EXPERIMENT - Tracking Top 10 Cryptocurrencies for One Year (2018) - Month Ten - Down 75%

The Experiment:

Instead of hypothetically tracking cryptos throughout the year, I made an actual $1000 investment, $100 in each of the Top 10 cryptocurrencies by market cap as of the 1st of January 2018. It began as a lazy man's Index Fund (no weighting or rebalancing), but I've moved away from that terminology as things have changed quite a bit since January 1st, 2018 (plus the term "Index Fund" seems to bring out the shills trying to sell their own Crypto Index Fund product).

My experiment is less technical, more fun (for me at least), and hopefully still a proxy for the entire market- or at the very least an interesting snapshot of the 2018 crypto space. I'm trying to keep it simple and accessible for beginners and those looking to get into crypto but maybe not quite ready to jump in yet.

The Rules:

Buy $100 of each the Top 10 cryptocurrencies on January 1st, 2018. Run the experiment 365 days. Hold only. No selling. No trading. Report monthly.

Month/Episode Ten - Down 75%

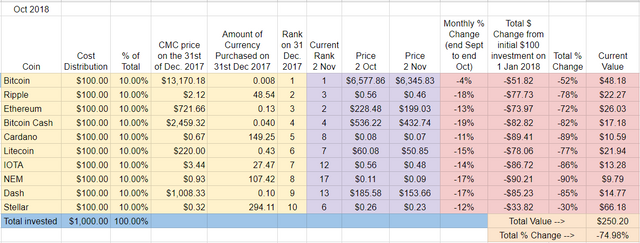

Like September, October ended up being pretty Paul Giamatti (Sideways). This is quite unusual for crypto this year, especially considering the wild fluctuations we saw in traditional markets. That said, none of the original Top Ten cryptos ended the month in the green, so while the flow may have slowed, this portfolio continues to bleed. In fact, this Top Ten portfolio reached a grim milestone: I am down a full 75% since the beginning of the year - my $1k investment is now worth $250 bucks.

October "Winners" - It was Bitcoin this month, holding remarkable steady, down only about 4% on the month. Cardano finished in second place "only" down 11% and moving up a position in the ranking from #9 to #8.

October Losers - Bitcoin Cash lost -19% of its value in October followed closely by Ripple, NEM, and Dash each down -17 or -18%.

Overall update – Stellar retains lead, BTC a distant second. NEM and Cardano at the bottom

October's report could have written itself (which I guess is interesting if we're looking for patterns). Although down -30% for the year, Stellar remains squarely in the lead, followed distantly by Bitcoin down -52% for the year. This is not a surprise to anyone who's been following the experiment - Stellar has been one of the strongest cryptos most if not all months this year. That said, BTC did close the gap a bit in October by being so stable this month while the alts slipped more significantly.

NEM and Cardano are both at or near the -90% mark since January 1st. My initial $100 investment in NEM and Cardano at the beginning of the year is now worth about $10 bucks each. IOTA and Dash closely follow, down -86% and -85% on the year, respectively.

In terms of ranking, only Cardano made a positive move this month, rising from #9 to #8 in October. IOTA and Dash fell a place each and now sit at #12 and #13 respectively. NEM, Dash, and IOTA are Top Ten dropouts - they have been replaced by EOS (now at #5), Tether (currently at #10), and Monero (currently at #9).

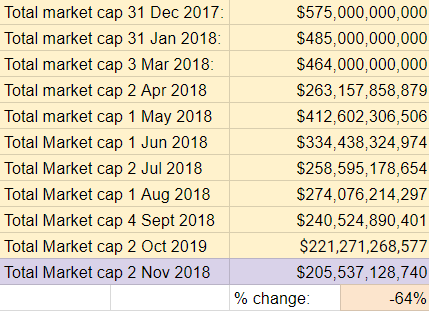

Total Market Cap for the entire cryptocurrency sector:

As mentioned earlier, October was a slow bleed, not a massive drop. Yes, the total market cap for crypto is now at its lowest month-end point of the year, but a relatively modest drop. From January 1st the market has lost -64% of its total value. Crypto hasn't ended a month above $300B since the end of May.

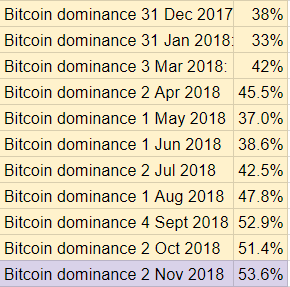

Bitcoin dominance:

Fairly flat here as well again, but Bitcoin dominance did reach its month-end high of 53.6% in October. As we've seen this throughout the experiment, when the overall market dives, BTC's dominance increases. This appears to be the case when the market is going sideways as well, or at least that was the case this month.

Overall return on investment from January 1st, 2018:

If I cashed out today, my $1000 initial investment would return $250, down -75%. I'm officially at the lowest point in terms of value.

Implications/Observations:

Zero cryptos finished the month in positive territory, but the way this year has been going, a relatively steady month isn't horrible news. A breakout (one way or the other) that I expected to happen in October didn't come to pass. All in all it was a fairly boring/sideways month in crypto.

Although it gave up some ground to Bitcoin this month, Stellar continues to be the crypto to beat in 2018 with only 60 days left to go.

Focusing solely on holding the Top Ten continues to be a losing strategy. While the overall market is down -64% from January, the cryptos that began 2018 in the Top Ten are down -75% over the same period of time. At no point in the experiment has this investment strategy worked: the initial Top Ten continue to under-perform compared to the market overall.

Last month that gap appeared to be shrinking as I reported a 9% difference, but this month it's back to 11%.

