Global Risk Exchange "by selling risks - you get rid of the risk"

Friends - not so much time has passed since my last review, but I again have to tell you about another significant event in the world of the blockchain, which I could not ignore. Decentralization is rapidly changing our existing financial system for the better, bringing a lot of positive points and modifying the outdated standards. This overview will be mainly interesting for people who are somehow connected with risks and are ready to work with them, including buying and selling. In fact, this applies to us all, since we all use insurance companies, we try to benefit in advance until the risk has not yet occurred. Some of us have traded on stock exchanges and are familiar with stock trading not by hearsay, but many of us don't heard the word trading, stock exchange, futures, and even more so the purchase and sale of risks. I will try to put everything in its place.

So, more recently, more precisely on May 20, 2018, sales of the company started GRE Global Risk Exchange - the world's first platform for risk sharing on a decentralized basis. What is decentralization and what it gives pluses I do not need to explain to you. Sales went exactly 4 days and on May 24, 2018, all tokens worth 10,000 ETH were sold to 1414 investors. After such overwhelming sales, the interest in such projects is increasing at times and those who were not familiar with the project are beginning to study it. After all, crypto investors know where to invest the money and what will be the benefits after that.

Risks in the modern world

Global Risk Exchange is a platform for risk sharing, built on a decentralized basis, to help people and companies protect their risks, trade and manage them. Risks are a rather complex concept, which can not always be described in simple words. One of the most common ways to trade risks and protect against risk is hedging - trading in financial instruments, futures, options, etc. Platforms providing the ability to trade and manage risks are quite numerous, but they are all centralized and devoid of the many advantages of decentralization.

A person who at least once bought and sold futures is familiar with the notion of risk. He can answer the question of how to trade risks and what is the point. A person who first plunged into this sphere is lost and does not immediately understand what's what. For example, when a person comes to brokers to open an account, they tell him that he will buy shares, currencies, futures, but nobody tells him that he will work with risks as a trader. The risk can be sold or bought cheaply or expensively.

There are a lot of risks, but we do not always think about them. For example, a farmer insures his crop from weather conditions without knowing whether the drought will be or not already preventing losses by concluding a contract with the buyer of risk and negotiating all the conditions in advance. In case there is no drought - the farmer sells the crop, only paying the cost of selling the risk and the amount stipulated in the contract and remains in the black. If the drought does happen, the farmer receives a reward for insuring the risks from the buyer and also remains in the black.

You can consider another example of insurance risks, when you are afraid that the value of the assets you bought will change for the worse and this makes you every hour to find out the value of your assets and worry, then you can easily insure them, thereby reducing your risks.

Selling your risk is one way to get rid of the risk

There are a lot of platforms that provide the opportunity to trade and manage risks, they are exchanges or insurance companies, but they are all centralized and do not have many advantages of decentralization. Let's compare them:

- The existing centralized products are of the same type and lack diversity. They can not meet the different needs of people in risk management. Because of obsolete forms and tools, insurance companies, being the only alternative, are pursuing their own pricing policy. Using a decentralized GRE platform based on graphene and Bitshares, everyone can realize their risks using their own rules.

- The existing insurance business system is based on a pyramid structure with the main center at the top and branches below. Because of this, in the end, the end user must pay more to provide all the necessary costs and maintenance of the pyramid hierarchy. There are no such problems in decentralization. GRE offers an exchange that uses smart contracts and has no extra middlemen.

- The structure of insurance companies is bloated and bureaucratic, which makes it difficult to make decisions quickly, under the ever-changing market. Because of this, overall performance is greatly reduced. Transactions used on GRE exchange are carried out very quickly and reliably since the block data structure has advanced technologies and high reliability.

- The big problem in the existing system is the confidentiality of market participants. In the case of an insurance company, all information about the client is stored in the insurance company's database and can easily be stolen and compromised. Again, our decentralization comes to our aid, which can not be falsified or modified, since there is no single information center.

- When insuring contracts, insurance companies often knowingly hide the full terms of the contract. Insurers also often deceive insurers in their own interests. Thanks to a full-featured platform for selling GRE risks, this is excluded. Everyone can be sure of the veracity of the information provided by each party.

This is only a small part of the differences that exist when comparing centralized solutions for the sale of risks and the decentralized exchange of GRE.

