Crypto trading strategies & configurations to profit in any market conditions & the tool I use as my secret weapon

At first, 3commas might seem a bit overwhelming and intimidating because all of the options it offers but let’s just go through them one by one. (check out my last post on 3commas to learn more!)

(Get Started with 3commas, get a Risk-Free free week Trial and 20% off your first order!)

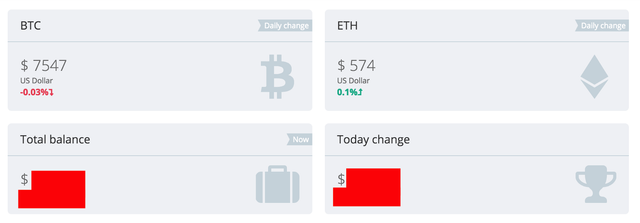

Dashboard

The dashboard gives you an overview of BTC and ETH price, your ‘Total Balance’ and Today’s change.

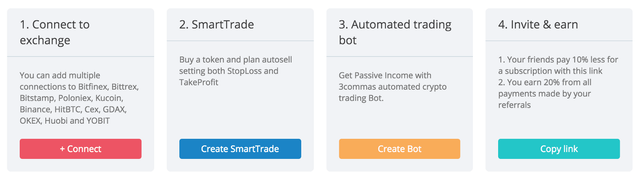

Below this overview you find 4 blocks:

Connect to the exchange: This is where you enter the API details of your exchange.

SmartTrade: This is where you place your “smart” trades, a trading interface similar to what you have on your exchange but with more bells & whistles to maximize your profits.

Automated trading bot: This is where you have a bot (or multiple bots) that based on TradingView’s recommendation for a buy or strong buy places trades and uses a direct cost averaging strategy to make profits.

Invite & earn: You can give a friend a 10% discount and earn 20% on his or her trading fee deposits.

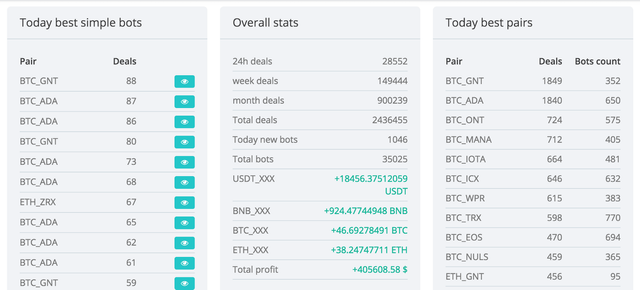

Below these, you’ll find the stats for best performing simple bots (bots with one trading-pair), overall stats and the best trading-pairs of the day.

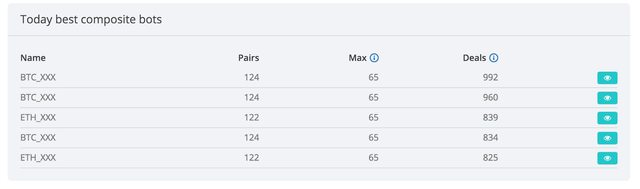

Underneath it you’ll see the best composite bots, these are bots dealing with multiple trading pairs.

At the bottom, there’s an aggregated overview of all your connected exchanges followed by a separate view of their balances.

At the very end of the page, you’ll see an overview of different portfolios and their performance, followed by the top marketing cap coins with their performance.

But let’s continue to the more important part.

SmartTrade

SmartTrade is basically one single uniform interface to trade on all your exchanges. What sets it apart is the extra possibilities it offers to place your buys and sells while maximizing profit.

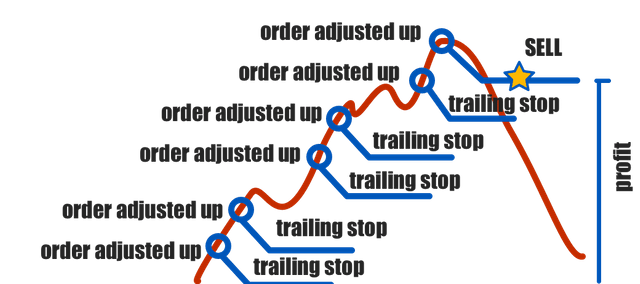

My favorite part is trailing. So let’s explain this first.

If you have been trading on the stock market you’re probably familiar with trailing stops. If you are unfamiliar with the concept let me just explain to you how it works.

A trailing stop is basically a stop loss trigger but rather than a stop that triggers at a fixed price it’s a trigger that follows your price and goes up with it, in other words, it’s relative your price.

So let’s say your coin is worth 1 satoshi and you set a trailing stop at -5% the coin will be sold when your price drops by 5%. So as soon as your price hits 0.95 your coin will be sold to preserve further losses. But if your coin goes up to 2 satoshis, the stop won’t stay at 0.95 but will move up too. Your new stop will be 1.95.

3commas has two trailing stop mechanisms built-in to really squeeze out the maximum gains.

Smart Trade overview

Trading Terminal

This is probably the intimidating part, so let’s break it down one by one.

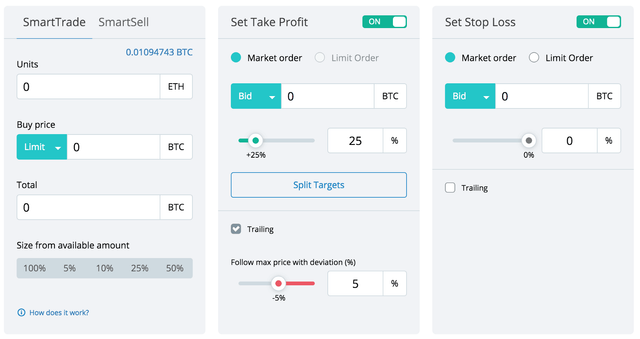

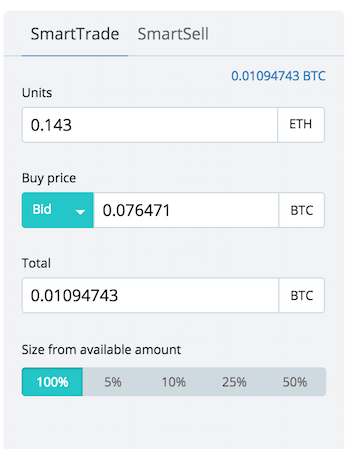

SmartTrade/SmartSell

Units: The amount of the currency you wanna buy (or sell) in this case ETH

Buy Price: Price you wanna pay (more in detail below)

Total: Total size of your order

Size from available amount: lets you quickly choose an amount based on a % of your total base currency

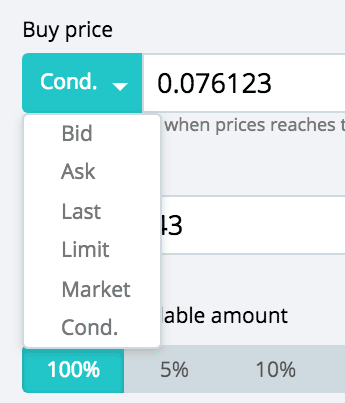

Now the buy price can be set in different ways. You can pick:

Bid: The current highest bid price (what buyers want to pay)

Ask: The current lowest ask price (what sellers want to get)

Last: Price of the last transaction

Limit: the limit price you want to pay

Market: the current market price

Condition: The limit that should trigger a market order

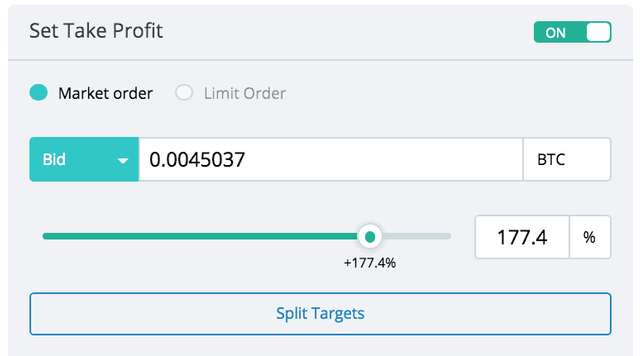

Set Take Profit

Market order: if you want the order to be executed at market price (fast execution but the price may fluctuate) when the target price is reached.

