What Happens To Corporate Buybacks During A Recession?

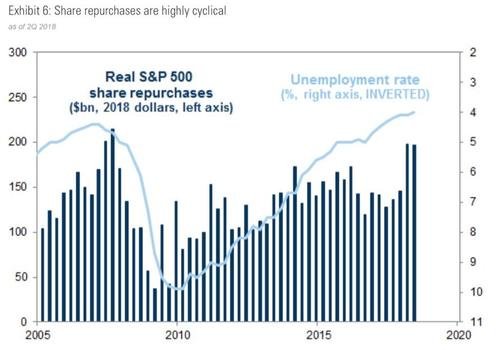

Corporate buybacks are a large part of the bull run in equities since 2009.

Buybacks in the S&P totalled $3.8 trillion since 2010. For the period that ended in June, the last full year record, the buybacks are the highest ever.

Stock buybacks are not a sign of stocks being cheap. Instead, they run lockstep with earnings. Companies buy their stock when they have plenty of money and there are not better alternatives out there.

Click on image to read full article.

Also, stock buy backs plunge the supply of the shares in the market, that could correlate to increased value. It’s a pretty talked about thing in the crypto community as well, where whitepapers released by organizations promise to buy back and burn crypto in the future, to help investors make more money.

Posted using Partiko iOS