Bitcoin: trust and kinda-religious faith / Buy eggs with IOTA: Adaptation continues and new information on project Qubic / Short interview with Tim Frey a big data analyst specialist

An economic sociologist from Pavia investigates the social structures Bitcoin is embedded in - and how the cryptocurrency becomes dependent on trust. The short paper outlines some exciting social science research ideas for Bitcoin.

Bitcoin is one of those technologies that can change the world permanently. Not just the economy, or just the Internet, but everything and everyone. That's why I think it's a pity that every week there is a pile of technical and economic scientific paper on Bitcoin, blockchain and cryptocurrencies, but sociological and cultural studies publications are still in short supply.

Bitcoin is, from a social science perspective, massively under research. Maybe it's because the cryptocurrency breaks the technical and conceptual capabilities of most humanities scholars. This is not changed by a new paper by the Italian sociologist Fiammetta Corradi. But at least the scientist succeeds in identifying some of the key sociological topics of Bitcoin and in deriving theses that other researchers can pursue.

Corradi asks about "embedding" Bitcoin in social structures - shaking one of the sacred shrines of the cryptocurrency: claiming that Bitcoin is a money that can not be trusted. This is, according to the scientist's perhaps most important thesis, a myth.

Embedding and trust

Before that, however, the sociologist explains the concepts and terms. "Embedding" is a central term in economic sociology. It is a "theoretical key tool" to analyze how economically rational - ie selfish - action is integrated into and interwoven with social structures. The concept originally goes back to the Hungarian scholar Karl Polanyi, who used it to show how business and society are related. It became more common, however, when the American economist Mark Granovetter took it up and developed it into a concept of economic-social research. Embedding becomes a condition of economic actions, but also their result.

To translate the concept of embedding it into Bitcoin, Corradi asks how it relates to the concept of trust. To this end, it borrows from the philosophy of money published by the German sociology Georg Simmel in 1900. She cites a delightful passage from Simmel's book that outlines how the everyday use of money requires trust:

"[...] Financial transactions would collapse without confidence. There are nuances of this trust [...] If a farmer did not have the confidence that his field would bear fruit just as it did last year, he would not sow it; if a trader did not trust the public to buy his goods, he would not offer them, etc. [...] However, in the case of credit, trust in someone, we encounter an additional element that is hard to describe: it is predominantly based on religious belief [...] 'trusting somebody', without adding or discussing why one trusts him, means applying a very subtle and profound idiom [...] economic credit includes an element of this supra-theoretical belief, and it is the same with the confidence that the community will confirm the validity of a token against which the products of labor have been exchanged. "

The exciting thing about this quote is that Simmel combines two kinds of trust with money: First, a trust based on personal experience, like the dealer's, that there is a need for the commodities for which there was a need in the past. One could say that it is the confidence that what was yesterday will continue to apply tomorrow.

But there is also a less rational trust, which Simmel also calls a "kinda-religious faith": trust in relationships that the individual can neither test nor judge, that is, a kind of blind trust. This is both behind the belief in the credit system, as well as in the fact that a money gets its value.

Corradi now combines Simmel's conception of trust with the embedding of economic action in social structures: "We understand embedding as a source of trust that is subject to economic action; on the other hand, we also understand it as the result of economic actions based on trust. "

Blind faith in technology

Now we finally get to know how the sociologist embeds Bitcoin in social structures while discovering trust.

First, she explains, Bitcoin claims to have solved the double-spending problem without the need for a central authority such as a bank or central bank. To know if you have been paid, you do not need a trustworthy middleman at Bitcoin. This is the thesis on which the enthusiasm of the bitcoin and crypto scene is based. Corradi starts at a very central point.

First, she explains the technical embedding of Bitcoin. In her very brief description of the system, it focuses on two points: first, that only the miners can form blocks, and second, that the functioning of the system depends on cryptographic technologies. She notes that "firstly, Bitcoin is involved to work in mathematical mechanisms and computing devices, and secondly, there are both computational and cognitive asymmetries, both between the nodes and between the investors."

