5 Data Points That Signal a Cryptocurrency Bubble

Following up from the last video I made about some of the intuitive signs of a potential crypto bubble, we're now going to take a look at some of the more "objective" data points that can signal a cryptocurrency bubble.

DISCLAIMER: This is NOT financial advice. I am just offering my opinions. I am not responsible for any investment decisions that you choose to make.

▲▲▲▲▲ Looking to get started with cryptocurrencies? Check out my crash course here: https://louis-thomas.teachable.com/p/buying-bitcoin-crash-course

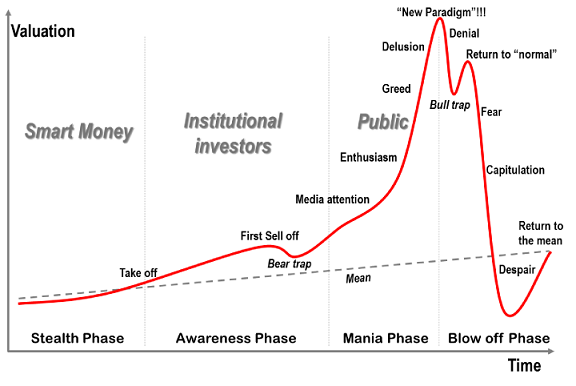

I like the way you say “when” not “if” the next bubble comes. We are on the same page on that . ... Actually have we ever not? Mayer multiple chart looks really interesting. First time I’ve heard about that and it’s very helpfull. I usually use moving averages, MACD and mostly RSI to evaluate whether it’s time to take some profits. In bubble it’s all different. If I felt there was an extreme overvaluation in crypto market, I would 100% take some additional profits. However, I would leave some on the table as well, since it’s called a bubble for a reason. No one knows how high it could eventually go. In this case I would try to compare it to this graph:

Good luck in search for your new apartment and also enjoy your time in Australia. I’m excited to see new places in your videos.

BTW: @dhenz’s account has just been hacked. Apparently @cryptoskill stole 11k Steem from him. He is asking for help. If anyone can advise him if there is anything he can do, go to his blog.

Thanks man! This is a very important video for newbies like me. I will agree that this cannot be full-proof but combined together, they can be a great possible indicator of an approaching bubble. I have written down the essentials for my own reference. Obviously these are just things to keep in mind and not words set in stone. So here they are:

PS: Good Luck with the travels! This was a beautiful backdrop to shoot a video against and it'll be missed. Who knows, maybe the new one might be even more beautiful :-)

I love the graph of Mayer multiple. I must check this out a bit closer. One is for sure, we are not in a bubble right now. It’s the best time to be accumulating. Just look at your graph. We are at the lowest point we’ve been. I can’t believe it was much much higher in the past than the bubble in 2017-2018. And yes, when price goes parabolic, it’s definately time to start cashing out. At least partially. Other than that, you made a great points yesterday and today as well.

I've never been able to even spot these signs on my own I guess there are factor that determines it, however as a bitcoin or cryptocurrency analyst I think these signs you've given I'd look out for it myself, might help me if I want to invest as well.

Certainly great data points to look at going forward. I am guessing that some of these could also apply to signal that the bear market is over-extended or oversold. For example, the Mayer multiple is now below 1 for a consistent period of time which could signal oversold conditions. For the future, SBD could break the $1 value which could also signal the same.

Thanks a lot. My only wish is that I look out for the signs when the prices are back up on their feet and not get caught up like the thrill of the last boom

Cryptocurrency - has real-world utility, but is still in an early experimental state that does not justify its current market price. In addition, the potential supply of Ether is infinite, unlike the Bitcoin – which has a finite supply hard-coded into its design. Long story short, the critics are right – we ARE in an ebullient Cryptocurrency bubble, and a painful correction is certain – but not imminent.

A number of market observers are right in noting that Cryptocurrencies are exhibiting bubble-like behavior. For Bitcoin, which isn’t backed by a central bank or doesn’t have a market regulator, this is particularly true, as its value is purely notional.

Public opinion towards Cryptocurrencies has always been divided. However, with the new surge in the market, opinions have become even more polarized. Sceptics hinge on Bitcoin’s first impression as being a black-market currency and call this a bubble, while proponents contend that this is a global currency that is just going mainstream and can indeed go way higher.