Quo vadis, CSR? Q1-2018

The first quarter of 2018 is coherently dedicated to disclosure and reporting. Reflected in multiple initiatives, the case for reporting on corporate sustainability and responsibility (sustainability / responsibility / citizenship reports) is getting stronger and stronger. While the number of reporters is on the raise, there is also evidence of harmonisation in sustainability and governance reporting. Both the events bring about maturity in reporting practise. This in turn encourages more organisations to embark on reporting practise.

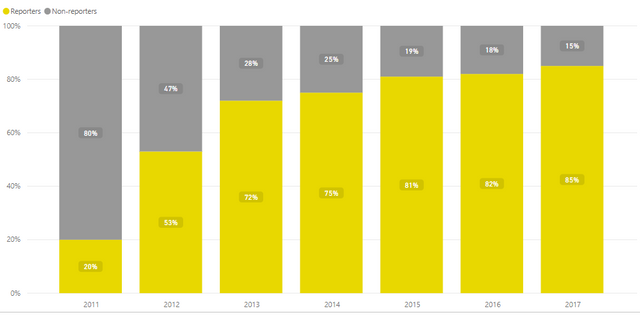

85% of S&P 500 Index companies report on CSR

Every year the gap of non-reporting companies in S&P 500 Index is closing. The share of reporters has risen to 85% in 2017. This leaves just 15% that are deferring disclosure on corporate sustainability and responsibility. The driver behind the raise in reporting is the increasing demand from investors - a quest for material, relevant, comparable, accurate and actionable ESG disclosure from companies they invest in. Given the present trend, the share of non-reporters is likely to fall below 10% by 2020.

Source: Governance & Accountability Institute

Harmonisation in sustainability and corporate governance reporting

With growing number of reports there is a risk of overflow of information that does not make sense. Infact this has been the case for quite some time. A recent study by WBCSD and CDSB suggest there is already alignment across various reporting regulations. This is a good sign as it allows showcasing companies in the context. Yet the plethora of reporting frameworks - GRI, IIRC, SASB, CDP and CDSB - leaves more scope for reconciliation. Integrated reporting is emerging as the frontrunner that offers not only disclosure on sustainability and responsibility related matters but puts sustainability in the context of value creation. This is a paradigm shift that none of the predecessors has offered.

Address of Mervyn King on evolution of corporate governance

Judge Professor Mervyn King has concisely put down on paper (or in this case on a web page) the evolution of corporate governance throughout the history. King's 2018 address is a worth read for those willing to dwell into historic milestones that have shaped today's agenda on corporate governance - the merger of annual financial statement and sustainability report.

The great companies that will survive and thrive into the 21st century are those which have their boards applying their collective minds to the fact that the corporate tools of yesterday can no longer be used today, that the mindset of the board has to change to one on an integrated basis, hoping to achieve positive outcomes on the three dimensions of the economy, society and the environment. -Professor Mervyn King

Quo vadis?

As the year will progress, there are many report releases expected to highlight goals and achievements in 2017. What is becoming more clear is that integrated reporting is slowly but steadily becoming the new norm. It may take a little while for companies to adapt to the concept of integrated value, however it is a matter of time. Meanwhile, let's begin with putting together the next report!

✅ @karinayadav, congratulations on making your first post! I gave you an upvote!

Please give me a follow and take a moment to read this post regarding commenting and spam.

(tl;dr - if you spam, you will be flagged!)

Congratulations @karinayadav! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP