Binance Coin and Dai

Two days ago I wrote about various promise-coins on the Ethereum blockchain. There are a lot of ambitious projects out there and I hope they all succeed. However, I forgot to mention a few ERC-20 tokens out there that are already delivering results: Binance and Dai.

Binance (BNB)

At first glance Binance's coin doesn't really make sense. Why does it even exist? It almost feels like a scam. Maybe it is. After all, Binance coin's value has been granted artificially by the exchange. The coin is used for three things:

Crypto Trading Pairs

There is a BNB tab on Binance that lets you exchange your Binance for many other coins. Currently I count 66 other coins you can buy with BNB, including Steem, EOS, and Bitshares. On the flip side, you can also turn these coins back into BNB, making BNB a convenient hub for crypto trading.

Trading Fee Reduction

TIME The 1st year The 2nd year The 3th year The 4th year The 5th year Discount 50% 25% 12.5% 6.75% None BNB cuts the trading fee in half from 0.1% to 0.05% for the first year of trading. This is a factor of five times as good as Coinbase's 0.25% trading fee.

Stake-Weighted Vote

Binance holds a community vote where users get to choose which coins will be coming to the platform next. By holding BNB users get to make governance decisions on the platform. This is similar to being able to vote for Steem witnesses, except instead of being a republic Binance would resemble more of a direct democracy.

These three reasons are why BNB coins are worth something. Surprisingly, BNB is #17 on the market cap right now. Even though these three functions are provided artificially by the centralized exchange Binance, the coin still has great value and utility. In my experience, Binance is a great exchange and will only continue to grow in popularity.

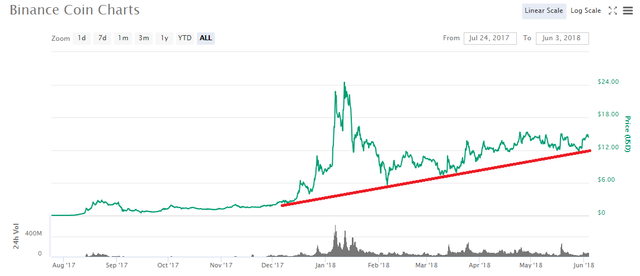

In addition, BNB is the least volatile coin I have ever seen.

For the last five months BNB has done nothing but climb slowly over time with little relative variance. When I see this I have hope that it will break away from the trends of Bitcoin... it really already has ever since Feb. The up and down swings are much much tighter than you see with any other price action graph, which I find incredibly surprising for a coin with artificial value.

However, when you think about it, it makes total sense. When BNB spikes up, people will use it to buy more of another coin, bringing the price back down. When BNB is cheap, people want to stock up on it because it gives a fee reduction and acts as a gateway to 66 other coins. This combination of variables creates high liquidity in the market that helps the price stay more balanced. In turn, this artificially created balance creates a domino effect of trust among users. Binance seems to have become a self fulfilling prophecy for stability while still making consistent gains.

BNB bulls even make the claim that Binance is going to transition into becoming more and more decentralized. When this happens they claim that maybe there is a plan for BNB that will make it's value less artificial. Only time will tell.

Dai and Maker

Dai is an ERC-20 stable-coin that I just found out about yesterday and I'm super excited and impressed by it. If you read my rant on Judas Coins I made the claim that centralized coins are not to be trusted. In particular, centralized stable-coins like Tether, Cloud, and TrueUSD are very dangerous additions to the cryptosphere because it's possible that those centralized organizations will game the system and create money that isn't there. Enter Dai coin to solve this problem.

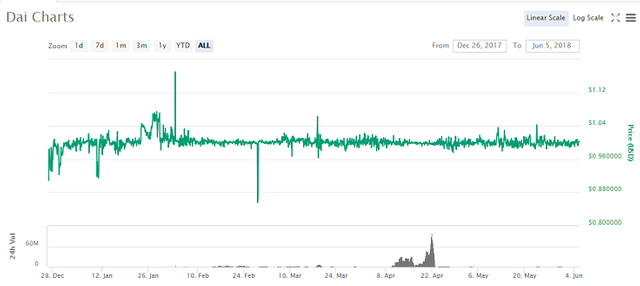

Dai is the first stable coin I've found that is actually decentralized while also being completely removed from the dollar (even though it's pegged to the dollar). The technology for this project is extremely complicated and I don't fully understand it, but the parts that I do understand are very impressive. Allow me to post a few links about how the technology works so you can read about it yourself if you want to.

