Forex $1 MM Challenge - Trade #10 (4-11-19) Sold EUR/SGD

At an ECB Press Conference yesterday, President Mario Draghi was shy about possible further stimulus to prevent the region from slipping into recession. He also talked about the additional risks to the EU if Trump moves forward with his tariffs on $11 billion worth of European Union goods.

Monetary Authority of Singapore measures the Singapore dollar against a basket of its counterparts, adjusting the pace of appreciation as necessary. Its decisions to tighten policy last year were spurred by rising inflation, underpinned by an improving labour market and robust economic expansion.

The take away is the Singapore dollar will potentially strengthen, while the Euro will potentially weaken. So the trade here was to short the EUR/SGD. Lets go to the charts for the details.

Monthly Chart (Curve Time Frame) - monthly supply is 1.6280 and monthly demand is 1.4750.

Weekly Chart (Trend Time Frame) – the trend is down.

Daily Chart (Entry Time Frame) – the chart suggests to go short at the daily supply at 1.5285.

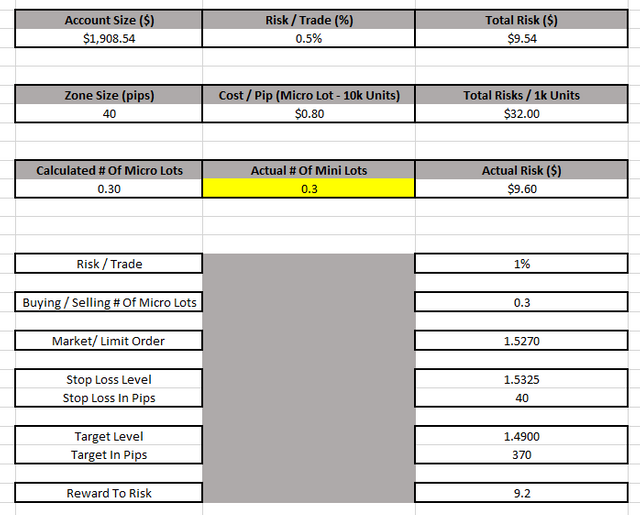

I wasn't in love with the supply zone structure, so only risked 0.5% on traded, but if we break the pivot low, I will be adding on to my position.

I was stopped out of trade 12 hrs later. All Euro pairs catching bids at this time.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

A million dollar challenge? It sounds too good to be true

I'm just going for singles instead of homeruns over the next 25 yrs.

@rollandthomas

Thank you for your reply.