Limit order: If you want the order to be executed at the target price 3 options here: BID/ASK/LAST

The slider lets you set the percentage gain you anticipate

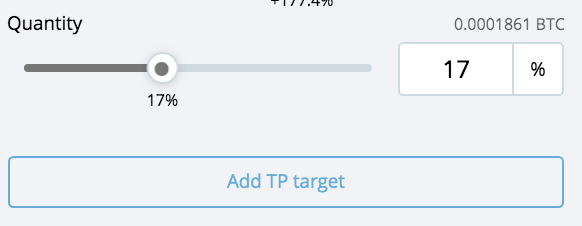

If you click on Split Targets you’ll see another % slider appear

.png)

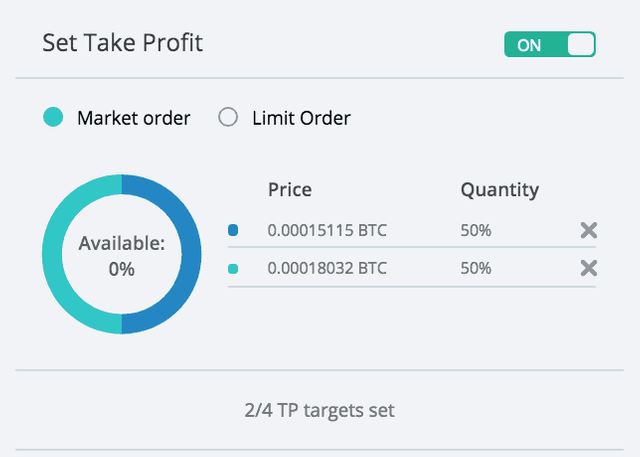

This slider sets the quantity of your order that you want to sell at the % you have set with the first slider. Let’s say your order is 1 ETH but you don’t want to sell it all at once at the same target price. You come up with 2 targets and sell half of your 1 ETH at each target point. Then you would set this slider to 50%. This way you allocate 50% to be sold at the percentage you selected with the first slider. Once done click on Add TP target and set the price for the rest of your order.

As a result, you get the picture above. Your initial order split in two to be sold at two different target prices.

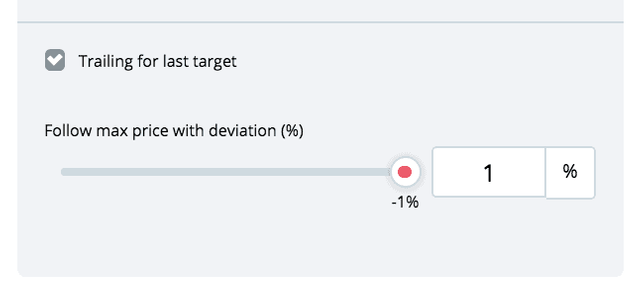

As if those features aren’t amazing enough they add trailing to it too.

Trailing for last target allows you to let your last target run even further up than what you have set as a target. If it goes up more it will have an extra trailing stop (as described above) of the percentage you chose with the slider. The trailing stop will follow the price and sell immediately once it drops by x% ( 1% in this case).

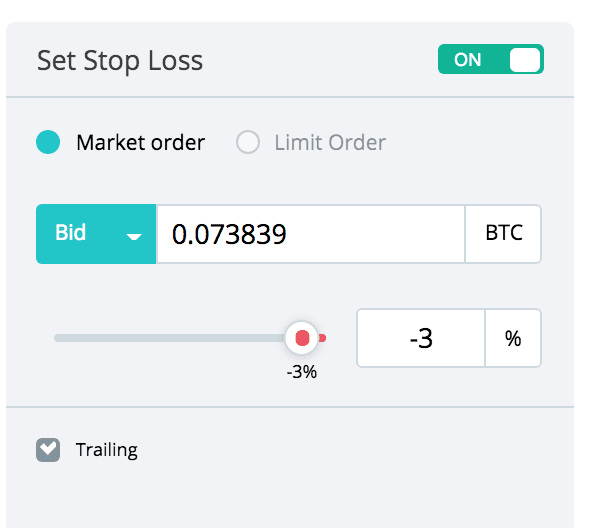

Set Stop Loss

Here you define your stop loss, not to be confused with the trailing stop from the previous Set Take Profit.*

This is the price at which you sell the order if it goes down instead of up.