Corradi sees this as "a kind of institutional / systematic trust, in the sense that, to be part of the system, one needs confidence in the set of technical and automatic rules designed to solve the double-spending problem "In fact, here we encounter a blind trust - perhaps even a quasi-religious belief - in the functioning of software and, above all, cryptography.

Once the crypto algorithms SHA256 or ECDSA are broken, Bitcoin crashes. Nobody can really judge their quality apart from a few mathematicians. You might find that users trust less in cryptography itself, but that the scientific-technical community system that reviews and implements cryptographic algorithms works well; that it will work tomorrow because it worked yesterday.

Unfortunately, Corradi hardly enters at this extremely exciting point. Instead, she focuses on embedding Bitcoin in social structures.

Trust as cause and result of pool mining

The social structures of Bitcoin lie in the technical relationships that Corradi has already recognized in a superficial inspection of the network: "The computational and cognitive asymmetries between the nodes of the network." Basically, it's about the miners, as the nodes, which can form blocks, pool together to improve their lucrativeness. The miners trust the pools, just as investors trust the pools when they buy cloud mining contracts.

A comparison of the distribution of the hashrates on the pools shows that the power of one grows and the hashrates of others' decrease. This could be seen as a reaction, in the sense that trust is not only the basis of economic interaction, but also its outcome - some pools earn their trust, others lose it. At the same time it demonstrates the change of variables of the system on the integrity of which the users are dependent - so they trust that the change does not lead to extreme results, such that a mining pool has more than 50 percent and you have to trust him effectively, as much as you need to trust PayPal.

In addition, Bitcoin is embedded as a speculative object in certain social structures that determine the price. These are in a bubble, above all, irrational surpluses of confidence in the future of Bitcoin, and in the case of a bear market rather an irrational lack of confidence. Unfortunately, Corradi only addresses both points without going too far into the depths.

Her paper has only nine pages. But it outlines an interesting and probably fruitful approach on how economic sociologists can examine key concepts of Bitcoin, such as trust, and classify them into a theoretical framework. One may hope that this becomes the basis of further research.

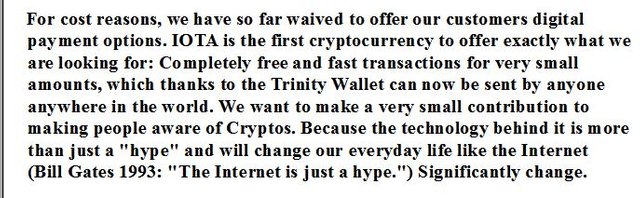

One of the most widely watched targets of cryptocurrencies is being used as a mass-market means of payment and being widely accepted by the public. A small farm from Switzerland allows its customers to pay eggs from the farm with IOTA.

A small farm from Switzerland, the Seeholz Farm, follows the trend of the times and offers its customers the payment of all goods, e.g. also eggs, with the cryptocurrency IOTA. Dominik Schiener, co-founder of IOTA, shows his excitement on Twitter.

I asked at the Seeholz Farm and wanted to know why they allow their customers to pay with a cryptocurrency like IOTA. Markus Zollinger states that he wants to contribute to our society and draw people's attention to cryptocurrencies:

Although this is only a small step, it helps to make IOTA and cryptocurrencies known to people and to bring them into contact with the subject. There are a few other shops that have been accepting IOTA as a means of payment for some time now. These include, for example:

