memo.cash: A kind of Twitter on the Bitcoin Cash Blockchain / Amazon wants to deanonymize Bitcoin Transactions with Data Marketplace / Parity: Is this a Bailout - or a Rescue?

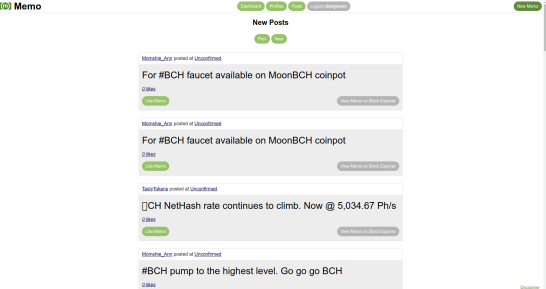

For Bitcoin Cash, memo.cash was released last week: A somewhat rudimentary clone of Twitter that completely stores the tweets or memos on the Bitcoin Cash blockchain. One can find this ingenious or insane. Markets seem to like it - the price of Bitcoin Cash has doubled within a week.

Last week memo.cash went online, a kind of Twitter on the Bitcoin Cash blockchain. You can send short messages with a maximum of 75 characters, follow other users and give memos of others a "like". Every action requires a microtransaction, which can be used to earn money if a tweet gets liked often enough.

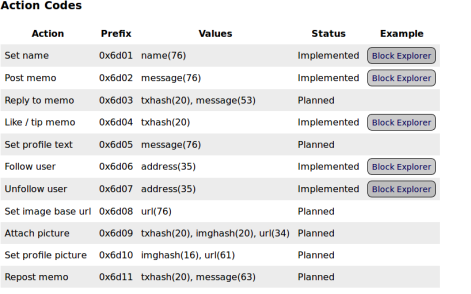

What at first glance looks like a Twitter to the poor is a very interesting technology. Because the website memo.cash is just an interface to interact with a protocol that works completely on the blockchain. A code at the beginning of the message indicates what causes it. In addition to the previously implemented codes - name set, follow, unsubscribe, like and send message - are still more codes planned, such as for retweetening or answers.

This memo.cash is not censored. Memos once confirmed can not be deleted. At the same time, memo.cash is independent of the actual interface. Although the memo website is likely to be the preferred port of call, anyone can search the blockchain for messages with the appropriate code. For example, there is already a memo cash explorer on the website WEWO.cash, which probably displays all memos. At the same time, WEWO.cash has released an API that allows everyone to build their own client for memo. Even Cryptograffiti.info already displays memos, albeit without marking them.

You could say that the difference between memo.cash and Twitter is the same as between Bitcoin and PayPal: it's an open, decentralized protocol that anyone can use with equal rights - while PayPal and Twitter only provide UI APIs for a centralized server , This makes the Bitcoin Cash blockchain an instrument for uncensored communication.

Many find that this is madness and misappropriation. After all, Bitcoin Cash is a decentralized cryptocurrency, and not a decentralized Twitter. The core design of the blockchain is designed to be resilient and provide a compelling history of financial transactions. Not only is such a system usually unnecessary for short messages, but it also prevents it from scaling. If every computer on the network stores and propagates every memo, you'll quickly be faced with an extreme load of data, even if Memo has as much success as Twitter in its approach. Using Bitcoin Cash as a decentralized message server risks harming the system itself more than exploiting it.

A post on yours.org calculates if this can work. His result could be summarized as "yes and no": It is not as tragic as one might think at first glance. One can prune the messages sent via OP_Return, ie delete them from the blockchain of their own node, which does not necessarily damage the integrity of the network. Moreover, the data load, at least at the beginning, still quite manageable. If memo.cash grows at the same pace as Twitter, the volume by 2020 or 2021 will be relatively unproblematic. Thereafter, thanks to exponential growth, it is rapidly increasing. To process as many messages alone as Twitter did in 2013, you would need 1GB blocks.

The potential of memo.cash should certainly not lie in a replacement for Twitter, but possibly in the transmission and publication of censorship-resistant news. This could be useful if Twitter is banned, such as in Iran or in Turkey, or if Twitter itself censors country-specific. Also in discussion is to use a memo.cah code to propagate BitTorrent download links. This would make (illegal) file sharing censorship resistant, which is of course morally and legally doubtful.

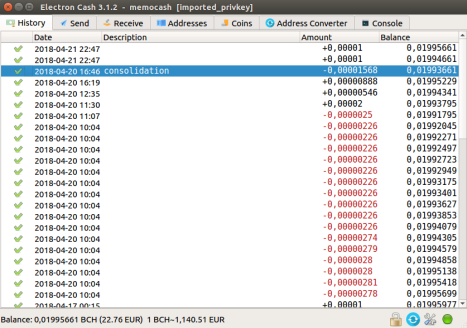

In addition, memo.cash shows two things that set quite good signals for Bitcoin Cash. On the one hand, the website follows the wallet standard for micro payments already established by yours.org: Every transaction takes place onchain, and you can export your key and import it into Electron Cash. So you have the coins that you use on yours or memo.cash in your own wallet, and even if you have lost the password or the page is offline, you can transfer the coins. This could become a nice standard for micro payments as well as any kind of platform that works with onchain transactions.

Secondly, memo.cash shows a certain enthusiasm of the Bitcoin Cash community: a few days after the announcement of memo.cash, wewo.cash was created and Cryptograffiti recorded the memos. Also Bitcoin.com has already declared to integrate memo into the wallet, and a user has already programmed a browser extension for Chrome, with which Memo.Cash looks much better. It has also been proposed to encrypt messages via ECIES. Anyone who makes an action on memo.cash publishes its public key, which in itself allows sending an asymetrically encrypted message. This could introduce the previously missing "purpose" for transactions.

Obviously, there is dynamism in it. If you add the upcoming hardfork, which increases the maximum block size to 32 megabytes and the space in the OP_Return field to 220 bytes, you can be optimistic. The markets are in any case: The price of Bitcoin Cash has risen sharply since mid-last week. From a good 600 euros, he has now risen to just under 1,200. No other cryptocurrency has performed so well in the last ten days.

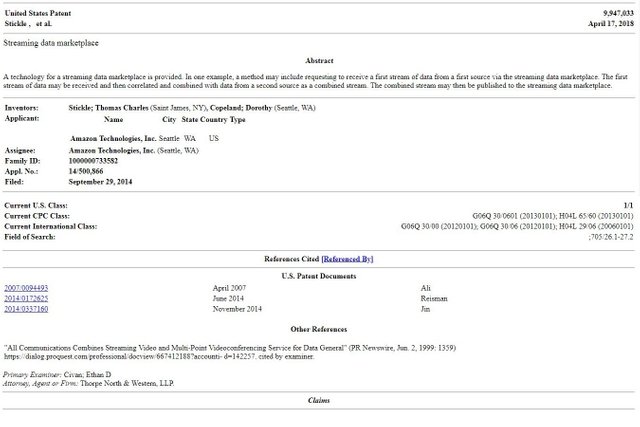

A patent from Amazon shows how the IT group with a marketplace intends to pervade privacy on the Internet. The focus will probably be mainly on Bitcoin transactions, for example, to be connected to the IP addresses. Anyone who has an interest in data protection should have their backs cold.

Data only becomes powerful when you connect it. As long as they are fragmented and disjointed, they do not yet reveal so much about the individual. But when you put them together, they give a shockingly accurate grid.

Amazon wants to exploit this fact with a data marketplace. A recently granted patent describes a marketplace for data streams. Individuals, companies or organizations can provide data streams and customers can subscribe, correlate and combine them. The combinations thus obtained can also be offered on the marketplace and further combined. Because whenever you put raw data to useful, values are created.

The patent gives an example of how data combinations can be worth more than the sum of parts. These are Bitcoin transactions that are visible to every participant on the network but hide the identity of the sender and recipient behind a pseudonymous address. "This raw transaction data does not disclose much to the customer unless it correlates with different elements of other useful data streams." For example, merchants that accept Bitcoin could correlate the delivery address with the data from the Bitcoin transaction and republish that combination as a new data stream , Then, for example, the Internet providers can subscribe to these data streams, correlate them with the IP addresses and place them on the data marketplace as a new package, where, for example, the tax offices can download and connect them with tax data. And so on.

Such a flow of data could help traders to implement the "blacklists" that some regulators are looking for. Just as, for example, in the case of mobile phone contracts concluded online, data is requested from credit scoring providers, so when a transaction is accepted, traders could automatically ask if it is too close to dark sources. Whether this is desirable in order to prevent, for example, that Bitcoins from blackmail circulate, or whether this affects the fungibility of Bitcoin - and thus its suitability as a means of payment - can be discussed, after all. One can not argue, however, that it is devastating for any rogue in the data marketplace to gather information together to find out how many Bitcoins someone who lives in this or that physical location has. It is also unquestionable that the very existence of these correlations is an inordinate mass surveillance of innocent citizens ...

One can and should complain that Amazon intends to undermine privacy in masses. One can also point to the German or European data protection, which presumably forbids the fact that it simply throws the address or IP data of customers on a marketplace where they can be seen in principle by anyone. However, Amazon's patented data marketplace is actually a way to make things that work better, even more efficiently. There is already data that can connect Bitcoin transactions to IP and physical addresses. Although they are still isolated in the silos of different servers, you never know if they have already been combined. A data marketplace would, after all, eliminate the existing uncertainty: one would have to assume that all data that one produces are already linked.

For the users then only one option would remain: to produce as little data as possible. To what extent this is possible is difficult to say. You can not permanently use Tor to prevent your ISP from connecting your IP address to a physical address. Possibly helps a VPN, possibly one is lucky that the Internet provider assigns dynamic addresses. On the side of Bitcoin transactions, one only has to maintain strict wallet hygiene. Coins that are "dirty" in the sense that they came into contact with a company that may sell the data - such as Amazon - should be separated from coins that have not yet come into contact with such companies and therefore not with the address be correlated. Maybe it helps to avoid service providers that are not based in a country with strong data protection, such as Germany or the Netherlands.