However, if you set it to Market order you can enable Trailing converting this fixed stop into a trailing stop for your order.

If these 2 trailing stops confuse you think of it this way:

the Set Take Profit trailing stop only starts when your targets are reached its function is to squeeze out as much profit as possible

the Set Stop Loss trailing stop is there to minimise losses when your targets are not reached

Once your order is created it will look like the picture below and you have a nice graphical presentation of your buy price, your stop-loss and your target.

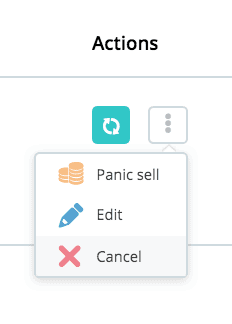

Under actions you can find the option to Panic sell (eg. if a sudden crash happens), to edit your order and update the parameters or to just cancel it.

BOTS

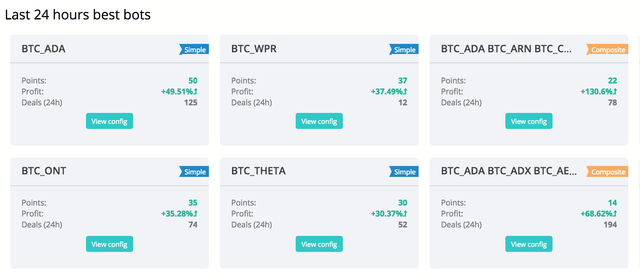

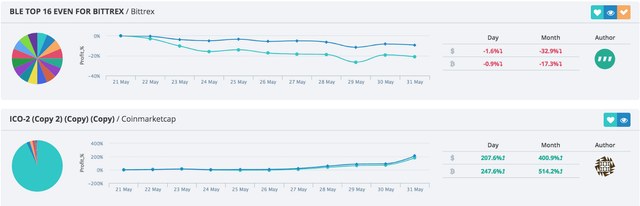

The first thing you see under bots is an overview of the best bots, which you can copy by viewing the config and adding the bot.

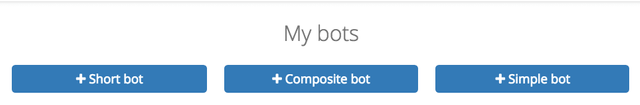

My bots

This section is where you create your bot and where you can view your bots.

Currently, there are 4 type of bots:

Simple bot

Short bot

Composite bot

Composite Short Bot

Simple bot: This is a bot for 1 base pair, it’s a bot for going long, simply put if you expect the coin on the right side of your coin-pair(e.g. ADA) to go up and you select BTC_ADA then you’re going long on ADA. The coin at the right side of the coin-pair is the one you’re betting on rising in this case ADA, the coin on the left-side, BTC is what you want to increase by buying ADA.

This bot starts by placing buy orders for ADA and placing sell orders for ADA at a higher rate. The difference is profit in BTC.

Short bot: This is a bot for 1 base pair, it’s a bot for going short, simply put if you expect the coin on the right-side (e.g. BTC) to go down and you currently have BTC in your account and you select USDT_BTC then you’re going short on BTC (but long on TUSD). The coin at the right-side of the coin-pair is the one you’re betting on to drop in value in this case BTC, the coin on the left-side, USDT is what you want to increase by selling BTC.

This bot starts by placing sell orders for BTC and placing buy orders for BTC at a lower rate. The difference is profit in USDT.

Composite bot: is similar to the simple bot but it supports multiple coin-pairs.

Before explaining the main settings, it might be good to explain how the bot actually works as it’s quite different from how other bots work. Initially released and didn't use any technical indicators like RSI, MACD or Bollinger bands but bases it’s buying decision on TradingViews analysis of the coin. All of these features have since been added.

