What is a Distributed Credit Chain (DCC)? Is scam? Should I invest in DCC?

Distributed Credit Chain (DCC) is a perfect combination of the blockchain industry and the financial industry.

1. What is Distributed Credit Chain?

The Distributed Credit Chain (DCC) is the world's first publicly traded bank blockchain with the goal of establishing a decentralized ecosystem for financial service providers around the world. . By redistributing credit card rights through blockchain technology and restoring data ownership to individuals, DCC's mission is to transform different financial scenarios and real financial realism. To meet this goal, a new type of bank based on technology was born - "Distributed Bank". This bank is not a traditional bank, but rather an integrated ecosystem of decentralized financial services.

We launched a major blockchain - the Distributed Credit Chain (DCC) to set business standards, reach consensus, roll out business contracts, bar services, etc. Decentralized financial operations.

2. Advantages and Improvement of Distributed Credit Chain (DCC)

Dominance of DCC

- Break the monopoly power

With a global decentralized banking ecosystem, DCC's goal is to break the monopoly power of traditional financial institutions and to reap the benefits of financial services to providers and users. Relate to the above services, enabling each stakeholder to benefit as the ecosystem grows. Number Bank will ultimately become the path to a truly comprehensive financial system.

- Thinking decentralization

Through decentralized thinking, decentralized banks change the paradigm of cooperation in traditional financial services, develops peer-to-peer cooperation models across regions and regions, with all stakeholders and different accounts.

- Transform the business structure

In terms of business, the bank decides to completely change the debt, assets and intermediary business structure of traditional banks. Thus, traditional bank tree structure evolves into a flat structure of a decentralized bank, setting up decentralized standards for many industries and improving overall business efficiency.

- Regulatory regulations of the government

Regarding the regulations, the registration information on the blockchain can not be forged, so this allows the regulatory authorities to access the underlying assets in real time. Large data analysis organizations can also help regulatory authorities better understand and respond to industry risks based on blockchain data analysis.

DCC improvements

- Ownership of personal data

Based on the blockchain technology, the DCC allows the provision of individual ownership of personal data, rather than centralized credit services that manage all data.

- The identity recognition system is unique and can not be denied

The decentralized, no-denying and counterfeit nature of blockchain protects transactional data for individuals and organizations.

- Credit system decentralization

Individuals have the right to own and store data, if the agency or organization wants to use this data, it must obtain the consent of the individual. Data service organizations are no longer able to profit from caching or the freedom to use data.

- Low cost and high-performance data and transaction networks

The distributed journaling system and decentralized architecture, independent of single node authentication, have distributed authentication nodes and enhance efficiency with collaborative authentication.

- The decentralization allows the marketization of interest rates

People can choose their debtors, and in a decentralized market with more competitors, the power of valuation will depend on the market than the market makers.

- Create an open platform ecosystem DCC

All parties involved in the consensus-based process address many of the issues in the centralized credit process, including forgery, high costs and abuse of privacy.

3. Value and services of DCC

Value of DCC

- Protect the privacy of users

Original personal information and unparsed data will not be stored permanently in third-party organizations. This prevents data from being misused or leaked by third parties.

- Reduce the cost of data usage

Personal data can be verified automatically. Therefore, users can freely use or access the data without having to confirm many times.

- Eliminate data exclusivity

Blockchain technology allows individuals to own and use their data and eliminate excess costs due to centralized hosting and data verification from third parties.

- Public and shared lending

Since transaction data is accepted by both parties as public, credit history reports are created on the blockchain to prevent problems such as long-term loans and repetitive test borrowing.

DCC Services

- User data on blockchain

With the DCC authorization credential verification service, basic user information is verified, processed, and stored locally while its hash is recorded on the DCC. Therefore, personal data can be verified and used many times in the future. Credit agents do not need to constantly ask the user for permission to access their data.

- Get user data

When an agent wants to use an individual's personal data, he or she will send a personal data report and verify it using the credentials of the DCC Intelligence Credential. Since the information on the blockchain can not be tampered with, the verification process will be quick and cost-effective.

- Providing credit services

Credit institutions may contract with DCC's lenders, provide risk control services, analyze user data and provide lenders, then decide Loans based on results from risk control.

DCC Distributed Credit Chains provides fraud prevention and modeling algorithms to help financial institutions process personal data without the need to store data. In this way, it helps financial institutions improve their risk control capabilities in line with compliance requirements.

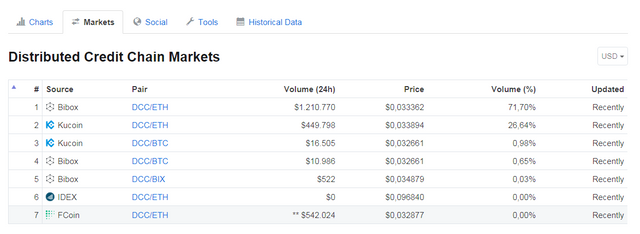

4. Listed Exchange of Distributed Credit Chain (DCC)

There are currently seven exchanges of Distributed Credit Chain (DCC) with different exchange pairs, but mostly with Bitcoin (BTC). DCC coin can also be traded with ETH, BIX...

