Crypto Predictions 2019: Alt-Coin Contenders — TRON

From an investment perspective, valuing businesses is typically done using time honored formulas like price to earnings and price to book ratios, PEG calculations and dividend yields. In the crypto space, none of these methods apply directly — and investors continue to wrestle with how best to assign a value to digital assets in a nascent industry that is sentiment driven and characterized by wild volatility.

To that end, the purpose of this 'Alt-Coin Contenders' series is to identify specific assets that BNC analysts have identified as having fundamental characteristics that at the very least, justify investors including them in a 'ones to watch' list.

Our selections are made based on a range of criteria - things like the number of Dapps deployed or an increase in on-chain transactions. Or the amount of Github activity and the size and enthusiasm of an asset's 'community'. Or apparent liquidity — significant exchange listings and fiat on-ramps. Exposure to potential legislative action is also important, as are the people behind the scenes — inspiring leaders with 'rock star' social media status, or alternatively, big-time financial backers with deep pockets and a track record of success. No single asset will tick every box, and some will tick more than others, but what this series aims to do is move readers beyond simplistic FUD, FOMO and speculation — and introduce the range of fundamental token attributes that should become recognized value indicators as the industry matures.

The Tron Blockchain: Transitioning to a new chapter

The Tron platform and attached native token TRX, remains one of the most polarizing projects in the crypto space. Depending on who you ask, Tron is either a revolutionary web 3.0 disruptor or vaporware that has accumulated market value through clever PR and marketing, with very little opinion sitting in the middle of the two streams.

As the ongoing crypto winter hovers around icy lows, tokens like TRX and their attached projects have a new opportunity to lead the next crypto bull run with fundamentals, not speculation.

The Tron foundation has a viable use case with the soon to be launched monetized torrent protocol, a hungry social community that remains optimistic about the blockchain's prospects, and a newly launched smart-contract platform upon which Dapps and ICOs are starting to be built. Thus TRX and its backers are ready with lessons learnt and new tools for when the bear market finally turns.

The current Tron narrative

The price of TRX has fallen ~96% from an all time high achieved in early January and currently trades at ~$0.015. This has not been a linear fall, with the token going through a number of swings in sentiment over the last 11 months.

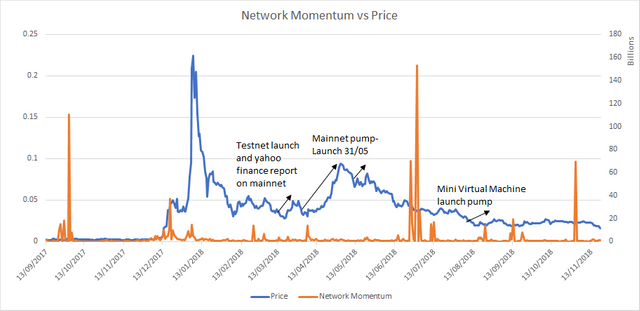

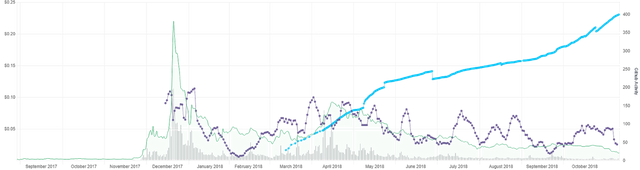

Figure 1: Comparing Price of TRX with Network momentum. Network momentum assesses daily onchain volume in token terms as a potentially leading indicator for future price movements. It is a simple mechanism of greater network activity because of factors like greater DApp activity eventually feeding back into price. The chart evidences that the price of TRX is relatively detached from onchain movements, even post mainnet launch when true blockchain utility was created.

Between 19/03 and 26/03 the price of TRX rose 60% from ~$0.028 to ~$0.045, triggered by excitement surrounding Odyssey, Tron's final testnet launch before its main network release in late May. A large part of buying pressure created during this period was a confirmation signal the testnet release sent that the mainnet would be delivered on schedule. TRX tokens then surged strongly. From 02/04 to 02/05 prices rose over 209% from ~$0.03 to ~$0.092.

With the launch of its own mainnet, Tron would be leaving the Ethereum network and moving to its own network that had been in development for over a year. The new Tron network had the template of the Ethereum network's open-source code to make improvements upon and a substantial war chest to hire developers or purchase crypto projects to beef up its capabilities.

