Why Millennials Are Using Cryptocurrencies Like Auctus Instead of Traditional Retirement Funds

Auctus is set to shake up the pension industry with a global retirement platform that integrates traditional and crypto investments on the blockchain.

- Ticker: AUC

- Circulating Supply: 16M

- ICO price: 1ETH = 2000 AUC

- ICO hard cap: $3M

- Current marketcap: $6M

- Exchanges: Idex, more to follow

What we like about the project:

- Fair ICO?—?Auctus raised just 3 million dollars from investors.

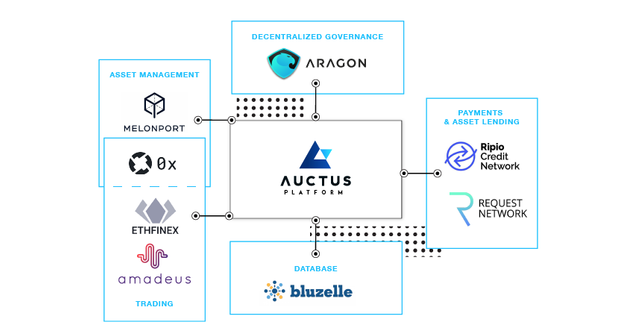

- Well connected?—?Auctus has just hit the market yet is already working with top tier blockchain projects such as Bluzelle, 0x, Request Network, Aragon, Ethfinex, Ripio Credit Network, and more.

- Market Cap vs Market Size?—?Auctus is currently trading at just a $6 million cap and is targeting a $41 trillion worldwide market, much larger than markets targeted by the majority of ICOs today.

- First mover advantage?—?Auctus is first- to-market for blockchain-based retirement planning.

- Opportunity?—?Retirement investments is one of the few financial sectors that has yet to be disrupted with blockchain.

- Small hardcap?—?The potential investment multiplier with Auctus is outstanding in light of their $6M hardcap.

Why is this needed?

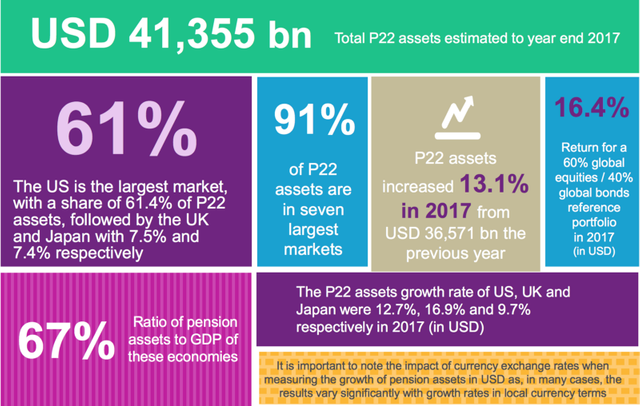

Retirement investment assets total a staggering $41 trillion globally with the US accounting for over 61% (Willis Towers Watson, 2018). Pension asset growth rates over the last year are in double digits for many countries and are expected to climb due to worldwide economic growth and increasing global prosperity.

However, despite a record number of assets in pension plans worldwide, there is a global funding gap that has many countries headed toward a financial crisis. It is estimated that the world’s six largest pension systems?—?the US, UK, Japan, Netherlands, Canada and Australia?—?will face a $224 trillion funding gap by 2050 (World Economic Forum, 2017). Low interest rates and an aging population are just two of the reasons that many countries will be challenged to honor basic retirement income commitments to their citizens.

“We are staring at a time bomb”?—?Amin Rajan, chief executive of Create Research (Financial Times, 2017)

However, the growing funding gap only compounds existing problems with an industry that is plagued by corruption, mismanagement, outdated technology and a lack of transparency. Consumers often have very little insight into the actual costs of pension plans and hidden charges have been found to account for up to a third of a plan’s value in some cases.