- https://lazypyramid.com/

- https://www.gemma-led.com/

- https://monstercleaning.com/

- https://grabschmuck.shop/

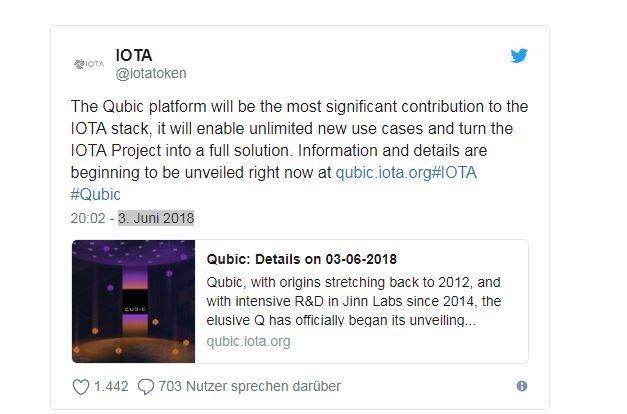

IOTA has made numerous partnerships in recent weeks and has revealed more details about project Qubic.

Norway's largest financial services group, DNB Asa, will explore how IOTA's Tangle technology can be used to streamline and expand its own business model and internal operations.

Furthermore, IOTA has published more detailed information about its project Q. According to the latest versions, it should be possible with Qubic to carry out Smart Contracts and operate Oracle machines to process data from complex sources quickly and easily.

Project "Q", which has been secretly edited by IOTA for a long time, has published new information about its exact future plan. The focus is on highly complex arithmetic operations and the introduction of smart contracts.

Myths and rumors surrounding the Q project have been around for months, with a countdown and the launch of https://qubic.iota.org/intro officially announced at the end of April. Last night, time was up and new information was revealed.

Myths and rumors surrounding the Q project have been around for months, with a countdown and the launch of https://qubic.iota.org/intro officially announced at the end of April. On June 3, 2018, time was up and new information was revealed.

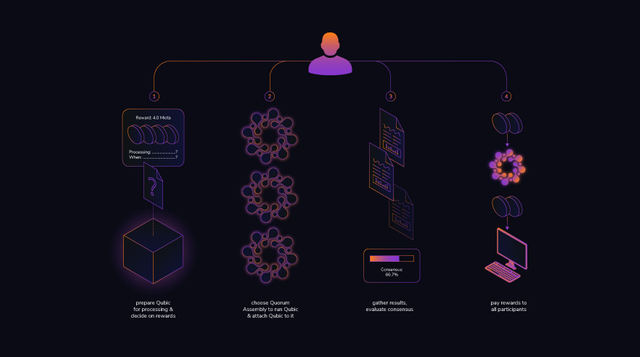

Qubic is a special protocol that will allow IOTA to perform various quorum-based operations. These include e.g. Features of Oracle machines, complex computation, and smart contract execution. The long-term goal is to develop a world-class computer that uses unused computing power for the operations already described while securing the tangle.

IOTA project Q Lifecircle:

Among other things, Qubic uses Oracle machines to collect complex data from external sources and to analyze and prepare it for predefined targets. These include, for example:

- Temperature data from real sensors

- Current or historical file values

- Personal properties such as the current age, marital status etc.

Furthermore, it should be possible, as is already the case with Ethereum, to implement Smart Contracts. This allows two or more parties to enter into a contract that is monitored, confirmed and executed (further details are not yet known).

An important feature of Qubic should also be that unused computing power is collected over a decentralized network and the resulting power for external calculations should be made available. In this case, people who do not have strong hardware can place an order that the powerful decentralized platform executes and in the end only the result is output to the person.

There is currently no exact time horizon for when the project actually starts. The IOTA Foundation has been working on its development for some time, but it keeps you covered with more information.

To prevent further speculation, the IOTA has announced that there will be no new token or cryptocurrency, as well as Airdrop. This information was often part of international heated discussions.

Tim Frey's company Iunera is specialized in big data analysis. Recently, they also provides an index of cryptocurrencies, sorted by popularity on Twitter. I asked how the analysis works and what meaningfulness such rankings can have.

Hello Mr. Frey! Your specialty is big data analysis. Can you explain what Big Data means for the beginning of the interview? From which size is it spoken of?

