rumors around:

May 6th with real Bitcoin backed ETF (exchange traded fund) filing with the SEC - we had the future contracts, but this time there is real value behind and if the SEC give green lights it would be another milestone for cryptocurrencies

May 7th Wall Street is preparing for trading with Bitcoin and other cryptocurrencies like stocks - Wall Street need new products urgently. With a drop of $27 billion in revenue last year they are confronted with the transformation of the whole market

May 9th 18 - Nasdaq's CEO Adena Friedman bullish on cryptocurrencies - look how highly enthused she is talking about the topic "..fascinating..", "..digital currency plays a role in the future.. - the company has about $2.4 billion in revenue and $734 million in net earnings

May 16th Jack Dorsey wants Bitcoin as native currency of the internet - he is a true believer and CEO of Twitter, his word has some weight - the company sported revenue of 2.44 billion in 2017 with 336 million users worldwide

May 23th - Goldman Sachs provides simple to use apps via Circle to attract more people to crypto - i call this "bridge building", it is one of the most needed activities today to convince people to get into crypto, buy, store, sell cryptocurrencies in a safe and secure way

June 6th regulators like Jay Clayton (SEC chairman) sees Bitcoin not a s security but Ethereum, Ripple and others - make it more clear for instituational investors to classify, the wild west of crypto could be soon over and big money of defensive or conservative investors will flow in the market, but it needs still time for legal guidelines

June 6th: Fidelity offers jobs for building crypto exchange - this investment company had a revenue of 18.2 billion in 2017 +14% to prior year and 5.3 billion in operating income +54% to prior year - i know them through Peter Lynch who steered the Magellan Fund where he performed a 29.2% return on investment per year for his customers!

June 7th sophisticated technology like lightning network is on the brink for mass usage - first came the lightning protocol 1.0 and now the mainnet is growing every day with lightning fast and zero cost transactions - currently just a few hundred thousand dollars soon maybe millions and at one point billions - even Cryptographer from Ripple believes it can be a game changer, making Bitcoin Cash almost obsolete

The next hype cycle

The parabolic rise is over for now. I wrote about that. 2017 was another bubble of a hype cycle like back in 2013. Now it needs time for the fundamentals must follow the price and that could take a while. Statistically 3.5 years seems normal. So many including me seeing for 2020 and beyond a multi-trillion dollar market for cryptocurrencies.

Preparing financial products without a single note in their financial reports for customers?

If you look in the 2018 Investment Outlook of Goldman Sachs there is not a single word or note about blockchain technology or cryptocurrencies, means currently the bank is not interested to inform their customers about this disruptive impact in the coming years.. mmh why? My thoughts:

- currently they are simply not prepared to serve their customers with a portfolio of products

- they need time to develop their trading desks, analysis tools and so on

- current market enviroment is still not mature enough to convince customers on a broad basis

- maybe they are investing since years into the space behind the curtains for their own benefit

- they wanna simply sell their well established products whether it's less profitable for their customers (similar to EV market vs. CE lines in automotive)

But overall i think soon we'll see many public papers and reports to market the new crypto products since the bank knows what is coming.. but everyone should think about that.. why you need a bank to invest in cryptocurrencies which hides information right in front of you or in other words why you not taking time and responsibility to make your own research for yourself, without any bias and prejudices.. to be part of a revolution which is just starting now and will take place in the next decade?! Excited enough? Already invested or using it? Thinking i'm writing b******t? In the end we all can choose, but if you have read my article you can see there are some undeniable facts like:

- cryptocurrency market cap of over $300 billion (in 2012 it was still under $1 billion, at end of 2016 we had just $16 billion)

- the Ethereum alliance backed by the second greatest development around blockchain consists of huge companies like Microsoft, AMD, Cisco, J.P.Morgan, mastercard, Pfizer, Santander, accenture and this is just the tip of the iceberg

- Bitcoin was never seriously hacked or compromised since 2009 although it's a decentralized network running on the internet 24/7, it has proven stable, robust and as secure store of value in itself

- big banks are lining up as quickly as they can now to provide financial products for cryptocurrencies - which will give virtually regular people the confidence of a safe investment vehicle or store of value

- ICO's succeeded as new form of collecting money for blockchain startups with $6 billion in 2017 and $7 billion already 2018 - allowed wordwide public sales to distribute token to everybody who wanted to participate except some countries with regulatory burden

- the crypto market never burned out after a hype cycle like in 2013 or 2017 and on January 3 in 2019 we have the 10th anniversary of Bitcoin. The market always came back, gained momentum after a while because it grows organically since 2009 an the long term trajectory is still exponential

- there are about 100-200 trillion in liquid assets worldwide which are available also for the cryptocurrency market - imagine if just 1%-5% would flow into the market - 2-10 trillion of assets would be 6-33 times the market cap of today and many estimate that range til 2020

- more and more countries accepting bitcoin as legal tender, including germany

Crypto and blockchain is definitely a bigger revolution on hands after the internet boom

Totally agree! Banks and other institutions don't wanna talk about like Goldman Sachs is hiding information from their customers if they don't do their own homework.. silently investing since years for themselves.. and many don't i guess.. history repeats if people don't wake up. I think in terms of smart money it's almost too late but not hopeless.

I think that cryptocurrencies will be the new money. Maybe the central stable coins, but I hope decentralized coins will prevail.

It will take a long time but i hope too. We are tied to fiat currently because we think fiat.. the best example is coinmarketcap. Why we need a dollar price? Why not calculating just in Satoshi..? Because we need to change our habits first.. it's burned-in deeply in our brains for now.

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.

Resteemed by @resteembot! Good Luck!

Check @resteembot's introduction post or the other great posts I already resteemed.