Bitcoin's Falling,Down Market Trend,Where Do We Go From Here ?

What an bad week the cryptocurriences are having, with Bitcoin driving the fall, dropping by 3%, more than $9 billion, after SEC's choice to put off their choice on ETFs.

With the bearish slant back in the business sectors, what wraps up of the week hold for the real cryptographic forms of money?

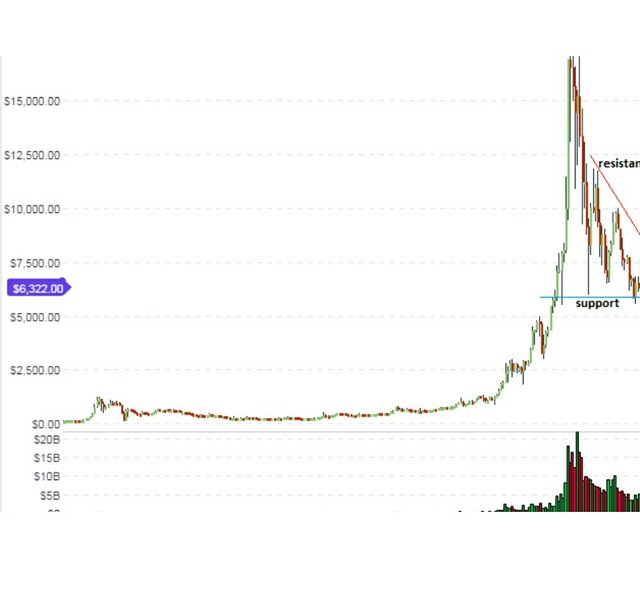

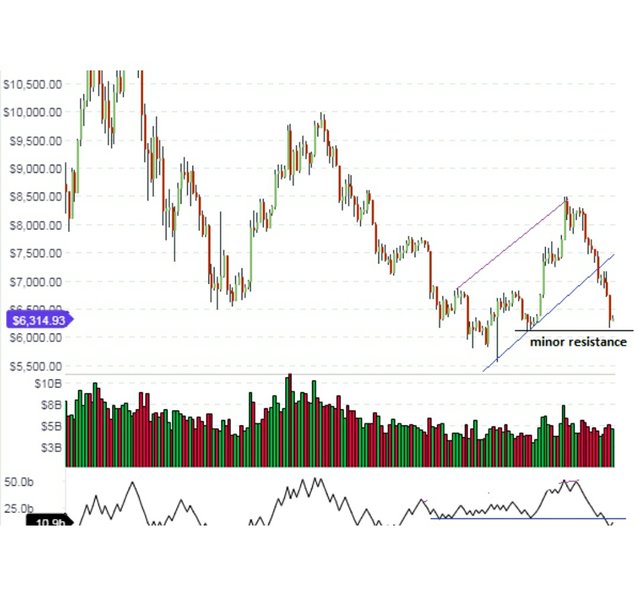

BTC/USD

BTC/USD keeps on satisfying the long haul desires on the week by week graph. As recognized in the last examination for this match, the outskirts of the symmetrical triangle on the long haul week by week graph remain the limits of value activity. The cost could contact the lower end of the range and do not break the helpline. We are probably going to see additionally trial of this line on the week after week diagram heading into the end of the week prior to another bar/light for one week from now discloses to us more about the circumstance.

The day by day diagram demonstrates that the up channel which had been on for fourteen days currently has been broken to the drawback. In any case, the cost is presently at a minor help territory ($6,200 — $6,300) and this may fill in as a medium-term pad at costs if that zone is tried and holds firm. On the off chance that the value gets through this level, anticipate that further drawback will the June 2018 lows of $5,700.

The situation on the hourly graph is clear. The inclination in the market is bearish and we can see costs beneath the day by day rotate.

An intraday exchange setup is offered at the day by day rotates inside the shaded zone, hoping to take some fast benefits at the S1 level. Intraday exchanges should be finished with cautiousness, as costs on the medium and long-haul outlines are moving toward the minor help zone at $6,300.