Haha, that's a good question. For us, the minimum is a data stream of one gigabyte a day. We do not understand data as fixed entries in a database, but as stream, that is, as something volatile that flows. Blockchains themselves are not big data, even though the Bitcoin blockchain will soon be 200 gigabytes in size. But what's going on around it, the ecosystem and the stock exchanges, produces data streams that could be called big data. A good example is the data included in the ranking of Coinmarketcap.

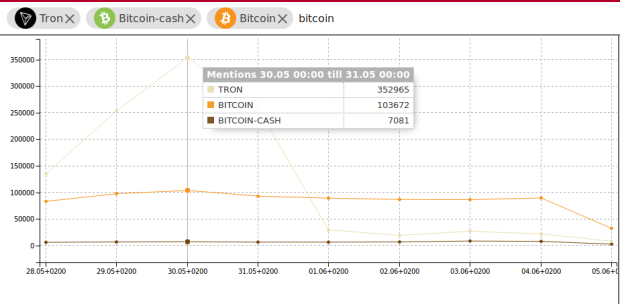

You have now formed an alternative cryptocurrency ranking based on tweets. In it there are some surprising positions, so Tron landed in third place. Which method is behind the ranking?

We sorted the tweets, which also involved cryptocurrencies, by currency. For example, there have been 89,000 tweets and retweets in the last 24 hours, involving #Bitcoin, #BTC or $ BTC. We do not rate normal words without hashtags or dollar signs. This would work well for currencies like Bitcoin or Ethereum, but becomes a problem with currencies like Tron or Waves, as these words are used differently, which would distort the result.

We have now extracted several values from the big data analysis, such as the number of tweets, the number of tweeters, and the number of tweets relative to market capitalization.

How does the ranking work technically?

We get the tweets in real time from Twitter, in which certain words and strings appear, such as Bitcoin, Ethereum and so on. In total, that's several gigabytes a day that come in. We process this data on our cluster. The amount is less problematic than I feared, and we could process much more data than we currently receive.

What does the number of tweets say about phenomena? Is it possible to draw any valid conclusions from this?

This is an exciting and interesting question. It might help to compare it to another topic. We also evaluated tweets for the general election. The AFD was interesting because it was in the polls at nine percent, but had the widest reach of all parties on Twitter, about 40 percent air sovereignty. The mood on Twitter was therefore very good for the party early on, and in the election, the AFD has then caught up to 12 to 13 percent. Of course, that's less than the 40 percent we found on Twitter, but it was a trend.

So are tweets more likely to be indicators of change?

Yes, I would say so. You can see in the tweets if something moves in the long run. If you go to a poll and three percent polls, but manage to reach a tweet share of 30 percent because of a hype, that does not mean they will get 30 percent on the poll. But there is a direction ahead.

If we look at cryptocurrencies, Ripple is an interesting example. There are relatively few tweets per market capitalization, but because many professional institutions work with ripple, the coin still has its value. I think you can make positive effects much better than negative ones.

Or look at Tron. The coin generally has an enthusiastic community. On a certain day, the Mainnet launch, the number of tweets went extremely high. With 350,000, Tron had a lot more tweets than any other coin. Of course that does not mean that Tron will soon overtake Bitcoin. But only that there was a temporary event.

Can I use the tweet indicators for trading?

That's difficult, I think. Although you can tell how many tweets there are, but it is hardly possible to concretely connect them with the course. There is no deterministic interaction between the two. Sometimes there are causal relationships, then we try to make predictions or recognize patterns.

When there was the Mainnet launch of Tron, there were also many tweets. That attracts a lot of attention, and maybe it does not matter if it's positive or negative. The main thing is that people talk about it. That does not mean that the price will rise, but there is movement and there is potential. Polarization is always better than silence.

The launch of the Mainnet is very visible in the Twitter analysis of Tron.

Take a second indicator, the tweets by market capitalization. Sumokoin is currently the best, then Bytom. But these are little coins, and it's hard to say what's behind it. I find Zclassic more exciting. Here you can see high tweets per market cap, and relatively few tweets from relatively few people. You could say that is a small but highly motivated force. SmartCash is different. There are a little more than 1,000 people, but only 1,500 tweets, which could be interesting.

