Iconiq Holding – A revolutionary ecosystem for both businesses and investors

Introduction

Hi Guys, So time for another ICO review. I will be discussing German-based “Iconiq Holding” today. I came across this project recently and I have to say it seems like an amazing opportunity. Basically, it is a digital asset management ecosystem, something which I feel is badly needed in the space. This article will look at the whitepaper in depth and examine if this ecosystem is as good as I have been led to believe.

Iconiq Holding is the project behind the world’s first decentralised Venture Capital (VC) group- “Iconiq Lab”, according to Sudhir, A. (2018). There is also another platform called Iconiq Funds built into the ecosystem which will provide investors with a more diversified exposure to blockchain based investments. I understand the Iconiq Lab team are headquartered in Frankfurt and have recently opened offices in New York and London, they also have a plan to open an Asia office in q4 2018.

I also believe they are part of the “Gibraltar Blockchain Exchange” (GBX) which gives them a lot of substance in my view. This Iconiq ecosystem operates via their utility token- “ICNQ token”, which is an ERC-20 token. I believe the token acts as a membership token and is used for services on the ecosystem. According to their whitepaper, holding the token gives exclusive access to their “labs” where one can get access to new ventures within their accelerator. Also, holders can take part in “share classes” and get involved with investments across PIFs, ETNs and ETFs via the Iconiq Funds platform, these are being developed at present. What really interests me is that these funds will all pay their management fees via ICNQ tokens, and the platform will allow portfolio managers to operate on the ecosystem.

Overall, I chose to write about this project because of a quote I heard from the managing partner of Iconiq Holding- Maximilian Lautenschläger who stated that their “aim is to make ICOs/investments available to institutional investors, family offices and retail investors” (Prnewswire.com, 2018). Essentially this ecosystem in my view has been designed to attract mainstream investors to the crypto space. As you all know, I tend to write about projects at the coal face of pushing for mass adoption to this space.

Before we start please check out this great short introduction video from the team:

https://www.youtube.com/watch?time_continue=8&v=BsQ_bUsqAVU

Source: YouTube, (2018)

The problem

From reading the whitepaper, it is easy to comprehend the problem which they aim to solve. As we all know we operate and trade in a very volatile space, which often falls prey to scams and bad practices and to date which is not regulated. Iconiq Holding aims to bridge the gap which exists between traditional investment means and the cryptocurrency economy. It has always been my view that in order for mass adoption to come to the cryptocurrency sphere change needs to occur. This change will come by attracting more mainstream investors to this space, and these will only enter when there is some form of secure structure in place. This space is still the wild west and until that changes, these investors/traders won’t come.

An ecosystem such as Iconiq Holding is such an example of a project which will change the way in which we operate. They will bring trustworthiness into this space via “traditional” trading vehicles such as ETFs and ETNs. The biggest problem today in the cryptocurrency world is that there are no “professional management systems” in this space. Surely this could be the answer this space requires.

The solution

The solution Iconiq Holding provide is their ecosystem, which is made up of 2 main platforms currently. The Iconiq Lab platform was launched in 2017 and gave us the world’s first decentralised VC club. The Iconiq funds platform will be launched in 2018 and will bring professional asset management into this space. This ecosystem will give companies a professional medium to launch their start-ups and open them up to “quality investment opportunities” via their VC club.

The Iconiq Funds platform integrates data from the many markets, tracks trades and utilises custody, auditing and compliance tools to provide us with a truly structured investment platform, which will give us access to these highly sought-after investment vehicles (ETFs & ETNs). Token holders will get exclusive rights on the ecosystem such as presales on projects at reduced fees. They also have a loyalty programme which distributes to long time club members to attract people.

So, in short, it is the ecosystem itself which brings the solution to this space. This in my view will bring in the masses to this space.

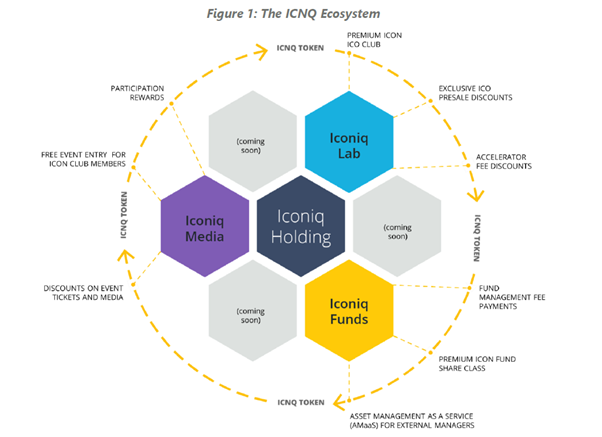

The ICNQ Ecosystem

Source: Iconiq, (2018).

