How to play short on Eur/Usd

One of my favourite quotes is this:

"The stock market is a device for transferring money from the impatient to the patient. "

– Warren Buffett

This is true for all markets.

Patience is always a virtue when it comes to the markets because whether a position works out or not is often a question of timing.

So to gain maximum opportunity we are often forced to wait when we see and opportunity, because the opportunity may not be fully mature yet.

Such is the case I consider, with EUR/USD

Some of the most important insights into this common Forex pair can be gained by looking at it's chart on ultra long-term timescales.

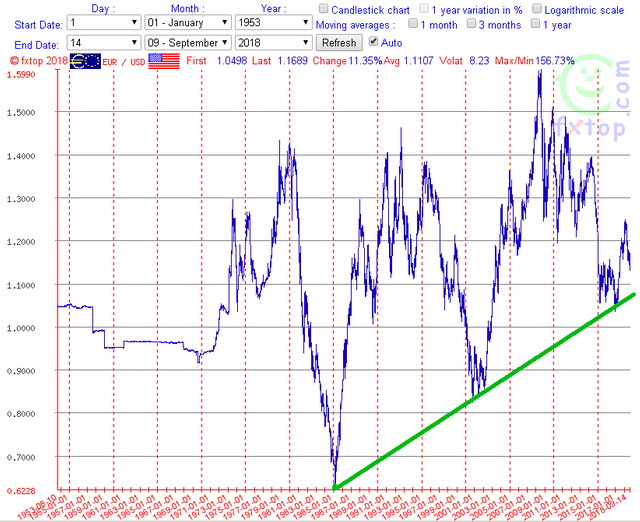

Here is a chart of EUR/USD which goes back to 1957

Now you might ask how we can possibly have a chart of EUR/USD which predates the Euro. That's because one has to remember what the Euro actually is.

The Euro is essentially a gigantic price fixing equation which harmonises exchange rates across a body of member states.

E.g. EUROS (being the sum of the aggregated exchange rates of member states) VS. US DOLLARS = X

Thus, the equation itself predates the actual hard-currency by probably anything between 20-40 years depending on how you interpret this. Certainly the ERM which was a pre-runner of the Euro came into force in 1979 so we can see the Euro as having a longer history than the hard-currency which came into being in 1999. The modern de facto hard Euro currency itself is merely a tokenized form of this equation which happens to have a legal monopoly across the Eurozone.

So this makes long-term macroscale analysis possible and is a useful insight into longer trends.

Lets add the most obvious long-term trend onto this chart. The wave of support which has driven the long-term future of the Euro upwards since the early 1980's.

This caught the Euro at the end of the bear market which the single currency entered when it began collapsing in 2008 due to the sovereign debt crisis.

This brings us to our most recent period beginning after Brexit and Mario Draghi's "bazooka" designed to stave off Eurozone inflation for good (we'll come to that in a bit) and the most recent small rally.

You'll notice that the Euro effectively has been clustered around it's long term support highlighted in the red in recent times.

This point lives between the 1.05 - 1.10 level and you'll notice that the recent "rally" is so far nowhere near as robust looking as those which followed the market collapses in 1987 and 2011. This is understandable given all the turmoil in the Eurozone.

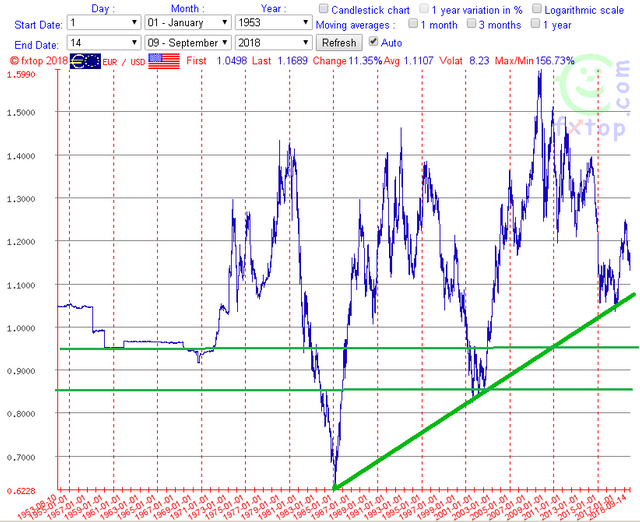

Lets have a closer look at that Euro rally using data from Macrotrends and their 10 year chart.

Now this view is important for two reasons here.

First of all is the very obvious downward trend of overhead resistance.

Secondly, the recent somewhat sickly looking rally we picked out earlier is already fading and has fallen back down to the 1.15 level after hitting this resistance line.

Thirdly, a rally here (which lots of people seem to be favouring) would actually seem to complete a bearish head-n-shoulder pattern as the rally would collide with the long-term resistance and then fall back down a small distance which would thus suggest that a de facto collapse would be on the cards.

Now this is important, because if the Euro is indeed forming Head-and-shoulders against the USD, then a collapse back to the 1.05 point is entirely possible and moreover I would suggest highly probable.

1.05 however, is not just any old support point. A violation of this would actually breach the Euro's 30 year upwards channel.

What does this mean? In short (pun intended) I think people suggesting EUR/USD parity are actually too generous.

Why? Because no hard support points live around the 1.00 level if the main wave of support breaks.

Support lives actually much further down - more around 0.97 at the nearest and around 0.88 after that.

Thus, the strategy:

Be patient and watch EUR/USD over the coming weeks. Keep an eye out for positive news from the Eurozone and also watch the FOMC's strategy for interest rates (dollar strength being a significant factor here).

If EUR/USD does indeed rally here, look for head-and-shoulders completion.

Enter the market at a point around 1.18 - 1.20 when the rally meets with the downward moving wave of overhead resistance which should coincide with the next part of a Head-and-Shoulders move.

From the peak of the right shoulder of the Head-and-Shoulder form, Short the Euro against the Dollar down past parity. This will take around 15-20% profit unleveraged.

If you're feeling brave then see what happens here. If there is a sign that the bearish move has more life in it to take it well past parity, then look for the market capitulating and moving down to 0.85. In this case, this move would net around 25-28% profit.

Thus, patience here will pay dividends. I will update this blog with EUR/USD news frequently.

Thanks! Which financial product would you buy to short the EUR? A mini-future (open-end)?

Hey didn'#t see this. An open-ended instrument is definitely essential. Binary instruments are no good here because volatility will kill you. You need to have a dynamic margin ultimately. Options, CFD's and mini-futures are all viable. My preference is Contract-For-Difference however. If you're not signed up to a CFD broker I can probably get you a referral link for some free cash to test drive some.