Nordea Warns 'Rocky Road' Is Not Just A Nice Ice-Cream

A CYCLE OF TARIFFS, BUT SO FAR MANAGEABLE FOR GROWTH

Trade politics have remained high on the agenda, with China, EU and the US in a cycle of responding to each other's tariffs. The macroeconomic impact should be small from what we have seen so far, although downside risks to growth must be rising. For instance, if the White House starts to mull leaving the WTO, as has been reported, this would remove a back-stop for global trade and increase uncertainty, which might depress business investments. Hopefully it won't come to that.

The EU's decision to send European Commission President Juncker to Washington, as well as comments from the US Ambassador to Germany and from German Chancellor Merkel, is consistent with a tentative cooling of the trade tensions between the EU and the US. Negotiations may be taking place, mostly out of the eyes of the public.

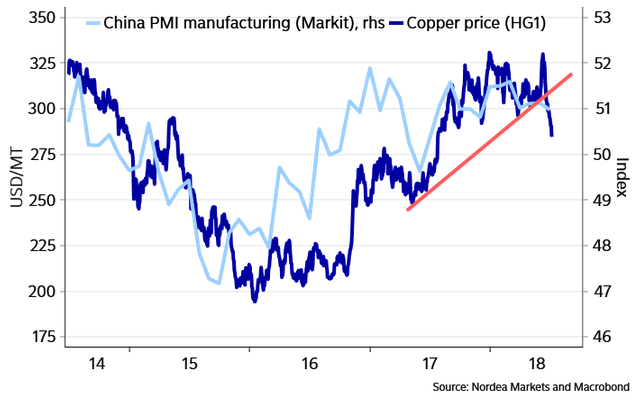

CHART 1: DR COPPER NOT LOOKING TOO DANDY

Industrial metal prices have been dropping, consistent with i) rising fears of a supply glut due to trade tensions, as well as ii) the general weakening of the global industrial cycle. Emerging markets, and especially China, have been in focus, in part due to the substantial weakening of the CNY. Indeed, EM FX just had its worst quarter since 2011. However, worrying about emerging markets has started to become old hat (ie a consensus proposition), and as a result, some investors are mulling over whether to start accumulating EM assets once more.

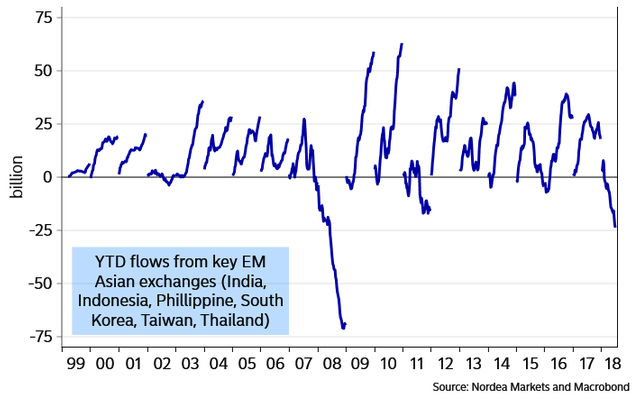

EM ASIA OUTFLOWS MIGHT PICK UP ON THE BACK OF CREDIT PAIN

While emerging Asia has seen equity outflows this year -- the worst situation since 2008 -- it risks spreading to debt products. The build-up in EM debt levels over the past decade remains concerning to many: EM corporate debt has tripled since 2007, and recent price action in the Asian credit space is worrying. If debt flows are truly turning away from EM Asia, this could be the end of the beginning rather than the beginning of the end (given the aggregated long position of recent years). For market participants wanting to ponder potentially positive game changers for EM, we published this thematic piece: Could spillbacks trigger a Buenos Aires accord?

CHART 2: EM ASIA EXPERIENCING EQUITY OUTFLOWS; ARE DEBT PRODUCTS NEXT?

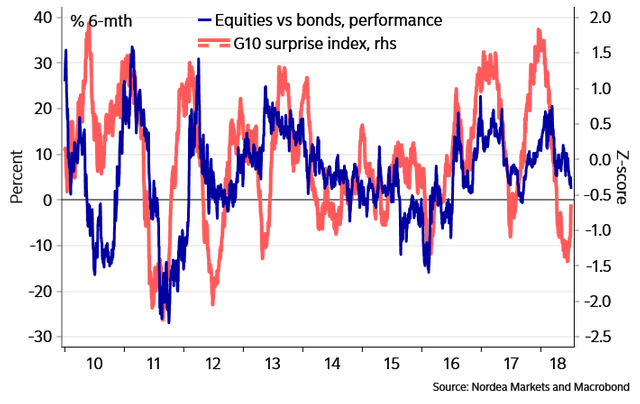

In Europe, activity appears to be stabilising, and the economic surprise index is heading higher after having been the worst within the G10 for 35 trading days in a row. This dampens near-term EA growth fears and is supportive of the idea that some of the setback in activity has been driven by temporary factors such as the inclement weather. European political risks also appear to be fading somewhat, even though Italy is sticking to its according to some "too expansive" budget plan. The recent improvement in the EUR surprise index has helped the G10 economic index rise, which is positive for risky assets.

CHART 3: G10 SURPRISE INDEX HAS BEEN HEADING HIGHER

ROCKY ROAD IS NOT ONLY A FLAVOURFUL ICE CREAM, IT'S WHAT TO EXPECT

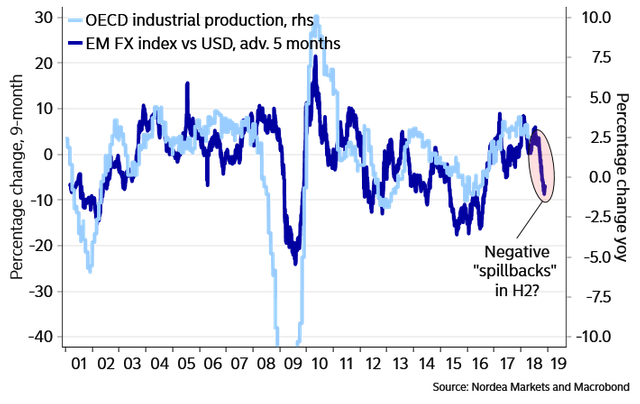

However, we will likely see negative spillovers on both the Euro area and the US from recent emerging market turmoil some time after the summer. For an explanation of spillovers and spillbacks, please see here. The combination of macro trends, liquidity risks and stretched equity valuations/margin expectations for 2019 should lead to a continued rocky road with higher volatility and a negative tilt for risky assets (see Nordea View). You might think such a rocky road would usually prompt central banks to turn a tad more dovish, but we believe higher inflation rates will prevent that.

CHART 4: EXPECT NEGATIVE SPILLBACKS ON DEVELOPED MARKETS AFTER THE SUMMER.

A lot of bond-positive news has recently been digested for the Euro area, however, and with a nascent lull in trade tensions and signs of improving Euro-area data, and ECB officials apparently unhappy with too soft pricing of the ECB, we think 10y swap rates should be ripe for a move higher. We expect the uptrend in 10y swap rates since the end of 2016 to remain intact (support seen at 85bp).

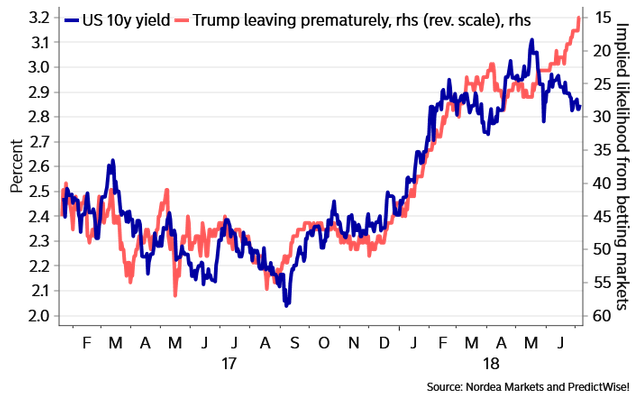

CHART 5: YIELDS SHOULD BE HEADING HIGHER AS PRESIDENT TRUMP WON'T BE LEAVING OFFICE PREMATURELY

THE DOLLAR WILL TRIGGER LOWER S&P500 EARNINGS FORECASTS

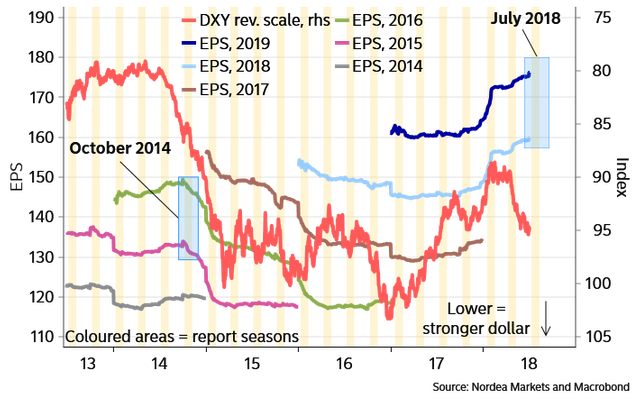

The US company report season for the second quarter is about to start. Earnings estimates have been revised markedly higher this year as a result of the US tax reform, underpinning equity indices in the process. The Q2 results will also likely be stellar. However, we argue the broader analyst collective may be missing something.

CHART 6: US EPS ESTIMATES TO BE PRESSURED BY THE DOLLAR

The general practice among sell-side analysts is to incorporate spot rates in medium-term forecasts. Since last updating their forecasts, the trade-weighted USD has strengthened by roughly 6%. As 40-50% of S&P500 revenues stem from abroad, the unhedged translation effect on 2019-2020 forecasts should be in the range of a negative 2.5%-3.0%. If companies remind the sell-side of this or sound more worried about trade, we may see volatility pick up**. **An even larger share of profits is created abroad for the FAANG equities: could the leadership of tech be threatened?

WHAT IS MOST IMPORTANT IN COMING WEEKS?

Politics are likely to remain important across global markets. First, will the tentative lull in trade tensions between the EU and US grow into something material, or will we see setbacks? President Trump seemingly played both good cop and bad cop with the North Korean leader only months ago, and something similar cannot be ruled out with regard to trade. One can only hope that Mr Juncker will still be welcome in Washington later in July.

Second, tensions have risen ahead of the NATO summit in Brussels (July 11-12), as the US President is not too happy with the low level of defence spending among several allies. Geopolitically parts of Europe are in a tight spot given a lack of military capability and a resurgent Russia, meaning strong US backing is required. But how do you square this with EU countries playing hard ball with Trump on trade? And does Trump support the idea of an EU army?

Third, President Trump will meet with Russia's President Putin in Helsinki (July 16) and are set to discuss a large range of topics from election meddling to nerve-agents to Crimea. The meeting might result in further signs that the Liberal world order is ending (a geopolitical Minsky moment, if you will), or it might not.

On top of such political events, we have the usual batch of macro culprits.

https://www.zerohedge.com/news/2018-07-09/nordea-warns-rocky-road-not-just-nice-ice-cream