FINANCIAL PLANNING: Avoiding the Income Trap

FINANCIAL PLANNING: Avoiding the Income Trap

Business planning to financial

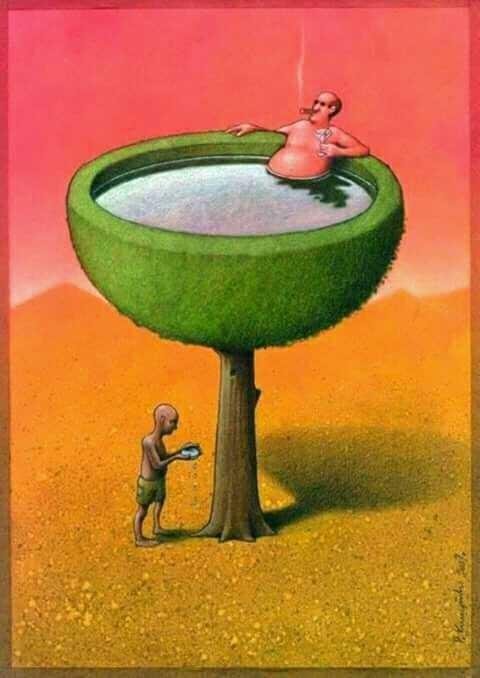

It may be that you are successful in the present, but later in the day even in the elderly much in debt until falling back to zero due to misplaced financial. either because of pensions, no endless treasure, and no investment whatsoever.

In this condition, the term middle income trap, ie financial condition stagnated at the middle level continues to take care of. such conditions make it difficult to rise to class or to achieve sound and wealthy finances. Alas, the previous income was able to meet the cost of living.

There are several factors that cause, among them is due to high lifestyle and minimal to save and invest. OneShildt's financial planner M. Andoko says such people usually follow lifestyle trends without thinking about finances in the future.

Pride or prestige of branded goods, high lifestyle, social association has become a habit. whereas, if viewed from the financial it can not be done.

"The trap did happen. That's a financial paradox, meaning when the income grows high at the same time has the potential for high income loss through lifestyle. let alone a more complex lifestyle, "explains Andoko.

Andoko said when someone has a good enough income, needs such as clothing, boards, and food feel fulfilled then they want self-actualization. it can be done with a luxurious lifestyle or have expensive items.

"For example the streets [abroad], usually when it has ever run out the nets are addicted. Desire is getting bigger, that's what needs attention, "he said.

nevertheless, it becomes a natural thing as long as it is well prepared in advance. It should, continued Andoko, if they have a financial goal will be more careful to spend money. "That goal will help guide what they want or that suits their needs," he said.

.can not be denied, in line with the development of increasingly sophisticated technology can make the temptation of spending more powerful, for example, have more than one advanced mobile phone, more than one car, and gathered with socialite.

on the other hand, he added, actually it can help facilitate the activity if we can mengotrol usage and understand financial goals well. "But do not just be seen as a trap, can also get additional income, additional activity or nerworking [the wider]," he continued.

Therefore financial planning becomes the key that will facilitate in managing and managing revenue. so as not to get stuck with a false desire and consumptive encouragement alone, it is better to first analyze the financial fortunes.

Like, read and write down whatever your capital, assets, financial resources you have. through financial analysis it will be easier to create realistic financial goals.

In financial planning the first step to take into account is financial ability. therefore, the first thing to do is to categorize where the priority needs are not, and everyone has different priorities.

after determining which needs become priorities and which are less then it should be able to cut the budget for unnecessary purposes.

According to Andoko, in terms of daily financial planning, you must have budgetinganggaran. ideally, from planning income of at least 20% for investment, 35% for installments divided into 20% productive installments and 15% consumptive installments, the remaining 45% can be arranged for other needs such as transportation money and for the needs of children.

PREDIKSI IHSG MONDAY: Corrugated IHSG Correction, A Number of Shares Is Worthy of Attention!