“The shocking news is that we have uncovered more than 100 types of costs and charges being routinely applied to pensions and investments, many of which are being hidden from the consumer, which is just plain wrong. ”?—?Andy Agathangelou, founding chair of the Transparency Task Force

One study indicated that fradulent activity was reported in every 1 of 5 pension plans (Financial Times, 2012). More recently it was found that U.S companies have settled cases for almost $400M on charges of excessive fees and poor investment management (Financial Times, 2017).

The Willis Towers Watson report also indicates the retirement industy’s failure to refresh outdated technology and systems leading to a lack of innovation and a lack of access for less privileged individuals.

What’s the solution?

Blockchain holds great promise for reforming outdated and failing retirement systems.

Blockchain is already disrupting a number of financial industries and it is likely that retirement management planning won’t be left untouched.

At its core, a pension plan is a contract describing a financial relationship between two parties. Blockchain smart contracts can automate this relationship in a manner that is more transparent and costs less.

Recording the contract on a distributed ledger ensures greater accountability and openness, something that is likely to reduce corruption, eliminate hidden fees, and improve management.

Auctus wants to renew and revitalize the worldwide retirement investment industry with a global platform based on blockchain that encourages transparency, openess, accountability, and inclusiveness.

How does Auctus work?

With plans to disrupt an industry not known for innovation, Auctus’ ideas for retirement planning are nothing short of revolutionary. In place of centrally-managed and often opaque pension plans, Auctus is introducing decentralized and community-managed retirement investing based on the blockchain.

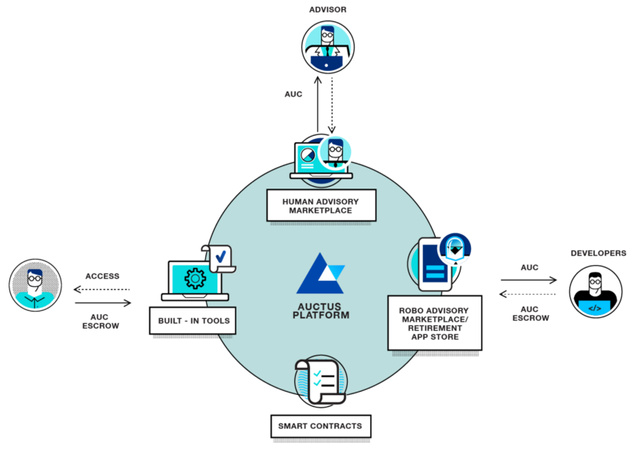

Users will create retirement portfolios based on traditional and crypto assets managed through smart contract automation that removes intermediaries and lowers costs. Stored on a distributed ledger, pension plans will be transparent, auditable, and immutable, meaning that a corporation or government agency won’t be able to raid the plan in the event of a funding shortfall.

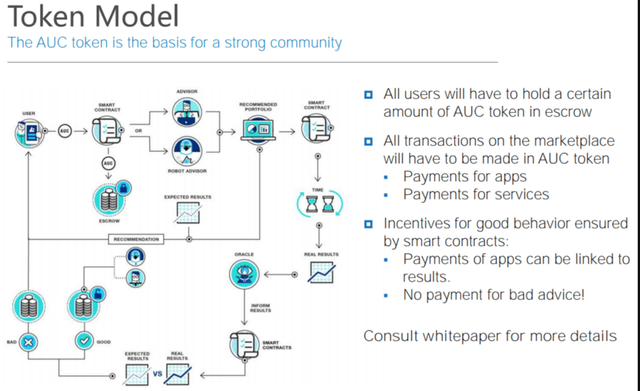

Smart contracts are only the beginning for Auctus. In an industry that too often rewards fund managers based on portfolio size instead of performance, the AUC token will be used to incentivize successful investment advice.

