Begun, this Hash-war has 💣 51% attacks & Crypto-Darwinism 🦎

Proof-of-Work is under attack as various cryptocurrencies suffer the infamous 51% attack. After Verge (XVG) and Bitcoin Gold (BTG) were struck, ZenCash (ZEN) was next to be attacked. In all cases the network security was compromised and attackers took off with substantial gains.

51% ATTACKS

The 51% attack is one of the most (in)famous ways in which one could attempt to attack a blockchain that uses Proof-of-Work (like Bitcoin) as a way to secure the network. The way Proof-of-Work works is that all the miners seek consensus amongst eachother and the majority determines the 'truth' that exists within the network.Just like in a sort of democratic process, if one party should ever manage to gain control over 51% of all the mining power, also known as hashing power, they could choose to impose their version of the truth - which would likely be malicious and contain so-called double spends which would let them spend the same money twice.

This is why hashing power matters. If a blockchain has a lot of hashing power this means that a lot of hashing power is required to make a 51% attack, which costs a lot of electricity and thus money. Bitcoin's PoW power consumption is often under attack as being environmentally unfriendly, but it is precisely because Bitcoin uses up so much processing power (and thus electricity) that it is so secure. Not long ago I read that Bitcoin mining costs the equivalent of Ireland's electricity bill, and while this is expensive it also means that it would cost half of Ireland's electricity bill in order to attack the network - no small price to pay for a double-spend attack.

SMALL COINS UNDER ATTACK

Unfortunately not all PoW coins are as secure as Bitcoin. In fact, there's a whole world of politics and game theory going on in the world of miners where blockchains compete for hashingpower from the miners, who are really only incentivized by money. After all, there's only so much hashing power to go around and Bitcoin really has so much more than everything else that it's no surprise to see that smaller PoW coins are starting to get attacked. It would only take a small amount of Bitcoin's hashing power in order to take over the network of smaller coins.First we saw Verge (XVG) being attacked a few times, and later Bitcoin Gold (BTG) where about $18 million was stolen and more recently $550,000 was stolen during a 51% attack on ZenCash (ZEN). Obviously the cat is out of the bag, and somebody has figured out that it is now profitable to attack small, weaker blockchains with low hashing power.

Will there be a next attack? I most definitely think there will be.

THE COST OF SECURITY

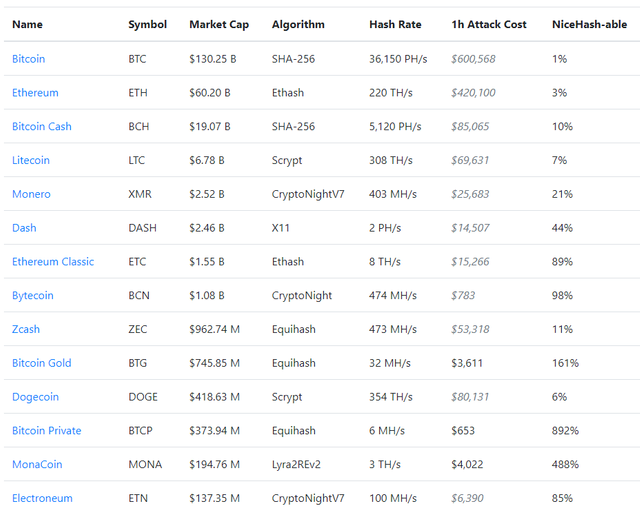

I've said it before: Hashing rate matters. A blockchain only serves it's purpose if it is secure, and it's only as secure as the cost of attacking the network. If it costs $100K USD to attack the network, then one might argue that the cost of the attack is enough insurance to be able to trust the network with $100K USD worth of value. Anything above that would turn the scenario into a profitable one for 51% attackers.A friendly crypto-enthusiast has created a website at www.crypto51.app which gives an overview of PoW coins and which shows the price of how much it would cost to attack the network with a 51% attack. Below is a screencap.

The first thing you may notice is how low the hourly cost of a 51% attack is on some of the smaller coins. Only $653 USD in order to attack Bitcoin Private (!). If you go to the website and scroll down the list you'll find some coins which cost only mere dollars to attack. The bigger cryptocurrencies too, seem lacking and at first glance it seems like it's not that expensive to attack. $600,000 USD an hour to attack Bitcoin seems like a lot, but what if you could manage to double spend twice that much? A lot of value is transacted on the network daily.

However, notice the last column 'NiceHash-able'. NiceHash is a company where you can rent hashing power to mine cryptocurrencies and they own quite a lot of hashing power. The percentage in this column shows whether or not it is possible to rent enough hashing power from NiceHash in order to make the attack. As you can see, most blockchains have enough hashing power in order to remain safe from an attack through NiceHash, but some like Bitcoin Gold, Bitcoin Private, MonaCoin do not. Bitcoin is the most safe: Nicehash is only capable of providing 1% of the hashing power required for a 51% attack.

NiceHash is only one party in the crypto-ecosystem though. There are many more, and let's not discount Bitcoin mining pools and large players like Bitmain.

THERE CAN BE ONLY ONE?