Global Risk Exchange

So what else helped to collect the hardcap for 4 days, apart from decentralization and undoubtedly a great idea to organize the sale of risks using smart contracts. One of the underlying reasons is the working MVP for risk exchange. Of course, the team is still working on the implementation of a full and trouble-free system, now it's a working one, but not a full-featured exchange. So far, only some risk contracts have been presented, including contracts for BTC, ETH and XRP. You can view the MVP by going to link or by downloading the mobile app here.Judging by the roadmap, the system will be completely ready by the beginning of 2019 and then different languages will be available, many contracts and additional improvements. At the moment you can follow the development of the platform on the site github. Undoubtedly a huge contribution to the development of the success of the token sale contributed the team and advisers who deserved such high trust for a long time working in the financial, insurance and IT industries.

- Among the advisers, there is Chia Hock Lai from the Singapore association FinTech. He has more than 20 years of experience in the financial industry, has graduated from the National Institute of Singapore, Nanyang Technological University, and Nanyang Polytechnic University. He is the president of the founder of FinTech, a member of the Singapore University of Social Sciences and a start-up advisor;

- Alberto Pedro Gabriel - founder and director of Segurarse.com, is also chairman of Cruz Suiza;

- Frank Desvignes - founder and director of Axa Asia Innovation Lab;

- Kazy Hata - founder and director of justincase and startup insurtech in Japan;

- Li Jun - director of Yibite.

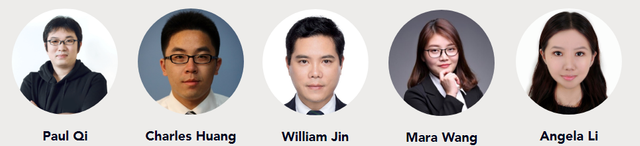

- The leader of the team is Paul Qi - the founder and director of OK auto insurance, also has a great influence in the global insurance industry;

- Charles Huang - manager for investments in IDG capital fintech, fintech and Enterprise Service entrepreneurs;

- William Jin - technical leader in Shanda, is also co-founder and director of OK auto insurance;

- Angela Li - master of Finance at the University of Fudan, also has a 3-year experience of investing in start-ups;

- Mara Wang - international MBA in NEOMA Business School.

token RISK

When buying RISK tokens, investors looked to the future. This ERC20 ETH-compatible token has an initial price of 0.00001 ETH and is well suited as a long-term investment, since all transactions conducted during risk exchange will pay commission in RISK tokens. Also, the token has the following features:

- all natural or legal persons can share contracts on the GRE platform and attract new customers for trading. In the future, they will be rewarded for the transactions of their clients;

- all natural or legal persons, when creating contracts, will receive remuneration, depending on the volume of transactions;

- the community will reward developers with the RISK token for their contributions;

- all operations under the risk management contract on the GRE platform will use the RISK token and when the contracts are negotiated the token will also be used;

- exchange dealers on the GRE platform can risk as collateral for issuing tagged tokens, such as GRE.USD or GRE.CNY. This mechanism is similar to BTS and BITUSD in Bitshares ecosyetem.

Conclusion

Undoubtedly launching such a platform for risk management will play a positive role in the financial system as a whole. More transparent transactions are guaranteed to attract many customers who have not yet found the right site and are afraid to work in centralized systems. I also think that centralized systems should be thoughtful and begin to change in order to catch up with the rapidly developing market of risks.

The GRE development team is rapidly improving its platform, clearly fulfilling the conditions of the roadmap. And there is no doubt that by the end of the year we will see a massive shift from centralized exchanges to the Global Risk Exchange. Do not forget that there are always risks and you can resell them to reduce risk.

Official site - https://www.gref.io

Bitcointalk ANN - https://bitcointalk.org/index.php?topic=3178591.0

White Paper (eng) - https://shimo.im/docs/z3hxFLzpYVgxj1SB

Telegram - https://t.me/GREF_EN

Author:

Bitcointalk - lesnik_utsa

Telegram - bullsandbears

This publication is informational in nature. The article should not be seen as an investment recommendation or advice. Readers of this review article must make decisions based on their own judgments, taking into account financial circumstances, investment objectives and the risk limit before investing funds.

Excellent article, the author has studied the project well. Thank you

The article is written correctly, the design-gorgeous!

Проект привлекательный, стоит рассмотреть его для своего портфеля

Interesting project, I will participate. Thanks to the author!

Read to the end, an excellent project!

The project clearly deserves attention. The article is simply super. It has all the necessary information. To the Author of the Good! Thank you for the excellent information!

Interested in the project, thank you for the review bro!

Excellent author! I was just looking for a place to invest.