Composite Short Bot: This is a combination of the short bot and Composite Bot. This allows you to short multiple pairs against your base currency

TradingView has a Cryptocurrency Signal Finder:

You can check it out here https://www.tradingview.com/cryptocurrency-signals/

This Finder issues buy or strong buy or sell and strong sell labels. This bot uses these labels to decide if something is good to place buys. To place sells it uses a fixed profit percentage, our Target profit(%).

The main algorithm is very simple. It basically buys low & sells higher. The bot basically buys at the current rate and immediately sets a sell order 1 or 2% higher, depending on how you have set your Target profit(%). When the target is hit the sell happens almost immediately since the buy order is already lined up on the exchange. No time is wasted placing the sell order when the target is reached as it’s set beforehand.

But, but…what if the price drops? In that case, bot automatically places safety-orders, which are lower than the last buy-order price every X%. So basically the bot is automatically averaging down and thus moving your profit target lower. On the next bounce, the coin is sold with a profit. (You can now adjust your preferences in trading view to adjust what factors it will send signals to execute buys and sells)

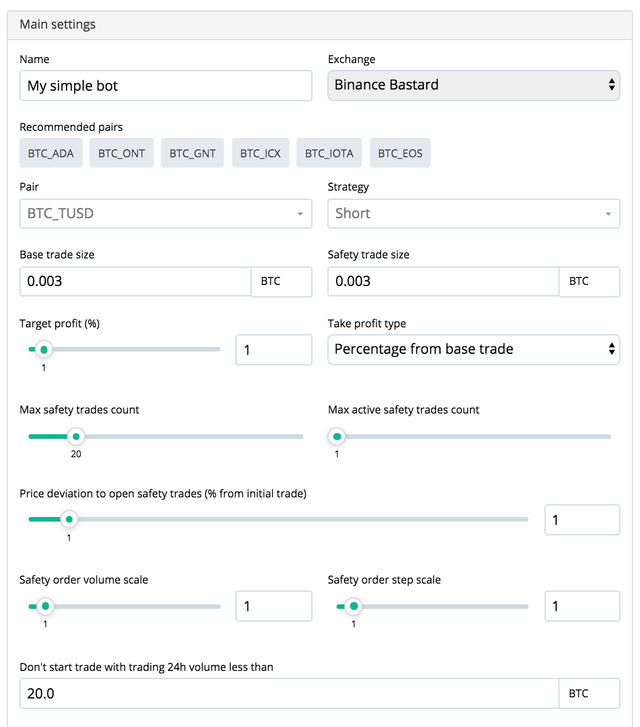

Main settings

Name: the name you give your bot

Exchange: the exchange you want to use for you bot

Recommended pairs: Based on the most successful deals in the last 24 hour

Pair: The coin-pair you want to use

Pairs: Available only for composite bots. Only pairs from 1 base currency can be combined in 1 composite bot, “***_ALL” adds all coins, Clear removes all.

Max active deals simultaneously: Available only for composite bots. How many deals the bot may open at the same time. If you have more bots than your funds allow for it will pick the most promising within your budget.

Base trade size: Initial trade size. The bot will use this amount for the first buy order. If put here 0.2 and select BTC_XRP pair for the bot, then launch it, the bot will buy XRP for 0.2 BTC.

Safety trade size: Safety orders are basically orders used to do (dollar) cost averaging to bring your profit target lower when the coin goes down.

Here’s a short example of how cost averaging works.

Let’s say you buy 1 coin X at $90 and the price of your coin drops to $45, you’re at a 50% loss. Dollar cost averaging would for example buy 3 times this coin X at $45. So now you have spend $45x3 + your initial $90 and you end up with 4 coins. This means your average cost per coin now is ($45x3 + $90)/4 or $56.25 you’re loss is now $56.25 -$45 = $11.25 per coin instead of $45 per coin. This means if the market goes up to $56.11 you’ll be break-even no need to sweat it out till $90.

The bot is going to place safety orders immediately after you have opened the trade to average your buy price in case your coin goes down. The size of each safety order is what you fill in here. If you put 0.2 and the bot will place three safety orders on -1%, -2% and -3% from starting price each 0.2 BTC in size.

Target profit (%): the percentage of profit you want for your bot to make. The bot will place a sell order x% higher after the initial trade.