Probably the strongest solution would be to use mixers or other methods to anonymize coins. Because this would break the correlations aimed at Bitcoin addresses, making it difficult or impossible to derive from that address to others belonging to the same person. However, these methods have the stall smell of money laundering. If you use them, you risk spoiling your coins or ending up on a blacklist - making the situation worse. Here, however, it is time to rethink. If the German justice system is really serious about data protection, it should not tolerate that procedures to protect the blockchain's privacy against such attacks are equated with money laundering by the police. On the contrary, they should be explicitly allowed and perhaps even certified and issued by the government itself.

In the 1970s, NIST released DES cryptographic algorithm in the US to ensure that American citizens and businesses can communicate securely over the Internet. Amazon's patent shows it's time for a similar cryptocurrency initiative.

A bug in Ethereum Wallert Parity's multisig contract in November last year caused $ 300 million in damage. Now the community is discussing whether to restore the coins via hardfork.

In November 2017, Ethers and tokens worth hundreds of millions of dollars froze on the Ethereum blockchain. To understand the discussion that currently exists around EIP999, it is worth remembering what exactly happened then:

The multisig contract that the Ethereum wallet Parity creates over the user interface used another smart contract on Ethereum to store and call a library of scripts. That's clever in itself, as it makes the actual code leaner. However, the library contract had a suicide function. After it was more or less accidentally triggered, the scripts were deleted - rendering unusable the multisig wallets made with parity. All credits stored in them have since frozen. At the time, these were estimated at $ 100 to $ 250 million, partly in tokens, partly in Ethers. A very large part belonged to the company Parity Technologies itself, or their Polkadot spin-off.

EIP999 to save the lost coins

Recently, Afri Schoedon of Parity Technologies filed an EIP999 proposal to eradicate the damage via hardfork. The proposal does not change Ethereum's rules, but makes a single change to the "state", the state of the blockchain, which replaces the self-destructed library code in order to restore the contract so that it can no longer destroy itself. This could be used to spend the credits stored in the multisig wallets again.

The proposal was of course controversially discussed, both on Github, Ethereum-Magicians and Reddit. It seems a lot of the developers and the community rather skeptical. The common reasons are that such a "bailout" weakens the immutability of events on the blockchain and he sets an example that can go to school, which in the future everyone wants their mistakes to be reversed, and therefore the developers make less effort to write secure smart contracts.

Incidentally, the term "bailout" is misleading. Because a bailout means that you use taxpayer money to rescue companies - mostly banks - after they have lost money. EIP999, on the other hand, only invalidates an event that led to a loss. It could be compared to having your bank delete all the money accidentally, but it could recover through a hard disk repair. The victims of the bug win, and nobody loses anything, at least not directly.

Healthy rigor - or religious asceticism?

However, it is now feared that such an approach damages the immutability of Ethereum, be it in fact, because the example makes school, be it in the eyes of the public. It is now a constitutive feature of a blockchain that things that happen on it are final, and Ethereum specifically promises that the smart contracts executed on the blockchain are irrevocable. If you break this rule because the Parity developers have messed up, you risk sawing on this important pillar of Ethereum.

Of course, one could argue that this is an exaggerated, downright religious understanding of immutability. In practice, EIP999 does not change anything. It does not change credits, does not create new Ethers and does not introduce a new rule nor does it override an old one. Should Ethereum really deprive itself of the option of eliminating misfortunes, if it has the opportunity, because "on principle" does not change anything? That sounds like an asceticism. In essence, this leads to the same discussion that already existed at the DAO hardfork, in which fundamentalists and pragmatists face each other.

The devastating consequences of a chainsplit for tokens

However, a lot has changed since the DAO fork. Ethereum is no longer so beta and experimental, but has become the platform for a growing ecosystem of smart contracts and tokens. As the developer Alex Van de Sade explains, it is known today that a chain split that can be triggered by a hardfork will last a long time. At that time it was still thought that a chain would die off quickly. Ethereum Classic, however, has shown that this does not happen. If it comes to such a split, all tokens will have to split. You have to decide on which side of the fork they are valid. Both sides are not possible for many tokens if they represent something else. "And in each case, developers are being asked by both sides to support the chain, and each time another version of the argument of which chain is better is repeated." It will be even worse for exchanges that need to determine which ones the tokens are now valid. Therefore, according to de Sade, a chain split should be avoided at all costs.

Help could bring a choice here with credit on the Blockchain. Via carbon vote you can vote with Ether. For about 6 days, a survey is running among the stakeholders, which will now be over. According to this, not even 40 percent are for the hardfork, but more than 55 percent against. This could mean that the project was called off.

However, a statement by Afri Schoedon, the author of EIP999, leaves room for further interpretation. To Trustnodes, Schoedon says they have neither started nor supported the election. There are no plans to split the chain, but as usual, will try to build a consensus between the developers and the community through the EIP process. It can be understood that Parity will continue to promote the recovery of tokens and Ethers. It can also be understood that a split as a last resort will continue to be an option. After all, you do not know what Parity Technologies is at stake.