Babb Token (BAX) Review: Everyone is a Bank

there is a video link at the bottom for those who prefer audio version

Babb describes itself as “The world bank for the Micro-economy”. But what does that actaully mean? The best way to describe the project would be to tell you about the features they offer.

- UK Regulated, Global Bank Account Based on Blockchain

Firstly, BABB will offer a UK bank account, compliant with UK regulations, available to any person or business in the world, instantly, without the need for a UK address or credit history. To open a UK bank account with BABB all you need is a valid ID document such as a Passport or National ID card.

SEPA & UK Faster Payments

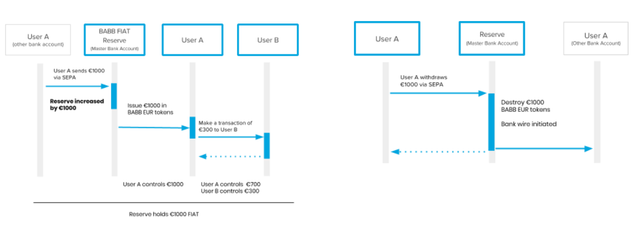

With your UK BABB account, you will experience seamless transition between legacy banking and your blockchain-based bank account. The way they do this is In addition to the usual cryptographic address, BABB Accounts are issued an IBAN (international bank account number) for european and international bank wires, as well as an Account Number and Sort Code for UK national transactions..

- Mobile Application

There is no physical bank, everything is done via the BABB Mobile Application.

BABB allows businesses and individuals to control their money anywhere, as long as they have an internet connection.

- Black Card

They will also provide a payment card known as the Black Card that links directly with your BABB bank account via a QR code or NFC. It allows both a debit-like functionality, or it can be issued as a pre-paid card for your friends and family. Because it works via QR code, it does not need a chip meaning it doesn’t have to go through mastercard or Visa.

The BABB Black Card is the first card of its kind, containing no personal information on the card itself, which greatly improves card security. If the card is lost, it can be easily unlinked from your bank account, preventing anyone else from using it. Should you find your card again, simply scan the QR code on the card via your BABB app and it will link to your BABB bank account once again. If the card is lost permanently, new cards will be available very cheaply from certain major online retailers with next day delivery. Alternatively, you can pick up a spare from a friend, or even print a less durable - but equally functional - paper version of the card.

- Central Bank Digital Currencies

Besides offering services for individuals, Babb also offers services for the banks.

BABB believes it is inevitable that Central Bank Digital Currency (CBDC) (or bank cryptocurrency) will be adopted by Central Banks (CB) over the next decade. This opinion was initially formed in 2015 and has seen been validation with announcements by Central Banks all around the world, each considering launching their own digital currency.

BABB will look to work with Central banks in primarily two ways:

Integration with existing CBDCs.

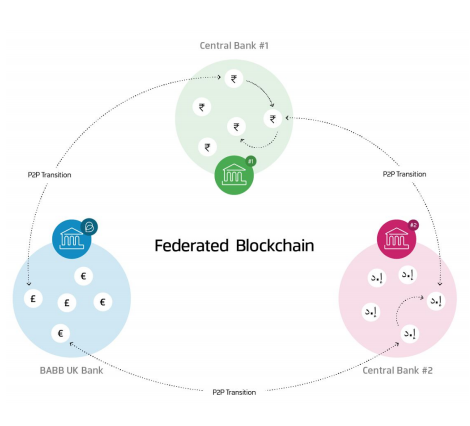

BABB’s has an inter-blockchain approach and provides the infrastructure for banks to interact with other existing CBDCs.Banks looking to launch their own digital currency can leverage BABB’s technology, to easily host and operate domestically a portion of the federated network.

So I think this is a smart project guys, there are a number of banks considering launching their own cryptocurrency, but this is the first project I’ve heard that is providing the service to link them up. I think this will be very popular.

Finally, data collected by central banks from our platform will be process to provide more insighs for future upgrades.

- There’s more!

Besides providing bank services, Babb even allows users to act as a bank and earn some extra money.