The launch was also hyped by 'those in the know', like the Tron project's maverick CEO Justin Sun and a number of crypto social media influencers. There was a clear belief among pockets of the crypto community that Tron could build a platform to challenge Ethereum as the 'go to' smart contract and Dapp hosting platform.

At the time Tron was part of the first-wave of well funded projects making switches away from the ERC-20 token standard and the lack of existing precedent as to 'what might happen' added to the speculation and hype.

This 'Ethereum usurper' narrative quickly ran out of steam, however, as a week before the mainnet was to be released the market began dumping TRX, and its price has not really recovered since.

Generally, in the technology sector the ethos of 'build something great and they will come' rings true. Tron (and many other blockchain projects) appear to have taken the approach of 'make them come and then force them to wait while we build something great'.

As such, much the market has seen no reason to wait and the TRX market cap is way down since May.

The case for Tron in 2019

The Tron blockchain is making its initial unrefined steps towards transitioning into a genuine cryptographic asset platform. The network also has more ambitious projects in the pipeline with greater potential than anything that has already been built.

The most exciting of these soon to be launched initiatives is Project Atlas, the Tron blockchain's integration of the Bittorrent client which it purchased in June. Bittorrent estimates that the network currently has over 170 million active users a month, and 45 million users daily. It is likely that only a small portion of these users will interact with Project Atlas but it still means substantial outreach for the blockchain and instant access to a huge pool of potential users.

The primary feature of Project Atlas appears to be a TRX based seed rewards for Torrent participants accessing the BitTorrent protocol. Seeding occurs when, after a file is downloaded by a user, the user opts to 'host' it, allowing other network users to transfer data between each other without needing a central server.

Currently, the primary rationale for seeders giving up their bandwidth for other users in the Bittorrent network is altruistic/libertarian sentiment. However, with a TRX based reward system, seeders will have a monetary incentive to continue hosting files for longer time periods after primary interest has tapered off. In theory, a balanced reward should align incentives and create a more functional torrent network with fewer dead files and happier seeders.

The Bittorrent protocol's capabilities of allowing straightforward upload and download of large media files (audio & video) aligns closely with Tron's original mission statement to construct a global free content entertainment system, utilizing blockchain, that allows each user to freely publish, store, and manage their own data.

Bittorrent has recently built a web platform designed to allow sections of video and audio files to be played while they are being downloaded, over a sleek and updated UI/UX interface.

Bittorrent began accepting the TRX, BTC and BNB digital assets as payments for some of the network's premium services on November 28th. This triggered a day of strong trading in TRX markets, with the token rising ~30%+ in under 24 hours.

While this a stepping stone towards the full integration of Bittorrent as a Tron blockchain Dapp with a financial incentive based seeding protocol, the date for the final delivery of Project Atlas is still unclear.

Another much touted use case for the TRX token is its integration within popular adult entertainment content provider Pornhub. Tron holders can use their TRX tokens to pay for premium membership on the website (or gift it to someone), which in 2017 was visited ~28.5 billion times.

The monthly membership option on Pornhub, which TRX is available for, currently costs ~832 TRX or $9.99.

Like the monetization of the Bittorrent network, the option for premium payment on a platform where the majority of content is free is only likely to appeal to a very small subsection of users.

Data from Pornhub's published insights reveals only about 1% of its 81.5 million daily users visit the site's premium section. Only a small section of these users will be new subscribers, and only a few will be willing to pay with TRX or Zen (Pornhub's alternate crypto payment option). Nevertheless, the partnership has extended Tron's mainstream outreach.

Community and partnerships

Tron has continued the trend of attaching itself to recognizable brands, organizations and individuals, securing basketball superstar Kobe Bryant as the keynote speaker for its upcoming annual conference, niTRON, due to be held in January 2019 in San Francisco.

While many may find this choice curious, Bryant is actually a partner in a venture capital firm, Bryant Stibel, that has a history of investment in technology ventures. His portfolio includes projects ranging from mobile game publishers, to sales platforms and sports websites.

While useful insights on investment strategy & fund management are likely to be gleaned from the keynote, the biggest coup for Tron will be the mainstream appeal and buzz created by having a non-crypto, household name like Kobe Bryant speaking at its event.