Take profit type:

Percentage from base trade: the bot will determine TakeProfit target from the initial order size, without taking total bought volume into consideration. Let’s say the initial trade size is $100 and target profit 5% ($5), after this the price drops. As a result, the bot bought coin on $900 more using safety orders, and now the total trade volume is $1000. The bot will place sell order in a way to get $5 profit (5% from $100) and not $50 (5% from $1000).

Percentage from total volume: the bot will take profit from total trade amount. From the previous example, the bot will place sell order in a way to get $50 (5% from $1000).

Max safety trades count: The maximum amount of safety orders that can be executed for 1 deal.

Max active safety trades count: Keyword is “active” here. Say you set 5 as the maximum amount of safety orders and 3 active, the bot will place 3 safety orders right after the coin is bought and 2 are not placed but kept as potential spare orders should they be needed. Now if you would set the Max active safety trade’s count to 5 it would set all 5 immediately.

Price deviation to open safety trades: This is basically the percentage interval between each order. If it’s e.g. 3% on a $100 order the 3 first safety orders are placed at $97, $92.15 en $89,39 (or 3% from each consecutive amount)

Safety order volume scale: This basically multiplies the volume of your safety trade on each new safety trade. Say your safety trade size is 0.1 BTC and scale is 2 then the next safety order would be 0.1*2 or 0.2 BTC, the next one 0.4 BTC, the one after 0.8 BTC …etc

Safety order step scale: this will not scale the volume of your safety order but it will scale the interval. So instead of equal interval percentages for price deviation, the interval increases by multiplying the price deviation by the factor you enter here. If your price deviation is 1% and your step scale is 2 it will place safety buys at -1%, -2% or 1%*2. The next one will be at -4%, -8% and so on.

Don’t start trade with a trading 24h volume less than: The bot will only trade if the coin has a 24h volume more than the amount entered here. If you create a bot with all BTC_*** pairs and set it to 500, the bot will trade only coins with 24h volume no less than 500 BTC. If the bot is using no BTC_*** pairs but for example, ETH_*** this filter will still use BTC for the calculations. The 24h volume will be automatically converted to BTC.

Assistant

Shows helpful information about your configured bot. You can, for example, see if your configuration exceeds the funds in your account.

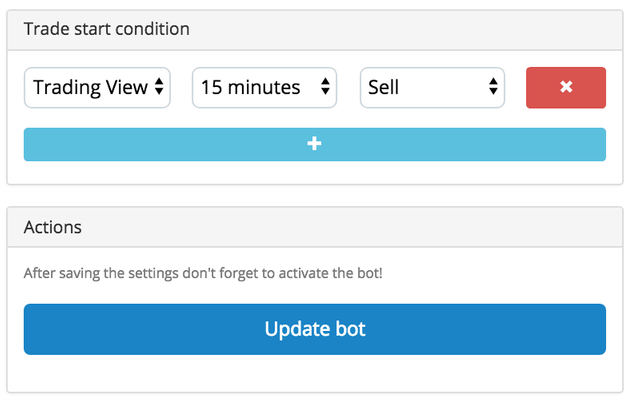

Trade start condition

Lets you pick which time frame from the TradingView scanner it should use to determine the buy condition. And whether it should look for Buy, Strong Buy or Sell and Strong Sell labeled coins.

Bot analytics

An overview of best bots similar to what you find on the dashboard.

Trader Diary

A place where you can create reports

Portfolios

Where you can compare, analyse portfolios and follow portfolios. Ideally, if you are looking more into diversifying your assets or want to copy successful portfolios.