06-03 | 20:07 Business

Employees move closer to monitor the movement of Composite Stock Price Index (IHSG) in Indonesia Stock Exchange, Jakarta, Wednesday (5/23/2018). - JIBI / Nurul Hidayat

Bisnis.com, JAKARTA - Composite stock price index (JCI) is predicted to be still prone to correction in trading.

JCI closed down 0.46% or 27.47 points at 5,983.59, after opening with a gain of 0.44% or 26.21 points at the level of 6,037.26, on Thursday (31/5). based on Bloomberg data, six out of nine sectoral indices of the JCI ended in the red zone, with the biggest pressure from the infrastructure sector which fell 1.27%, followed by the miscellaneous 1.07% industry.

while the other three sectors strengthened and withdrew further weakening of JCI, led by the basic industry sector which gained 1.46%.

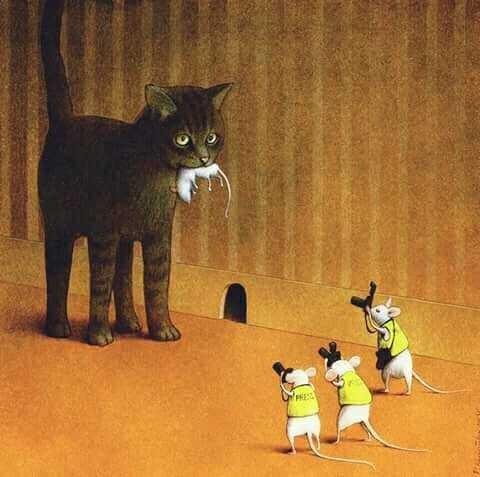

Artha Securities analyst Frederik Rasali said the JCI decline at the end of trading last week was due to investors' anticipation of the short trading day in the last week of May 2018, as well as MSCI rebalancing which resulted in the decline in the share of big caps.

'' IHSG is predicted to weaken as the new MSCI will impact on trading Monday 4 June. In addition, the lack of stimulation in the country also contributed to pressing the rate of JCI, '' said Frederik through research.

Frederik predicts the JCI Monday to move in the range of 5,905 to 6,074. some of the recommended stocks are BSDE, GGRM, BBTN, BBNI, PWON, ADRO, ICBP, and LPPF.

Meanwhile, Binaartha Securities Analyst M. Nafan Aji Gusta Utama revealed based on daily indicators, MACD has managed to form golden cross in the negative area. meanwhile, stochastic and RSI looks already in neutral area.

'' The index is still potentially heading to the resistance level area as long as its movement still hold above the line of MA 20.based on daily pivot from Bloomberg, the first and second support has a range of 5,927.25-5,870.92. Meanwhile, the first and second resistance has a range of 6,047.46 to 6,111.34, '' Nafan said.

some of the stocks he recommended were ASII, BBRI, BMRI, BRPT, DOID, and SMGR.

Vice President Research PT Indosurya Bersinar Sekuritas William Surya Wijaya revealed the start of the new month in the first half of this year, JCI will move consolidated. sentiment that affects the inflation data release and foreign exchange reserves are predicted to be stable.

'' JCI movement in the long term will still be in an uptrend condition. This should be understood by investors as a reference for investing. on Monday June 4 JCI has the potential to go up, '' said William.

He predicts JCI to move in the range 5 845-6.071 with some stocks that can be recommended are BBNI, SRIL, SMRA, ICBP, MYOR, TLKM, BBNI, BJTM, and KLBF.

what's the point of me sharing this? I know many people are dabbling in vlogging, or have not started yet - but want to. I think the content is really the way of the future, and the more content we can generate here on the platform - the faster Steemit will grow!

not only that, but I really think there is a lot of value in improving your speaking ability. Not only can I bring value to the company I work for, but also help me deliver the presentation

I work not for rewards - I stand by myself!

one who must know this is my world FACT and REAL 😅😅😅

Successful greeting driven optimistic !!!

Thanks ☺