CryptoCurrency today Balkan >> "50 Shades" of Scam in the Crypto Market

In his author's column, Alexey Voronin, the founder of the decentralized Smart Valley scoring platform, talks about the signs indicating that an ICO project is a scam.  A scam is a project with the deliberate intent of committing fraud, and in the case of ICOs, this most often means the theft of its investors’ funds. At the very least, a low quality or potentially dangerous ICO project may be considered a scam, which means its supporters will lose all of their invested funds or will suffer any other consequences.

A scam is a project with the deliberate intent of committing fraud, and in the case of ICOs, this most often means the theft of its investors’ funds. At the very least, a low quality or potentially dangerous ICO project may be considered a scam, which means its supporters will lose all of their invested funds or will suffer any other consequences.

In turn, the scammer is an investment agent who, for whatever reason, ceased to fulfill financial obligations to his investors. Most often, the term "scam" is widely used among investors of various hypes and pyramids. Now we shall consider and classify this phenomenon only in relation to the crypto industry.

For a better understanding of this phenomenon, let us outline the criteria that divide this negative phenomenon into three large, distinct groups:

Intentional;

Unintentional;

Manipulative.

Intentional Scam

————————

The most primitive variety is a premeditated criminal action when people conduct an ICO initially to steal investors' funds and "vanish with the money in the annals of the internet.”

Let us learn how to independently identify projects of the first type. Here is a list of external criteria that should alarm any potential investor of the project:

The presence of anonymous participants in the project is unacceptable;

The problem of "random people.” For example, there should be specialists from according industries in an insurance project, etc.;

Lack of reputable advisors;

No escrow agent or escrow scheme in the project;

Availability of schemes for additional emissions of tokens (there are no explicit restrictions on emissions);

No soft cap and/or hard cap;

The absence of an MVP;

The absence of feedback and physical presence of the founders at related conferences, lack of personal contact with project leaders;

Hindsight edits of the main points of the project in the white paper;

Use of non-original media materials, copying (stealing) other people's texts and concepts, plagiarism.

Here is a typical historical example: Confido. After the successful completion of its ICO, all official accounts and the project website were closed. The founders vanished and the information about their personalities that had been mentioned earlier turned out to be false.

Unintentional Scam

—————————

As a rule, in this type of ICO, the owners themselves are sincere victims of their own ambitions or belief in unrealizable and fantastic ideas. This is a very common group.

Let us learn how to independently identify projects of the second type, and here is a list of external criteria that should alarm any potential investor of the project:

The absence of at least minimal testing of the new revolutionary model by users, lack of an MVP;

Harsh rejection of reasonable criticism, stubborn fanaticism, threats in response to any criticism;

Excessive project complexity, ornate concepts (when one needs to read the description of the project many times over to understand its essence);

Lack of independent expertise, as well as ignoring such expertise, if any;

The presence of an unprecedented idea or unique fix for the industry, a la "perpetuum mobile";

Lack of a detailed project development map;

The size of the budget is hypothetical and has no serious justification for the declared figures.

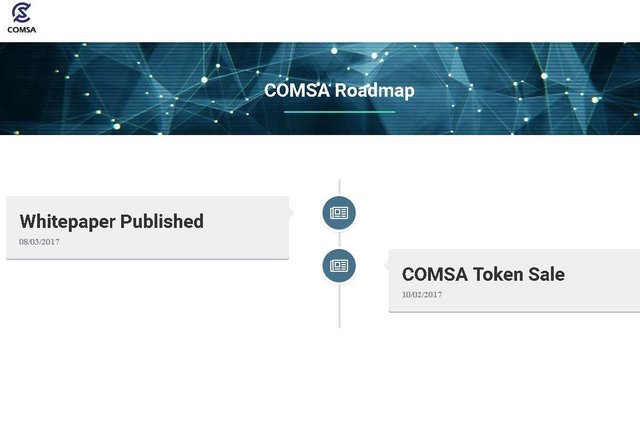

It is very important to have a carefully worked out plan, financial model and terms of project implementation, especially for large and complex projects. As a typical problematic example, I would like to mention the Comsa ICO project (2017), which raised $92.6 million. The official plan for the development of the project looked like this:

