Time to Collect More Cash on this Tech Giant

Let's continue to outperform regular shareholders by taking less risk.

First remember it is important to focus on great businesses trading at good prices. Then apply a simple put selling strategy to profit as long as shares do not fall to much.

We are paid upfront a premium for agreeing to buy a stock at a lower price (the put buyer is looking for protection from a stock market decline). Most of the time these options expire worthless and we never have to purchase the stock. But if we do, we can turn around and sell covered calls on that stock to earn more income. By selling a covered call, we collect cash for agreeing to sell our shares at a higher price.

If you followed the recommendation in March (https://steemit.com/money/@slider2990/collect-big-checks-from-this-tech-leader) you own 100 shares of stock for every put sold.

Qualcomm is a leading maker of semiconductor chips for mobile devices. These are the little "engines" that help smartphones and tablets connect to cellular networks, surf the web, and complete hundreds of other tasks.

Qualcomm also owns rights to the dominant technologies that 3G and 4G (and soon 5G) cellphones use to deliver data. It earns a royalty on every cellphone and tower around the world that uses its technologies.

Over the past 12 months, Qualcomm received $23 billion worth of revenue and earned a solid 16% profit margin.

Qualcomm is in a strong financial position with enough cash to pay off all its debt and still have $17 billion left over.

Shareholders are treated well with Qualcomm buying back 14% of its outstanding shares. And it has increased its dividend at a rate of 18% per year over that span. It now pays a 4.5% dividend (nearly three times that of the benchmark S&P 500 Index).

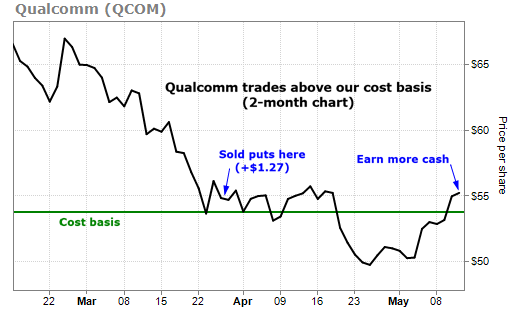

Rather than buying shares, I suggested selling the April $55 puts. At the time, Qualcomm shares were trading at $56.34. We got paid for agreeing to buy shares at a $1.34 (2.4%) discount to where they traded. That's how we can buy shares with less risk.

This is how we outperform regular shareholders. Investors who bought shares of Qualcomm in March are down 2% but establishing a position by selling a put we are up 2.8%.

You collected about $1.27 (2.3%) for selling the puts. That gave you a cost basis of $53.73 on the position ($55 strike price – $1.27 put premium = $53.73).

When those puts expired on April 20, Qualcomm was trading below $55. So you were assigned shares. On Friday, the stock closed at $55.23 (2.8% above your cost basis).

Continue outperforming the average investor by collecting more cash today!

Today's trade: sell the July 20, $57.50 covered calls on your Qualcomm shares for around $2.30 (1 call per 100 shares of stock). That's a 4.3% payout on your cost basis. You'll also likely collect the company's upcoming dividend, which it typically promises to folks who hold shares at the end of May.

If Qualcomm is trading at $57.50 or more on the July 20 expiration date, you'll sell your shares for $57.50. You'll close the trade for a 12.5% return in a little less than four months (from the March 27 open date). That's a 39.5% annualized return.

If Qualcomm is trading below $57.50 on expiration day, you'll keep your shares and the income you earned. You can then sell more covered calls to earn additional income.

Regular Qualcomm shareholders have likely been frustrated with the stock over the past couple months. But as you can see, by selling options, we can profit even if a stock falls. It's a great strategy to collect cash on high-quality businesses.

If you're not selling puts and covered calls already, get started today.

Disclosure: I wrote this article myself, and it expresses my own opinions. I have no business relationship with any company whose stock is mentioned in this article.

Trade update:

Home improvement retailer Home Depot (HD) increased 1.7% on Friday to $190.31. If you sold the June 15, $180 puts on May 2 recommendation, you're on track to close the trade for an 1.8% gain in a little more than six weeks. That's 14.9% annualized. Continue holding the position with a hard stop at $162. (https://steemit.com/finance/@slider2990/housing-is-booming-are-you-cashing-in)

Congratulations @slider2990! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

To support your work, I also upvoted your post!

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP