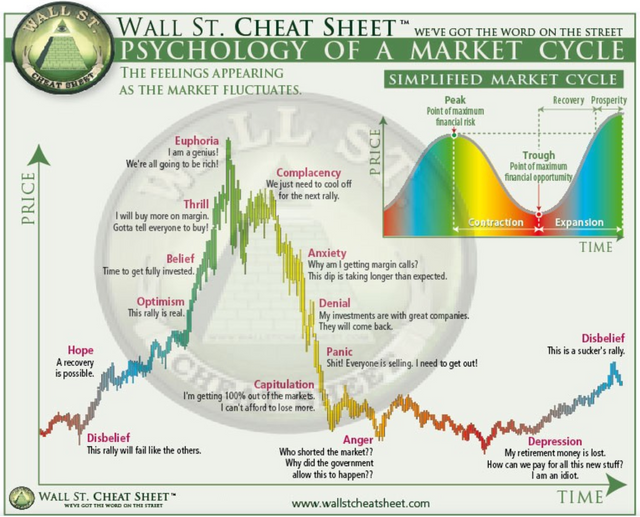

Psychology of a Market Cycle

I'm sure a lot of you have seen this image before. After going through the last crypto bull run in November-January, and the subsequent correction/bear market the last six months, I can say without hesitation that this accurately reflects my moods and personal psychology at each stage of the market cycle. I didn't understand all of this at the time. I was just going with the flow of things. And I lost a lot of profit because of my ignorance. But it helps to reflect on these things when considering your future strategy.

It's not possible to completely remove your emotions from your trading. If anybody figured out how to do that, they would become the wealthiest trader in the world. But learning to control your emotions is the single greatest advantage you can gain as a trader. The majority of the common mistakes people make in their trading are because of emotions, more than lack of technical expertise. The worst traders in the world are constantly anxious, afraid, and angry; and they consistently lose money because of letting those feelings drive their trading habits. Conversely, the most successful traders in the world are the ones who manage their emotions well and make calm, well-calculated decisions every time. They have done psychological studies on traders, and the evidence backs up my claims here. (Source: https://core.ac.uk/download/pdf/6863984.pdf)

The most difficult emotions to control in your trading are greed and fear. Everybody experiences these emotions when they trade, and these emotions are ultimately the driving force behind all the market movements. The key to becoming successful is learning how to manage the intensity of those emotions. The evidence is clear: The more emotionally detached you become to your trading, the more successful you will be.

Whenever I try to gauge a good entry/exit point for a swing trade, I always try to think in terms of fear and greed. More than anything else, this has helped me make successful trades. There are always clues in the chart, if you look closely enough, that reveal whether there is more fear or greed in the market at any given time. This has helped me make some very good trading decisions recently.

I entered the market when Bitcoin had bounced up from $5,780 to $5,900, because I saw some compelling clues that there was more greed than fear in the market. It wasn't anything I read in the technical analysis. There were still plenty of analysts saying Bitcoin would keep on dropping to $5,000 at the time. But the fact that it made a higher low (the first low was $5,750), and that the momentum was totally exhausted once the price dropped under $6,000, all pointed to a corrective market rally. And that's exactly what happened.

Now we've had a requisite correction from that rally, and the bearish analysts have come out in force again calling for $3,000-5,000 Bitcoin, just like they always do whenever the price starts moving down. But I think the price action is telling a different story, once again. What I see in the chart right now is more greed than fear. Does that mean I think that a yearly lower low for Bitcoin is out of the question? Of course not. I don't have a crystal ball here. I am simply making the observation that most people are clearly very happy to buy Bitcoin at $5,700-6,300, and so far this market consensus has kept the price from falling to $5,000 or below.

Right now we have found strong support at $6250-6350, and as long as we hold above $5500, I see no reason why we can't move back up towards $10,000 within the next month or two. From a technical analysis standpoint, you can draw the Elliot waves all the way down to any level, but that doesn't mean the price will ever move there. The price is driven by market consensus, not the opinions of the technical analysts or the traders.

I am not saying that technical analysis is bunk by any means. It is the best tool we have for predicting market movements and behavior, but it is far from perfectly accurate. I try to avoid reading other's technical analysis of Bitcoin whenever I'm getting ready to enter the market, because I don't want it to influence my decision making process. I prefer to enter the market in a cold state, based on my own analysis and judgments, and follow the basic fundamentals of 2:1 risk/reward ratio and setting up a proper stop loss. This is what makes successful trades in my experience; not trying to perfectly predict every market movement, which is impossible.

So what do I see in the market right now? As I said before, I see more greed than fear. And I am in the market right now, waiting for a move back up over $6600 BTC to sell my bags. My strategy is very simple. Buy low, sell high. I bought when the RSI reached oversold levels, and I will sell when it pushes high again. I never try to perfectly capture the bottom or the top of the market, but instead aim to buy after the market finds support, and sell before the requisite correction begins. I call this strategy Trading on the Trend Reversals. And it's the most profitable strategy of trading that I've discovered so far.

I avoid day trading and pump and dumps, but I will occasionally buy into a random coin that's in a strong bullish cycle, if the whole market is in a bullish trend as well, because I've found that's usually a safe bet to make, as long as you are cautious about how much you allocate for a riskier trade like that. I always put the bulk of my trading chunk into one of the top ten coins, and that approach has never failed me so far. In the last rally I put most of my funds into Ada at 12.5 and 13 cents, and that worked out beautifully. I am still working on refining my strategy, and I still experiment with new techniques all the time. But I have learned the hard way that every time I deviate from the core elements of my strategy, it almost always ends in failure. My goal in sharing my trading knowledge and experience on Steemit is to grow and evolve into a more skilled, successful trader. And I hope I can help others do the same.

When I look at the Psychology of a Market Cycle image, I notice a very distinct parallel to the path Bitcoin has taken this year. It's uncanny how closely they resemble each other. If Bitcoin continues to follow this path, we should be heading towards the end of the "depression" stage soon, and the beginning of the "disbelief" rally. I know this is hard to believe right now, and that's a great example of why they call it the "disbelief" rally. We are in the best accumulation zone of the market right now, and this is the point where the fewest number of people are actually accumulating positions, because the overall sentiment is still fearful and depressed. The mass volume won't return until the price starts rocketing up again. And by then we will be halfway up the bull rally. But that volume will carry us the rest of the way, and so I'm glad for it nonetheless.

To listen to the audio version of this article click on the play image.

Brought to you by @tts. If you find it useful please consider upvoting this reply.