EOS: The State of Current Technology & RAM Trading

EOS is the software that introduces a blockchain architecture that is designed to allow vertically and horizontally of the distributed applications. This is achieved by creating an operating system structure like these applications can be built.

The EOS provides accounts, authentication, databases, non-sync communications and scheduling applications on hundreds of cores or CPU clusters. The EOS is a blockchain technology that has a percentage of millions of transactions per second, removes usage fees and allows for easy deployment and rapid allocation of applications. The technology of the EOS is a blockchain structure capable of expanding to millions of visits per second, eliminating the use fee and allowing the deployment of quick and easy allocation of applications.

The EOS is a project developed by Dan Larimer, a design and technical expert of Steem. The EOS will allow similar smart contracts with Ethereum but with performance and better scalability capabilities.

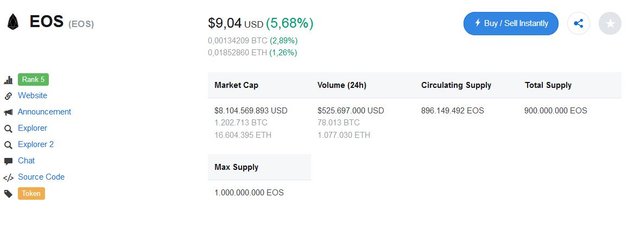

EOS is a blockchain technology platform that revolves around the use of EOS tokens. EOS tokens were launched this past summer after a successful ICO. Today, the token has a market cap of over $800,000,000,000 USD, putting it in the top 5 cryptocurrencies by market cap.

The EOS is a project developed by Dan Larimer, a design and technical expert of Steem. With the EOS, we will be able to add similar smart contracts to ethereum but with better performance and scalability.

The EOS system provides account users, authentication, databases, non-sync communications and programming applications across multiple CPU cores or the CPU. The EOS coin technology is a blockchain structure, which is capable of extending to millions of visits per second and removes the use of charges, enabling the deployment of quick and easy allocation of applications.

The EOS is a crypto located in the top 5 first electron coins under Coinmarketcap. The EOS is a platform that has a structure of a blockchain that is capable of extending to millions of visits per second, eliminating the use fee and allowing the deployment of quick and easy allocation applications.

The price of EOS is 9 USD/EOS, volume 24h is 500,000,000$, total market is 7M $. This is a huge number.

We can trade EOS in Huobi Pro – 3rd digital exchange with EOS/USDT, EOS/BTC, EOS/HT, EOS/ETH.

Sign up an account on Huobi Pro by this link

View the video at

Delegated Proof-of-Stake

Delegated Proof of Stake (DPOS) is the fastest, most efficient, most decentralized, and most flexible consensus model available. DPOS leverages the power of stakeholder approval voting to resolve consensus issues in a fair and democratic way. All network parameters, from fee schedules to block intervals and transaction sizes, can be tuned via elected delegates. Deterministic selection of block producers allows transactions to be confirmed in an average of just 1 second. Perhaps most importantly, the consensus protocol is designed to protect all participants against unwanted regulatory interference.

Not only is DPoS a more democratic system, it is also more efficient and effective. The selection of block producers allows for the transactions to be validated in a matter of seconds, rather than the 10 minutes it takes the proof of work system employed by Bitcoin. For example, in the case of Lisk it currently only takes 10 seconds to validate a block of transactions.

Delegates are incentivized to run the nodes that process and validate the transactions going through the network with transaction fees, as well as monthly rewards for maintaining the network that, with time, are gradually reduced. There can only be a certain number of delegates at any one time (101 for Lisk) and those are determined by a competitive election system, wherein each and every Lisk holder can cast a vote for their preference to fill that role.

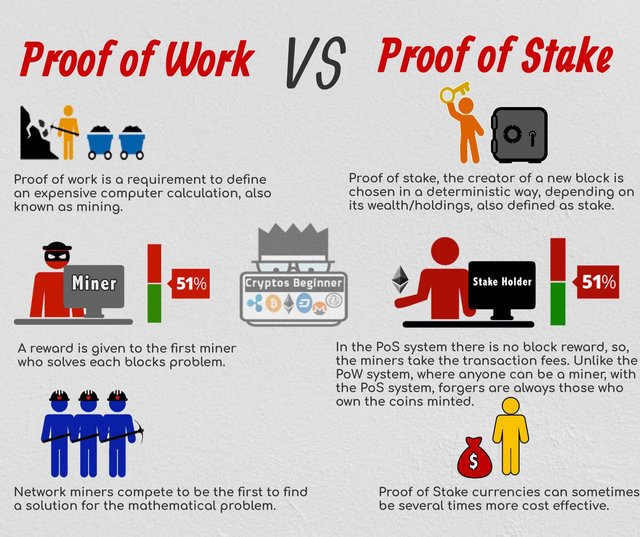

Proof of work vs Proof of Stake

What is the Proof of work?

Proof of work is a protocol that has the main goal of deterring cyber-attacks such as a distributed denial-of-service attack (DDoS) which has the purpose of exhausting the resources of a computer system by sending multiple fake requests.

The Proof of work concept existed even before bitcoin, but Satoshi Nakamoto applied this technique to his/her – we still don’t know who Nakamoto really is – digital currency revolutionizing the way traditional transactions are set.

In fact, PoW idea was originally published by Cynthia Dwork and Moni Naor back in 1993, but the term “proof of work” was coined by Markus Jakobsson and Ari Juels in a document published in 1999.

But, returning to date, Proof of work is maybe the biggest idea behind the Nakamoto’s Bitcoin white paper – published back in 2008 – because it allows trustless and distributed consensus.

What is a proof of stake?

Proof of stake is a different way to validate transactions based and achieve the distributed consensus.

It is still an algorithm, and the purpose is the same of the proof of work, but the process to reach the goal is quite different.

Proof of stake first idea was suggested on the bitcointalk forum back in 2011, but the first digital currency to use this method was Peercoin in 2012, together with ShadowCash, Nxt, BlackCoin, NuShares/NuBits, Qora and Nav Coin.

Unlike the proof-of-Work, where the algorithm rewards miners who solve mathematical problems with the goal of validating transactions and creating new blocks, with the proof of stake, the creator of a new block is chosen in a deterministic way, depending on its wealth, also defined as stake.

No block reward

Also, all the digital currencies are previously created in the beginning, and their number never changes.

This means that in the PoS system there is no block reward, so, the miners take the transaction fees.

This is why, in fact, in this PoS system miners are called forgers, instead.

What is RAM Trading?

On the EOS network, RAM is mostly used by developers to store the data used in the launching and production of decentralized applications. There are speculations that a new issue is added to the list of other EOS problems. EOS is offering buying and selling of RAM which is another source of guesstimate while the token’s market price is stagnant.