The ICNQ token is central to the ecosystem. For example, if I hold the tokens then I gain exclusive access to Iconiq Labs and Iconiq Funds. I could also redeem the token as a voucher for services on the ecosystem. The Iconiq Media platform is another platform which I will not discuss but it publishes the weekly “Unbloqed podcasts”, according to Iconiq, (2018). We can also see they have 3 more application slots to be filled.

What I like about this ecosystem is that they incentive people to hold the token and the token has a real use case on the ecosystem. They also implement token burns to keep supply constant, this combined with the rewards system makes this a worthwhile token to hold. According to Iconiq, (2018), users are incentivised to hold through the ICNQ club membership process. There are 2 different types:

ICNQ membership: If one holds 1 or more tokens they gain access to public presales. This gives access to Iconiq Lab accelerator program graduates; however, the whitepaper does state that participation will be pro-rated against one's ICNQ holdings, thus incentivising one to hold more tokens. Also, members get access to Iconiq events and some other benefits.

ICON membership: You need to hold 100,000 or more tokens to get full membership benefits and premium access to Iconiq accelerator graduates with the added benefit of being able to negotiate your investment amounts. Furthermore, according to the white paper, they can subscribe to ICON share classes on index funds and receive reduced management fees.

According to the whitepaper, token demand will be driven by ecosystem growth. Fees are paid by companies using the accelerator after their token sales. Funds using the ecosystem also pay management fees in ICNQ tokens. These fees will increase with growth thus keeping a high demand for holding the tokens. Also, as previously mentioned, 10% of ICNQ tokens which companies receive back as redeemed vouchers will be burned quarterly. This will gradually limit ICNQ tokens and make club membership more exclusive and appealing.

According to Iconiq, (2018) loyalty rewards will also be central, to encourage engagement on the ecosystem. For example, I believe that long time club members will be rewarded and they will also reward those who make it to ICON membership. Also, assets managers will be rewarded as they meet milestones and users will be rewarded for using the Iconiq media platform. As we all know, people will use a platform more when they can benefit from it. I believe this will be a very popular ecosystem based on all of this.

What is Iconiq Labs?

Source: Iconiq, (2018).

This is one of the most appealing platforms in this ecosystem and perhaps the one which made me write this article. According to Iconiq, (2018) the lab platform was named a top 3 German accelerator program. For those of you who don’t know what an accelerator program is, they are basically platforms from which business can launch their own projects from, essentially providing a service for business wishing to conduct an ICO.

With Iconiq labs we get the worlds first decentralised venture capital club. This gives users of Iconiq the chance to invest in some of the most promising new projects entering the space at the lowest possible prices via their pre-sale feature. The accelerator provides business with the tools and guidance they require to succeed, but they must offer tokens to Iconiq investors as a condition of use.

Another element to this which has instilled confidence in me is that the Iconiq labs accelerator programme is hard to get into. According to their whitepaper, they have had 500 applications since starting and to date, only 9 have been vetted and approved to use the platform. Once a business gains access to the programme they are progressed through a 5-stage procedure:

- Sourcing & due diligence

- Acceleration & ICO service package

- Exclusive presale opportunity to ICNQ club members

- Public graduate ICO launch

- Post ICO financial & milestone reporting

Furthermore, Iconiq has invested 1 million dollars into these 9 companies ICO development, according to the whitepaper. This shows me that the team is ensuring only the best gets in. I am personally sick of all these new ICOs raising easy capital from inexperienced “investors”. Most ICOs today are nothing more than off the shelf start-ups and many have no vision, and an even greater percentage will fail, as is the norm in the normal world. At least with Iconiq labs, we are insured these businesses are vetted.