5. Team of Distributed Credit Chain (DCC)

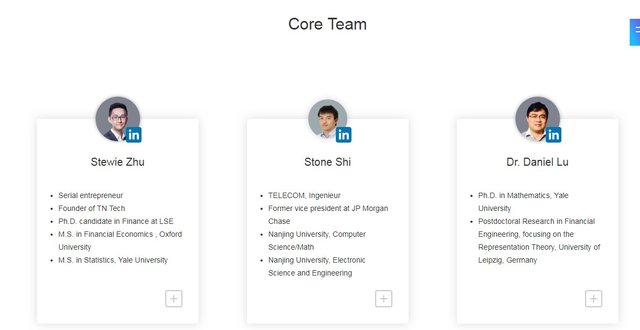

Core Team

- Stewie Zhu: Founder and CEO of DCC

Prior to founding DCC, Stewie served as CEO of TN Tech, leading his team to build the company as China's leading consumer financial services SaaS system.

PhD (Finance) major in Finance at LSE

Master in Financial Economics, Oxford University

Master of Statistics at Yale University

- Stone Shi: In charge of engineering and development in the DCC project

Engineer of Telecom

Former vice president of JP Morgan Chase

Nanjing University, majoring in Computer Science / Mathematics

Nanjing University, majoring in Science and Electronic Engineering

- Dr. Daniel Lu: creative and product design finance in the DCC project

Ph.D. in Mathematics, Yale University

Postdoctoral Fellowship in Financial Engineering, focusing on Representation Theory, Leipzig University, Germany

Experienced in many domestic and foreign financial institutions, working at Deuthche Bank and the financial department of a joint stock bank.

Advisors

- Yu Chen

Partner of JX Capital

Angels investors famous

As a KOL (Key opinion leader) in China with the nickname "Jiang Nan Fen Qing"

Author of Best Selling Books in the Financial Industry in China: Payment Revolution and Wind of Jiangnan: Internet Finance Five Years Continuously Selected as the "Top 50 Internet Financial Characters of China" 2016 and 2017 made Man of the Year by Hurun Report

- Ming Yao

CTO of China Chengxin Credit (CCX Credit)

Working at Bell Labs, has many years of experience in "big data"

From 2016 up to now, focusing on the creation and application of a variety of techniques such as Blockchain financial sector, machine learning and artificial intelligence, to promote smart credit assessment

- Zhiwu Chen

Former professor of financial economics at Yale University, currently a research director at the Asian Institute of Research, professor Feng Quojing Feng Quolun of the Institute of Industrial Economics Learn Hong Kong. Professor at the Peking University Institute of Economics.

One of the most famous and influential economists in China

- Henry Cao

A well-known financial economist

Professor at the CKGSB (Cheung Kong Graduate School of Business)

Former professors at UCB and UNC

- Matthew Chang

The CEO of KKR (Kohlberg Kravis Roberts)

A leading expert in the field of private equity, fixed income and capital markets

Former global senior partner at Roland Berger

6. DCC's partners and investors

Partners

Investors

DCC's investors include JRR Capital and many founders of leading fintech companies as well as anonymous investors who are chairman of publicly traded companies or CEOs of companies. Top internet. They support DCC with profound capital and resources.

7. Roadmap of Distributed Credit Chain

2017

09/2017: Set up unified identity system based on Ethereum testing network

10/2017: Introduced DCC testnet

12/2017: The DCC online credit reporting contract is implemented on the DCC trial network

2018 Q1-Q2

03/2018: First Personal Loan DApp Debuts on DCC, Launches DCC Explorer

04/2018: Release of the DCC Distributed Credit Chain Extension Platform, launching the second DApp

05/2018: Interface for over five financial institutions and services from loans, data and risk control

2018 Q3-Q4

Q3-Q4; Open self-extracting API of the authorization chain, DCC MPC Setup

Q4: Join the lending market in Indonesia

2019

Q1-Q2: Join the lending markets of Vietnam and other Southeast Asian countries

Q3-Q4: Continue to expand and expand lending market in Southeast Asia

2020: DCC Public Transformation

To develop asset management and settlement systems

8. Conclude

It can be concluded that the Distributed Credit Chain (DCC) is not a scam. The DCC platform is a combination of the financial industry with the blockchain industry. DCC has made significant strides in continually implementing technological innovations, proposing new credit services, etc. So can Distributed Credit Chain be a worthwhile investment for you?

More details about the project can be found in the following official sources:

- Official website: http://www.dcc.finance/

- ANN: https://bitcointalk.org/index.php?topic=3209215.0

- Whitepaper (here you can find all information about the project): http://www.dcc.finance/file/DCCwhitepaper.pdf

- Telegram Offical: https://t.me/DccOfficial

- Twitter: https://twitter.com/ DccOfficial2018 /

- Facebook: https://www.facebook.com/DccOfficial2018/