Overall, however, I believe that these are only individual indicators that make sense only in the overall picture. They say relatively little for themselves, but they can be valuable as part of the analysis.

What do you mean, how much manipulation is in the tweets?

You mean, manipulation by bots? That's a pretty exciting topic. There are definitely bots, we have already experienced in the general election. In our statistics, we not only list the number of tweets, but also the number of tweeters. Basically, it is easier to shoot tweets per account than to create new accounts or bots.

By comparing these two values, we can identify potential bots or other irregularities. For Bitcoin and Ethereum there are about three tweets per person, only two for Tron, Rippple stands somewhere in between. That seems to be the norm by and large. A departure from this, as with Zclassic, does not necessarily mean that it is being manipulated. There may also be an event that tweets a lot, such as a conference.

Overall, it's not that important to us whether a human or a bot is behind a tweet. If a person shoots out 100 random tweets a day, or a bot does that, it will have the same effect. On Twitter, we have a noise floor, which often has nothing to do with the course, because not only traders are on Twitter. Whether this noise is now made by bots or humans, does not really matter.

Note:

To all #steemmonsters fans if you like to win some Monster Cards check out this post https://steemit.com/steemmonsters/@monsterworld/introducing-monster-world-300-steemmonster-give-away from @monsterworld a new account and fan site here on Steemit who is looking for writers, artists, posters ... who want a great forum to share their content and even earn some money.

Image Sources:

- Article headers created by myself

- https://www.researchgate.net/profile/Fiammetta_Corradi

- https://twitter.com/DomSchiener

- http://www.iotashops.com

- https://twitter.com/iotatoken/status

- https://iota-news.com

- https://www.itb-berlin.de

- https://scoinanalytics.iunera.com/social

Have a nice day!

LOVE&LIGHT

Great .. well done

You know there are a lot of great ideas

But we need the real will to change in the presence of greed and corruption..

That's right

Great .. well done

You know there are a lot of great ideas

But we need the real will to change in the presence of greed and corruption..

thanks for the info

Amazing the mindset of the swiss farmer! i am also thinking about developing a business on a blockchain (perhaps with an SMT). Great post thoug. I believe that this technology will really change the world we live in!

Yup he is getting free advertisement just by adding cryptos this is what I told my brother all the time to do for his company.

Btw go a bit down in the comments and you will see that @tariqul95 made a shit copy of your comment!

absolutely agree and its not the only benefit! ...wtf what a copycat, can't believe it haha

Too many news about the partnerships of IOTA but price is hardly moving. Many other coins fake news about partnership and price goes up in no time. What I mean to say here is that are these news fake or what is going on?

Man...EOS needs to get their tweet on and catch up! haha good insight!

Lol damn right can't wait to see EOS going up crazy ;)

great!! @loudlou @danyelk

I absolutely love the information. I suggest anyone interested in learning more about Bitcoin check this out.

Thank you :)

Nicw

■ 1st of all I'm in love with bitcoins,

■ I enjoyed full of the post , this is interesting as well as informative,

■ undoubtedly blockchaine will change the world !

Thank you and I am glad you enjoyed my post :)

I am in love with cryptos too ;)

Follow me. I followed you.

Source

Leaving comments asking for votes, follows, or other self promotional messages could be seen as spam.

More Information:

The Art of Commenting

Comment Classifications

Good job, I loved the presentation, description and photos, unbeatable, THANKS for sharing!

Thank you and your welcome :)

I dunno about this weirdo crypto-religion stuff but I do know that I want to be able to buy coffee at every coffee shop with my cryptocurrency!

hello there!!! those are great news for cryptos because every time more people it is getting involve into cryptos, i wish to see more and more small business to introduce blockchain in their products.

nice post, good luck, have a wonderful day!!!!