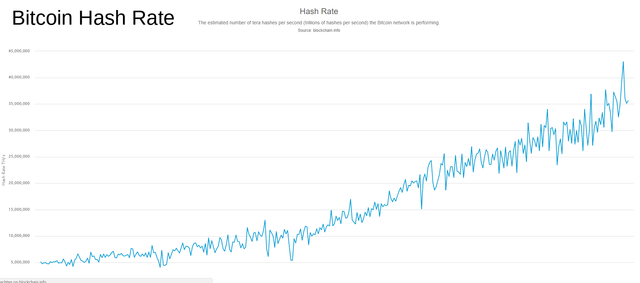

Since the worldwide hashing power and in particular Bitcoins hashing power has increased so much the disparity between blockchains has increased tremendously. Bitcoins hashing power increased as much in the last half year as it did in the first 8.5 years of it's inception and despite the market downturn Bitcoin's hashing rate is still shooting through the roof.

Since it's profitable to attack smaller networks, we can almost be guaranteed that smaller networks will be attacked. It's only a matter of time. I believe the start of these 51% attacks will herald an era where PoW blockchains will be tested for their merits. A blockchain that is not secure is useless, and through a sort of crypto-Darwinism I expect many of the weaker coins to die off, much to the betterment of the stronger coins who will obviously absolve both the hashing power as well as the market capital that will flow out of the weaker crypto's. Bitcoin, as the de facto secure blockchain, will as usual be the place to go.

Many people, including Andreas Antonopoulous, have speculated that perhaps in the end we will only have (or need) one PoW coin and that coin will be Bitcoin. Not only is more than one wasteful and contra-productive, in the long run crypto-evolution and game theory will likely cause a convergence onto a single PoW blockchain as it proves to be the best and most useful due to it's properties. The race for hashing seems to be long won by Bitcoin, and the race for hashing power really is the race for security.

Of course not all cryptocurrencies are Proof-of-Work and multiple consensus algorithms exist. Not only is there Proof-of-Stake which some cryptocurrencies are using and Ethereum is looking to move towards, there is also Delegated Proof-of-Stake which the likes of STEEM and EOS use. Both models are still unproven on a large scale and serious criticisms regarding their centralisation exist. Lastly there are also entirely different designs, such as the DAG-based IOTA and NANO which operate on a vastly different manner.

I am still on the fence on which is the best algorithm. I believe PoS/DPoS is certainly faster and thus provides a more agile blockchain, but Bitcoin's PoW dominance remains the only environment where you can send large amounts of wealth in a trust-less fashion, secured by as much electricity as half the country of Ireland. And it's only getting more and more secure.

You're becoming one of my favorite crypto writers. Upvoted and resteemed.

Thanks so much! You're one of my favorite commenters too! :D

Another great article @pandorasbox! Thanks for sharing :)

As always, you're welcome and thanks!! :D

We;lllll yeah you can do a 51% attackbut so far none of them have reallly worked... Show us an example of a 51% attack wheer a LARGE marketcap coin like I mean over 100 million dollars had a double spend

I Know many doubel spends have happened but in recenttimes its a rarity to have happen to a LARGE marketcap blockchain

also even if you DO a successful 51% attack, the exchanges will KNOW and delist and hahaha duuuude no one is going to accept money from the attacker, they get black listed, its hard to pull off.,....

Also if all the POW coins get 51% attacked, GOOD, it will leave is with just BTC as the ONLY POW coin left LOL it will just be BTC EOS and Steem and a couple others :D

hey i will go get ytou a 100% Upvote from @tytran and even a resteem, good job with you are article it is good!

Hi! Thanks so much!!

Yes a larger market cap is usually a bit more secure, but Bitcoin Gold has a $750 million market cap - that's not quite small!

I honestly think the attackers are likely using these smaller attacks to fine tune the mechanism and prepare to take on a bigger honeybadger as they hone their skills.

And I agree, I think it would be good if the weak coins get exterminated and everything flows from it into BTC. I even considered that this may be the sole intention of the attackers to begin with - discredit other blockchains and strengthen Bitcoin's security reputation. It might not even be about direct monetary gain.. I could see some angry Bitcoin maximalists getting behind this.

Thanks for stopping by!

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.

Go here https://steemit.com/@a-a-a to get your post resteemed to over 72,000 followers.

Thank you for this analysis, and I agree with your thoughts that a lot of the "everyone wants to launch their own token" coins are going to lose. I am all for some diversity and testing out different systems, but there being eleventy million different coins only slows crypto adoption, imo. So this might make things better in the long run, but be painful in the short term.

Thanks for posting this! Very good info. Hmm you are right the value of a coin is largely determined on security.

Incase of verge what do you think of their community and devs?

So much information. Thank you for enlightening me. This article almost qualifies as comprehensive guide to CRYPTOs.

I have resteemed this post. (I very rarely resteem but I really have to do it.)

Great job. Really well written. I wonder if cryptos will need to set up emergency hash power contingencies as a defence against 51% attacks.

I also wonder if this threat/trend might push Ethereum along to PoS a bit faster.