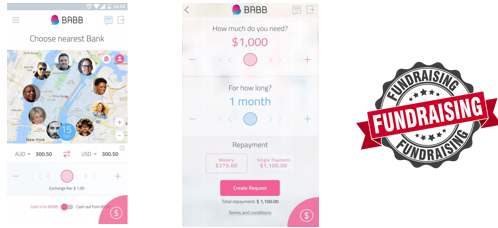

a. Firstly they allow Peer-to peer Cash. So instead of ATMs, the mobile app will show users in your proximity and you can contact them to “draw” money from them should they wish to trade.

b. Next is peer to peer borrowing. Users can lend and borrow form each other. Payment terms and rates are clearly defined, agreed on, and fast to conclude.

c. There will be peer-to-peer fundraising. Advantages of using Babb to fundraise include:

i. You can fundraise small amounts, less than $1 per participant.

ii. It’s the BAX tokens, so there is no currency conversion

iii. No middleman

iv. Can be done privately, personally (only family) or publicly

v. Public fundraisers need to be verified so that participant money can be protected.

d. And lastly there will be a payment and payroll service where companies can easily automate payroll processing.

It sounds great! Lots of features, very unique concept. The great thing is they are already an FCA authorised payment institution (API) and are in the process of applying for a banking licence. If they get the banking licence which they seem confident they will, it will be absolutely huge.

Now lets take a quick look at their tech to see how they achieve all these features with blockchain.

Tech:

To begin, their system design is one of a federated blockchain. For those who don’t know what Federated means, think of it as centralised.

So all the nodes come under Babb’s platform governance, but big organisations like Central banks will also have their own little cluster of nodes that they specific jurisdiction over. So think of it like Federal government and state government ruling.

All the rules and processes are of course run with Smart contracts.

Any Fiat funds that exist in Legacy systems are represented by Babb Tokens. It isn’t an actual conversion, it is just represented. The transaction then happens in Babb tokens and fiat is then paid out or collected into the Babb bank reserve.

Because it’s done with trusted smart contracts, account holders are in control of their own funds and can do transactions peer to peer without the approval of any intermediary.

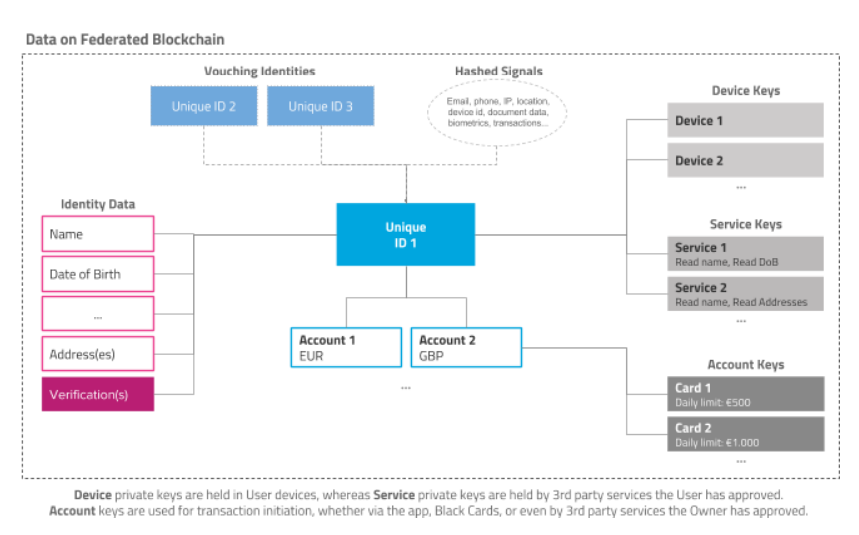

Privacy is also protected as the only access to the User’s identity is through a private key that is in the sole possession of the user on their device. Not even Babb has access to the data. Furthermore, they employ data encryption and cryptographic hashing as well as biometric identification e.g. face and voice recognition to ensure privacy on the blockchain.

Now related to identification and signing up is their unique way of creating an account called “social KYC”.

Generally to create a bank account requires several documentations e.g. ID, proof of address, residency status etc… Babb employs and easy method of KYC (know your client) to help everyone across the world to participate. Basically making it possible for anyone with a mobile phone to create a bank account. This includes a photo of their passport or ID and various forms of biometrics.

