PWN Stars: The Benjamin FRANKlin Bacon POSTcards | History: Celebrity BONDs - Buy Some Ignorant Art!

"Don't give'em anything man... Trade, TRADE. YEAH! That's what real artists do with each other, besides he'll just use you man. He's famous for it." ~SICARIO

Celebrity bond

From Wikipedia, the free encyclopedia

A celebrity bond is commercial debt security issued by a holder of fame-based intellectual property rights to receive money upfront from investors on behalf of the bond issuer and their celebrity clients in exchange for assigning investors the right to collect future royalty monies to the works covered by the intellectual property rights listed in the bond. Typically backed by music properties, the investment vehicle was pioneered in 1997 by rock and roll investment banker David Pullman through his $55 million David Bowie bond.

Contents

- Background

- Bowie Bonds

Background[edit]

While a celebrity bond can cover any work of art whose future royalties are based in part on a widespread reputation of the creator of the work, celebrity bonds often are music-based celebrity bonds. For a music-based celebrity bond, the issuer seeks to put together intellectual property rights of one or various artists to "songs that have stood the test of time," typically "top-40 greatest hits across genres from jazz to rap to rhythm and blues." In addition to getting money upfront, artists additionally retain ownership of their work and do not have to pay tax on what the IRS considers a loan, since yet-to-be received royalties are re-characterized by the bond agreement as loan interest and principal payments. The artists also passes on the risk to investors that the works backing up the celebrity bond will lose their appeal, where the investors are in a better position than the artist to assess such a risk.

Bowie Bonds[edit]

Bowie Bonds are asset-backed securities of current and future revenues of the 25 albums (287 songs) that David Bowie recorded before 1990. Bowie Bonds were pioneered in 1997 by rock and roll investment banker David Pullman. Issued in 1997, the bonds were bought for US$55 million by the Prudential Insurance Company of America. The bonds paid an interest rate of 7.9% and had an average life of ten years, a higher rate of return than a 10-year Treasury note (at the time, 6.37%). Royalties from the 25 albums generated the cash flow that secured the bonds' interest payments. Prudential also received guarantees from Bowie's label, EMI Records, which had recently signed a $30m deal with Bowie. By forfeiting ten years worth of royalties, Bowie was able to receive a payment of US$55 million up front. Bowie used this income to buy songs owned by his former manager....

The Bowie Bond issuance was perhaps the first instance of intellectual property rights securitization, a financial practice of pooling various types of contractual debt such as residential mortgages, commercial mortgages, auto loans or credit card debt obligations and selling said consolidated debt as bonds, pass-through securities, or Collateralized mortgage obligation (CMOs), to various investors...

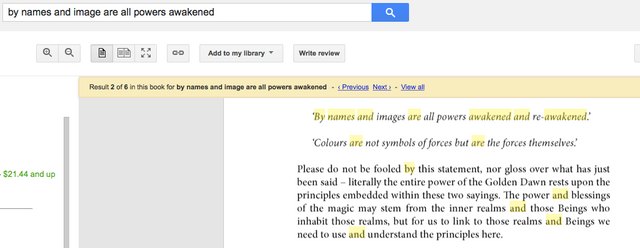

By names and images are all powers awakened, and re-awakened.

.