Currency Analysis Report - 6/10/19…First Signs Of Cracks In The US Dollar

Lawmakers, business executives and economists have all tried to warn President Trump that his trade policies could hurt growth. On Friday, the government reported that employers added just 75,000 jobs in May, a fact that will be hard for him to ignore.

The increase was a far cry from what economists had expected and a fraction of the number of jobs created in April. The weakness was most evident in sectors that depend on exports, and analysts were quick to blame Mr. Trump’s tariffs on China and other countries.

The new data from the Labor Department also increases the likelihood that the Federal Reserve will cut interest rates, and is the latest sign that the economy is slowing.

So the significance of the weak US jobs report, leading to potential interest rate cuts is that investors will go and seek a higher return on another currency. This will cause investors to pull their money out of the US dollar, which means less demand for US dollars, resulting in the US dollar falling in price.

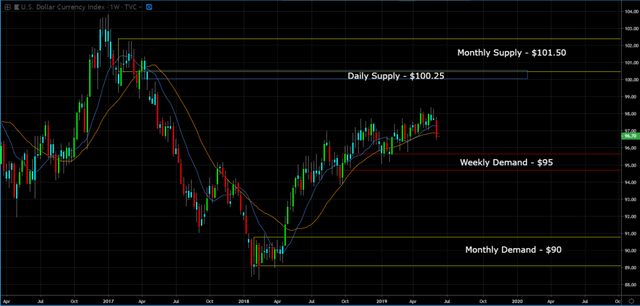

Nevertheless, the monthly chart is still bullish.

And the weekly chart is still bullish.

However, on the daily chart, price not only broke to the downside a major resistance/support line, but formed a daily demand zone as well for the first time in at least six months. Thus, the recent price action suggests further downside for the US dollar.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.