Basically, using the Maker platform (another ERC-20 token) anyone can create Dai by taking out a loan with Ethereum as collateral for said loan. There are many incentives in place for people who use the maker platform to keep the value of Dai as close to one dollar as possible. The farther away Dai is from one dollar the more profit you can make by bringing it closer to a dollar. This is a completely oversimplified generic explanation of how it all works. The specifics are much more genius. Dai has already proven itself worthy as a stable coin because it was able to remain pegged to the dollar even as the value of Ethereum crashed from $1400 to $350.

With this brilliant system, Dai gets pegged to the dollar without the need for dollars to be stored in a bank. This is one of the key reasons why Dai is superior to other pegged assets. You don't have to trust anyone to store the asset. You don't have to trust any central authority. Anyone can use the Maker platform to take out a loan and bring the value of Dai closer to $1. If Dai is worth more than $1, you can create Dai coins for $1 and sell them for a profit. If Dai is worth less than $1, you can pay off your debt for a cheaper price than it originally cost you to acquire it. I can't stress enough how amazing this technology is from a technical standpoint.

The implications of this technology are huge. The Maker platform will be able to create other coins that are pegged to other assets. Don't trust the United State Dollar? Use a coin pegged to another currency. They will even be able to peg coins to assets like gold and silver. This is truly revolutionary. The Maker coin is currently sitting at #38 on the market cap at $800 a coin. Don't be fooled by unit bias, there are only 600,000 coins in circulation and 1,000,000 coins possible. $800 is a steal deal because hardly anyone even knows about (let alone understands) this technology yet.

This is a platform that can bring a whole new level of trust to the cryptosphere. Not only can businesses have the guarantees of a pegged asset they also get the guarantees of a decentralized asset. It's the best of both worlds for vendors. The Maker platform may very well lead the charge into mainstream adoption. Vendors operate on razor thin profit margins. What's going to happen when coins like Dai completely undercut Visa's 3% fee? Don't forget, Dai may be a stable coin, but it is also a way to take out loans. Technology like this could full on slap down credit card companies (or any entity that issues loans) in the future.

The nuclear option

The weakest points of the Maker platform are the Oracles. The platform has to trust the oracle's price feeds so that it knows how much the pegged assets are worth. Steem is also talking about introducing oracles to SMTs. Steem already uses oracles (witnesses) to determine the price feed on its own platform. Although oracles are a risk, the value they provide is often well worth it. If shit hits the fan with Dai and the platform breaks there is even a nuclear option that will freeze the system and pay back everyone it owes for as much as it can. They really thought of everything on this project.

Another weak point that no one seems to point out is that the Maker platform is an ERC-20 token and relies on the Ethereum blockchain. We all know that Ethereum has major scaling issues at the moment. Still, this technology is open source and there is no reason why it can not be implemented on multiple platforms. Mainstream crypto adoption is coming soon™.

Conclusion

BNB and Dai are not exciting projects. BNB gets it's value because Binance thrusts that value onto it. No matter how complex and awesome Dai is, from the outside looking in it is simply a stable coin pegged to $1. These coins are boring, but they are still delivering results, unlike many other coins out there (Steem excluded).

I have also noticed BNB's steady climb and low variance. Chart looks very different from BTC's whereas many cryptos have similar chat to big daddy bitcoin

https://medium.com/cryptolinks/maker-for-dummies-a-plain-english-explanation-of-the-dai-stablecoin-e4481d79b90

Another good post about how the Maker coin works.

I always felt like BNB was apart from its artifical value, an unpleasent provider lock-in, as all about it depends on binance, and wouldnt be able to transfer it somewhere else. But that it has a stake for voting in icons is a cool feature!

Pairing cryptocurrencies together on an exchange is not a trivial process. If it was, Binance would already have access to every coin on the market. When you take this into consideration, the value of BNB is likely much less artificial than we speculate it to be. They are putting in real work on this coin and will continue to do so.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Edicted from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, theprophet0, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

DAI stablecoin is somehow much better than the other stablecoin because they are more transparent and faster and they are also giving away a lot of rewards on their buy and sell competition on kucoin exchange https://news.kucoin.com/en/dai-dai-trading-competition-win-182-mkr/

Check out https://steemit.com/@a-0-0