Furthermore, the Iconiq labs team are out there engaging with businesses and fortune 500 companies offering blockchain consulting services. Also, this team has the same vision I do when it comes to tokenisation. They see that the emergence of tokenised securities as an eventuality, I have written about this before, it is going to happen on large scale. Iconiq Labs will be at the forefront of developing this for businesses using its accelerator programme. They state in their whitepaper that they are in the process of obtaining the required licenses to do so in Europe and the US already.

As mentioned above already, holders of the ICNQ tokens get exclusive access to invest in ICO’s which graduate the Iconiq labs accelerator programme. In my view, this could be a million-dollar opportunity for somebody to get an early seat at the table for when they eventually start delivering security token ICOs for companies.

Iconiq, (2018) tells us that FinLab AG (German fintech company builder & investor) made a strategic investment in 2017. They collaborate on the management of a 100 million-dollar EOS venture fund. Iconiq lab carries out the due diligence for investments. Iconiq lab also raised 2.5million dollars with ICNQ token sales already. This instils even more confidence in me.

You can check out their whitepaper to see current projects using the Iconiq lab accelerator. However, they state that their aim is to offer 2/3 quality ICOs per month with an overall target of 20-25 per year, as described by Iconiq, (2018). I feel the ultimate aim is to capture large fortune 500 companies and be the vehicle for their ICOs, these would most likely be funds similar to an IPO (exceeding 100m). I believe that 2019 will be the year when this comes to fruition, as they are obtaining licenses to tokenise financial instruments as we speak.

What is Iconiq Funds?

Source: Iconiq, (2018).

As mentioned in my introduction, this is a platform which will allow investors to diversify their investments across many types of investment vehicles. This platform will house investment funds with the first being the “Maltese professional investment Fund (PIF), in Nov 2018, according to Iconiq, (2018). Iconiq further tells us these PIF funds are open to professional investors. They have also engaged BITA to act as a digital index company on the platform. I believe the competitive advantage of doing this, will ensure price action is tracked better than anything else out there, making this platform the go-to place for market information.

The way this will work is, Iconiq Funds will license out the platform to asset managers, this will attract a lot of new entrants as barriers to entry are lowered. They can register with the relevant regulatory authorities and they can gain access to an ecosystem of like-minded professionals. This will provide managers with a more cost-effective way to manage their system and provide an in-depth reporting programme for them.

Icon Funds provides the “Icon vault “to provide a safe working environment for these people. The whitepaper states it is a mixture of cold/hot and multi-sig wallets. There will also be an aggregated order book for managers to make management more streamlined across exchanges. I think the platform will automatically search exchanges and create best cost/sell data for the manager. This is amazing as I feel it will take away a lot of the administrative side of things which is the norm in the process at present.

According to Iconiq, (2018) they will launch ETNs and ETFs in 2019. They envisage a crypto sphere full of “fortune 500 debt & equity issuances” further down the line. This is a project with a true long scale vision. This vision in my view will make them the leading digital assets management platform out there. To begin with, this will be offered to high quality and vetted digital asset managers in Q2 2019.

Token Sale

What is great about this project is that the team have already raised a lot of their funds via presales. According to their whitepaper, In April 2018 a finite 20m ICNQ tokens were minted, 4.1 million of these tokens have already been sold in these presales which have raised 2.5 million euro. The ICNQ token is also already trading on IDEX.

This raised capital was since put to use in the Iconiq lab accelerator programme which I spoke about above. The current private sales period will be closed in Nov 2018. The aim is to reach a hard cap of 10 million euro via the remaining 10 million tokens.

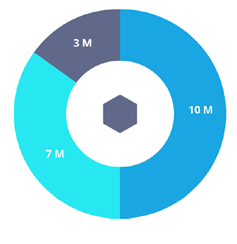

Token distribution

Source: Iconiq, (2018)

- 10 million tokens will be sold to reach the hard cap of 10million USD. Of this, 500k will be sold in GBX (Oct 29th) which will allow the token to be traded straight after on GBX. In the whitepaper, they state the trading pairs will be in both fiat & Crypto. So, we get another exchange listing. Of this 10 million, 500k further tokens are set aside for bounties. The team also retain 1 million of these.

- 7 million tokens were set aside for the presale phase, however, only 4.1 million of these were sold and the team burned the remaining 2.9 million.

- 3 million tokens were bought by the team and advisors in 2017, which are vested for 12 months.

