MAP Rewarder: MAPR Payouts to Delegators and Price Increase for Token-Holders for 7 Oct 2019 (17.6% APR)

This week's distributed profits are 0.3375%, equivalent to 17.6% APR.

Total rewards to delegators and token-holders, including bonuses, are 0.348%, or 18.1% APR.

Remember that MAPR has a unique distribution and pricing system. If you look at the MAPR tokens you, as delegator, have received today, multiply that number by the new official BUY Price and you get the same amount in STEEM as you would have done under the old system of just paying out STEEM transfers.

Token-holders receive no token distribution, unless they are also delegators. Their profit comes in the token price increase.

The added bonus is that if you don't sell this week's tokens, then next week their value will rise to at least the new BUY Price. This is how the token allows compounding of profits, for both delegators and token-holders.

Using the language of investment trusts, delegators hold "income" stakes where the "interest" is paid out in tokens, whereas token-holders have "capital" stakes where the profit is added to the token price.

MAPR: The Numbers

All these numbers relate to a 7-day period (Monday to Sunday) and calculated in STEEM per SP.

Value of Steem upvotes = APR 25.7% [1a], 14.7% [1b], 14.2% [1c]

Value of Steem rewards payouts = APR 12.8% [2], 7.3% [2b], 7.1% [2c]

Distributed MAPR payouts = 0.3375% (APR 17.6%) [3]

Total MAPR payouts = 0.348% (APR 18.1%) [4]

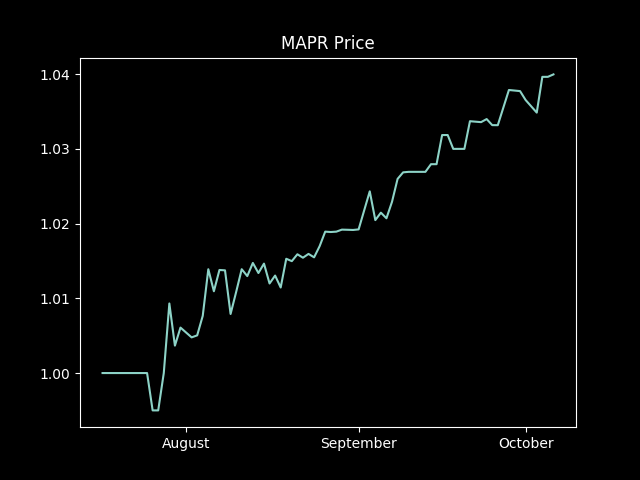

MAPR BUY Price: 1.04005 STEEM [5]

MAPR SELL Price: 1.05045 STEEM [6]

[1] Theoretical maximum value of Steem upvotes, assuming 10 full upvotes at 100% power for 7 days, averaged over 7 days and expressed as an APR. This calculation was performed for an SP of 1 million STEEM to be as close as possible to linearity. Your own upvote will be somewhere between 50-100% of this value.

The values are now calculated for three levels of voting power: 1 million SP (a); 10,000 SP (b); and 1,000 SP (c).

[2] Theoretical value of Steem upvote author rewards, assuming 50% curation rewards, 50-50 split of post payouts and SBD print rate, averaged over 7 days and expressed as an APR. Your own author rewards will be somewhere between 50-100% of this value.

[3] MAP Rewarder distributed payout sent to delegators this week as tokens and the MAPR price adjusted to reflect this.

[4] Total payouts for the week, including bonus upvotes, free full upvote, free SBI and this week's distribution.

[5] Our BUY price is the price you may sell your MAPR tokens such that their value in STEEM is the same as if this week's distribution was done by direct STEEM transfer.

[6] Our SELL price is about 1% above the BUY price.

Our MAPR distribution [3] is much higher than the average blockchain author rewards [2].

Our payout [3] is now significantly higher than most users can achieve [2a, b & c]

and

higher than most users can even generate with a full vote [1b, 1c].

Profits will be paid today in the new MAPR tokens.

MAPR News

Our profit distribution has edged up this week to 17.6% APR. This comes from a mixture of post and curation rewards and token trading. With the new Steem economy, the latter has become more important.

It may take some time, analysis and experimentation to see if we can get closer to the 20% mark again, but a quick look at the above table of the potential returns shows that a real return of 17.6% is much higher than any author rewards, higher than most people's full upvote, and lies somewhere in the range of a whale's self-vote, adding both author and curation rewards.

So, by investing in MAPR, whether as a delegator or by buying tokens, you will be earning about the same percentage as a whale. Sure, it won't be the same amount but it is the same percentage - and with a non-linear curve that's Important.

Although our weekly returns are variable, here is a graph of how we have been performing since the MAPR token was launched. (Thanks to @gerber for the discord-bot.)

MAP Rewarder, without the token, has been in operation some 20 months, so you can extrapolate back from that graph to get an idea of our returns to members.

There really needs to be a psychological change in Steem users who think that SP is the only way to invest in the blockchain. Tokens such as MAPR, and others in the MAP FinTech family, are designed to achieve high and stable returns without any SP. This also means you no longer have to wait 14 weeks to undelegate SP and then power it down fully.

See you next week!

Next rewards distribution will be on Monday 7 October.

[BUY MAXUV] - [READ MAXUV]

[BUY MAPR] - [READ MAP REWARDER]

[BUY MAPXV] - [READ MAPXV]

ONECENT: The First Strategic Token Investment Game (STIG)

Hi @accelerator, a small upvote and a tip.

$trendotoken

Thanks for playing the ADDAX trading game!

Congratulations @addax, you are successfuly trended the post that shared by @accelerator!

@accelerator got 0.54761400 TRDO & @addax got 0.36507600 TRDO!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

A small upvote and an extra tip!

$trendotoken

Thanks for playing the ONECENT trading game!

Congratulations @onecent, you are successfuly trended the post that shared by @accelerator!

@accelerator got 0.51179400 TRDO & @onecent got 0.34119600 TRDO!

"Call TRDO, Your Comment Worth Something!"

To view or trade TRDO go to steem-engine.com

Join TRDO Discord Channel or Join TRDO Web Site

Thank you for supporting @CatsMakeKittens by being a part of our community @accelerator.

Each CATS you purchase gets you daily upvotes from me @CatScientist as our community grows so do your rewards for being a member!

My brain is registering: Increase = hold = increase. 😁 I have been noticing the increase whenever I go take a look in Steem-engine.

By the way, when creating a token, what determines the token's value, how can a token be distributed? I'm considering creating a token in steem-engine, but I don't even know what I need to consider or keep in mind before I do so. I think it would be fun for me and people who follow me, but I don't know if it's practical or what's involved.

Posted using Partiko Android

Yes, thought it was time to post a graph! :-)

Depends what your token is for: is it supporters funding you with potential future benefits, or is it some income shared so more like an investment? There are lots of other possible uses as a kind of club token.

Could be a long convo, so feel free to ask on Discord :-)

Thanks, yeah I'll ping you there ;)

!BEER

View or trade

BEER.Hey @rycharde, here is a little bit of

BEERfor you. Enjoy it!