8 Frequently Asked questions about Blockchain.io

In the first article we discussed about The Status Of Cryptocurrencies In Europe And Where Paymium And Blockchain.io Fits Into The BIG Picture

What does Centralized order-books with decentralized settlement mean?

In simple explanation, Blockchain.io aims to combine the advantages of both. In order to have the fastest trading speeds they will need to utilize a centralized form of of exchange interface coupled with the best custodial services so that your coins are in good hands. This is generally the same as what normal centralized exchanges do as compared to decentralized ones. One of the worst nightmares of a decentralized exchange is speed and transaction bottlenecks. Etherdelta is one prime example and during high ETH network loads, the etherdelta orderbooks and transactions are delayed by several minutes to hours. This leads to losses and the stress that comes along with it especially during crucial trades and high volume trades.

In the settlement (payment) side, they will be doing it the way decentralized exchanges do it which is usually in a form of P2P transaction. The seller would not know who the other side (the buyer) is and vice-versa. Also, a novel addition Blockchain.io would want to implement is cross chain atomic swaps.

Though still in its infancy, atomic swaps are the links that interconnect one blockchain to another. If they successfully implement this then it would be another added decentralization layer and faster settlement.

So once again... fast orders and anonymous settlement. Practically it is the best of both worlds plus coupled with the fact that it is compliant with EU rules and regulations.

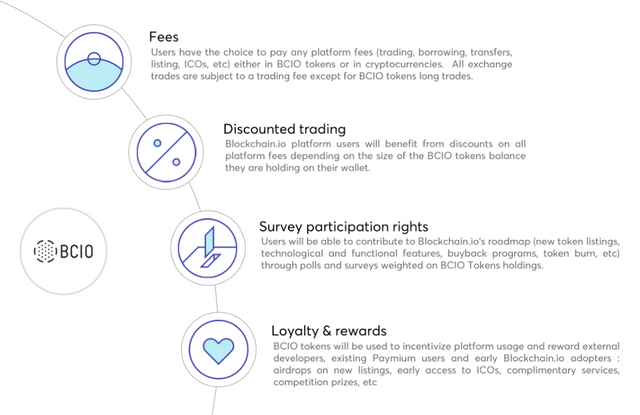

How are BCIO tokens used?

Their primary function will be as utility tokens. The BCIO token sale is fully registered with the SEC. BCIO tokens will be utilized in fees, discounted trading, ICO participation and their loyalty and rewards program.

Image source: https://medium.com/blockchainio/bcio-token-a241fed3132f

Image source: https://medium.com/blockchainio/bcio-token-a241fed3132f

How does the BCIO Tokenomics look like?

The total number of tokens distributed will be 200,000,000. Sixty percent of which are available to the token sale contributors.

Image source: https://medium.com/blockchainio/bcio-token-a241fed3132f

Image source: https://medium.com/blockchainio/bcio-token-a241fed3132f

200 million is just the right amount for an exchange token. Most likely, at these numbers, profitability is maximized if you are an investor. Having too much of a supply makes the 0.70 Euro per BCIO token price tag a bit expensive. A range of 100-250 million is just right for the pricing.

Can you tell me more about the team behind the project?

Image Source: Silicon Luxembourg

Pierre Nozat - Founder & CEO

The CEO of Paymium and Blockchain.io. Pierre is a recognized expert in the cryptocurrency industry. Having an MSc from Ecole Polytechnique - France's leading Engineering school and an MBA from Columbia University in New York, Pierre's background is a mix of engineering and finance and perfect for taking the helm of Blockchain.io

For more information you can contact Pierre on Linkedin.

Image Source: Linkedin

Dominique Rodrigues - CTO

A founder of two startups namely 'Nano Cloud' and 'Cloud computing and virtualization'. A highly skilled research engineer with more than 15 years of experience as a part of the French Atomic Energy commission

For more information you can contact Dominique on Linkedin.