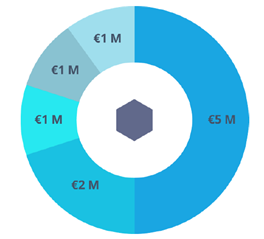

Use of funds

Source: Iconiq, (2018)

- 5m for a pool to aid the accelerator programme with expenses.

- 2m to scale the accelerator internationally.

- 1m for marketing.

- 1m for finance/legal expenses.

- 1m for launching new business.

Token Economics

When I consider a new project, I have to make sure the cryptocurrency I am buying has a real use. I have talked about this time and time again, there are so many projects out there which are just riding the ICO bandwagon to raise easy capital. Iconiq Holding is another example of an ecosystem project with a true use for their token.

The ICQN token is an ERC-20 token. Smart contracts will ensure members can partake in the graduate presales on a pro-rata basis. This smart contract has been audited by solidified.io, according to Iconiq, (2018). This fact has given me a lot of confidence in the ecosystem.

In fact, the ICNQ token is central to the entire Iconiq Holding ecosystem. Users secure memberships with them and use them for voucher discounts for services/products. The quarterly 10% token burns on redeemed vouchers discussed earlier aid the price stability. Alongside the loyalty program rewards we discussed earlier, here are some more uses of the ICNQ token:

- The token gives investors access to Iconiq Lab's presales, thus giving them the largest discounts. As previously mentioned this is pro-rated against ones holding and holders of more than 100k euro worth have premium rights. Businesses who join the program can pay their fees at a reduced cost via the ICNQ token.

- The token gives access to Iconiq Funds investment vehicles. All fund management fees and platform fees are paid in the ICNQ token.

- The token gives access to Iconiq media. Premium members (<100k) gain free entry to all events. All members get discounts via redeeming ICNQ voucher tokens. Also, listeners of their podcasts get rewarded.

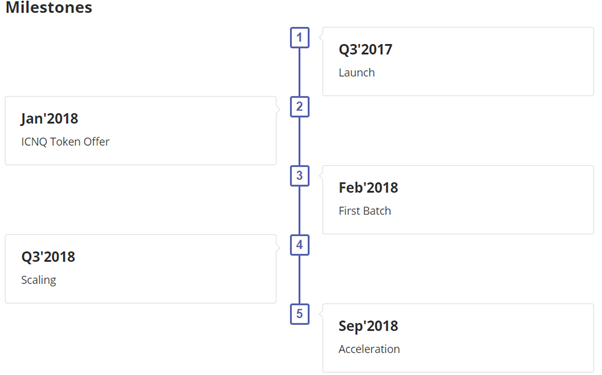

Roadmap

(ICObench, 2018)

As can be seen from the above roadmap, this is a project which is pretty much progressed nicely to date. It is very rare that we find a project which is so far along its roadmap at the ICO time. People always speak about MVP when considering ICOs to invest in. This is an example of a project which has already delivered and is seeking funding to get it over the finish line.

Conclusion

Overall this is an amazing project in my opinion. The 11-person team and 9-person advisor team have developed a very impressive ecosystem here. They also have some very impressive strategic partnerships. In the whitepaper, they state that they have entered into a strategic partnership with EOS VC funds and Wanchain, where they co-invest in emerging companies. This is a very impressive project I have to admit. This project has even got a 4.6 rating on ICO bench to further give relevance to my conclusion.

Iconiq Holding has developed a truly remarkable ecosystem here. The benefit of having the Iconiq labs platform aid worthwhile projects via their acceleration program is a much-needed service in the crypto sphere. I personally feel this will instil more confidence in investors who currently have to gamble on the projects they invest in. I personally spend hours every day reading whitepapers and researching, it is very easy to be “won over” by projects, this coupled with the lack of regulation in the space leads to a lot of projects never delivering on their promises. The Iconiq labs vetting procedure will hold companies to the highest standards, thus instilling confidence in investors.

The Iconiq Funds platform will also be revolutionary in the space. For the first time, investors will have full confidence in where they put their money. This platform I feel will attract more mainstream traders and investors, who I feel will never touch this space until some form of structure is put in place. Iconiq Funds is this solution.

