Never Give A Bad Loan, Use Ethlend

In the previous article I introduced Ethlend, an ethereum-based crypto-lending platform that allows users to give/receive loans using digital assets as collateral and in a trustless environment. This is all possible because of Smart Contracts. In this article, we shall discuss getting started with Ethlend and how to use its services.

Remember that even though Ethlend is ethereum-based, it is interoperable with other blockchains such as Bitcoin. This information was shared in a press release by AAVE announcing Bitcoin launch on Ethlend platform.

Ethlend released their Bajjii version on the testnet in December 2018 and in February 2019 Ethlend officially deployed their Bajjii release on the mainnet of the platform.

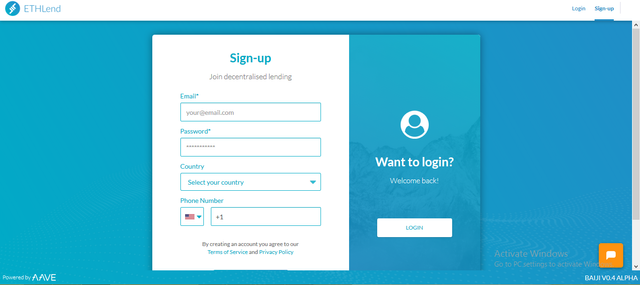

The first step is signing up. This is pretty easy, just fill in the required information and click the confirmation link in your email.

After you successfully login, you will be prompted to import your wallet. This external wallet is where you will draw funds from to offer loans or offer as collateral for receiving loans. You can choose to either create a new wallet or import an existing one.

If you do decide to create a new wallet ENSURE TO KEEP YOUR WALLET PHRASE WORDS SAFE.

After setting up your wallet, you can now decide if you want to lend out or take a loan.

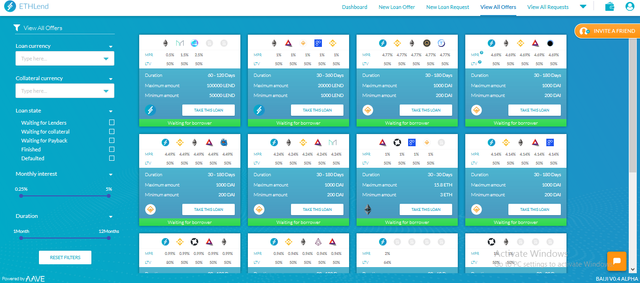

You can even take a look at the latest loan offers and requests

Those whose funds are yet to be matched to a partner in need show in the records as "waiting for borrower" while loans have already been matched and given out show in the records as "waiting for Payback".

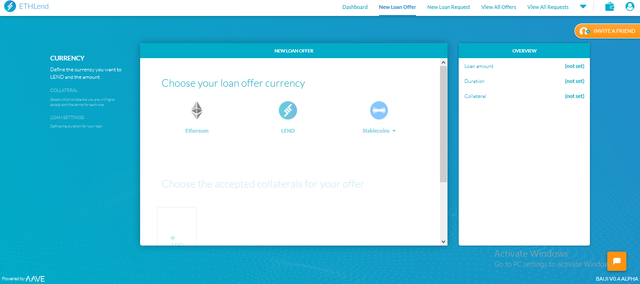

If you decide to be a lender, You simply click on the Ethlend New Loan Offer tab.

You can then decide what currency you wish to offer your loan in. You cn choose between Ethereum, LEND (the custom token of the Ethlend platform), or a Stablecoin (currently DAI). Dai (DAI) is a USD-pegged stablecoin built on the Ethereum blockchain, and has no centralized authority. Its $1 USD equivalent is maintained through automatic pricing mechanisms built into smart contracts. source.

You can decide the amount you want to loan out, the duration of your loan(1 month to 12 months), the percentage interest you wish to charge(monthly interest 0.25% to 5%), and even the preferred collateral currency(ies).

After your offer has been recorded you simply wait for willing borrowers to come to you if they like your terms. The entire process is automated and their collaterals are locked before your loan is transferred to them.

The Smart Contract takes care of the loan payments (in installments or lump sum). The ethereum blockchain has a complete and immutable record of the transaction which nullifies theft and fraud.

You can also check out the Ethlend website yourself or read about them in the Ethlend State of The Dapps page.

DISCLAIMER

The information contained within this post is not to be taken as financial advice. I am not a financial advisor and none of your investment decisions should be carried out based on any information presented here. Please do you own research before investing in cryptocurrencies or any digital asset. You can lose all of your money by investing wrongly. The information presented in this article is for educational and entertainment purposes only.