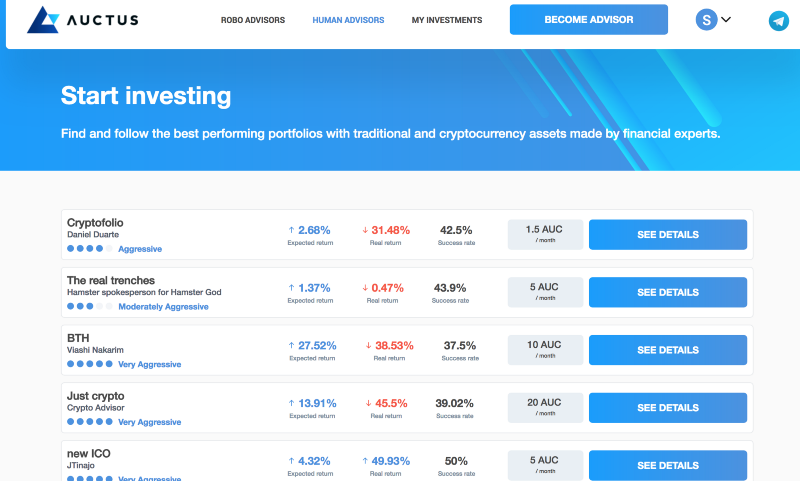

Users sign up for either robo or human advisory services and only pay for advice that leads to positive returns. This merit-based system should ensure that the best advisors rise to the top and are rewarded for their service to the community of investors.

Auctus also envisions a marketplace built on the blockchain where users can choose from a global offering of products and services. Imagine an app store of dApps, financial services, and widgets paid for in AUC tokens all designed to improve the retirement investment experience and a user’s financial return.

Unlike many blockchain companies based on a white paper idea, Auctus is bringing a variety of services to users within a short time frame by partnering with other blockchain companies.

Users will be able to deposit fiat or cryptocurrencies, manage assets, trade cryptocurrencies, access liquidity, borrow and loan assets, and participate in community management through plug and play partnerships with Request Network, 0x, Bancor Network, Ripio Credit Network, and Aragon, just to name a few.

What are the benefits to the Auctus?

Retirement investment plans managed through smart contracts on the blockchain offer numerous benefits including:

- Balancing of traditional investments with cryptoassets

- Cryptocurrency trading and lending

- Transparency through publicly available smart contracts

- Greater data security through decentralization

- Lower costs through disintermediation

- Enforceable and non-immutable terms through smart contracts

- Performance-based advisory services

What services will be enabled?

Auctus is building a full-service retirement platform offering the following:

- A dashboard for managing investments including third party plans

- Traditional and crypto asset investments and management

- Portfolio analytics and optimization

- Human and robo advisory services

- Financial product and services marketplace

- Cryptocurrency trading and lending

Who’s on the Auctus team?

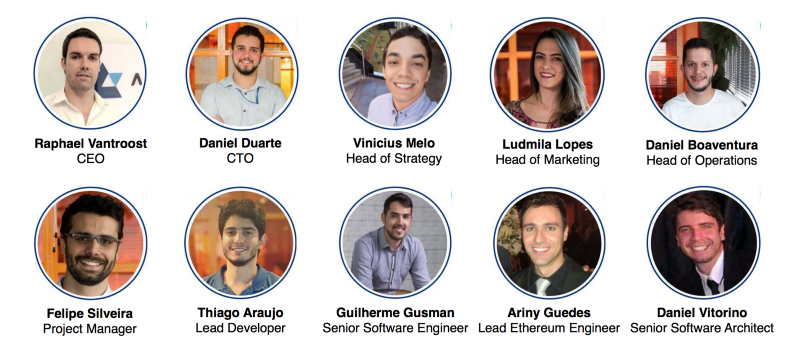

CEO?—?Raphael Schmid Vantroost

Vantroost studied economics at Yale and has a financial services background that includes positions with UBS Investment Bank and Deutsche Bank. He also founded Swissline Real Estate.