Finally, the ICNQ token itself has a true use case within the ecosystem. I have shown here that the ecosystem revolves around the token. This project has already sold a lot of tokens in their presale rounds, so I really do feel it could be a great opportunity to get your hands on this at an extremely early stage. It is not very often I find worthwhile projects to write about, you can tell this by the frequency of my work. Iconiq Holding is yet another example of a project which will revolutionise this space and open the doors to the masses.

Final word

Lastly guys, I just want to stipulate to you that you should not take any of this as investment advice. I am not a financial advisor and urge you all to do your own research when considering any investment, this space can be very unforgiving and is very speculative in nature. Never follow somebody blindly; my job is to showcase projects I see with real potential that is all. I hope you enjoyed this article and I will aim to find the next amazing project in due course. I thank you all for your support and ask for you to share my work. I would be more than happy to discuss any questions you may have in the comments section.

Further reading

- Iconiq Lab Website: https://iconiqlab.com/contact/

- Iconiq Lab whitepaper: https://iconiqlab.com/wp-content/uploads/2018/09/20180903_Iconiq-White-Paper.pdf

- Iconiq Lab Facebook: https://www.facebook.com/iconiqlab/

- Iconiq Lab Twitter: https://twitter.com/iconiqlab

- Iconiq Lab LinkedIn: https://www.linkedin.com/company/iconiqlab

- Iconiq Lab GitHub: https://github.com/IconiqLab

- Iconiq Lab Reddit: https://www.reddit.com/r/iconiqlab/

- Iconiq Lab Medium: https://medium.com/@iconiqlab

References

- Barmatz, O. (2018). ICNQ Token - Iconiq Lab - Iconiq Lab. [online] Iconiq Lab. Available at: https://token.iconiqlab.com/ [Accessed 11 Sep. 2018]. (Barmatz, 2018)

- Iconiqlab.com. (2018). [online] Available at: https://iconiqlab.com/wp-content/uploads/2018/09/20180903_Iconiq-White-Paper.pdf [Accessed 11 Sep. 2018].

- ICObench. (2018). Iconiq Holding (ICNQ) - ICO rating and details. [online] Available at: https://icobench.com/ico/iconiq-lab [Accessed 14 Sep. 2018].

- Prnewswire.com. (2018). Iconiq Holding Launches Digital Asset Index Funds and Announces Upgrades to the ICNQ Token With Gibraltar Blockchain Exchange Token Sale and Exchange Listing. [online] Available at: https://www.prnewswire.com/news-releases/iconiq-holding-launches-digital-asset-index-funds-and-announces-upgrades-to-the-icnq-token-with-gibraltar-blockchain-exchange-token-sale-and-exchange-listing-300698652.html [Accessed 15 Sep. 2018].

- Sudhir, A. (2018). AmaZix and Iconiq Holding Partner to Advocate for Blockchain and Digital Asset Class - Iconiq Lab. [online] Iconiq Lab. Available at: https://iconiqlab.com/amazix-and-iconiq-holding-partner-to-advocate-for-blockchain-and-digital-asset-class/ [Accessed 11 Sep. 2018]. (Sudhir, 2018)

- YouTube. (2018). ICONIQ LAB - THE ICNQ TOKEN. [online] Available at: https://www.youtube.com/watch?time_continue=8&v=BsQ_bUsqAVU [Accessed 14 Sep. 2018].

Great work, Mick, I loved the 'References' section, gives me a sense of true academic material.

Thanks, I never shook off the old habits from my university days. Always best to tell one where content was taken from, as if people pass work off as their own then it is of no use to anyone, especially the person who wrote the article.

Congratulations! This post has been upvoted from the communal account, @minnowsupport, by Mick2018 from the Minnow Support Project. It's a witness project run by aggroed, ausbitbank, teamsteem, someguy123, neoxian, followbtcnews, and netuoso. The goal is to help Steemit grow by supporting Minnows. Please find us at the Peace, Abundance, and Liberty Network (PALnet) Discord Channel. It's a completely public and open space to all members of the Steemit community who voluntarily choose to be there.

If you would like to delegate to the Minnow Support Project you can do so by clicking on the following links: 50SP, 100SP, 250SP, 500SP, 1000SP, 5000SP.

Be sure to leave at least 50SP undelegated on your account.

Thank you

Congratulations @cryptoguru1! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPNice one