Firmo: Hoping to tackle security issues and vulnerabilities on the Blockchain

The Idea of a decentralised currency all began when Satoshi Nakamoto mined the genesis block of Bitcoin in 2009.

Every innovative solution fills a void, and also opens room for improvement-pushing the boundaries even further.

Speaking of boundaries, that opened the door for Vitalik Buterin to come up with the innovative idea that extended the use of the Blockchain beyond financial services. This came to be known as Ethereum.

As newer ideas were conceived and technologies improved, the need to improve the security and speed of the Blockchain arose again, and it was natural for people to want more.

When a vacuum is created, it is only natural for people to rise up to the task, and try to solve such problems.

.png)

One of such innovative solutions which is actually unique, in the sense of what they are trying to achieve/achieving is Firmo.

Firmo is concerned about security on the Blockchain, among other issues. They are creating infrastructure for the cryptoeconomy, which any top level Blockchain can take advantage of.

Life as it is at the moment revolves around Ethereum, but works are in the pipeline to expand to other Blockchains, such as Cardano, Qtum and Neo in the near future.

Most transactions in the world today require are credit based, but on the Blockchain, reliable, and verified smart contracts are needed. This is what Firmo creates.

This system ensures that loans, futures, options and swaps are secure within the crypto economy.

Firmo is at the first stage of creating an alternative infrastructure for financial contracts. This system is transparent, secure and provably fair. Their API also ensures that integration into any exchange or product is seamless.

When about 19,000 contracts on the Ethereum mainnet were checked by a team from the University of Singapore, it was discovered that about 45% of them had vulnerabilities that could be exploited.

Many of the solutions being worked on to tackle such lapses in the industry are not verified, which essentially means that they can only offer single instruments. FirmoLang is a formally verified domain specific language (based on Haskell).

With the introduction of the formal verification process (using abstract mathematical modeling to prove logical correctness in a programming language), Firmo ensures that smart derivatives are securely deployed and lives aren’t put at risk.

To minimise errors, the contract would not compile if an error is made in the syntax. It will also let the user know that an error has been made, to enable that user effect corrections. This is not the case with Turing complete contract oriented languages(Solidity for example). This makes them much more prone to hacks. FirmoLang was created to take care of these vulnerabilities.

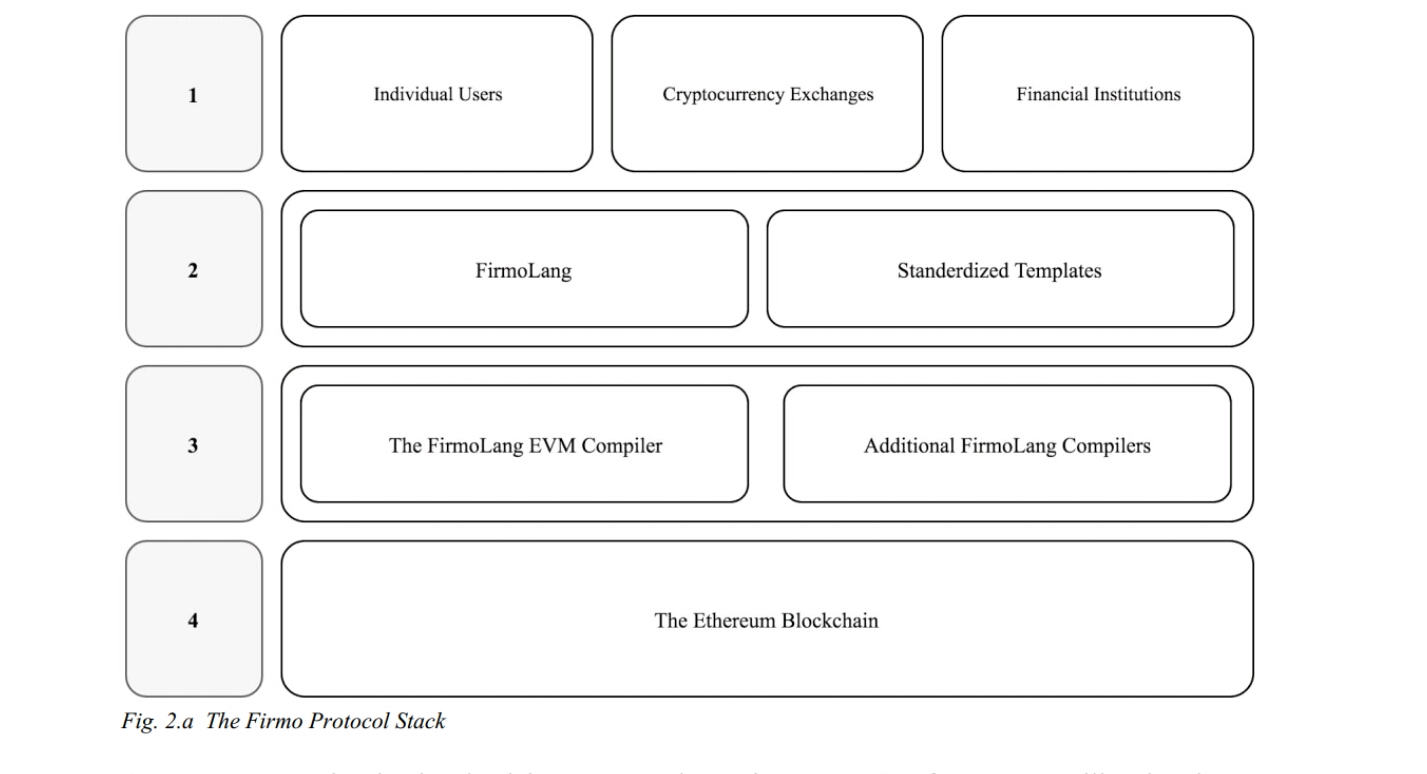

Firmo Protocol Stock

Firmo Protocol Stock enables a user to create automated smart derivatives. These are very secure and are done with the aid of FirmoLang.

Smart derivatives that make use of FirmoLang can be compiled to the Ethereum Virtual Machine(EVM) using a FirmoLang Compiler.

It also makes room for the creation of smart derivatives with little or no collateral.

What do interested parties stand to gain?

Individuals: The Protocol would enable individuals to get into smart contracts, and trade their positions to third parties via second party options.

Exchangers: Cryptocurrency exchanges can offer secure derivative products to their customers as a result of this. They could as well act as clearing institutions or counterparties in any smart derivative contract.

Traditional financial institutions: These can leverage the Firmo Protocol to reduce their overhead and other costs involved in clearing and settlement of derivatives.

Smart Derivatives

Smart derivatives are a type of secure smart contract. Trading of smart derivatives is supported on regulated exchanges that are Firmo Protocol compliant.

Firmo plans to have two offering at this stage:

Deployment of template contracts: Firmo intends to offer a set of templates in collaboration with exchanges. This template would obviously be written in FirmoLang, and it would be customised to meet the needs of the second party. This could also be future or forward contracts.

Deployment of customised contracts: Users have the opportunity to develop customised smart derivatives by navigating to the console in the user interface. Code can also be inspected and customised contracts can be created when the need for them comes up.

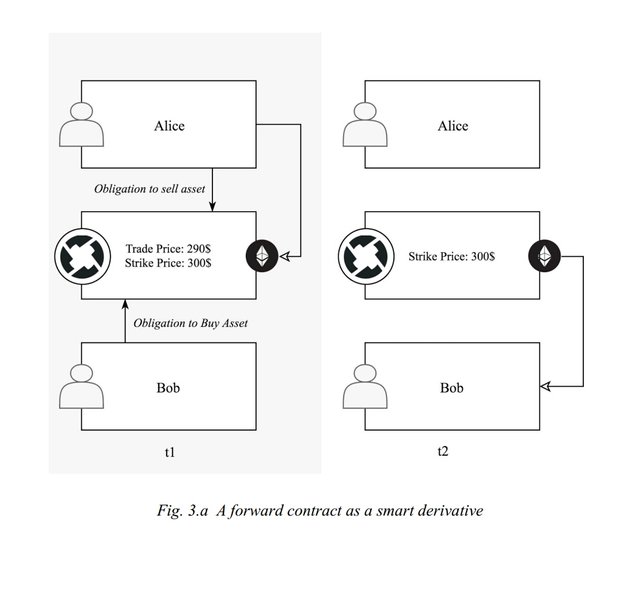

The Forward Contract

The Forward Contract is usually used as an assurance against risk related factors in volatile commodity markets. A buyer is therefore obligated to make a purchase of an asset in the future, and at a specific time. This would require a physical settlement of the asset in question. See figure below showing a possible scenario.

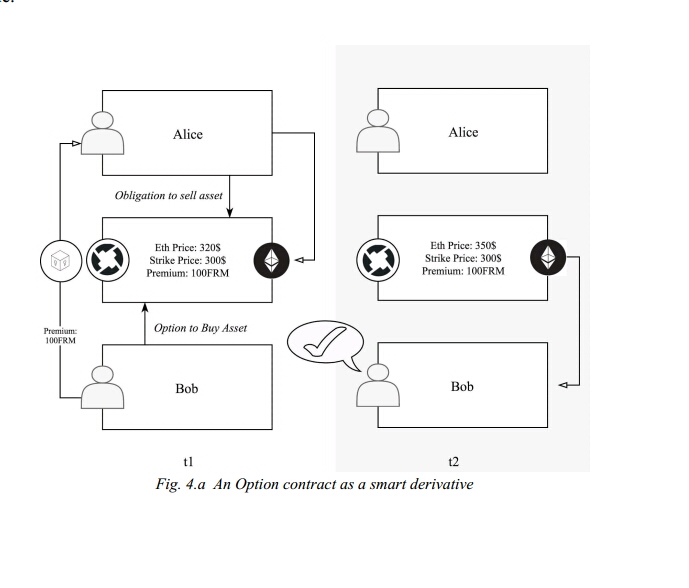

European Vanilla Option

Here, the buyer has an option to buy an asset by an agreed time. He is not bound by any agreement to make the purchase at the pre agreed amount and time. The figure below, illustrates a user case scenario.

Seeing security is a big talking point, and coding with FirmoLang is easy and also straightforward from a users perspective, it will most likely catch on, and Firmo would solve a huge problem the industry faces. Firmo will also be able to assist with decentralised Peer-to-Peer lending and prediction markets, so the possibilities are truly vast.

Where we go from here is left to see.

Videos

This publication has registered to the writing contest thanks to @wakanda.

writing contest thanks to @wakanda.

For more information, click here!!!!

See the Minnowhelper contest conditions here

Submitted.