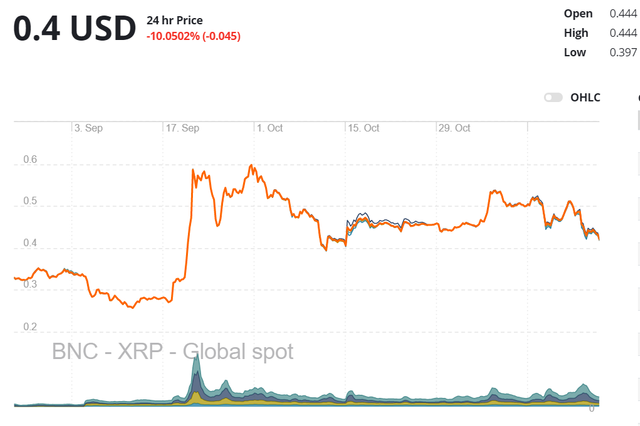

Precedent for this sort of celebrity effect within crypto has been set. Former US president Bill Clinton, who when speaking at Ripple's Swell conference in October, was strongly bullish about crypto and XRP's potential as a disruptor of traditional cross border payment institutions.

The anticipation of the event coupled with significant updates to XRP's closely related X-rapid platform, lead to a significant surge of speculative momentum for the token. The pump came during a period of relative stability in overall crypto markets and XRP was a clear standout.

Price of XRP- Early September to November, price momentum generated approaching Ripple: Swell 2018

While this may sound like a simplistic rationale for endorsing a blockchain asset, good marketing and PR has shown an ability to create strong buying interest in the retail crypto markets, which tends to dominate the space, particularly alt-coin markets, over institutional buyers. Tron's ability to generate crypto buzz has been a large part of it building positive price momentum in the past.

This retail effect is particularly intensified in volatile, speculation driven altcoin markets and spot exchanges that TRX moves around within.

Data over the last year shows that while Github activity is lacking, the Tron foundation has picked up social media followers with ease. The Tron Foundation currently has 353,106 followers, growing ~28% since March of this year. This is alongside the 593,000+ followers accumulated by CEO and no.1 Tron cheerleader Justin Sun.

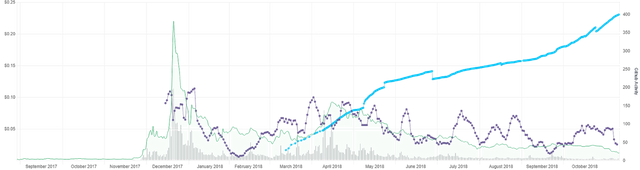

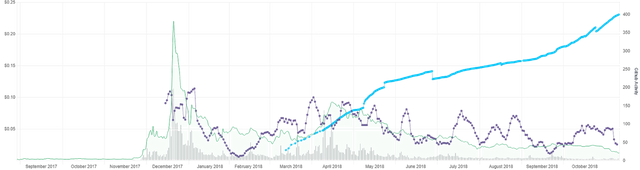

The Social Volume metric as collected by solume.io is a measurement of mentions of a selected token on relevant spaces of Reddit and Twitter, breaking them down into positive and negative mentions.

Tron Twitter and Reddit mentions, appear for the most part to be dominated by positive social volume. Even during periods of flat price movement, Tron has been able to build positive social traction. The only day in the last three months when negative mentions exceeded positive mentions was following a 15% price dump.

With the most recent price drop beginning around the 12th of November positive comments have still strongly exceeded negative ones. A number of tweets like this one, indicate a faction of feverish support within the Tron community that continues to be bullish about the token's prospects even during down periods.

Monero (XMR) a popular proof-of-work token with a market cap of ~$900 million, versus the ~$790 million marcap of TRX, has had far less social media traction on Reddit & Twitter over the last three months. This is both in terms of total number of mentions and positive vs negative comments.

Another Monero observation is that in general, positive social activity tends to be flat when price is flat. This is in contrast to Tron which showed an ability in the last three months to gain strong positive social traction irrespective of flat price movements.

Tron's ability to excite and provide its community with HODL fuel is no accident. High production value advertising, numerous yearly event focused livestreams, and monthly community updates in multiple different languages, have all contributed to Tron's ability to generate wide community outreach and relationships.

Little traction to date as an ETH alternative

Today the Tron network is an up-and-running blockchain that verifies transactions using a functioning, non-disruptive Proof-of-Authority consensus model where block publishers are decided through community voting.

What appears to be missing is genuine developer activity or token use outside of speculative trading opportunities.

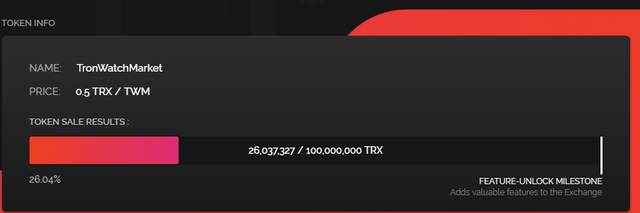

The most referenced Tron ICO built using the TRX20 protocol (an alternate to ERC20), is Tron Market Watch (TWM). The token is a payment tool to be used on a TRON network based DEX which will offer trading a decentralized platform for trading TWM, TRX and other yet to be launched TRX20 tokens.

The project stage was able to meet a soft cap level set at $310,000 but was not even close to its hard-cap (set at $5,000,000) and ended its raise with less than $1,000,000. Another token, E-sports focused Intergalactic Gaming (IGG) raised a tepid ~$110,000.

While TRX block explorers do list a number of tokens issued on the Tron blockchain, most of these projects appear to be very basic, lacking tangible information, backing or funds. The DEX on Tronscan currently lists 14 Tron based tokens.

TWM token raise summary, the ICO was only able to achieve 26% of its 2nd goal and was a long way away from hitting its hard cap target.

The current state of the Tron ecosystem is a far cry from the explosive nature of the Ethereum ICO ecosystem through 2016 and 2017.

Even at this stage of bearish ICO sentiment, ongoing Ethereum ICOs like SYLO are finding the legs for $10 million+ valuations. Tron is clearly not yet at a stage to challenge Ethereum as the 'go to' smart-contract fundraising platform.

Dapps

The Tron Dapp store currently lists 14 Dapps, a majority of which are gambling focused (easy to build, accessible), many of which have limited transaction volume or users.

Again, at this stage it is very difficult to compare this aspect of onchain activity and utility between Ethereum and Tron. Ethereum has a much larger and more diverse portfolio of Dapps, with projects in spaces like decentralized betting, crypto collectibles and distributed data storage all fully functioning on the network. Volume and active address metrics between Tron and Ethereum are comparable and Tron's blockchain casino has gained popularity quickly in recent weeks.

Top 5 Tron Dapps on Dappradar

Exposure to regulatory risk

Securities laws in the United States are 'principles' rather than rule based, meaning there is some space for subjectivity. While there is a lack of information and precedent on the true nature and utility of immature blockchain based tokens like TRX, transactions of the token likely fall under the category of an 'investment contract' as defined by the Howey Test, making TRX a security in the United States, and thereby falling under the tighter constraints of the Securities Act of 1933 and the Securities Exchange Act of 1934.

Classification as a security would mean greater considerations for investor protection and trading on secondary markets would be needed for TRX. This may mean the issuance of fines and the cutting of trading channels.

TRX and others having value drops of over 90% in under a year likely adds to the SEC urge for stepping in and regulating ICO and foundations. The teams behind Airtoken (AIR) and Paragon (PRG) tokens have already been ordered to pay back investors because of failures to comply with American securities law.

Rule 4 of the Howey tests states that a transaction is an investment contract if 'Any profit comes from the efforts of a promoter or third party'. Tron, unlike currency style tokens such as Bitcoin, is likely not decentralized enough to override this condition.

In the network's current state TRX's market cap and trading interest is primarily driven by actions undertaken by the 'Tron Foundation', the group behind the initial ICO raise of the token and who are still at the wheel directing operations on the Tron blockchain. The token has yet to derive genuine utility and value through user participation, but this may change with the growth of organic Dapp activity and ICO raises.

Whether the SEC will choose to go after a large-cap asset like TRX, which is likely to have the resources to challenge any charges, is uncertain. There are likely a number of smaller, slam-dunk cases for the commission to go after before Tron and Justin Sun. Tron operating as a non-American entity based out of Beijing may also protect TRX from SEC enforcement in the near term.

Conclusion

On the positive side of the ledger, Tron has a market cap of almost a billion dollars and trades on a multitude of exchanges with a wide range of available pairs. Its founder Justin Sun has rock star status across Asia and its social media presence has appeared to be immune to 2018's grinding bear market. Its purchase of BitTorrent and its partnership with Pornhub have delivered it approximately 120 million potential users a day, and it is now operating on its own mainnet.

Of concern is the low number of Dapps deployed and ICOs launched - in addition to its exposure to disruption from US regulators should the SEC decide Tron is a security and not a utility token.