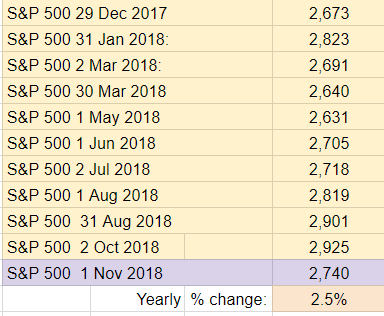

I'm also tracking the S&P 500 as part of my experiment to have a comparison point with other popular investments options. October was a volatile month - many of the gains obtained over the last few months were erased. The S & P 500 finished October up about 2.5% on the year meaning my $1k investment would have given me $25 on the year.

Conclusion:

Yet another down month, but again very sideways. This is the second month in a row the crypto space has been relatively "boring" in terms of price action while the stock market had a bit of a wild ride. I'd be surprised if something doesn't shake out soon and am guessing that by the time I compile this report at the end of November, there will be a significant movement one way or another.

Thanks for reading and the support for the experiment. I hope you’ve found it helpful. I continue to be committed to seeing this process through and reporting along the way. Feel free to reach out with any questions and stay tuned for progress reports.

As the year winds down, I haven't decided yet what to do with the experiment after December. If any one has suggestions, let me know in the comments.

August Recap

July Recap

June/Half-time Report

May Recap

April Recap

March/Q1 Recap

February Recap

January Recap

- @checky Tribute Post

- My Steem Origin Story - eoj

- Proof there is indeed life after HF20

- Share Your World - @eoj

- The Get to Know Me Challenge - Top Ten Posts by @eoj

- A Lakeside Walk in Pokhara, Nepal - A Wednesday Walk

- Street Art in Pokhara, Nepal - A Lakeside Walk

- Steemit Survivor Contest UPDATE - 20 STEEM Grand Prize - IT'S ON!!!

- Giving Back: Nepal - Four Worthwhile Causes to Support

- More Street Art in Bangkok - A Walk Through Talat Noi, Bangkok

- The Stranger Than Fiction Digest - Edition One: Art Gone Wrong

- Personal Finance 101 - Part 1 - Step on the Scale, Get Organized, Feel the Pain

- Street Art in Bangkok - A Walk Through the Neighborhood

- WINNER ANNOUNCEMENT - Think you're well traveled? Name that.... TAIL!

- Giving Back: Thailand - Four Worthwhile Causes to Support

- Why I Disappear from Steemit on Sundays

- Well Off the Beaten Path - Restoration of Saat Tale Royal Palace - Nuwakot, Nepal

- It's July 4th - Happy Birthday America!

- Cox's Bazar Surf Report and the Father of Bangladeshi Surfing

- World's 50 Best Restaurants for 2018 Announced

- How to Overcome Screen Addiction - 5 Practical Tips

Amazing that out of all of them in the top 10 xlm preformed the best with the minimum lost.

Posted using Partiko Android

Yep! And that's been the case almost every time I do a month-end report. Stellar has consistently performed better than its Top Ten peers all year long.

It hasn't been a good year for crypto but hopefully a bull run is just around the corner.

As always I look forward to next months report.

This is fascinating!

Would you have had fairly different results if you had started on Feb 1 instead of Jan 1? Surely...

Personally, and I apologise if this is a jerk request... but I'd love to see you invest another $1000 on Jan 1... and basically run your two experiments side by side...

I know it seems like like a Top 10 Index fund as a strategy was a massive failure, but it's hard to believe we'll be in a similar space at this point next year...

Hey there @aussieninja, thanks for stopping by!

Good question. I went ahead and plugged in the numbers for you and this is what it would look like if I started February 1st, 2018, with the new amounts I would be able to buy at Feb 1 prices:

Actually 31 January, because that's when I did by first update :)

You may have to zoom in (it's coming up small on my laptop) but bottom line is it would be fairly similar. Instead of being overall down 75%, a Top Ten portfolio would be down about 68%. So instead of having a value of $250, it would be worth about $315.

It also would flip the best performing crypto to date from Stellar to Bitcoin. NEM and Cardano would still be the worst performing out of the group.

I'll definitely take your suggestion into consideration, although I'm not sure I can swing $1k by New Year's Day! :) I could just track the numbers, but I have to say, having but actual $ into this has really made me pay attention. I don't know if I'd be tracking so closely if I hadn't put a bit of actual skin in the game, probably not...

Ahhhh, sorry I totally stuffed that... I thought the BTC correction was in mid-Jan, but now that I've actually spent 1 second looking at it, I see that the 6th of Feb is actually when BTC hit $6,100ish.

I know, and I'm kind of apologetic because I know I can't swing $1000 by NYE, otherwise I'd piggyback off your work and try my own experiment, because it is truly interesting... especially because there is real life dollars and therefore opportunity cost involved.

I'm sure companies are working on their own Crypto Index products, but I'm also sure they wouldn't be keen to advertise 'Invest with us, lose 75%'. Great work Joe!

Very interesting, helpful article. This is a great experiment that really lets us see how the market has moved - for a newbie like me it’s really a clear way to look at this.

Thanks @lilyraabe, I'm happy you found it helpful!! Glad you're posting regularly again too :)

Thanks for using eSteem!

Your post has been voted as a part of eSteem encouragement program. Keep up the good work! Install Android, iOS Mobile app or Windows, Mac, Linux Surfer app, if you haven't already!

Learn more: https://esteem.app

Join our discord: https://discord.gg/8eHupPq

Thanks so much for the support @esteemapp!