Image source: Twitter

Pierre Tavernier - CMO

In charge of strategic planning. Holds Masters in Management in EDHEC Business School. He is also the founder of Advaluation - Fintech startup delivering algorithmic asset valuation services in media, real estate & financial market industries. With consultancy experience and work experience in seven different countries.

For more information you can contact Pierre on Linkedin.

Image source: Linkedin

Laetitia Zito - CFO of Paymium and Blockchain.io

Laetitia has more than 10 years of experience in finance management and control. Holding a Master in Financial Management & Controlling from ESSEC Business School, she has work experince in the US, Canada and France; and is an expert in international business management.

For more information you can contact Laetitia on Linkedin.

The Developers:

Emmanuel Vaillant Emmanuel Vaillant | - DevOps at Blockchain.io. He is passionate about Infra-as-Code, micro-services, containers and automate everything! Linkedin |

|---|---|

Anthony Grouselle Anthony Grouselle | - Full-stack developer at Blockhchain.io with over 10 years of experience in web technology in the United States, the United Kingdom and France. Proficient in numerous technologies including Ruby, Javascript, HTML5, CSS3. Enthusiastic, passionate and detail-oriented. Linkedin |

Paul Gaston Gouron Paul Gaston Gouron | - Full-stack developer at Blockchain.io with 5 years work experience in both branding and data-based industries. Expert in Bash, Ruby, JavaScript, Coffeescript, Ruby on Rails, Node, React Redux, Sinatra, Backbone, and Marionette Linkedin |

Samuel Bezerra Samuel Bezerra | - Mobile developer and Product Owner at Blockchain.io. He is a game changer inspired by new technologies, innovative projects and working hard with great people Linkedin |

Marketing and Business Development Team:

Guillaume Berche Guillaume Berche | - Marketing & Business Developer at Blockchain.io. Bitcoin proponent since the early days. Twitter Linkedin |

|---|---|

Julien Lee Kien On Julien Lee Kien On | - Marketing & Business Developer at Blockchain.io with 9 years experience as digital business developer in various assignments: strategic marketing, partnerships, digital technology strategy, DATA marketing, digital transformation & innovation managementLinkedin |

Advisors

A great team of advisors which are powerhouses in finance, AI, data and blockchain. One of them is the former Head of the Tax Administration in French Minidtry of Finance and Advisor at Goldman Sachs, Jean-Pascal Beaufret. Also, the co-founder of Feedly, Cyril Moutran and co-founder of Twazzup are on the list. The advisors are also comprised with executives from known asset management and consulting companies in Europe and partners from an international law firm, Cohen & Gresser LLP.

What are other exchange tokens competitors?

The most notable altcoin exchanges which offer their own exchange coins are Binance, Bibox, Huobi, Coinbene and Kucoin. If we were to talk about exchanges with Europe origins however, Blockchain.io stands out and is poised to become the market leader if they are able to fulfill all their roadmap goals especially during their crucial 2019 year.

How is their roadmap looking?

2019 is the make or break year for the exchange as most of the main functionalities will be released to the public on this year.

What are the main goals of Blockchain.io in the near future?

According to their pitch deck, by 2020 Blockchain.io aims:

- To become a world class incubator for high quality ICO projects - helping them in planning and execution.

- To have the highest standards in security and accountability and

- To be the number one European Exchange in terms of volume of transactions

Do they have a bounty or airdrop?

Yes they do. You are free to do the airdrop and we have outlined the steps in a separate post here:

Blockchain.io - The European cryptocurrency exchange of trust for individual and institutional traders and investors (Token Airdrop).

Disclaimer:

We do not offer investment advice. In any form of investment you should always do your own research. Answers to questions posted here are taken from the Blockchain.io company website and pitch deck.

|  |

|---|

upvote for me please? https://steemit.com/news/@bible.com/2sysip

Coins mentioned in post:

Sweet!