Regulation Costs Give Rise to Decentralized Exchanges

Regulation costs, especially in the United States, combined with the bear market is putting increased pressure on centralized exchanges, which is creating a market opportunity for decentralized exchanges.

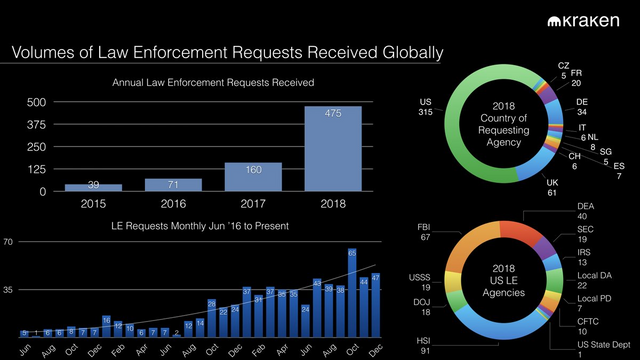

Peek at our Compliance team's 2018 Transparency Report. You can see why many businesses choose to block US users. Cost of handling subpoenas (regardless of licenses) is quickly becoming a barrier to entry. Inquiries up 3x YoY. pic.twitter.com/YbyLEqhOUf

Kraken Exchange (@krakenfx) January 5, 2019

Kraken is the most recent to highlight this issue by outlining how they received 475 law enforcement requests, globally, in 2018. The United States submitted 66% of total requests, which puts the United States far ahead of any other county and is part of the reason why many cryptocurrency businesses deny services to US citizens.

With a heavy heart, today we laid off 37 people. We've published a blog on this, also discussing some of our missteps and lessons as a company. "Overcoming ShapeShift’s Crypto Winter and the Path Ahead" by @ShapeShift_io https://t.co/1eNT54eyPp #bitcoin

Erik Voorhees (@ErikVoorhees) January 8, 2019

Then only a few days ago, Shapeshift announced that it would be laying off 37 employees due to the bear market. However, Shapeshift has also had its dealings with regulatory agencies since only a few months ago the company implemented a membership registration program as a form of KYC/AML compliance. All of these compliance issues are increasing costs on an emerging industry.

Market opportunity for decentralized exchanges

The increasing cost on centralized exchanges, both by regulations and by declining market exchange prices creates a market opportunity for decentralized exchanges. One of the more popular decentralized exchanges, Bisq, is a prime growing example of enabling further decentralization in the cryptocurrency space. Steve Jain, a Bisq contributor, outlined just how significant regulation costs are getting in the United States.

"There's no doubt that financial compliance in America adds significant costs to doing business. Many financial ventures don't even consider entering the US market because the costs are just too high to make it worth it. Financial ventures being started in the US virtually need venture capital to get started just to handle the costs of pushing paper to comply with the law (no such thing as bootstrapping a payment processor in the USA!). People joke about needing to rent moving trucks to haul the paperwork needed to start a bank. Both dynamics—financial companies hesitating to enter the US and limited US-based financial startups—result in sluggish innovation and perpetuation of old broken models. All regulation isn't bad, but when it's this limiting, something's wrong!Bisq is able to take advantage of this pressure on centralized exchanges since they are decentralized and are not located in any specific jurisdiction.

"I would say it's an exchange's job to follow the rules and regulations of the jurisdictions they're registered in. Bisq isn't an entity registered in any jurisdiction...it's just software with open source code that anyone is free to run on their own computer."Nevertheless, there is room for both centralized and decentralized exchanges to coexist since they each bring their own advantages.

"They attract different customers. Centralized services tend to be much more convenient, as most have websites and mobile apps. The trading experience is vastly quicker since order matching and execution is done by a server in fractions of a second. Perhaps most importantly, the overall experience on most centralized exchanges is more intuitive: it mirrors the services they're used to using already."However, more people are starting to learn about the underlying technology of cryptocurrency and are driven away from centralized exchanges either by regulations or deplatforming. This causes the currently steep learning curve to become a little more flat."Decentralized exchanges are a relatively new phenomenon for most people. They don't understand them. Because they haven't had to spend energy learning what bitcoin is really all about, they think that buying bitcoin on Coinbase is the best they can do (i.e., #proofofkeys means nothing to them). They don't understand the underlying technology, so expecting them to embrace decentralized exchanges is probably unreasonable."

Dash services both types of consumers

Dash also recognizes that the cryptocurrency learning curve is scary for many individuals. That is why the Dash DAO Treasury has funded so many community outreach initiatives to not only encourage more adoption, but also encourage educated adoption. This helps ensure that consumers will use Dash properly by controlling their own keys and use Dash's more advanced features such as InstantSend and PrivateSend.

The Dash community also recognizes the importance of decentralized exchanges since consumers can utilize DashNearby, Dashous, and Wall of Coins to buy and sell Dash, but both currently suffer from a lack of liquidity. Dash is also on Bisq, which provides more liquidity than the previously mentioned options. Komodo is also another option for consumers to trade Dash on a decentralized platform. This is all in addition to the numerous centralized exchanges where Dash is available. As more consumers learn about Dash and cryptocurrency they will be better positioned to move from centralized services to decentralized services.

Posted from Dash News : https://dashnews.org/regulation-costs-give-rise-to-decentralized-exchanges/