CTO?—?Daniel Duarte

Duarte has a software engineering background and led various blockchain initiatives at DTI Digital.

Head of Strategy?—?Vinicius Melo

Melo background includes retirement fund experience, having worked at one of Brazil’s main pension fund companies (FUNPRESP-JUD).

The website lists 12 team members several of which have engineering backgrounds.

Who are Auctus advisors?

The Auctus advisory team has significant finance, legal, and technology experience and includes:

- Martijn van Eck?—?Head of Pension at Holland Fintech, co-founder of Symetrics, a European FinTech 50 actuarial and risk analytics company.

- Mitja Pirc?—?Partner at Cofound.it, responsible for advising startups and giving insight in new business models, blockchain, data and analytics.

- Philippe Castonguay?—?Former relationship manager for developers at 0x. Focused on cryptocurrency development and collaborations.

- Eric Paley?—?Partner at Nixon Peabody and member of the Employee Benefits team. J.D. from Syracuse University College Law.

- Steven Clark?—?Partner at Horizon Investments, Associate Professor of Finance at UNC Charlotte. Ph.D. in Mathematical Sciences and Economics.

- Adam Greetis?—?Partner at Seyfarth Shaw, member of Employee Benefits and Executive Compensation Department. J.D. from Chicago-Kent College of Law.

What partnerships and alliances do they have?

Auctus has an impressive collaboration effort focused on integrating decentralized components from other companies into their platform.

This provides Auctus with an ecosystem of leading blockchain companies will vastly expedite their product release schedule.

- Aragon?—?Allows Auctus to create a transparent and decentralized governance organization

- 0x?—?the protocol for trading AUC into a portfolio of crypto assets

- Ethfinex?—?DEX for token trading

- Amadeus?—?liquidity for dApptoken trading

- Melonport?—?crypto asset management

- Ripio?—?lending of crypto portfolios

- Request Network?—?monthly deposit payments

- Bluzelle?—?decentralized data storage

- MakerDAO?—?DAI token stability for retirement portfolios

- Bancor?—?Liquidity for AUC token holders

How far along is Auctus development?

Auctus is deep into development with an active Github repository and a recently released testnet version of their MVP. The MVP provides an early preview of human and robo advisory services and management of traditional and crypto portfolios.

Their mainnet beta version with real AUC tokens is planned for release in Q3 2018.

What are the token metrics and utility?

AUC tokens are used to pay for access to the platform and other financial products and services. Financial advisors are rewarded with tokens for successful advice and developers earn tokens for apps sold in the marketplace.

Token Metrics:

- Circulating Supply: 16M

- Total supply: 67M

- ICO price: 1ETH = 2000 AUC

- ICO hard cap: $3M

- Average bonus private+presale: 13.6%

- Lock up?—?Core team has 2 years vesting, with a 6-month cliff.

The tokens are distributed as follows:

- 51% Public Contributors

- 2% Bounties

- 9% Partnerships and Advisory

- 18% Future Stakeholders

- 20% Core Team

How Auctus plans to use the proceeds:

- Product Development (42%)

- Business Development (28%)

- Communication and Marketing (18%)

- Other Expenses (12%)

Here’s why we love this project:

- Auctus has a grand vision for disrupting an industry ripe for innovation

- If Auctus only captures a small percentage of this market, they will be incredibly successful.

- Auctus has an aggressive partnership plan that has plugged them into a broad blockchain-based financial ecosystem that should help cement their leadership role.

- The potential investment multiplier for a $3 million hardcap is outstanding.

Our Auctus rating: 9/ 10

Vision?—?10/10

Team?—?8/10

Advisors?—?8/10

Partnerships?—?10/10

Roadmap?—?9/10

Token utility?—?9/10

Follow us at www.twitter.com/blockgrade

Note: Blockgrade Capital and its affiliates do not provide investment, legal or financial advice. This material and opinion above has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, investment, legal or financial advice.