The viewpoint for BTC/USD is as per the following

Long haul: bearish

Medium-term: impartial

Here and now: bearish

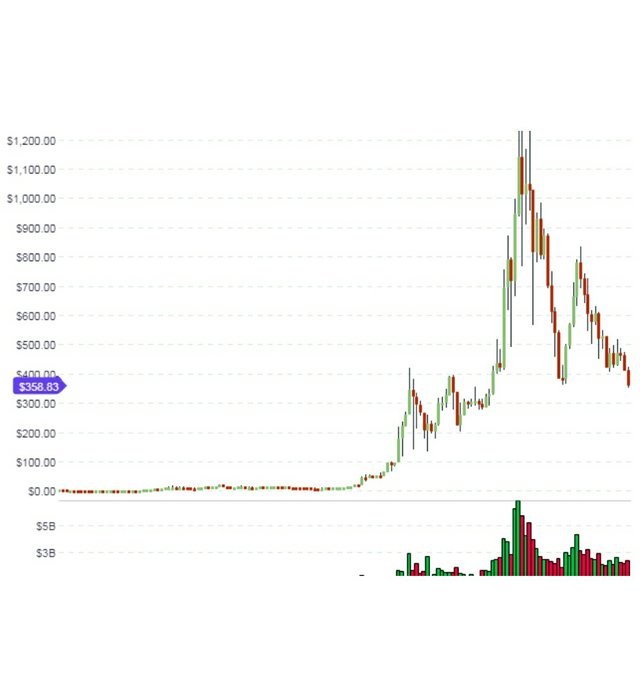

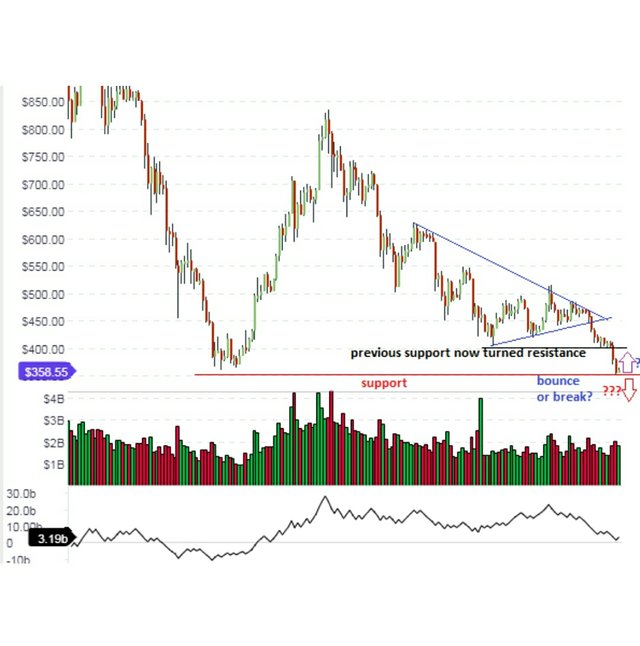

ETH/USD

The week after week diagram for ETH/USD demonstrates that the value activity has accomplished an entrance of the help trendline. This isn't yet an end entrance to affirm a drawback break, yet that there has been an infiltration at all is critical. It demonstrates that the present state of mind in the cryptocurrency advertise which right now, is bearish. Long haul, we would need to see the week by week candles close solidly beneath the help trendline with around a 3% infiltration for the drawback push towards the April 2018 help of $358.

In this graph, the ETH/USD value activity is pushing hard on the helpline with a long bearish light. Be that as it may, this long haul bolster which goes back to September 2017 has kept on holding firm. What amount long this will be the situation must be reasoned from the activity of this flame and the following two weeks after week candles on the outline, as the cost has achieved the pinnacle of the triangle and is expected for a breakout. The course of this breakout is misty as of now. We would need to see an end entrance of the pertinent candles over the opposition or underneath the help to know where costs will go in the long haul.

