Forex Price Action Baby, No Technicals or Fundamentals...1Q 2019 Review

Forex Price Action Baby, No Technicals or Fundamentals...Trade #9 - Sold EUR/CAD (3/6/19)

However, I was stopped out of the trade several hours later by one tick before price starting moving in my favor.

And price eventually hit my target.

Forex Price Action Baby, No Technicals or Fundamentals...Trade #7 - Bought USD/CAD (2/25/19)

I really must give my trades more of an opportunity to work out, as I'm risking only 10 pips and could have easily been stopped out. However, on the flip side, it means that my Reward to Risk are extremely high...if I can withstand the many stop outs. I'm sure over time I will find that happy medium.

Forex Price Action Baby, No Technicals or Fundamentals...Trade #6 - Bought CAD/JPY (2/21/19)

Last night I was stopped out by a tick...probably the spread took me out, before price reversed and eventually moved higher. The below chart shows the price action on the 1 min chart.

And price eventually hit my target.

Forex Price Action Baby, No Technicals or Fundamentals...Trade #2 - Sold NZD/JPY (2/3/19)

This was another trade, this time stopped out by 3 pips, before price hit my stop.

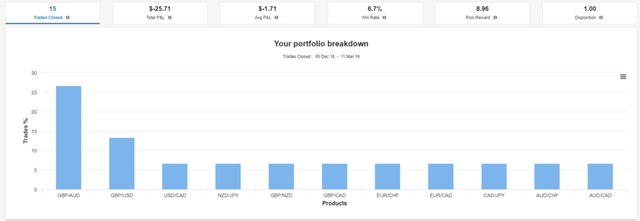

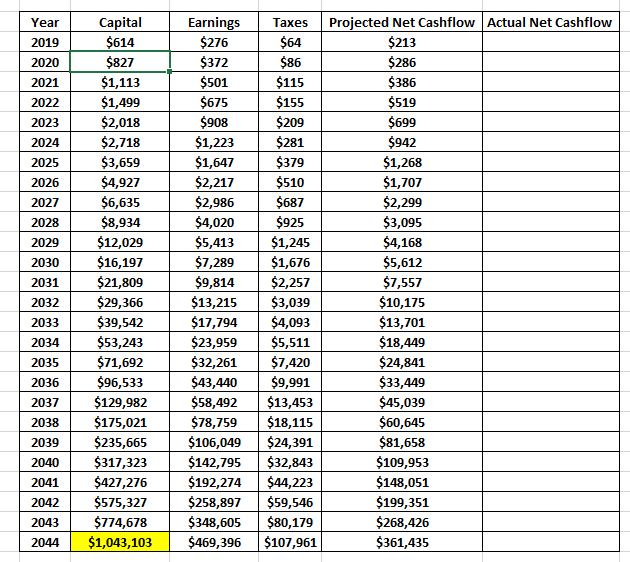

Thus, my performance for the first quarter can be breakdown into one table. 15 trades equating to a 7% winning percentage, but my account has been draw down by just 4%.

So what's the lesson from the first quarter...to increase my stops by 10 pips to give my trades a chance or working. If I had done that, the account would be up 8% instead of down 4% and I would be on target to achieve my annual goal of $276. So lets see if the simple adjustment of adding 10 pips to my stop gives me better results in the second quarter.

This post is my personal opinion. I’m not a financial advisor, this isn't financial advise. Do your own research before making investment decisions.

The most frustrating thing for sure, but it is the best way to trade, could you perhaps let the stop loss go to the previous days high considering the movements you make are on supply and demand from daily chart movements (that's a lot of pips) how long do you aim to hold the trade for? If it's intraday you are sitting perfectly in my opinion. A larger timescale would warrant allowing room for a larger movement against you. You must read my last post about being on the wrong side of the trade!

Posted using Partiko Android

hi @rollandthomas,

It's great to see your trades and analysis, that really helps to make better trades in the future. I'm also forex trader and right now waiting for market open.