How I shorted the market and won with Huobi

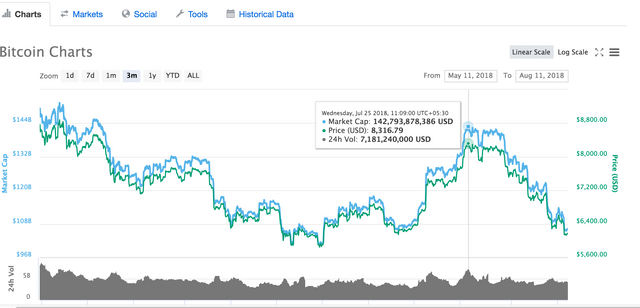

There’s blood in the streets, everything is in the red, suicide hotlines are buzzing and things look as bleak as they can be in the crypto world. But why all the gloom and why are things in such turmoil? That’s because, over the past few weeks, BTC has declined by about 28% from its intra-day high price on the 25th of July 2018. Although many have lost a substantial portion of their BTC holding, and more so their altcoin holdings, there have been a few lucky people like me who’ve managed to make decent gains by shorting the market on Huobi. But we’ll get to that a bit later on. First, let’s take a look at some of the reason why BTC has been performing the way it has and it suddenly declined.

Why I think prices have fallen so much:

Just a few weeks ago, things were looking on the up for BTC with the price have risen to as high as 8350 on July 25th on news of the possible ETF product being launched by the Winklevoss brothers post a hearing by the SEC. On 12th July BTC prices were at 6200 and swiftly moved to the upside - This signified a nearly 40% move in the price of BTC. But the happiness was short-lived and things came tumbling down soon after the SEC hearing.

This brings us to the reason of the prices crashing. The SEC postponed the meeting and also released a negative statement in regard to the Winklevoss ETF and Bitcoin and cryptocurrency ETFs in general. Their reasons were long-standing ones of markets being highly unregulated in nature and fueled by speculation. With no clear path ahead and the dream of a bitcoin ETF being out of sight investors began to lose confidence and began to sell. A big reason why the price had risen so much was that many influencers had also hyped up the ETFs and made it seem that they were about to happen very soon - which was clearly far from the case, but which resulted in prices being inflated in anticipation of big news.

This downward move brought us back to where we were before all the hype of the ETF which is the 5750-6350 level and where the bitcoin price currently resides. The price of 5760 is a good support level but we aren’t there yet and it would take another 10% downward move to get there.

So what did I do?

When BTC had hit 8000, I had a clear choice - To go short! My reasoning for this was first that I knew the move was mostly hype surrounding the ETF. I also knew that influencers were hyping it up for their own gain… and even on the unlikely chance that the ETF did get approved, the price of BTC had already risen too much over the past few weeks. This all translated to the downside is much much greater than the upside and also highly dependant on good news which seemed very unlikely. So I decided to short BTC on Huobi.Pro using the margin trade function.

Here’s a great video that guides you through the margin trading process:

WARNING!

Now before we get into the short, it is critical to understand that it’s not for novices. Although your gains can be multiplied and lead to riches so can the losses - so tread very very carefully. Unless you are absolutely sure you are willing to lose the money, DO NOT get into futures trading. In fact, if you are new and not sure of what you’re doing HODL-ing would be a much better and safe option. Again, I would like to assert and advise newbies not to get into margin trading unless they learn more about it first before diving into it.

Now that we have got that warning out of the way, let’s get back to the story. So I decided to short at 8000 on Huobi.Pro. I went about this my visiting Huobi.Pro first and then clicking on ‘Margin’. I went to the USDT section, entered my Short Sell order for BTC and clicked the button. That’s it. If you don’t have Huobi.Pro account yet, you can create one by clicking here.

My plan initially didn’t seem to work out well as the price of BTC increased to 8350 and I began to get worried, but soon the news of the ETF decision not being takes was announced and prices started falling. I was relieved. A couple of days later, and I was in profit on my trade when the prices declined sharply. As others were making a huge loss, I was getting a bigger profit on my trade. I closed my position at 6400 and booked a not-too-shabby profit. Normally that would be considered a good 20% profit, but since it was a margin trade the gains were multiplied. Since it was a 10x leverage trade I was making twice the amount I had made the trade for which translates to a 200% profit on my investment.

Can I short again?

This brings us to where we are now. BTC is at 6350 and there is a lot of negative sentiment in the market. The bear is in full swing and things are only looking further down. The next support level is 5750 and that’s 10% below current price levels. So what should you do?

Well, I’ll tell you what I’m going to do - short BTC again, of course. However, this time I will be a little more conservative and make a margin trade for only 5x leverage. A 10% move down to support levels would translate to a 50% ROI assuming I’m right. So that’s the plan for now. I don’t urge you guys to do what I’m doing. I am aware of the risks, but if you were to do so and have experience in margin trading you’ll know what I’m talking about and you know my gameplan for the near term.

Before you get into margin trading you can check out this article I’d written earlier about 5 tips to be successful at margin trading in digital assets: https://steemit.com/cryptocurrency/@somejasonguy/5-tips-on-margin-trading-in-digital-assets

Apart from BTC, there are a few other coins I would like to go margin trade on Huobi Pro. ETH and NEO are great candidates as I can see a lot more downside in these coins making them perfect candidates to go short on. Another great choice would be XRP given the negative sentiment surrounding it. For now, however, I will be focusing mostly on shorting BTC. You can check out the complete list of coins you can margin trade on Huobi.Pro here. To be able to trade, you’ll need to sign up for an account first though.

How do I short XRP on Huobi?

First, loan a certain amount of XRP in the “Margin” Page.

After the loan is completed, short it in the “Margin” page (sell it at a high price). You can choose to place a “Limit Order” or “Market Order.” Enter the amount and click on “Sell.”

Then wait for the price of XRP drops to your expected price. Then in the “Margin” page, you can buy a certain amount of XRP at a low price to repay the loan and interest. When you buy it, you can choose to place a “Limit Order” or “Market Order.”

Sell your loaned coin at a high price and buy it at a low price to repay the loan and interest. The bigger the price spread is, the more profits you can earn by shorting the coin.

Reminder:

Leverage enables users to gain higher profits through fewer funds. If you estimate the price trend correctly and you will be able to earn money by shorting or longing a coin. But if you estimate it incorrectly, you will face a larger loss. Ordinary investors should avoid high leverage trading to prevent liquidation or debt.

Disclaimer: The material provided herein is general in nature and does not take into account your objectives, financial situation or needs. While every care has been taken in preparing this material, we do not provide any representation or warranty (express or implied) with respect to its completeness or accuracy. For the avoidance of doubt, this article is solely intended to be for general information only and does not in any way constitute as professional advice or financial advice. This is not an invitation or an offer to buy or sell cryptocurrencies, nor is it a recommendation to buy or sell specific types of cryptocurrencies. Trading cryptocurrencies carry a high level of risk that may not be suitable for some. Consider your investment objectives, level of experience, financial resources, risk appetite and other relevant circumstances carefully. The possibility exists that you could lose some or all of your investments, including your initial deposits. If in doubt, please seek independent expert advice.

If you liked this article do share and resteem.

Cheers!

Follow me on twitter: https://twitter.com/SomePokerGuy

Huobi Pro Official Community and Social Media Channels:

Website: huobi.pro

Facebook: https://www.facebook.com/huobipro/

Twitter: https://www.twitter.com/Huobi_Pro

Instagram: https://www.instagram.com/huobipro/

YouTube: https://www.youtube.com/Huobipro

Medium: https://medium.com/@huobipro