Bearish on GOLD Precious Metal

SUMMARY

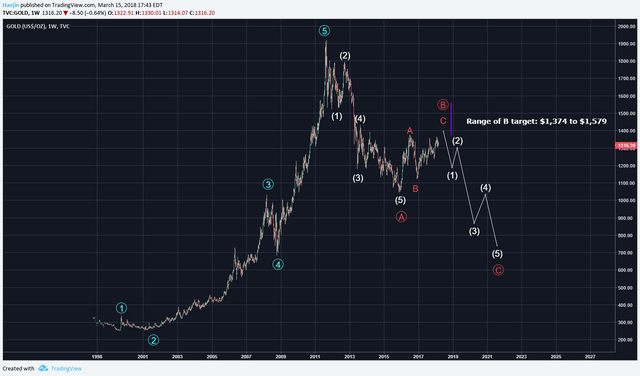

While I believe having a bag or two of Gold and Silver as well as Numismatics is a good core position hold constant, my analysis is bearish on Gold. The below is a long term weekly chart of GOLD. The Blue Elliott Waves show a distinct five waves motive up which peaked in August of 2011. Since Elliott Waves states that after a five wave up impulse sequence, there must be a retracement in the form of an ABC (ZigZag or Flat), Triangle or Combination. I believe the retracement is likely in the form of a ZigZag (5,3,5) count. The white subwaves of red cirecled A counts to five. Price is currently completing the three wave ABC for the red circled B wave. And since C waves always have five subwaves, the 5,3,5 sequence is satisfied thus far. The range of the red circled B is estimated to be in the range of $1,374 to $1,579. Once complete, the ferocity of the final red circled C wave down could be quite deep and thorough.

Close look at the daily chart shows that the red C of red circled B could be tracing out the Ending Diagonal which is quite befitting for the C wave of an ABC. The blue subwaves 1,2,3,4,5 show that five is the only wave the remains incomplete. Once the Ending Diagonal finishes, the downdraft that starts the final red circled C wave down could get quite scary.

Legal Disclaimer: I am not a financial advisor nor is any content in this article presented as financial advice. The information provided in this blog post and any other posts that I make and any accompanying material is for informational purposes only. It should not be considered financial or investment advice of any kind. One should consult with a financial or investment professional to determine what may be best for your individual needs. Plain English: This is only my opinion, make of it what you wish. What does this mean? It means it's not advice nor recommendation to either buy or sell anything! It's only meant for use as informative or entertainment purposes.

Please consider reviewing these Tutorials on:

Elliott Wave Counting Tutorial #1

Elliott Wave Counting Tutorial #2

Elliott Wave Counting Tutorial #3

Laddering and Buy/Sell Setups.

Laddering Example with EOS

Tutorial on the use of Fibonacci & Elliott Waves

@haejin's Trading Nuggets

Essay: Is Technical Analysis a Quantum Event?

Follow me on Twitter for Real Time Alerts!!

Follow me on StockTwits for UpDates!!

--

--

And what would be your opinion on Silver?

It formed a massive 20yr cup and holder pattern.

I HAVE COFFEE CUPS!!!

If You Would Like To Help STOP #HAEJIN Please Visit @FlagAWhale.

#haejin #abuse #steemit-abuse #flagadonkey #flagawhale #rewardpoolrape

I wonder where all the gold money will go to...hmmm...very interesting...

Great post. they say that the people who are most successful are those who are doing what they love.

I LOVE SEX!!!

Any girls here with big boobs?

SILVER SILVER SILVER !!!

I like the idea of hodling silver. It just makes a lot of sense. Shoutout @haejin..

Upvote this comment if you appreciate this service.

Reply "REMOVE" if you do not want this comment displayed on your post

^--- You made this exact same comment at least 6 times in the last 6 hours. View these duplicate comments

Upvote this comment to support @duplibot and help reduce spam and superfluous comments.

REMOVE

interesting analysis I hope to be able to recover a money that I have lost, thanks for the help.

Useful! I subscribed, I hope for reciprocity. Offer for everyone! Checking subscriptions every other day

^--- You made this exact same comment at least 92 times in the last 6 hours. View these duplicate comments

Upvote this comment to support @duplibot and help reduce spam and superfluous comments.

great post .thank you

Very interesting post!!!