.png)

(Get Started with your 3commas Risk-Free free Trial)

Try 3commas to automate your crypto trades and get a 20% discount on your commission fees with my link! https://3commas.io/?c=tc86519

Trade smart and safe with CryptoBaseScanner: https://cryptobasescanner.com?a=iLwcE9Z5sDnL28dw

Best crypto exchanges get a signup bonus

Join Binance with me: https://www.binance.com/?ref=35181698

Better than Coinbase Get $10 of free Bitcoin through Coinmamma - http://go.coinmama.com/visit/?bta=55219&brand=coinmama

BEST Bitcoin faucet check out my last post! - https://freebitco.in/?r=320572

Get CryptoTab Browser: https://get.cryptobrowser.site/4629357

Earn free BTC with Moon Bitcoin- http://moonbit.co.in/?ref=c69b1e844696

Mine Crypto with any device passive- https://minergate.com/a/3acfa834fd5c6e289a33dd41

2 of the most effective crypto advertising platforms below

Advertise and earn faster for Cryptotab or any crypto Referrals- https://ref.adbtc.top/959159

Advertise and earn faster for Cryptotab or any crypto Referrals- http://www.easy-hits4u.com/?ref=jam199716

BTC- 17iN9xNLU4EFvBVCbuB9cz425EL8tuZnJb

Very thorough and informative post. I was previously unaware of the existence of this site. I will definitely be checking it out now and hopefully this will be the answer I've been looking for to manage all the exchanges I'm currently using. Thank you for taking your time to give this walkthrough. Glad I followed you before. Cheers!🤙

Thanks much appreciated! I've tried out a lot of bot platforms and this is the best I've found so far but I'm always open to new info and looking for ways to protect my investments, minimize risk while maintaining the immense upside of crypto. Hope this helps. I'm always happy to share info or answer questions.

In my opinion,It's not just the leadership of the coins and blockchains that will drive this industry forward. The more the crypto community sticks together, shares info, and deals in win-wins; blockchain and crypto will truly revolutionize the world.

Love 3commas! The multiple take profits and stop loss features have saved me so much! And have been profitable in the bots. I'm not the most experienced trader, really is a testament to 3commas!

That's awesome! I'll be posting more tutorials tips and tricks to capitalize on 3 commas. Keep crushing it and keep collecting crypto!

3 Commas is the real deal! great post, I'm going to start using the portfolio auto allocation feature

Auto allocation is definetly really useful. Makes it so easy to go into a stable coin in a bear cycle and then auto reallocate to the coins portfolio and distributionn you'd like to have, without having to manually do each individual trade. Also I saw their is a feature in it will keep your portfolio percentages fixed so if coins go up it will take some profits and redistrubute to lagging coins to maximize returns, if you set it up and use it right

Great information! I am a new trader and playing the waters and always looking for the best tools.

That's awesome, good luck, man!

If you have any questions and resources : email me at [email protected]

very good and useful info. stop loss is the best tool to reduce the risk of loss and money management that are no less important

That's the truth! Capital preservation is so key to withstanding bear msrkets, so you can enter the next maarket crycle in a great postion for yourself

Help me! I want a good exchange and i found this one on facebook. Any opinion about this? https://worthofcrypto.com/exchanges/kucoin-review-2019/

Kucoin is a solid exchange in my opinion. Personally, I prefer Binance. Kucoin is in my top 3 or 5 in terms of exchanges. I use several exchanges to diversify my risk instead of being on just one exchange. Hope that helps. If you want me to go into more detail LMK, and let me know if you want me to give my perspective on any questions. Wishing you prosperity and happiness in 2019. Keep collecting crypto!

thanks a lot for your post, not that I understand a lot of it as it seems to be a very complex stuff.

Congratulations @the.success.club! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click here to view your Board

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Do not miss the last post from @steemitboard:

img credz: pixabay.com

Nice, you got an awesome upgoat, thanks to @the.success.club

BuildTeam wishes everyone a bullish new Year!

Want a boost? Minnowbooster's got your back!

Welcome to Steem the.success.club! Partiko is officially the fastest and most popular mobile app for Steem. Unlike other Steem apps, we take 0% cut of your earnings! You can also be rewarded with Partiko Points while using Partiko and exchange Partiko Points for upvotes!

Partiko for Android can be downloaded here on Google Play and the iOS version is available here on the App Store.

If you have more questions, feel free to join our Discord channel and ask @crypto.talk, we're always here to help!

Thank you so much for your interest!

Just downloaded the app. Excited to try it out!

Awesome! Let us know how it goes! And don't forget to check your Points tab to receive the 3000 Partiko Point sign on bonus!

Posted using Partiko Android

Awesome will do much apreciated!!

Nice info