The day by day outline above demonstrates that after the trendline break, the minor help of $402 couldn't hold. This has viably given route with costs currently pushing towards the significant help level found in April 2018 at $358. Two things can occur here. In the event that the value breaks the $358 bolster level, anticipate that further drawback will push towards the $306 flat help of September 2017. On the off chance that the cost can skip off this helpline, at that point, it should approach the help turned-opposition point at the $402 check.

The hourly graph demonstrates the value activity being solidly dismissed at the day by day turn. The market predisposition is bearish. Any short exchanges to take after the inclination of the market ought to be finished by enabling the cost to pull back up towards the day by day turn. On the off chance that the candles at that zone bolster a bearish move down (e.g. a pinball or bearish immersing design which closes beneath the day by day rotate), this would support additionally moves south.

The market supposition for ETH/USD is as following-Term

Long haul — bearish

Mid-term — nonpartisan

Here and now — bearish

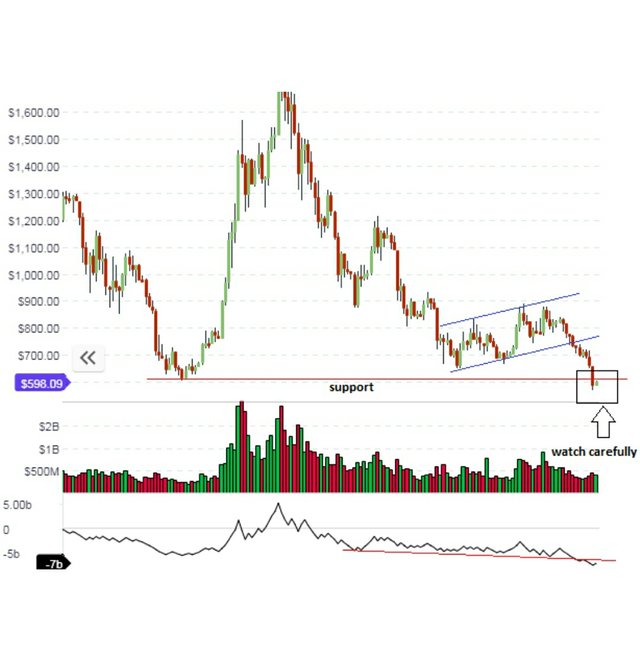

BCH/USD

Bitcoin Cash is likewise following its enormous sibling Bitcoin down south. Be that as it may, the week by week diagram demonstrates that the long haul bolster at $598 is holding solidly.

The photo on a medium-term day by day graph is one which indicates exactly how far the BCH/USD combine has fallen beneath the past help level of. In any case, we can likewise observe that the past help level seen on the medium term diagram is being undermined truly. There has just been a break of this line; all we are sitting tight for is to perceive the end result for the pullback move which is continuous. Regardless of whether this help level will absolutely give way or not will depend, all things considered, on what occurs with Bitcoin costs one week from now. On the off chance that Bitcoin can organize a little recuperation, at that point, Bitcoin Cash will likewise do likewise and this help will hold.

Notwithstanding, if Bitcoin costs proceed on their turn down south, at that point the photo at the boxed help territory on the day by day graph will wind up critical. There has just been a break of the helpline and the pullback move is continuous. A dismissal of this upside pullback at this region will spell promote drawback for BCH/USD.

The intraday graphs demonstrate that the value activity might be amidst a bearish flag arrangement. If so, at that point we may see costs being rejected at the summit of this flag (which is at the every day turn) and a push down south to the S1 rotate is likely. Accordingly, informal investors should endure this circumstance quietly and just take exchanges when the photo with this potential example arrangement is much clearer.

The standpoint for BCH/USD is as per the following

Long haul: impartial

Medium-term: bearish

Here and now: bearish

Disclaimer: data contained in this is given without thinking about your own conditions, subsequently ought not to be understood as money related counsel, speculation proposal or an offer of, or sales for, any exchanges in cryptographic forms of money.