China Begins RECORD Stimulus, Tax Cuts as Real Estate and Cars Mega Slowdown!

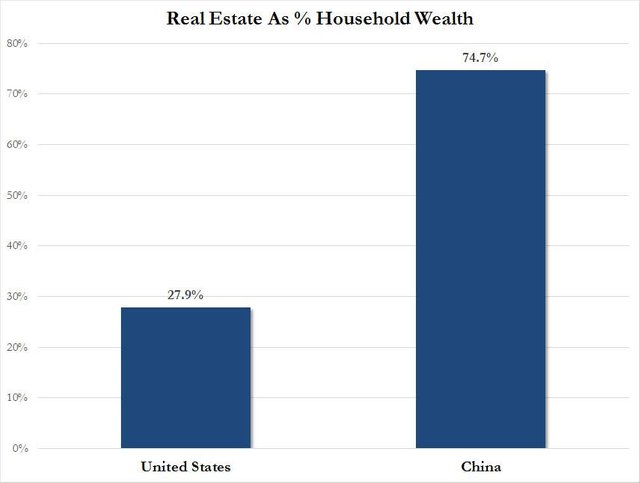

China is slowing down. Most of their wealth is in real estate and yet their market rests upon a fragile foundation. There are only so many empty cities that can be built. Only so many bridges to nowhere. This unsustainable path is failing. Today, we see a record level of stimulus injected into the markets, tax incentives, easy money from the banking system, and still slower growth than expected. This house of cards will collapse.

Bloomberg on Twitter: "A fifth of China's homes are empty. That's 50 million apartments https://t.co/nf2iKJNFLX"

https://twitter.com/business/status/1061198134943068160?lang=en

China vs US Real Estate.jpg (855×645)

Xu Jiayin presided over the Evergrande sales conference to sell the house: 10% off all residential projects in the country_real estate _澎湃新闻-The Paper

https://www.thepaper.cn/newsDetail_forward_3053292

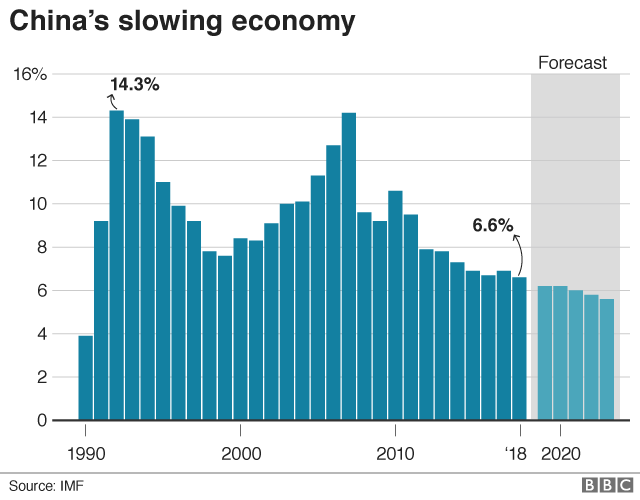

China economy: Beijing unveils $298bn tax cuts to boost growth - BBC News

https://www.bbc.com/news/business-47450223

_105263520_chinagdp-nc.png (640×500)

Evergrande: China’s biggest property developer faces debt crunch

https://outline.com/taJAeq

http://com.ft.imagepublish.upp-prod-us.s3.amazonaws.com/be06a8c6-f307-11e8-9623-d7f9881e729f (700×521)

https://www.ft.com/__origami/service/image/v2/images/raw/http%3A%2F%2Fcom.ft.imagepublish.upp-prod-us.s3.amazonaws.com%2Fbe06a8c6-f307-11e8-9623-d7f9881e729f?source=next&fit=scale-down&quality=highest&width=700

China Car Slump Has Dealers Slashing Prices, Giving Cheap Loans - Bloomberg

https://www.bloomberg.com/news/articles/2019-03-03/china-car-slump-has-dealers-slashing-prices-giving-cheap-loans

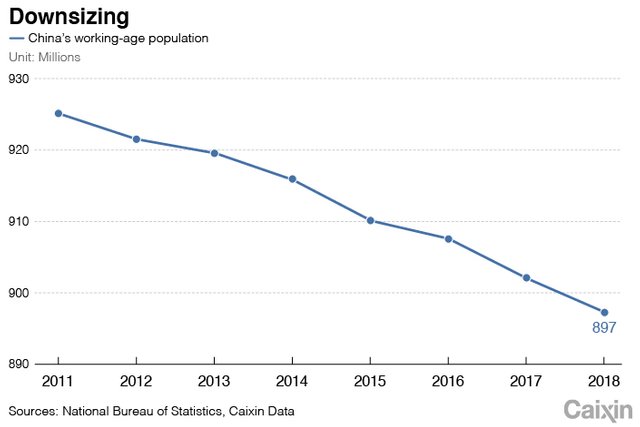

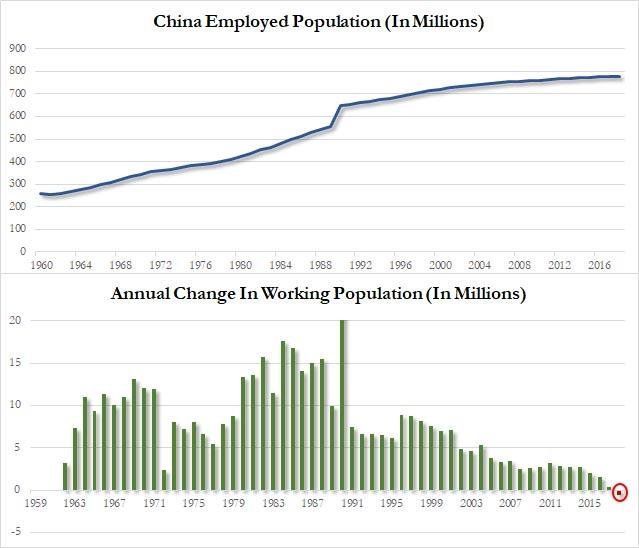

Chart of the Day: China’s Shrinking Workforce

https://outline.com/cKwWnd

1548758308822117.jpg (705×470)

china working age population change.jpg (639×548)

▶️ DTube

▶️ IPFS

Basically they do the same (mistakes?) everybody else is doing, the USA, Europe, Japan ect.

Their only advantage is, that once they decide to do something its getting done. Without having to negociate with political opposition or bankers or other interest groups.

That can be very advantagous if the decision is a good one, but also very destructive if the decision is wrong.

I tend to believe that Chinese know what they are doing when it comes to making business. They have always been really good at that.

China's primary emphasis is to expand its domestic market and lessen its dependence on exports. The trade volume between China and the U.S. will be much less 5 to 10 years from now.

Excellent analysis as always, can you do for your next video the economy behind the 5G technology?, I guess the 5G tech will be the next war initiator component for the XXI century, just like the oil was for the last century, or not (I don't know :3), can you bring some light in this matter.