They will also have peer-to-peer identity validation. Every user who has gone through the whole identity validation process can vouch for other users in the platform, thus helping validate their identity.

The ease of creating an account might very well be their main gateway to mass adoption.

Token use:

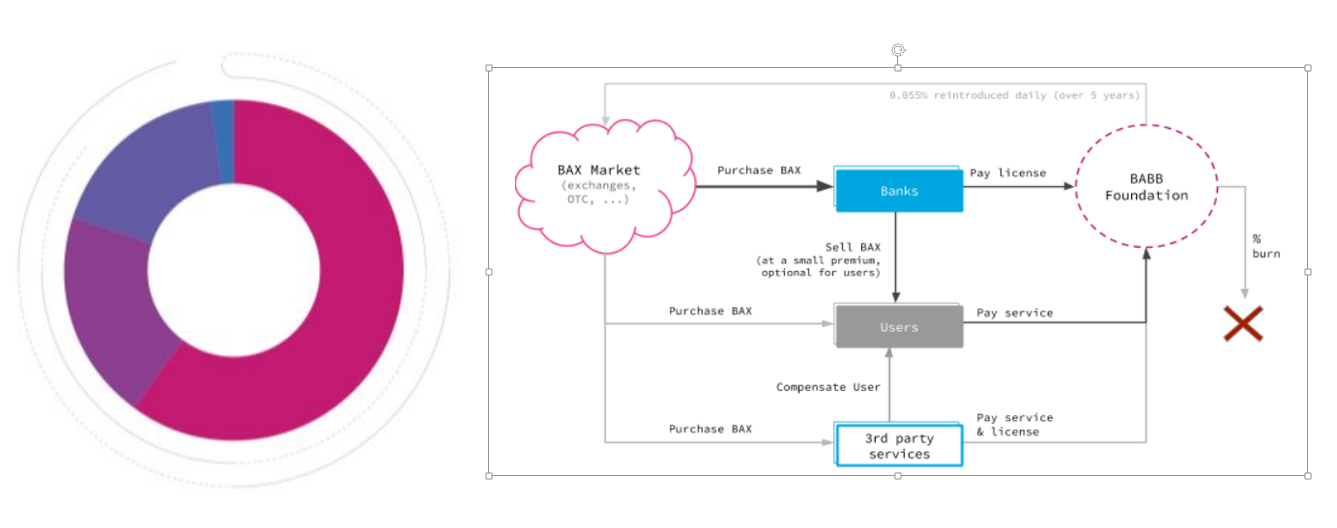

There will be 50 billion BAX tokens. All services, fees and licensing of the BABB platform use BAX under-the-hood. If a user doesn’t hold any BAX to operate on the platform, they can easily purchase the necessary amount from banks in the BABB platform, and also from other users, online exchanges and other 3rd party services.

Because this project has so many features, the number of token use cases are also a lot.

E.g. – Banks may charge a small fee for services

- Platform fees. E.g. opening a new account, sending/ receiving a transaction, exchanging currency etc.

- licensing fees, fundraising campaigns, and also requesting access to a user Identity information, so not only does the user have control of his privacy, he also gets paid if someone else requests that information.

- Onboarding / offboarding. E.g. sending funds to and from an account,

- international payments etc….

So definitely a currency that will be in demand.

There is also token burn, any tokens that are paid to operate the platform will be 50% burned, and deleted forever. This will happen until the total amount of tokens in circulation hits 20% of the current total.

The remainder are also frozen in the platform reserve so that it doesn’t affect the market price for years.

Furthermore Babb platform has also placed self-imposed restrictions on liquidating their funds in the reserve for the first 5 years. So every day not more than 0.055% of the initial reserve can be made available for liquidaton, meaning sold.

So it sounds good and they are careful about the token mechanics to ensure both short and long term token value.

Team:

This is the team. It’s a decent size team.

Their CEO is Rushd Averroes. He is a previous system engineer at Bosch for a year, a broker at OANDA, CEO of Wowpaymobi (a payment instituition) and a co founder for Baffi.UK which stands for (Banking Alliance for Financial Inclusion).

Their CTO is Jorge Pereira, he founded Seegno in 2008 which is a world class web application development firm, in 2014 he joined Uphold as CTO where he was responsible for the design and architecture of the whole technology stack, in 2017, he founded FintechServer and also other statups Wayfex and Loyal Chain.

And the rest of the teams also have their linkedin profiles you can check out.

They’re not heavyweights in the blockchain space and the team is very young compared to some other projects. But they have had successful careers uptil this point.

Advisors:

These are their advisors.

It includes Adi Ben-Ari who co-founded Applied Blockchain and a number of other blockchain start ups.

Peter Cox who is an executive chairman of Contis Group.

Thomas Brooke who is a US licensed attorney and technology executive serves as Of Counsel for emerging technology companies, innovators and entrepreneurs.

And more.

Il be honest, I don’t recognise the names they are involved with, but it is a different part of the world from me, so maybe they are big over there. The advisors are definitely older in age than the team and come across as mature in the Fintech arena.

No list of angel investors or partners, which I was surprised for a project of this magnitude.

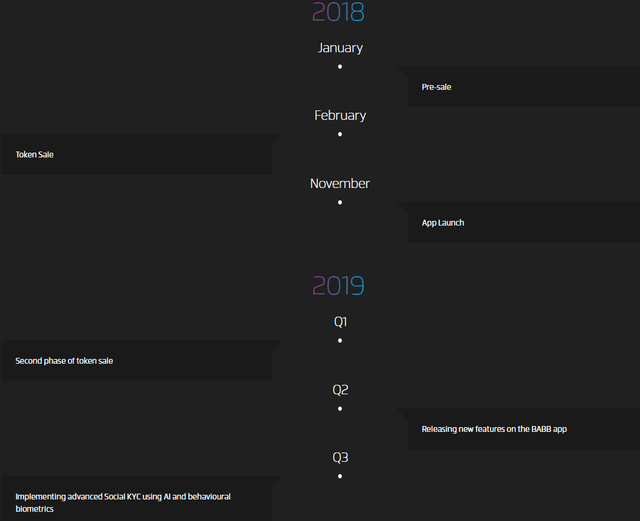

Roadmap:

This is their Roadmap. I was surprised, not in a good way. Its skimpiest roadmap I’ve ever seen. Usually you would expect a more detailed breakdown of milestones e.g. when wallet is due, when bank partnerships can be expected etc.. but those details are not here.

The next milestone is half a year later in Nov with the App launch, so that’s when we’ll see the first working product I guess. The first quarter of next year will see another token sale. And the roadmap ends in Q3 of next year with implementing advance social KYC.

That’s it, would be nice to see when other features like the black card, or peer to peer lending etc.. will be introduced. It’s a bit disaapointing.

That aside, when I was doing my research, up til this point, I was thinking this is a really good project and getting quite excited, but then I came across a couple of things that got me concerned.

The first is about their upcoming equity sale.

So they completed a $20 million ICO in Feb, and an ICO is basically a fundraising to cover the costs of running every aspect of the project. And $20 million is an average ICO amount, and definitely enough to cover costs right. But a week ago, they announced that they will be having an equity crowdsale. And this was a separate fund to put as a deposit to get a bank license. They explained that they didn’t realise ICO money can’t be placed as a deposit for bank license. I was thinking, that’s abit careless, to conduct a $20 million fundraiser without being sure of what you’re using the funds for. And as I took a closer look at the equity fund raising, I got more uncomfortable.

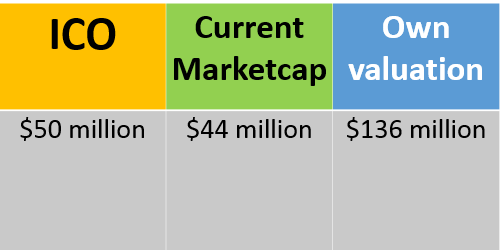

So an equity is buying a share of the company. Its not the same as a token where it has not share value. With equity the whole idea is that you have a voting right or say in the company. Now they are aiming to raise $2.6 GPB or british pounds. And they have said this is equivalent to 2.5% of the total company’s share. So that’s not much, even if you got the 2.5% the company holds 97.5% so they still going to do whatever they want. But the thing is how they valuate the 2.5%, which I think is not fair to the token holders.

So in their ICO phase, they sold 40% of their tokens for $20million. So that gives them a value of 100% of tokens at $50million dollars worth. Their current marketcap is $44 million. So its dropped abit but not much. Still in the same ballpark.

But for their equity sale. In order to sell only 2.5% of their company, they have self-valuated their company as $100million pounds (GBP), meaning $136 USD.

How do you jump up that much? Nothing has changed. The tech hasn’t changed, no new product has been launched, how come your own valuation of the company is now more than 3x the current marketcap? It’s very different from the ICO valuation just a couple of months ago.

And there is no account of how they valuated the company. Now, if I want to sell a house worth $1million, I would have to get an external reputatable appraiser to value my property. I can’t just give my own subjective value of $10million dollars. Same thing here, if you want to sell equity, the shares of your company, to make it fair for your investors, you need to get an external reputable appraiser. The reason I think they haven’t done it, is because they know the appraiser is likely to value it a lot lower. They have a lot of promise and could be worth billions one day, but right now they don’t have partners or investors or a working product yet. If you work on the current marketcap of $44million, then 2.5million is actually $3.4million USD which is 7.7%.!So investors in the equity sale should actually be getting more than triple the current offered equity share potentially.

Furthermore, they promise to sell you shares. But what can you do with the shares? As we pointed out above, the shares give you a negligible voting right even if you bought all the $2.5 million GBP worth. And what a lot of people don’t realise is you can’t sell it on the share market. So once you get, you are kinda stuck with it. Il show you clip from their recent QnA so you know I’m not making this up. So you buy thousands of dollars worth of shares that currently you can only trade with friends or family members? There’s no promise of dividends or anything like that.

Some say, oh, but you’ll get some BAX tokens when you buy the equity. Yes, you will, but its not much, they have also said in the same video that it is not worth selling your BAX tokens to buy the equity as you would get less BAX tokens. So if you’re hedging on free tokens even with the potential airdrop if they hit their target, it would be better just to buy their tokens on the exchange.

And this fund raising is just a step to apply for a banking license. What happens if they can’t get a banking license. You can’t get back the money. It’s not that easy to a banking license. I hope they do get it, but investors need to know raising this equity fund doesn’t equal to getting the banking license. And also they are going to have another fundraising token sale next year. How many token sales will this project have exactly?

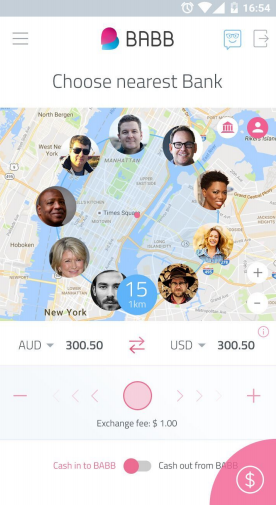

Another aspect of their project which concerns me is the human ATM.

Now if we put money into the bank, it is important to know that I can withdraw my money in cash anytime. The only fiat output from the Babb bank is through the ATM. There isn’t a physical bank outlet or ATM machine you can withdraw cash, it is only through the human ATM route. I mean people do banking for all sorts of reasons and in a day people could go to a bank outlet and withdraw thousands of dollars. Let’s imagine a simple scenario. Let’s say you wanted to buy an IPAD, but the apple store doesn’t accept black card yet. So you have to withdraw $1000 cash. If I sent you $1000 worth of Bax tokens today, how confident are you that you can go out into the street and find another Bax user within 50metres or even a 100metres who has $1000 cash in their wallet who will be willing to give it to you. Because he doesn’t need the $1000, he just carries it around to be a human ATM.

Furthermore, if I was a user, I would be thinking, why would I ever want to be an ATM. Because the only thing I get from you is Bax tokens which I can get from the exchanges at exactly the same exchange rate. Also if you look at the app, it shows the profile pics of people in the vicinity who have above the amount of money requested—in this case $300 USD. No way do I want to announce to the neighbourhood that I am carrying a significant amount of money, and place my picture and GPS location on an app they can track me. It would be so easy for robbers to use this app to target individuals to rob. I like my privacy and I don’t want to unnecessarily interrupt whatever I am doing. Why would I be a human ATM?

And again, the human ATM is the only way to get FIAT out directly from the system immediately. There is no bank outlet or actual ATM machine.

Converting to BAX tokens, going through a crypto exchange and transfer to your bank would take days and a lot of transaction fees.

And it will take a long time before they can build up a user base that can sustain this model assuming people even want to, and it also excludes smaller cities and towns from cashing out their holdings effectively.

Personally I don’t think this feature is the best idea.

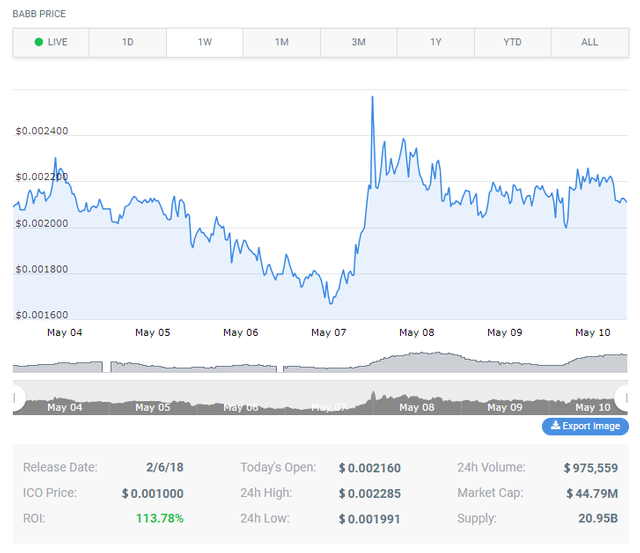

Price

The Bax token is cheap guys. The token cost is $0.002, they are only on tiny exchanges. They haven’t even hit mid size exchanges like Kucoin.

There’s a lot of hype on this project which we all know is what drives token prices currently. And their marketcap is only $44 million. This project if it takes off could be worth billions, we’re talking 50-100x returns maybe even more in the long term.

But high returns also mean high risk. In the short term I think they will go up as the market goes up, but in the long term, I think this project is high risk. I don’t think it’s a guaranteed success. They have big milestones they need to cross, and they don’t have a working product yet, although the tech is super hard and technically speaking I am sure they can do it, I just wonder if they can attract mass adoption with the potential cashing out issues. cross, and they don’t have a working product yet, although the tech is super hard and technically speaking I am sure they can do it, I just wonder if they can attract mass adoption with the potential cashing out issues.

I’m also not a fan of their equity crowdsale model. I think its not a fair deal to the investors and I strongly feel they should get an external appraiser independent of the project to do an appraisal before the crowdsale is launched. The thing that makes me uncomfortable is that if it was an unfair valuation, it was done intentionally by the company who are the ones self-determining their value. Also the amount of Bax tokens given and to each investor is not clear, so I personally don’t understand why people would invest in something where the returns are not spelled out in black and white, I always thought that’s a red flag for investment.

But the concept of the project is good and the team seems genuine and capable with mature advisors. So good and bad guys. This is not professional advice, just my own thoughts, so always do your own research and make you own decisions. Just be careful not to FOMO into a project and you will know the FOMO crowd, because they can only see the good points and can’t be neutral enough to see the potential negatives. Negatives don’t rule out a project, everyone makes mistakes, no project is perfect. Its how a project responses to negatives that shows the attitude of the team and determines the final outcome of a project. I’m certainly looking forward to seeing where Babb goes in the future.

We mice would like to thank you for your research here @cryptolite.

We were scurrying around trying to sniff out a new small cap ICO for investing. We are looking quite seriously at BABB. You have given us plenty to think about, especially when it comes to the equity crowd-sale.

Thanks again for your efforts. We will be sure to drop by from time to time to see what hidden ICO gems you might discover.

Im glad you found it helpful. Was checking out your post too. Loved it and subscribed. Are you guys Christians too? :)

Happy to see another Bax enthusiast, it will be so big. I am a strong believer in this coin. Keep up the good work.