Now that the ICO is long over, the project development plan has been reduced to 1 point. And this is a roadmap worthy of the $92 million raised? If you sift it through the sieve of the abovementioned criteria, then a brief analysis for Comsa looks like this:  In general, there is no development plan;

In general, there is no development plan;

Anonymous people in the team;

Almost half of the tokens are being distributed by the team for their own needs and purposes;

There is no prototype or even a logical scheme of the future project;

Technical nonsense: they intend to use three blockchains at once: Mijin, NEM, Ethereum (and maybe even something else);

Cynically copy and pasted text from other sources in the white paper.

Another example of ignoring the opinion of independent experts is IOTA, which created its own cryptography "in haste":

The MIT Digital Currency Laboratory published an IOTA code audit with the following conclusion: numerous vulnerabilities in self-contained cryptography and fundamental errors in the code. The project was forced to make an emergency hard fork, hastily patching up the revealed fundamental problems. Then came the criticism from the leaders of the Ethereum Foundation. There were several other similar studies, but the last incident was particularly memorable when University College London asked the community to declare an IOTA boycott because of threats of legal action in its address (in response to the publication of another Curl vulnerability that potentially threatens the safety of the funds). According to the published correspondence, the threats were sent to the researchers by the head of the IOTA foundation Sergey Ivancheglo.

IOTA is a contender for a place among second-tier scammers associated with stubborn disregard for independent research and the opinions of the scientific community about the chronic problems within its technology.

Another characteristic feature of the projects of the second tier is "featurism,” which is the overloading of the project by unjustified complexity in order to impress investors, a trait which subsequently makes the project unviable.

Here is an anecdote about all similar projects of the second type:

An air hostess in the cabin of a new advanced airliner announces the contents of the aircraft:

“On the first deck we have the luggage compartment, on the second deck we have a bar, on the third is a golf course, on the fourth deck we have a pool.”

And adds:

"Now, gentlemen, fasten your seatbelts and pray. We will be attempting to take off with all this junk onboard."

Manipulative Scam

—————————

The motto of this type of scam is manipulation and half-truths. The main difference from the second group is that the project by itself can be quite feasible, but some far-fetched, bright, and enticing images and characteristics are often being used for its promotion that have nothing to do with it.

Let us learn how to independently identify projects of the third type. Here is a list of external criteria that should alarm any potential investor of the project:

Use ("utilization") of bright images for their own purposes, for example, gold;

Persistent statements about features that the project does not have (nor ever did);

Creation of very complex bonus schemes, referral programs, various MLM schemes of promotion;

Playing on human weaknesses and hypertrophy of promises. For example, the promise of guaranteed profit or the speedy resolution of all the problems of our civilization.

Most typical for this type of ICO is the use of sheiks or gold bars in advertising, joint photos with Vitalik Buterin, prominent figures, ingenious buyback schemes, and guaranteed profits. All of these are alarming signs.

A typical example is the IOTA that we already know. Just compare the following two statements to understand how the third type of project works:

Not a single manufacturer of home electronics (as of 2017) has agreed to cooperate, although IOTA is exerting titanic efforts to attract "solid" vendors.

In spite of this, their advertising commonly states that by 2020, 50 billion devices will be connected to IOTA.

Forewarned Means Forearmed

——————————————

Certainly, sometimes some "hybrid" scam projects can combine the properties of different types of projects, but they mostly stick to one form of behavior and can be attributed to one of the three groups described above.

In conclusion, let us remember the "black swan effect" applied to ICOs. No one can know in advance that a project is an unequivocal scam (this applies to the examples I cited above, which are purely illustrative and do not contain any accusations of fraud). But you are now armed with an exhaustive list of criteria for recognizing all the typical categories of scams, so at the very least you can disregard the most dangerous options for investing in ICOs.

——————————-

Don’t miss out next post! Comment, upvote, ask and follow @atimk23!